🏰 The psychology of a market cycle

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes. If you are reading this and are not subscribed yet, feel free to join the Compounding Quality Family via the button hereunder:

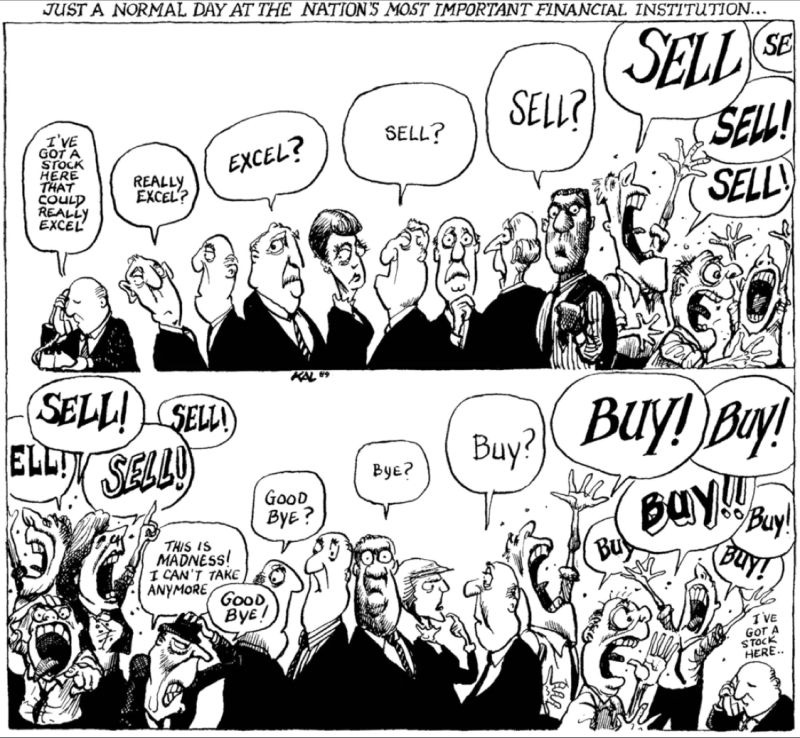

1️⃣ The psychology of a market cycle

This time it’s not different. Use volatility in your advantage.

2️⃣ Be rational

Herd behavior kills you as an investor.

Be as rational as possible and make your own homework.

3️⃣ One simple investment quote

The economy is a lagging indicator for the stock market. In general, the stock market is ahead of the economy by 6 months.

“Every economic recovery since World War II has been preceded by a stock market rally. And these rallies often start when conditions are grim.” – Peter Lynch

4️⃣ Different kind of moats

You want to invest in companies with wide economic moats (strong competitive advantage).

Here you can find a great framework from Morningstar:

5️⃣ Example of a Quality Company

A lot of Quality Companies are active in an oligopolistic market.

In the picture below you can find an overview of Buffett’s investments in oligopolistic companies. Credits go to M/T Capital.

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.