The Top Picks of Our Partners

The Wisdom of Crowds is an amazing thing.

Many Partners of Compounding Quality state that the Community provides even more value than the newsletter itself.

At the end of 2023, I asked every Partner about his 3 favorite stocks.

Almost 200 stocks made the list.

Let’s dive into them. Did our Partners do well?

Performance

Since the beginning of the year, the top 10 picks of our Partners returned 18.7% versus 17.6% for the S&P500.

This outperformance is remarkable given the fact that there was NO Big Tech name within the top 10.

Big Tech accounted for roughly 50% of the returns of the S&P 500 this year. Nvidia alone accounted for 25% of the returns.

If you ask me, the outperformance of Big Tech can’t continue.

The expectations implied in the current stock prices for Big Tech are very high and it rarely happened that the largest 10 positions within the S&P 500 accounted for such a large portion of the index.

Source: Guide to the markets - J.P. Morgan

10 Interesting picks

Now let’s dive into 10 interesting picks of Our Partners.

The Partners with the highest return at the end of the year will win some attractive prizes.

10. ASML (+30.9% YTD)

Company Profile

ASML is a Dutch company and one of the world's leading suppliers of semiconductor manufacturing equipment.

It specializes in photolithography systems used to produce computer chips, playing a critical role in the advancement of semiconductor technology.

Investment rationale

ASML has a (quasi-)monopoly in semiconductor manufacturing equipment

The Dutch company is still investing heavily in future growth

CAGR since IPO in 1995: 26.2%

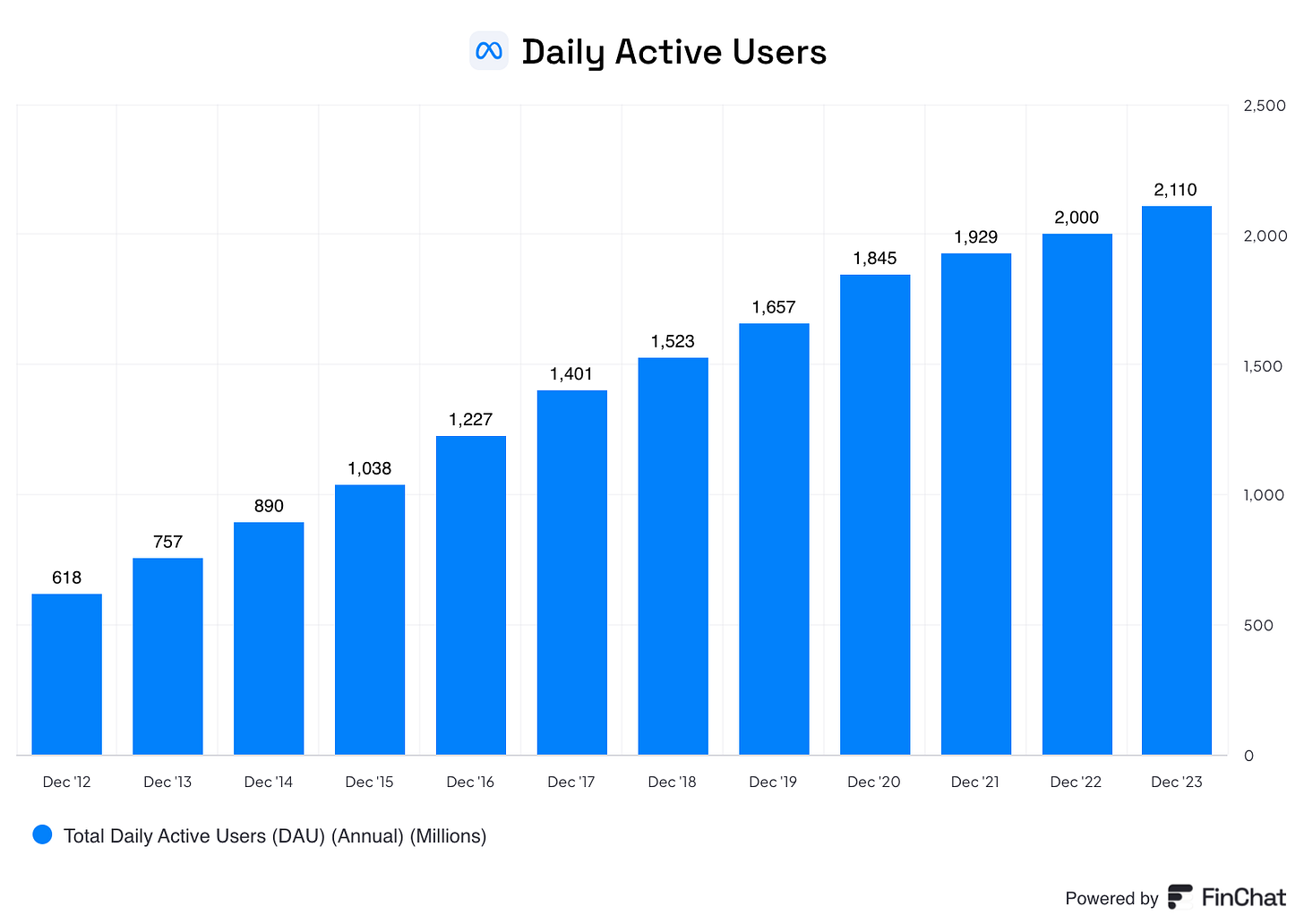

9. Meta Platforms (+33.4% YTD)

Company Profile

Meta Platforms, Inc., formerly known as Facebook, is a multinational technology conglomerate.

It owns and operates various social media and communication platforms, including Facebook, Instagram, WhatsApp, and Oculus, focusing on building community and virtual connectivity

Investment rationale

Mark Zuckerberg is an excellent Owner-Operator

High profitability and great capital allocation skills

Trading at reasonable valuation levels (forward PE: 26.0x)

Source: Finchat

8. The Trade Desk (+34.9% YTD)

Company Profile

The Trade Desk is a global technology company that provides a self-service platform for digital advertising buyers.

It enables advertisers to create, manage, and optimize digital campaigns across various formats, such as display, video, and social media.

Investment rationale

Healthy net cash position

Bright future. Expected long-term EPS growth: 21.7% per year

The Trade Desk returned more than 3,000% to shareholders since 2016

Source: Finchat

7. Crowdstrike (+43.7% YTD)

Company Profile

CrowdStrike is a cybersecurity company specializing in endpoint protection, threat intelligence, and cyberattack response services.

Using its cloud-native Falcon platform, it helps organizations detect and prevent breaches in real time.

Investment rationale

The market for cybersecurity is growing at attractive rates

George Kurtz, the co-founder, is still the CEO today

Crowdstrike is on the verge of becoming profitable

6. Arista Networks (+45.4% YTD)

Company Profile

Arista Networks is a leading provider of networking solutions, particularly known for its high-performance cloud networking technology.

The company designs and sells multilayer network switches to deliver software-driven cloud networking solutions for large data centers and high-performance computing environments.

Investment rationale

Arista Networks will benefit from Artificial Intelligence

The company translates 35% of its revenue into free cash flow

Expected long-term EPS growth: 19.0% per year

Source: Finchat

5. Eli Lilly (+52.9% YTD)

Company Profile

Eli Lilly is a global pharmaceutical company headquartered in the United States, renowned for its innovation in developing medications for diabetes, oncology, immunology, and neuroscience.

With a legacy spanning over 140 years, it continues to focus on research and development to improve patient outcomes.

Investment rationale

The market for diabetes and obesity will keep growing

Eli Lilly is active in an oligopoly together with Novo Nordisk

The fundamentals of Eli Lilly look excellent

4. Synektik (+61.1% YTD)

Synektik specializes in medical technology and innovative solutions, primarily in diagnostic imaging and nuclear medicine.

The company provides comprehensive services, including the development, production, and sale of radiopharmaceuticals.

Company Profile

Diagnostic imaging and nuclear medicine is an attractive segment to be active in

The company still has plenty of growth potential

Cheap valuation level (forward PE: 12.8x)

Source: Finchat

Now let’s dive into the top 3.