The Most Important Company You’ve Never Heard Of

Not So Deep Dive ASML

Without ASML, your life wouldn’t be the same.

The device you're using right now might not even exist.

Let’s see whether ASML is a great investment.

ASML - General Information

👔 Company name: ASML

✍️ ISIN: NL0010273215

🔎 Ticker: ASML

📚 Type: Monopoly

📈 Stock Price: €682.5

💵 Market cap: €274.6 billion

📊 Average daily volume: €470 million

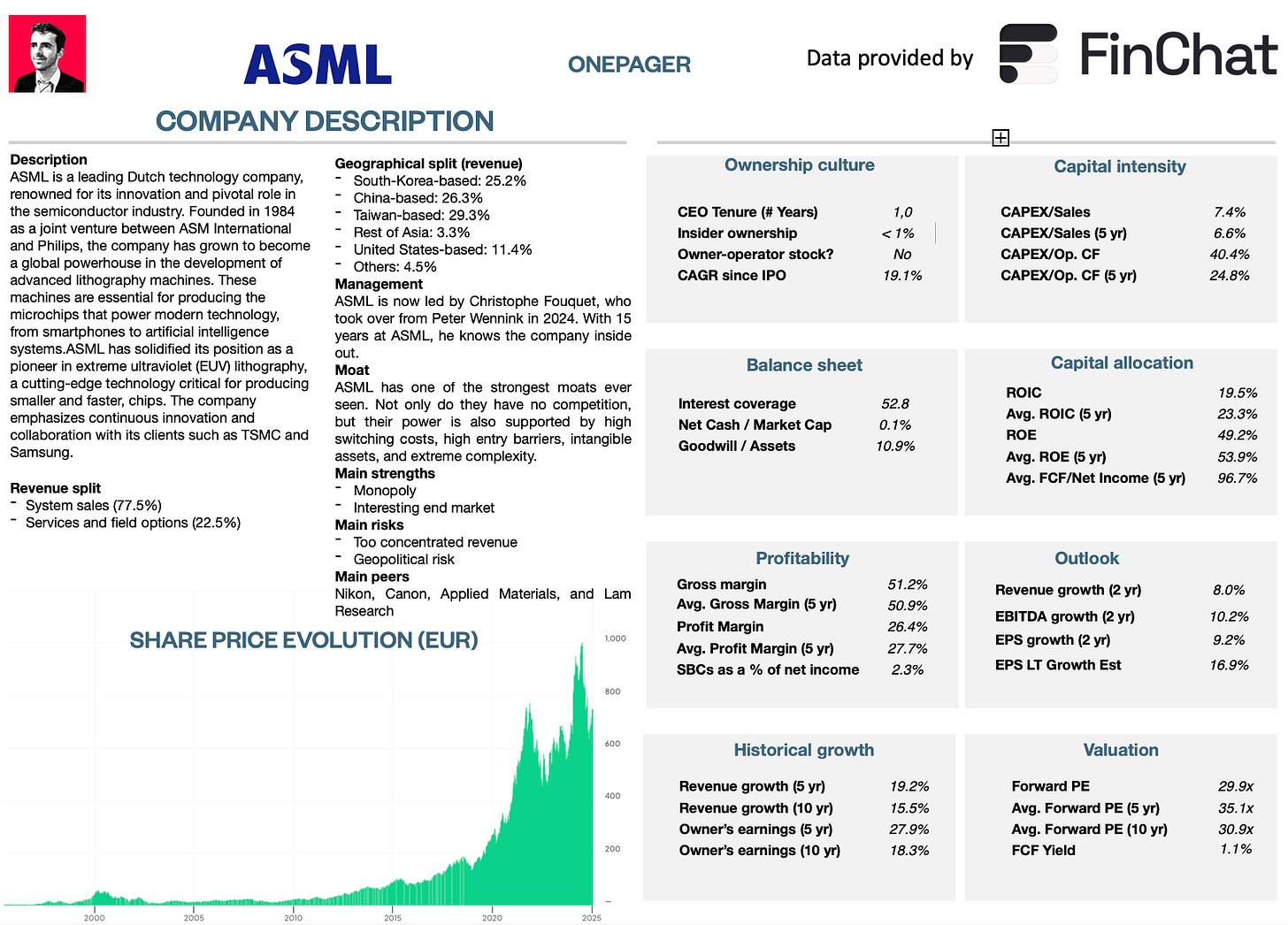

Onepager

Here’s a onepager with the essentials of ASML:

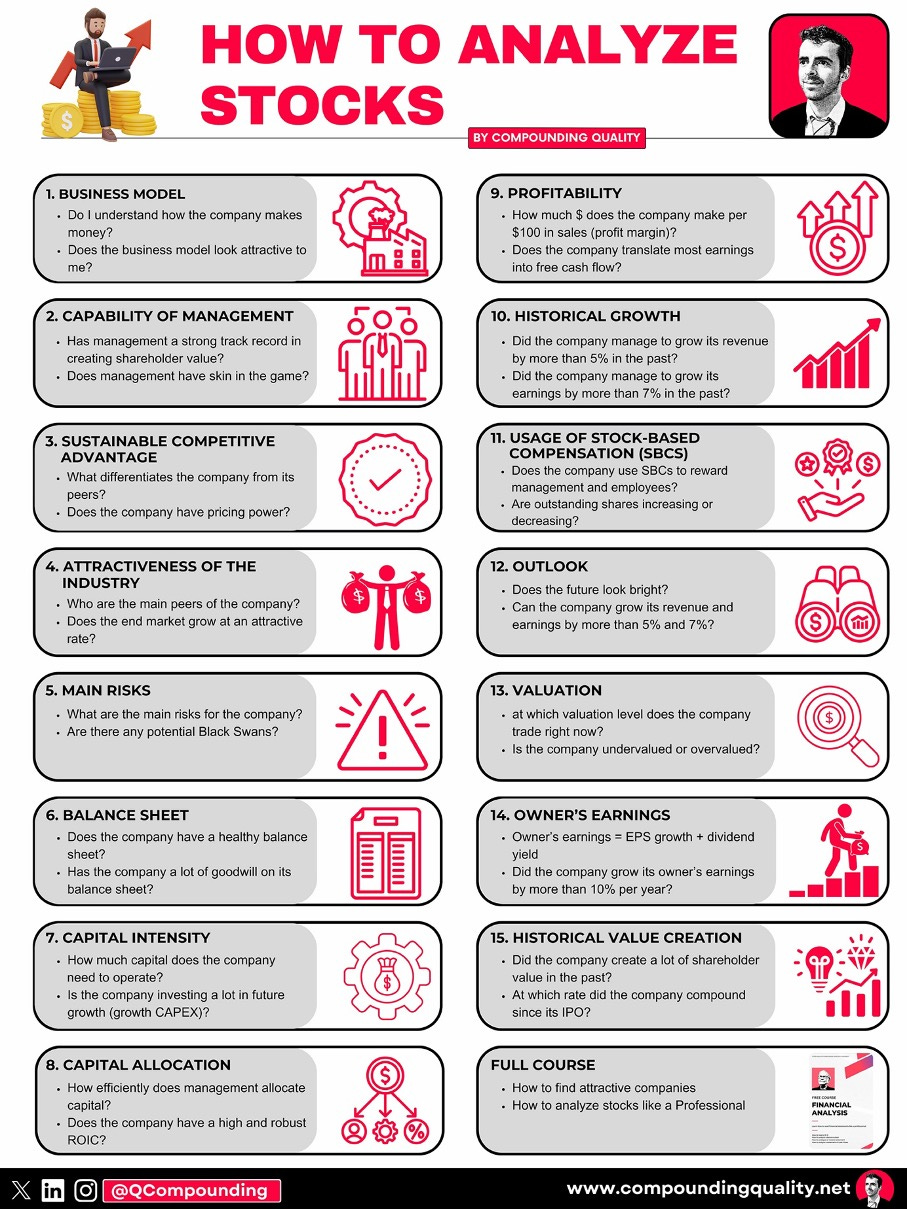

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give ASML a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Did you know UV light can do more than just give you a tan?

There’s a company from the Netherlands called ASML that uses a special type of UV light called EUV to create chip machines. This has made them VERY successful. They’re now the fourth biggest company in Europe.

Here’s what they do: ASML makes machines that help create tiny computer chips. These chips are used in phones, computers, and many other gadgets. Their biggest customers are TSMC, Intel, and Samsung.

How special is their technology?

In 2019, spies from China tried to steal secrets about ASML’s machines by working there

There are even rumors that China tried to buy a machine just to take it apart and learn how it works

Peter Wennink, a former ASML CEO, said this about their tech:

"EUV is the most sophisticated, complex machine humans have ever made."These machines are so advanced that it takes seven (!) Boeing 747 planes to transport just one.

Each ASML machine costs up to €200 million.

There’s even more. ASML also makes another type of machine called Deep Ultraviolet (DUV) machines. DUV is the older, less complicated technology.

Here’s why ASML is so powerful:

They make over 90% of all DUV machines in the world

They’re the only company making EUV machines, 100% of them come from ASML

ASML earns money in two ways:

System sales (77.5% of revenue): Selling their high-tech machines to chipmakers

Service and field options (22.5% of revenue): Fixing and upgrading the machines and helping customers use them

2. Is management capable?

ASML recently said goodbye to two key leaders: CEO Peter Wennink and Chief Technology Officer (CTO) Martin van den Brink.

They both played a big role in the company’s success.

In 2024, Christophe Fouquet became ASML’s new CEO. With 15 years at ASML, he brings much experience, especially from his previous role as Chief Business Officer. He also worked for a competitor, Applied Materials, from 1997 to 2001 as a global product manager. Now, he leads over 42,000 employees at ASML.

Fouquet has a clear vision for the future:

“I want everyone at ASML to think about what’s next. The industry will only stop when people stop having ideas.”The French CEO owns €5.73 million worth of ASML shares. Considering his wage of well over €3.5million, it would be great if he bought more shares to align his interests with those of shareholders.

As for the new CTO? ASML hasn’t announced who will take on that role yet.

3. Does the company have a sustainable competitive advantage?

ASML has some big advantages that make it hard for others to compete with them.

Here’s how:

Switching costs: ASML takes great care of its customers. For example, they have 1,600 employees just to help their main customer TSMC. Happy customers don’t have a reason to switch. Some customers even help ASML pay for research to keep the technology going

Patents: ASML has 17,500 patents. These protect their inventions and keep others from copying them

High entry costs: Making EUV machines took ASML over $15 billion and 20 years of work. Most companies can’t afford that

Complexity: Each EUV machine has over 100,000 parts. ASML has strategic partnerships with crucial suppliers

But the best part?

ASML has no competition. They are active in a monopoly. They’re the only company making EUV machines. This unique market position gives the power to raise prices.

As Peter Thiel once said:

“Competition is for losers. If you want to create and capture lasting value, look to build a monopoly.”Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 51.2% (Gross Margin > 40%? ✅)

Return On Invested Capital (ROIC) 19.5% (ROIC > 15%? ✅)

4. Is the company attractive in an interesting end market?

Have you heard of Moore’s Law?

It’s a simple rule: the number of tiny parts (transistors) on a computer chip doubles every two years.

This makes chips faster and better. Chips are getting more advanced. ASML’s EUV and DUV machines are perfect for this because they can print the tiny designs required for the next generation of chips.

ASML’s end market is expected to grow 9% annually for the coming 5 years.

The company’s machines are super important for growing industries like:

Artificial Intelligence (AI): AI needs powerful computers, which means more advanced chips

5G: Faster internet needs smaller and quicker chips

Cars: Electric and self-driving cars need lots of chips to work

Because of these trends, big companies like TSMC, Samsung, and Intel need to make more chips. And who will sell the machines to do that? Most likely ASML.

However, DeepSeek, an AI company, could threaten the demand for ASML. This Chinese company created a chatbot like ChatGPT at a much lower cost. This made people worry that companies might need fewer ASML chip-making tools.

5. What are the main risks for the company?

Some of the main risks for ASML:

Geopolitical risk: technological dominance is a source of geopolitical tension with (potential) export bans as a result

Too concentrated in Asia: in 2023, roughly 84% of revenue came from Asia

Leadership crisis: the new CEO has yet to prove himself

High dependence on few customers: ASML relies heavily on a few big customers

Technological risk: competition can come up with new and better solutions

Cyclicality: the semiconductor business is known for cyclical demand

DeepSeek: companies might need fewer ASML chip-making tools

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of the balance sheet:

Interest coverage: 52.8x (interest coverage > 15x? ✅)

Net Debt/FCF: Net cash position of €292.3 million (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 10.9% (Goodwill to assets < 20%? ✅)

ASML has a very healthy balance sheet. We love to see businesses with a net cash position. Prudence is always better than optimism.

Now let’s dive into the most important Fundamentals.