Portfolio Update: Is it time to buy?

Extensive Portfolio Update (Part III)

To measure is to know.

That’s why we’re giving an extensive Portfolio Update today.

Which companies are worth buying today?

Did you miss the first two articles?

You can read the first part here and the second part here.

Kinsale Capital

How does the company make money?

Kinsale Capital is an established and expanding specialty insurance company focused exclusively on the excess and surplus lines (“E&S”) market in the United States.Weight in Portfolio: 6.8%

Performance (%): +21.6%

Update investment case

You know who loves insurance companies. too? Warren Buffett.

Why? Because of the float.

What is float?

When policyholders pay premiums upfront, insurers often hold that money for months or even years before paying claims. In the meantime, they can invest that money. Effectively, customers provide an interest-free loan, and the insurer keeps the returns.If premiums (what clients pay) cover claims and expenses (what insurers need to pay out), the insurer gets to invest the float like free money.

Even small underwriting losses can be acceptable if investment returns outweigh them.

This unique setup allows insurance companies to compound wealth in a way most businesses can’t.

Insurance companies grow using other people’s money rather than relying solely on profits or debt.

The model is further strengthened by predictable cash flows: people need insurance regardless of economic conditions.

When I was in Omaha to attend the annual shareholder meeting of Berkshire Hathaway, I went to a private dinner with Tom Gayner (CEO of Markel).

The funny part? Markel truly admires Kinsale Capital.

One of the key people within management even confessed he had a significant stake in Kinsale Capital.

Markel also mentioned Kinsale Capital as the best peer in the industry during their annual brunch in Omaha:

This tells you everything you need to know.

Kinsale Capital is a phenomenal business that will continue to thrive.

They focus on smaller accounts with less competition and better pricing. Founder Michael Kehoe still leads the company, and insiders own 5.6%.

The company stands out in the insurance world thanks to its technological edge, disciplined underwriting, and owner-like culture.

They target 10–20% annual growth without acquisitions and aim for a ROE of at least 15%.

If we look at the most recent results (Q2 2025), we see the following:

Combined ratio: 75.8% versus ~95% industry average (this is an amazing result)

Book value per share: $73.9 (+20.7%)

Operating EPS: $4.8 (+27.5%)

Return On Equity: 24.7%

Investment income has become an increasingly important growth engine. Net investment income jumped nearly 30% year-on-year, driven by higher cash flows and a growing portfolio of high-quality assets.

Pricing discipline and efficiency remain central to Kinsale’s edge.

The outlook remains positive despite more competition. Management expects long-term premium growth of 10–20% through the cycle and sustainable ROEs in the low-to-mid 20s.

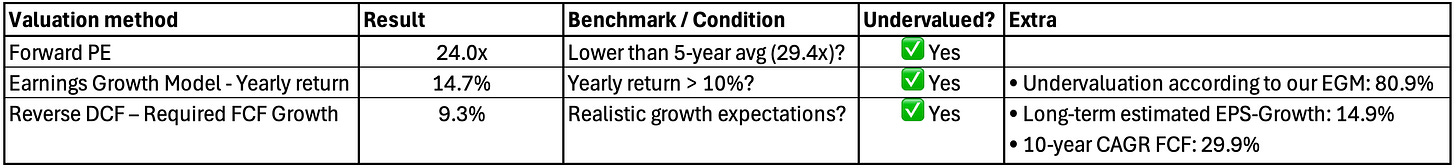

Finally, it’s time to look at the valuation.

Kinsale Capital now trades at one of the cheapest valuation levels of the past 10 years:

Current valuation level

Expectations intrinsic value

Expected growth intrinsic value 2026: 13.9%

Expected growth intrinsic value in the long term: 15.0%

Conviction level

9/10: Kinsale Capital is a wonderful company at a fair price. It will continue to take market share from competitors in the years ahead.

Relevant articles

Now let’s dive in the next 3 companies.