🏰 The impact of taxes on compounding

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes.

If you are reading this and are not subscribed yet, feel free to join the Compounding Quality Family via the button hereunder:

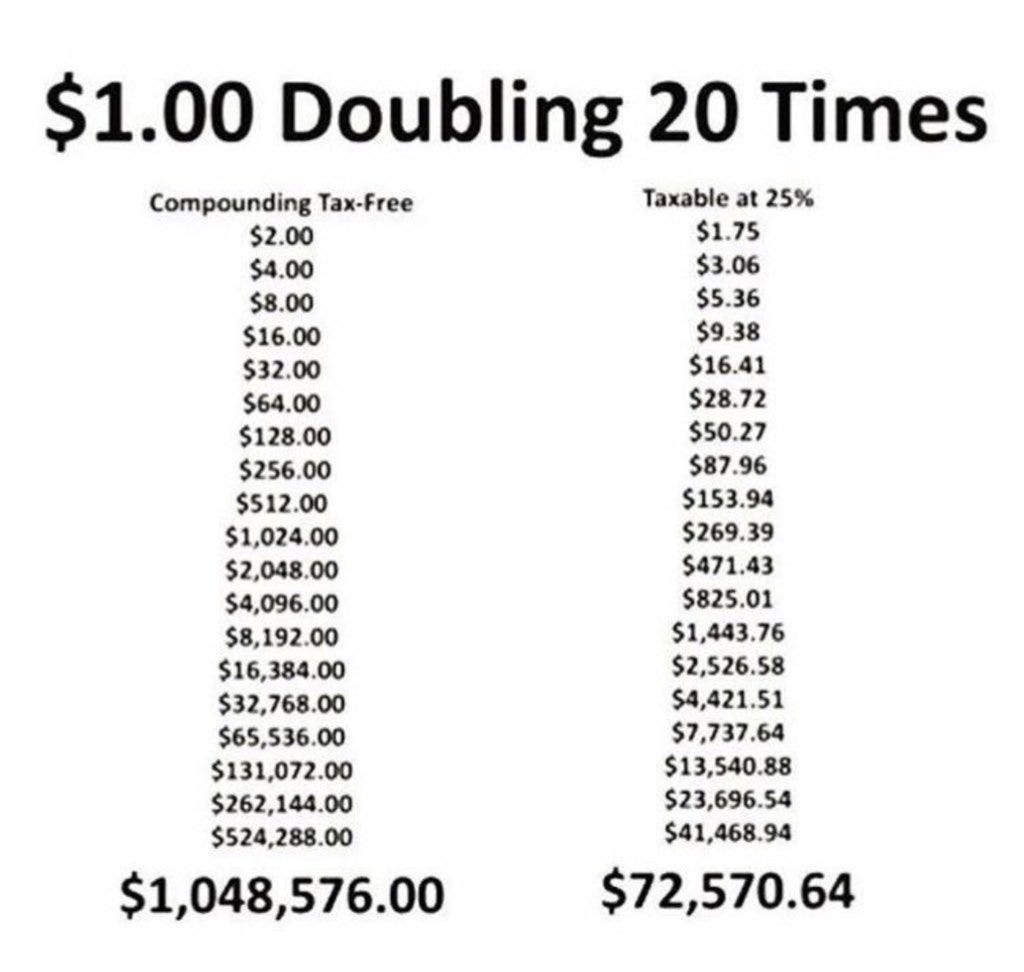

1️⃣ The impact of taxes on compounding

Costs and taxes hurt your investment results.

Try to postpone paying taxes as long as possible.

2️⃣ The power of big tech

Today, Apple’s market cap is equal to the sum of the bottom 180 companies within the S&P 500.

Don’t focus solely on big tech. Small cap stocks outperform the market in the long term.

3️⃣ One simple investment quote

Don’t use debt to buy stocks.

Every debt is ultimately paid, if not by the debtor, then eventually by the creditor." - James Grant

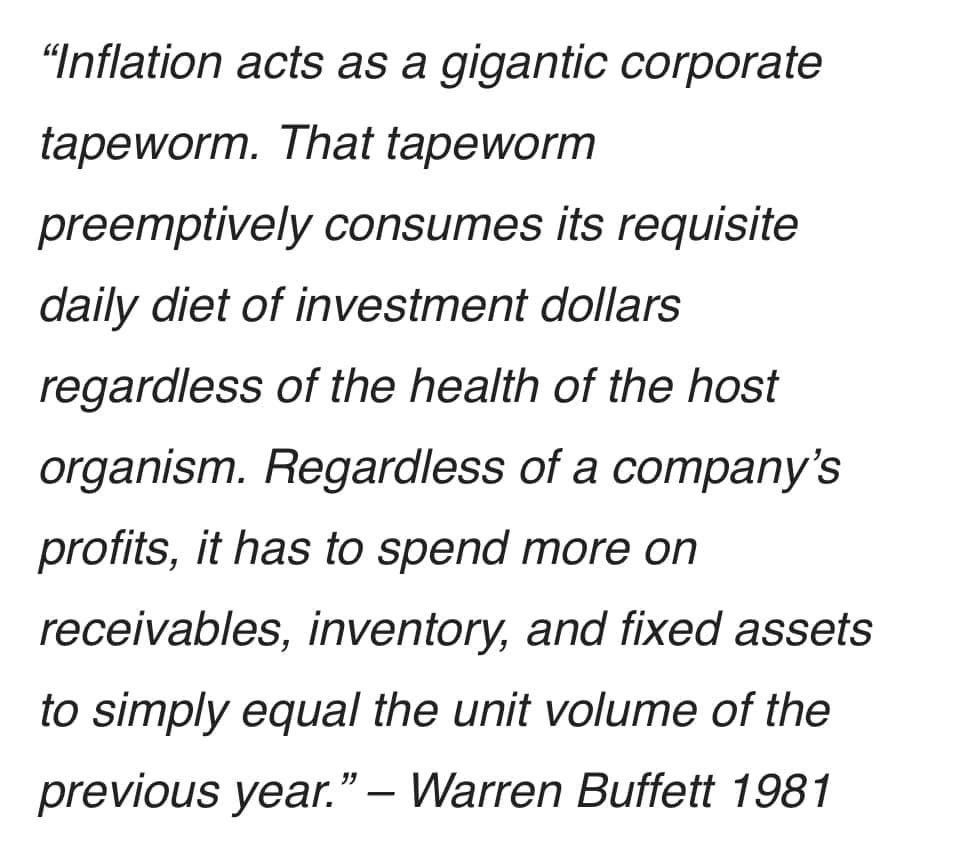

4️⃣ Warren Buffett on inflation

Inflation harms your wealth.

The best way to protect yourself against inflation is buying quality stocks with high gross margins.

5️⃣ Example of a Quality Company

Automatic Data Processing is a global provider of business outsourcing solutions (human resource, payroll, taxes, …).

The company has a free cash flow margin of 17.7% and should be able to grow its FCF with 15% per year until 2025.

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

That chart on the effect of taxes really shows a lot. Not enough people talk about taxes, they only mention how many X they gained.

Nice