The 30-Year Buying Opportunity

What an interesting time to be alive.

Mr. Market is very negative about a lot of Quality stocks right now.

This offers tremendous opportunities if you ask me.

It’s time to buy quality

What’s happening right now reminds me of this quote from Peter Lynch:

“If a stock is down but the fundamentals are positive, you should buy more of it.”

– Peter LynchThat’s exactly what’s happening right now.

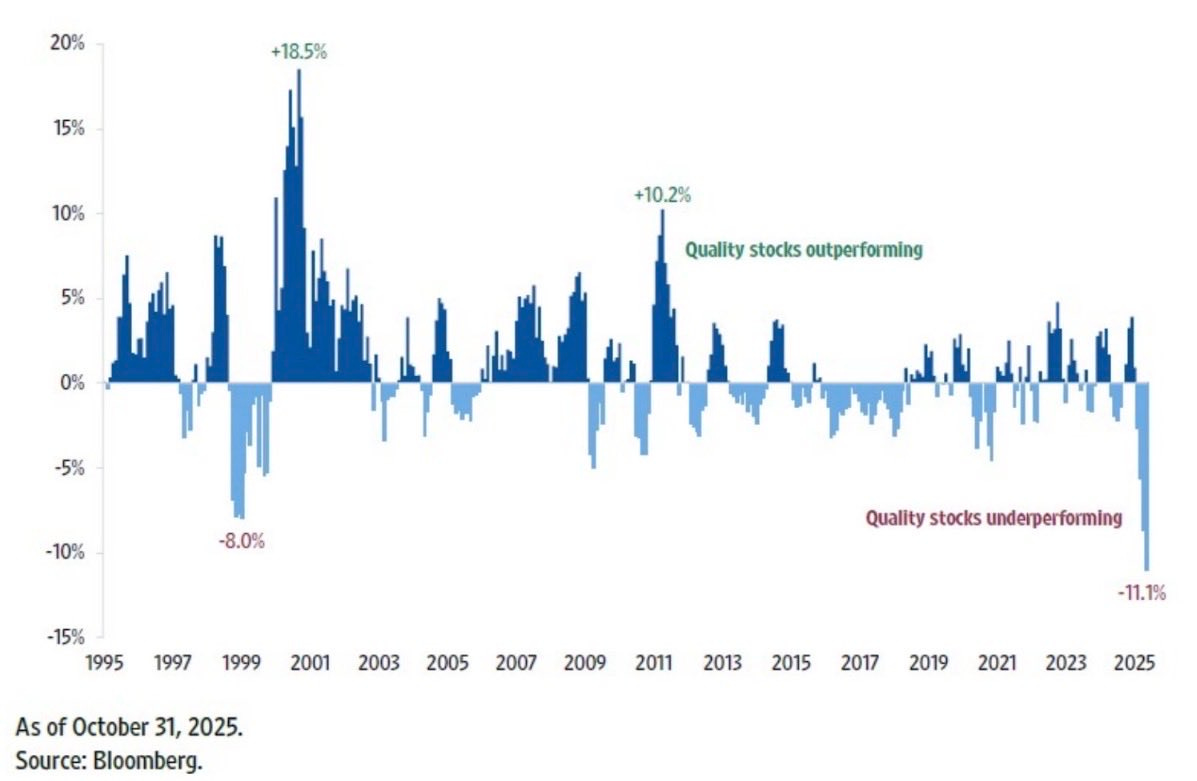

Quality stocks are currently underperforming.

It’s the largest irrationality in the market over the past 30 years.

The last time this happened was in 1999, just before the dotcom bubble.

After that, quality outperformed massively (+18.5%).

I think it’s likely to happen again.

Why?

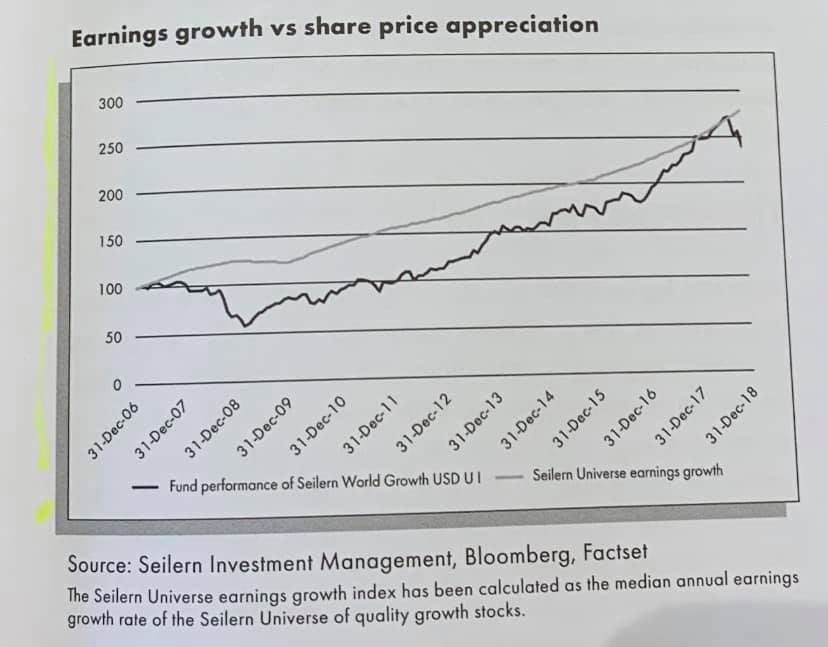

Because stock prices eventually follow earnings.

Always.

Your Strategy Matters

Your strategy matters.

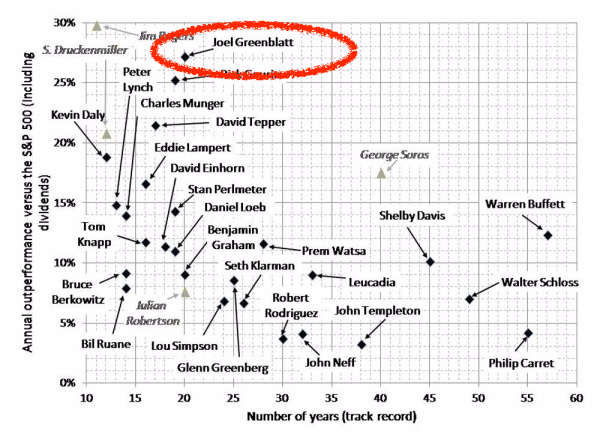

Just think about Joel Greenblatt.

He ran a hedge fund that delivered a yearly return of +40% (!) for over 20 years.

Which investment strategy you choose is very important.

The two most important things?

You don’t need the optimal strategy. You need a sensible strategy that works for you

Your strategy needs to be simple and easy to understand.

Our strategy is very simple:

Buy quality companies

Led by excellent managers

Trading at fair valuation levels

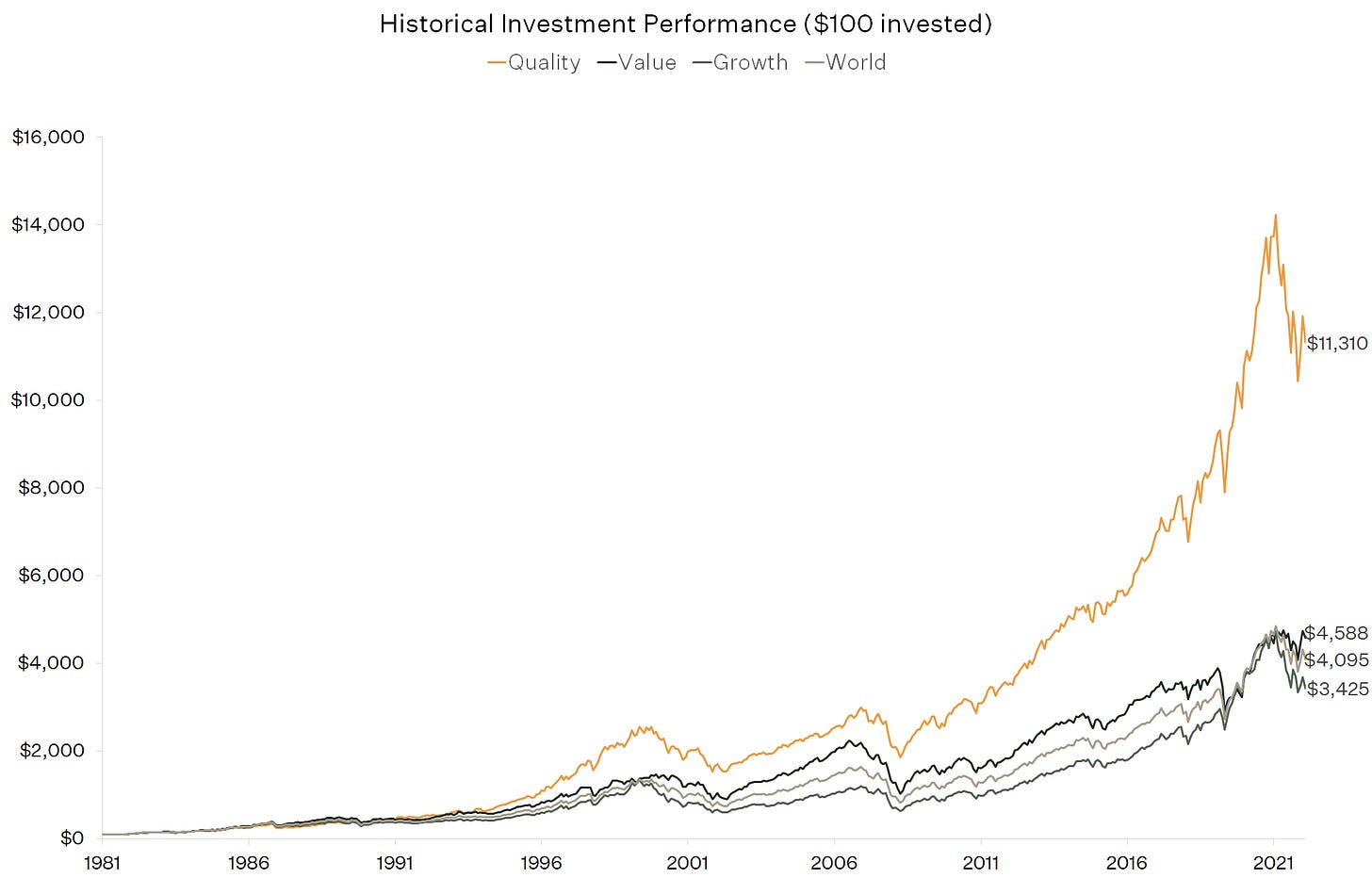

This strategy massively outperformed the market in the long term:

So now you learned quality outperforms the market.

But it gets even better…

… Because you can buy quality at a discount today.

Here’s the situation for Our Portfolio over the past 5 years:

Average yearly growth in Owner’s Earnings: +22.3%

Average change in valuation: -10.0%

This is exactly what you want to see.

You can buy amazing companies at a discount of almost 33%!

But which companies are the most interesting within Our Portfolio right now?

Let’s dive in.