🏰 The performance of superinvestors

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes.

If you are reading this and are not subscribed yet, feel free to join the Compounding Quality Family via the button hereunder.

1️⃣ The performance of superinvestors

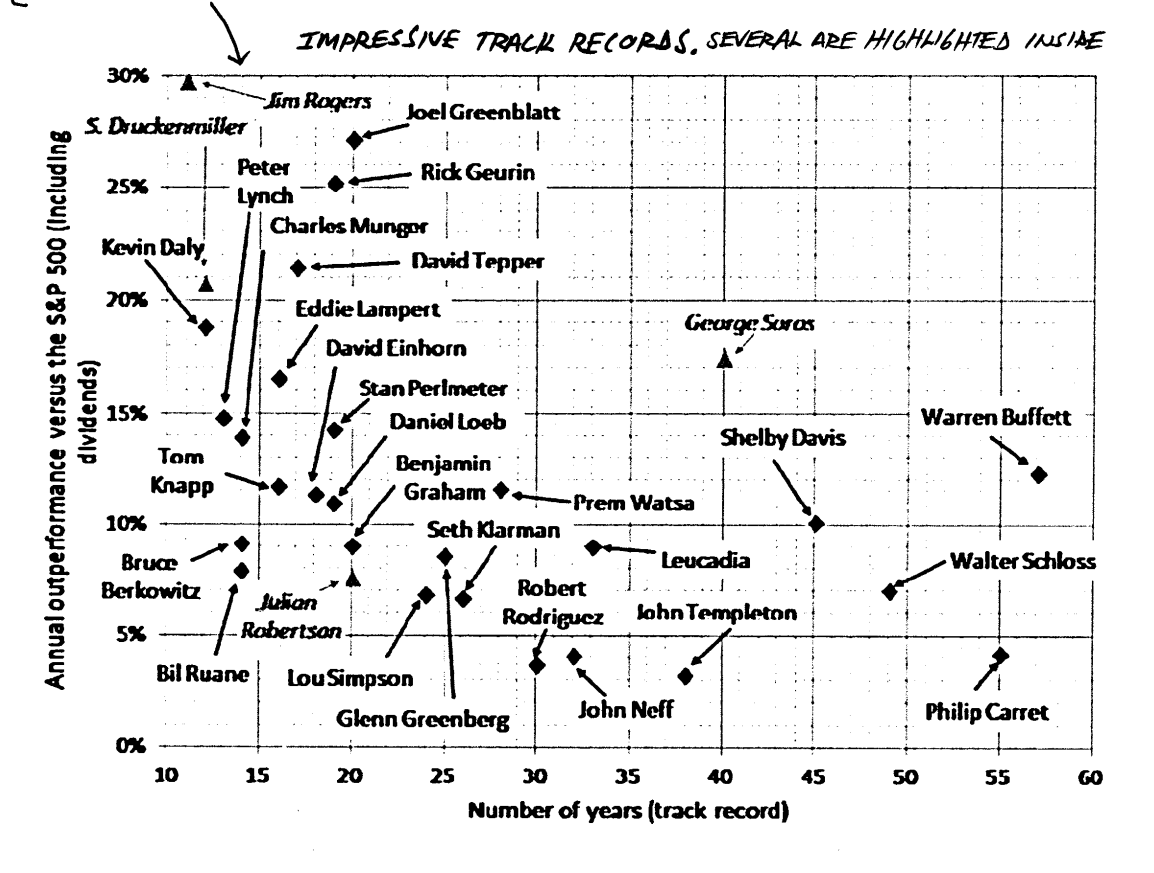

We can learn a lot from superinvestors like Warren Buffett, Charlie Munger, Joel Greenblatt and Li Lu.

Here you can find the track record of the best investors in the world (source: CLSA).

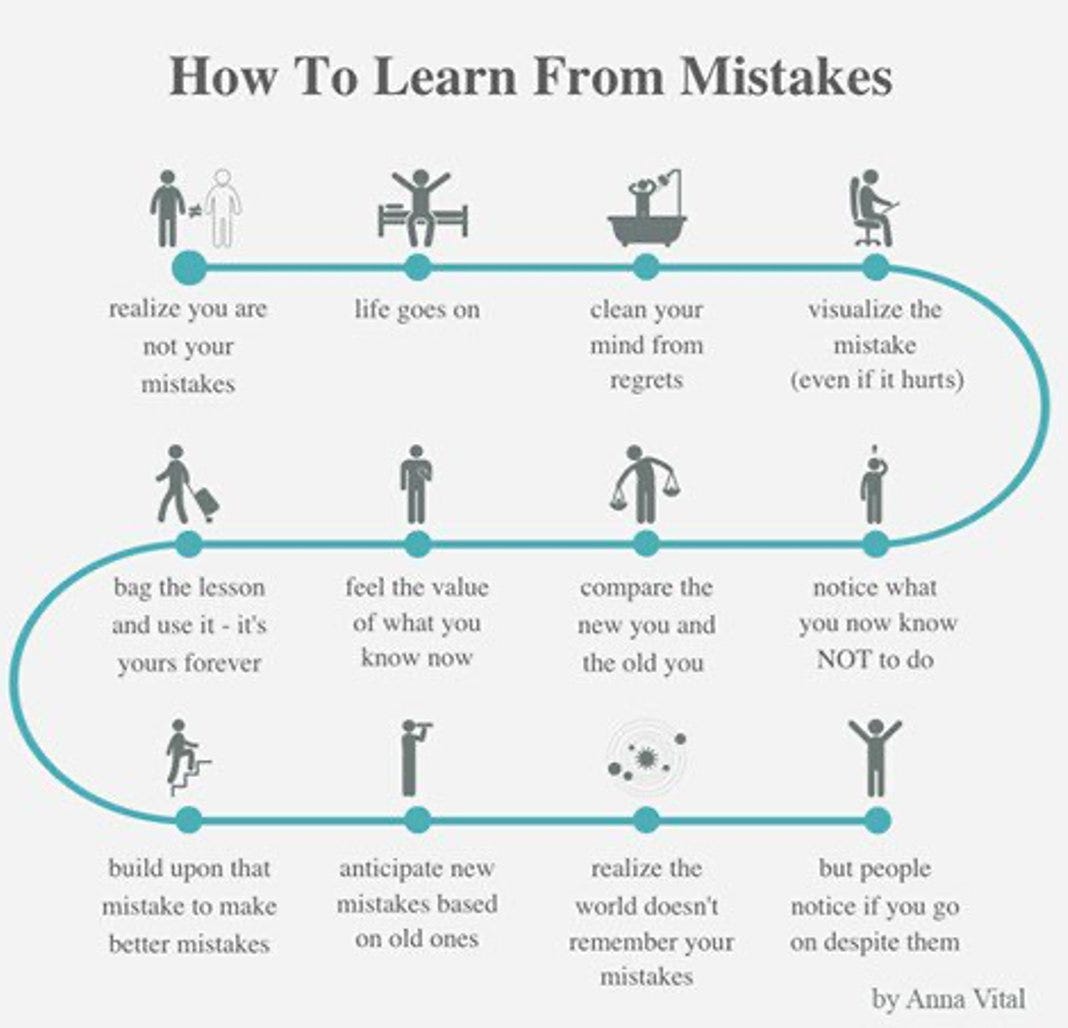

2️⃣ How to learn from mistakes:

Every investor makes mistakes.

Here is how you can learn from them:

3️⃣ One simple investment quote

Volatility is your friend. When a company is trading at its 52-week low but the fundamentals are still good, the stock might be very interesting.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” - Benjamin Graham

4️⃣ Today is a great day to buy stocks

When you invest $200 per month at a return of 7% per year, after 10 years your investment will return more per year than what you contribute each year.

The power of compounding.

5️⃣ Example of a Quality Company

Sonova is a clear market leader in premium hearing aids. More and more people are suffering from hearing problems and this is beneficial for companies like Sonova.

FCF margin: 24.3%

ROCE: 50.7%

FCF yield: 4.4%

Exp. FCF growth (3 yr): 13.3%

CAGR since IPO: 15.5%

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Are you sure the outperformance data is correct and up to date?

The data in section 4 are correct? 200 per month is 2400 per year but the plot suggests otherwise