The best stocks for 2026

A collab with Michael Gielkens and Kris Heyndrikx

2026 is just around the corner.

How will quality companies perform? Are we in an AI bubble?

Let’s take a look.

In 2025, technology and growth companies as a group benefited greatly from the enthusiasm surrounding artificial intelligence (AI), while investors paid less attention to many quality companies, holding companies, and serial acquirers. With the end of the year in sight, attention is turning to 2026. Will AI once again demand attention, or will the focus shift to quality companies?

We put these questions to a panel of experts consisting of Kris Heyndrikx (founder of Potential Multibaggers and Best Anchor Stocks), Michael Gielkens (partner/owner of Tresor Capital), and Pieter Slegers (founder of Compounding Quality, De Kwaliteitsbelegger, and Tiny Titans).

You can find Kris and Michael’s newsletters here:

Tresor Capital newsletter (written by Michael Gielkens and Tresor Capital)

Potential Multibaggers (written by Kris)

1. As an investor, how do you deal with the AI hype?

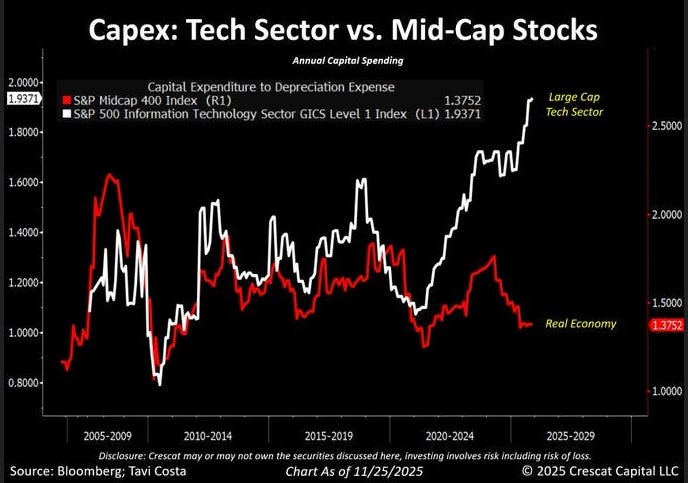

Michael Gielkens: Few would deny that AI is the future. Yet it seems that investors are getting ahead of themselves. The tech giants have transformed from a ‘capital light’ to a capital-intensive business model due to large investments in chips and data centers, while the returns on those investments are still uncertain.

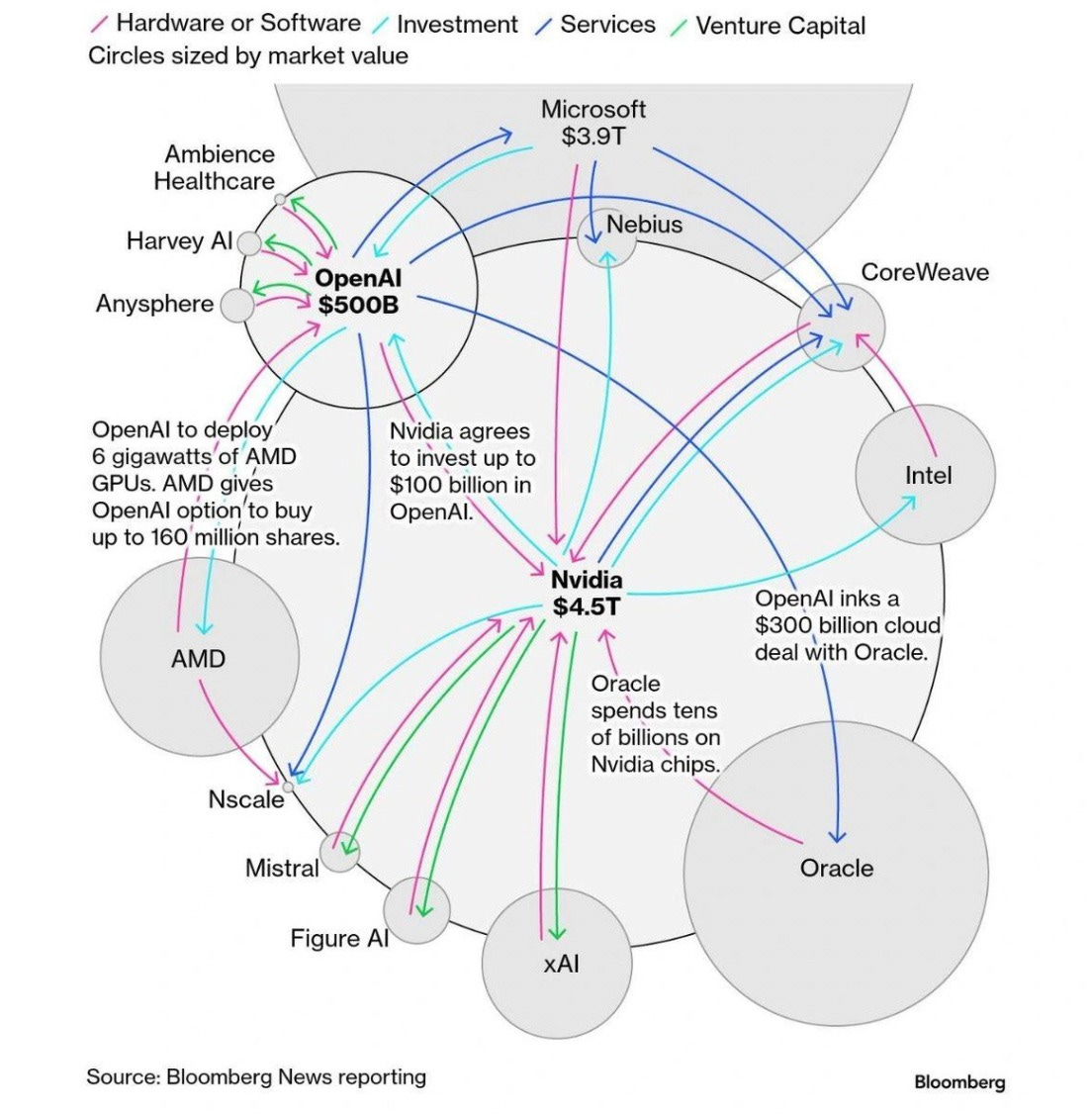

The capital merry-go-round between players such as OpenAI, Oracle, and Nvidia is reminiscent of the tech bubble in the 1990s. No one doubted that the internet was a tremendous innovation, but investors learned a hard lesson when the Nasdaq corrected by nearly 80%.

We are currently seeing a lot of ‘hopium’ in the share prices. The difference with the dot-com bubble is that tech giants are now generating solid cash flows, although they are also taking on more and more debt in the AI battle. This is reflected in credit default swaps, the insurance against bankruptcy, which have risen sharply recently.

In times when markets focus on a single theme, investors pour their capital into one area, causing prices to move vertically. When sentiment reverses, these prices can plummet. Warren Buffett once said, “It’s only when the tide goes out that you discover who’s been swimming naked.”

At Tresor Capital, we choose a different route. We focus on companies that do benefit from AI, but are not existentially dependent on it. These players were already strongly positioned within the technology sector before the hype. Crucially, they generate significant cash flows, enabling them to finance their AI investments from their own resources without incurring additional debt. This means they are not at the mercy of the kindness of strangers. We play this field through holding companies with stable cash cows or with a broad portfolio of various tech and AI companies. In this way, we create indirect exposure through a mix of public and private companies.

Kris Heyndrikx: As a growth investor, I have already benefited greatly from AI. Nvidia, AMD, Broadcom, TSMC, Google, Cloudflare, CrowdStrike... I have them all in my portfolio. You certainly won’t hear me complaining. But even I am getting a little nervous about the big money carousels that are now being set up. The weakest link in the whole system is OpenAI, which has committed no less than a trillion dollars for the coming years. The company is currently loss-making and generates only $13 billion in sales. That certainly makes everything more risky now than in recent years.

Still, I think there is upside potential. Currently, there is a bit of an AI selling wave, which is very healthy.

I see a division in AI. On the one hand, there are AI software platforms, which are incredibly expensive. Companies such as Palantir, Cloudflare, and CrowdStrike are stocks I would not buy at the moment. Put them on your list for when there is a sharp dip, because they are top companies, but currently too expensive.

At the same time, you can see that infrastructure expansion will accelerate even further in 2026. This also means that stocks such as Nvidia and AMD are not expensive at all. Next year, Nvidia’s earnings per share are expected to grow by no less than 60%. That implies a price-earnings ratio for 2026 of 22.8. If you divide that PE by the growth, you get a 2026 PEG ratio of just 0.38x. Anything below 1 is cheap, so this is very cheap. For AMD, you see a 2026 PEG ratio of 0.49, which is also cheap. Of course, the slightest suspicion that expectations will not be met will cause the price to plummet. Moreover, the market often runs ahead of reality, so if the expectation is that capex will be lower in 2027, this will already be priced in during the second half of 2026.

Pieter Slegers: Warren Buffett said that as an investor, you always have three choices: 1. Yes, I want to invest in the stock, 2. No, it’s not for me, or 3. The “too hard pile.” In other words: I don’t know and I’ll stay away from the stock. For me, anything related to artificial intelligence falls into the ‘too hard pile’. The great thing about the stock market is that there are more than 80,000 listed companies worldwide. In other words, you can be very selective. Always stay within your circle of competence. Only the best stocks are good enough for you. Or as Buffett so aptly put it: “The difference between successful people and really successful people is that really successful people say ‘no’ to almost everything.” Ninety percent of all stocks should end up in the too hard pile for every investor.

The US economy is less robust today than many people think. Stock market returns in 2025 were driven by AI and momentum stocks. Traditional companies are struggling, such as Old Dominion Freight and Pool Corporation. Old Dominion Freight is an American transportation company. Pool Corporation makes money by selling pool and spa products to stores and businesses. They can be considered companies active in “the traditional economy.” Both stocks have fallen 10% and 29%, respectively, since the beginning of the year.

Am I very cautious about everything related to AI today? Yes. The valuations of large technology companies have risen sharply. Today, the S&P 500 is trading at 22.8 times earnings. It has been since the 2000s that valuations were even higher. We all know what happened next. As Michael points out, the difference with 2000 is that today’s big tech companies are very capital-light and profitable. In 2000, it were mainly promising companies that were still loss-making. Today, Big Tech is investing heavily in data centers. The million-dollar question is whether the facts are being anticipated and there is overinvestment. If this is the case, these companies could take a hit.

2. Do quality stocks now offer the most opportunities?

Michael Gielkens: Due to the primary investor focus on AI companies, we see many opportunities in lagging sectors that have benefited less from capital flows. Quality companies, which include our family holdings and serial acquirers, offer interesting opportunities.

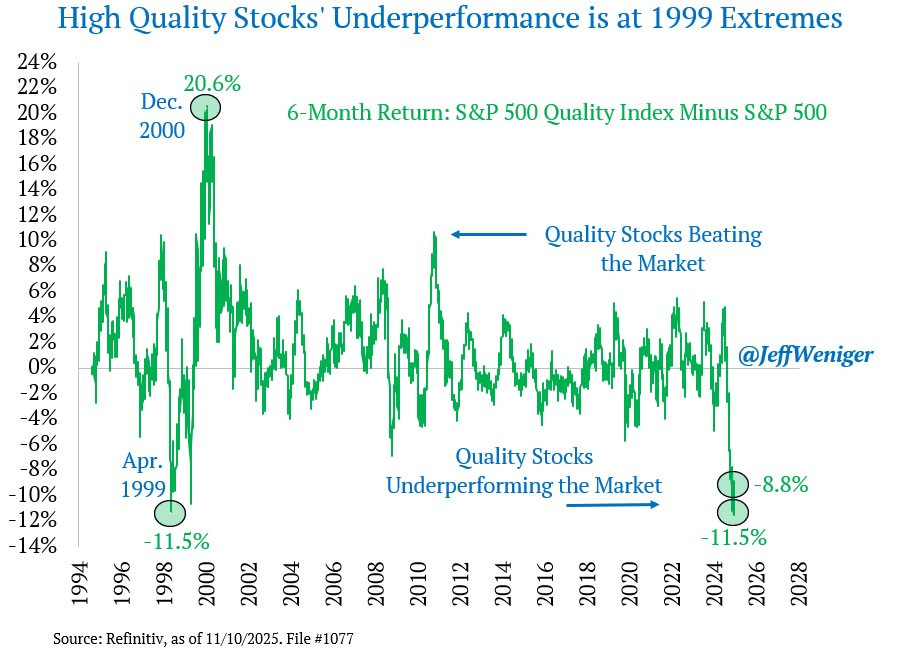

The historical parallel with the dot-com bubble can be seen in the relative performance of quality companies compared to the broader stock market. Since April 1999, quality stocks have not underperformed as significantly as they have in the past six months. At that time, this was followed by a significant recovery. I don’t have a crystal ball, so I’m not claiming that such a price jump will occur again in 2026. But as Mark Twain once said, “History doesn’t repeat itself, but it often rhymes.”

After a strong first half of the year, software companies are now under pressure. Investors think AI will eventually replace software and are selling off their software stocks. At Tresor Capital, we invest in Vertical Market Software (VMS) as part of our family holding strategy. The market is dismissing VMS as an “AI loser.” Our view is that VMS companies are protected from disruption because they own the crucial infrastructure and data. AI acts more as a tool to work more efficiently and build new applications more cheaply than as a replacement for business-critical core software. Precisely because the consensus is so negative, VMS is a perfect ‘contra-sector’: should the AI hype run into rough weather, this stable corner offers protection. Moreover, the fact that valuations are under pressure offers serial acquirers an opportunity to achieve higher returns on their acquisitions.

Holding companies in the private equity space have also had a difficult time recently. Rising long-term interest rates and fears of corrections in the private credit market have created uncertainty among investors. Nevertheless, we anticipate that the intrinsic value of various names in our portfolio will continue to grow at attractive rates of more than 12% per annum.

Kris Heyndrikx: I completely agree with Michael. I also see opportunities in software due to the false belief that AI will replace all software. Serial acquirers of VMS are indeed being punished unfairly. So there are definitely opportunities there.

Gradually, more opportunities are emerging for companies that are thought to be on the verge of disappearing, even though there is no logical reason for this. I don’t have these stocks in my portfolio (yet?), but stocks such as Hubspot and Monday(.)com are starting to look attractive and deserve closer scrutiny. These are rock-solid companies, their revenues are growing by more than 20%, and yet they have fallen sharply because investors think that AI will render these companies worthless. These companies themselves use a lot of AI, so this is more of a tailwind than a headwind.

So, some stocks look attractive because the story is that AI will kill them. But some high-quality companies are also overvalued. A company such as Walmart is trading at a price-earnings ratio of 40, Costco even at 50. Apple, which seems to have completely missed the AI train and had to enter into a partnership with Google, is also trading at a P/E ratio of 36.5, which is a lot for a company that has only managed to grow its revenue by a mere 3.5% annually over the past five years.

So there are certainly bargains to be had at quality companies, but there are big differences between them.

Pieter Slegers: I believe there are certainly opportunities to be found in quality stocks at the moment. During the latest presentation by Akre Capital Management, founded by legendary quality investor Chuck Akre, it was stated that it had been since 2020 that the expected return on their quality stocks had been this high. We are seeing a similar trend in the portfolio of Compounding Quality.

If you didn’t have any major technology stocks in your portfolio in recent years, it was almost impossible to beat the market. Today, Nvidia has a weight of 6.9% in the S&P 500. Never before in the past 50 years has a single stock had such a significant weighting in the index. On the stock market, there is something called reversion to the mean. This simply means that extreme situations do not usually continue indefinitely. Trees don’t grow to the sky.

Today, there are many high-quality stocks trading at their cheapest valuations of the last 10 years. Take, for example, the American insurance broker Brown & Brown, run by the Brown family. Today, you can buy the stock at 17.8x times earnings, compared to 24 times earnings at the beginning of this year. In other words, the valuation has fallen by 25%. And that’s despite the fact that, according to our calculations, the intrinsic value has risen by 10%.

In general, it is definitely not wise to constantly monitor stock market prices. What should you focus on instead? The evolution of the intrinsic value and valuation of your portfolio. Today, Compounding Quality’s portfolio has a Free Cash Flow Yield of 5.4%. Over the past 10 years, the portfolio has never been this cheap. And what about the evolution of the intrinsic value? In our models, we assume that over the next three years, the intrinsic value of our shares should increase by an average of 14% per year. If this proves to be correct, stock market prices should follow. This makes us very comfortable with our current positioning.

3. What are your specific stock market tips for 2026?

Michael Gielkens: For the 2026 stock market year, we have selected two compounders that are attractively valued and have been unjustly overlooked: Topicus.com and 3i Group.

Topicus.com is active as a serial acquirer within the VMS industry. Its strength lies in its unique market position. Due to the high degree of fragmentation in languages, cultures, and complex local legislation, Europe is a difficult terrain for globalized tech giants. For a local specialist such as Topicus, this actually offers great opportunities. They supply business-critical software that is deeply embedded in the processes of customers in many niche markets, from healthcare to governments, which ensures very stable, recurring cash flows. The growth engine is intact and is even benefiting from the current sentiment: now that VMS valuations are under pressure, Topicus can reinvest its free cash flow at even higher returns. With thousands of potential acquisition targets in Europe, investors are buying a compounder with enormous runway to consolidate the market in the coming decades and thus create very significant value for shareholders in the long term.

3i Group is the holding company behind the successful Action formula. The share price recently fell due to a slowdown in sales in France, but this seems to be an exaggerated reaction, as sales in all other markets continued to grow by more than 22%. The underlying growth model remains rock solid: Action has already opened 255 stores this year and raised its target to 380 openings, with plenty of room for growth in Southern and Eastern Europe. The key lies in the valuation. 3i values Action internally at 18.5x EBITDA, while sector peers such as Costco, Dollarama, and Ollie’s are structurally valued much higher. In fact, the stake in Action covers almost the entire market value of 3i, giving you the rest of the portfolio for free. The fact that 3i recently invested an additional £755 million in Action and insiders bought €5 million worth of shares is a strong signal of confidence and points to the undervaluation.

Both companies offer significant upside potential without AI dependency.

Kris Heyndrikx: AI is sucking up almost all the money, at the expense of quality, but also at the expense of international stocks. In Europe, there will already have been a catch-up movement by 2025, but that is not the case in Latin America, for example.

This is one of the reasons why Mercado Libre is now so interesting. It is the largest e-commerce company in Latin America and also has the Mercado Pago payment platform. In the last quarter, turnover rose by 39% in US dollars, but in local currencies it was much higher. Due to high inflation, particularly in Argentina, I prefer to calculate in dollars.

That was the 27th consecutive quarter of more than 30% revenue growth. Of the approximately 83,000 publicly traded companies worldwide, Mercado Libre is the only one that has grown more than 30% in each consecutive quarter for so long.

Amazon’s strength lies in its logistics network, but Mercado Libre is much better in this area in Latin America. Amazon has been present in Brazil since 2012, but it remains a distant second player after Mercado Libre. Mercado Libre’s share price has fallen by around 25% since the latest results, mainly because the company now offers free delivery in Brazil for orders over approximately $3.5, whereas previously the threshold was $14. This naturally puts pressure on margins, but order volumes have skyrocketed. As a long-term investor, that is exactly what I want to see: long-term thinking instead of short-term profits.

A second tip is Duolingo. The learning platform’s share price has taken a heavy hit and is currently trading 66% below its recent peak. However, there was 41% revenue growth in the last quarter. But bookings, money that has already been prepaid but cannot yet be recognized as revenue, were lower. In addition, Duolingo wants to focus on the quality of its lessons and attract more users, at the expense of immediately monetizing its customers. That seems to me to be the right choice for the long term. I am an avid Duolingo user myself. I am learning Italian, Latin, music, and now mainly chess, and my streak is more than 1,400 days.

Here, too, the narrative is that AI will destroy the company, but AI is primarily beneficial for Duolingo to release more courses in a more cost-effective manner. The real distinction lies in engagement, and my streak proves that it works.

Pieter Slegers: The best investment is always one in yourself. As an investor, it’s best to remain open to new ideas. Standing still is going backwards. That applies to the stock market too. If your view of the stock market in 10 years’ time is exactly the same as it is today, then you’re not doing things right.

Anyway, everyone is here for the stock tips. I would like to highlight two companies: Kinsale Capital and Zoetis. These are two stocks that took a dive in 2025. Kinsale Capital fell by 13% in 2025 and Zoetis by 25%. As a quality investor, it’s fantastic to buy wonderful companies at lower valuation levels.

Kinsale Capital is an American insurer specializing in Excess & Surplus Lines. This usually involves matters that traditional insurers are unwilling to insure. Examples include higher risks, new technologies, or companies with a history of significant claims. These risks are greater, but the margins are also higher. Kinsale Capital distinguishes itself through excellent risk management and a strong technological advantage. The most important ratio to look at for an insurer? The combined ratio. The lower this ratio, the better. A combined ratio below 100 indicates that the insurer is profitable. Over the past 10 years, Kinsale Capital’s average combined ratio has been 78%. That is significantly lower than that of its competitors. I met the founder and CEO Mike Kehoe once so far and he made a deep impression on me. Kinsale Capital should be able to double its market share in the coming years. Investors should be able to benefit from this. The fact that Gregory Share (an insider) bought $1 million worth of shares last week inspires confidence.

Zoetis may also be of interest. Zoetis is the global market leader in animal health. They benefit from stable, recurring revenues. Today, the company is active in two segments: pets (70% of revenues) and livestock (30%). The pet segment focuses on treatments for allergies, pain, and parasites. The livestock segment focuses on vaccines and anti-infectives. Today, pets are increasingly treated as full-fledged family members. Zoetis is taking full advantage of this trend. More and more money is being spent on pets. The share is currently trading at its cheapest valuation ever. You can buy the share at 18.6 times earnings.

Conclusion

That’s all for today.

Despite the AI craze, there are interesting opportunities in the market today.

These stocks currently look interesting to us:

Michael Gielkens: 3i Group and Topicus

Kris Heyndrikx: Mercado Libre and Duolingo

Pieter Slegers: Kinsale Capital and Zoetis

You can find Kris’ and Michael’s newsletters here:

Tresor Capital newsletter (written by Michael Gielkens and Tresor Capital)

Potential Multibaggers (written by Kris)

Everything In Life Compounds

Pieter

PS I am looking for a few interested investors who want to step up their investment game. You can apply here if you think it’s something for you.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Appreciate this write-up. The headline lesson is right: time in the market beats timing the market.

Where I’d sharpen it is the vehicle.

2025 also reminded us that “buy and hold the index” increasingly means “buy and hold a concentrated bet,” with mega-caps dominating and Nvidia alone sitting around ~6.9% weight in the S&P 500. That’s not a moral problem — it’s a structural one. If starting valuations are rich, a long hold can turn into “a long wait” for multiples to do the heavy lifting.

My bias is simple: long holds should compound on cash flow and control, not sentiment. That’s why I prefer real-asset structures where value is anchored to NOI and governance — not a daily voting machine.

Good framework here for anyone thinking about 2026: stay invested, diversify intentionally, and understand what you’re actually concentrated in.

#Investing #LongTerm #RiskManagement #Quality #Diversification #CapitalAllocation #RealAssets