It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

Thinking, Fast and Slow is the best Behavioral Finance book ever.

Here are 10 things I learned from the book:

Guess what? We’ve just launched our brand new Investing Course.

Here’s what you’ll learn:

My best investment ever

Why you should invest in quality stocks

How to analyze a company

Everything you need to know about valuation

The best free investing tools

You want to become a better investor? This course is perfect for you.

Yes. I want to get the free course

The main problem of Wall Street? They always think on the short term.

That’s why more than 90% of all Professional Investors underperform the market.

Investing with a long-term mindset is the greatest advantage you can create for yourself.

“The inability of so many investors and managers to invest with a long term horizon creates the opportunity for time arbitrage – an edge in an investing approach that requires the commitment to long-term holding periods.” - Joel Greenblatt

Warren Buffett says that The Intelligent Investor from Benjamin Graham is the best book he has ever read.

Here are 11 things I learned from reading the book.

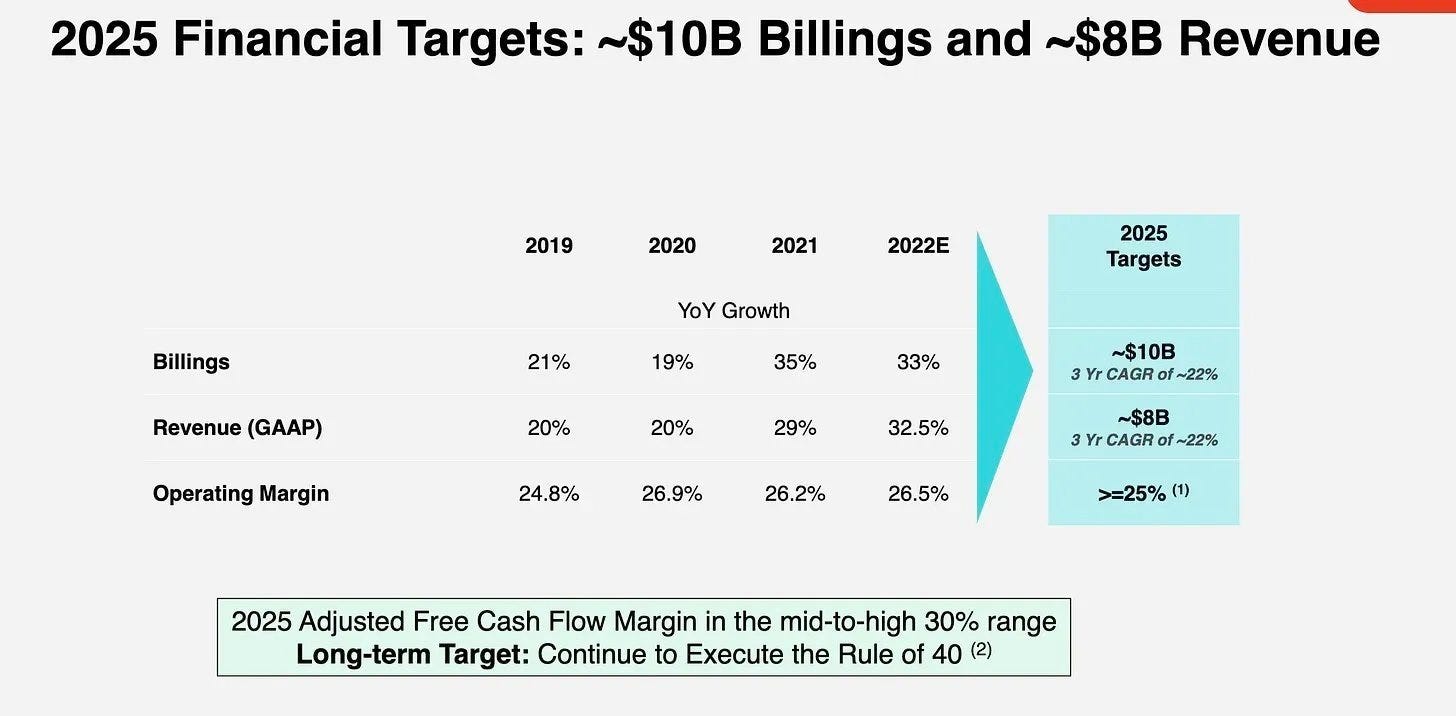

A company we’re looking into currently? Fortinet.

The stock price of this American cybersecurity company plummeted with 12% last week after the publication of their Q3 results. As a result, Fortinet now trades at one of the cheapest valuation levels it has ever traded at since its IPO.

That’s it for today.

Whenever you’re ready, here’s how I can help you:

Disclaimer: The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Compounding Quality serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

The information found on this website should not be interpreted as investment advice, nor does it express any viewpoint on the future trading prices of any company's securities. The opinions and information shared here should not be taken as specific guidance for making investment decisions. Investors are encouraged to conduct their own research and evaluations based on publicly available information, rather than relying on the content herein.

No Offer or Solicitation

The content, including opinions and expressions, present on this website, is not a direct or indirect offer or solicitation to buy or sell securities or financial instruments mentioned.

Forward-Looking Statements and Uncertainties

Any forward-looking statements, projections, or market forecasts contained in this content are inherently uncertain and speculative. They are based on certain assumptions and may not accurately reflect actual future events. Unforeseen events might impact the performance of discussed securities significantly. The provided information is current as of the preparation date and might not apply to future circumstances. The publisher is not obligated to correct, update, or revise the content beyond its initial publication date.

Position Disclosures

The publisher, its affiliates, and clients may hold long or short positions in the securities of companies mentioned. Such positions are subject to change without guarantee.

Liability Disclaimer

Neither the publisher nor its affiliates assume liability for any direct or consequential losses arising directly or indirectly from the use of the information provided in this content.

Consent and Agreement

By accessing the site or affiliated social media accounts, you signify your agreement to this disclaimer and the terms of use. Unauthorized reproduction of the content, whether through photocopying or other means, is unlawful and subject to legal consequences.

Website Ownership and Terms

Compounding Quality (www.compoundingquality.net) is operated by Substack. By accessing the site, you agree to adhere to the current Terms of Use and Privacy Policy. These terms are subject to potential amendments. The content on this site does not constitute an offer to buy, sell, or subscribe to securities where prohibited by law.

Regulation and Investment Guidance

Compounding Quality is not an underwriter, broker-dealer, Title III crowdfunding portal, or valuation service. The site does not provide investment advice or transaction structuring.

Compounding Quality does not validate the adequacy, accuracy, or completeness of information provided. Neither the publisher nor any associated parties make any warranties, explicit or implied, regarding the information's accuracy or the use of the site.

Investing in securities carries substantial risk, and investors should be prepared for potential loss. Each individual should independently assess whether to invest based on their own analysis.

FTNT is great. Hold it and going to buy at every price down.

CQ, I also hold ENPH for a long term. I want to get your opinion since it's a huge drawdown but I'm not scared and am going to hold it for years (the same with FTNT).

Thanks for your work 💓