An exciting niche of Quality Stocks? Holdings.

They outperform the market in the long run.

Let’s take a look at my top 10 favorite holdings.

👁️ Webinar: How to invest in Quality Stocks

On Tuesday, June 10th at 2:00 PM ET (8:00 PM CET) I give a free webinar.

Here’s what you’ll learn:

✅ How to invest like a professional

✅ How Our Portfolio currently outperforms by 9% per year

✅ Find Quality Stocks yourself

✅ Three undervalued Quality Stocks right now

✅ A special gift

You want to become a better investor? Register here:

10. Loews Corporation ($L)

How does Loews make money?

Loews is an American holding company. They own different businesses in areas like insurance, energy, and hotels.Loews Corporation started in 1946. Laurence Tisch convinced his parents to buy a hotel worth $125,000 in Lakewood, New Jersey. His brother Robert joined him shortly thereafter.

With their profits, they bought more hotels.

By 1956, they had sufficient funds to construct a brand-new hotel in Florida. It was called the Americana in Bal Harbour. The rest is history.

Today, the holding also owns businesses in other sectors like insurance and energy.

The Tisch family still owns more than 15% of all the shares.

The family likes to maintain a strong balance sheet and allocates its capital efficiently:

Investment Rationale

The Tisch family is an excellent capital allocator

The company bought back 38% of shares outstanding in the last 10 years

Very healthy balance sheet

9. Markel Group ($MKL)

How does Markel make money?

Markel is an insurer that uses the premiums they receive to invest in stocks. It’s often called a “mini Berkshire Hathaway”.I was invited to a private dinner of Tom Gayner (CEO Markel) at the Berkshire Hathaway weekend this year.

My key learnings? The management team is very humble and transparent. They acknowledge the disappointing results of the last few years.

Markel is working hard to lower its combined ratio (the most important metric for an insurance company).

If they achieve their goal, there is considerable upside potential.

Investment Rationale

The stock has compounded at 15% per year since 1986

Tom Gayner is an excellent CEO

Net asset value has grown by 18% per year over the last five years

8. KKR ($KKR)

How does KKR make money?

KKR is an American investment company. They use money from big clients (like pension funds) to buy and grow other companies.It’s interesting to see the market fully recovered from the Trump Tariffs, but KKR didn’t:

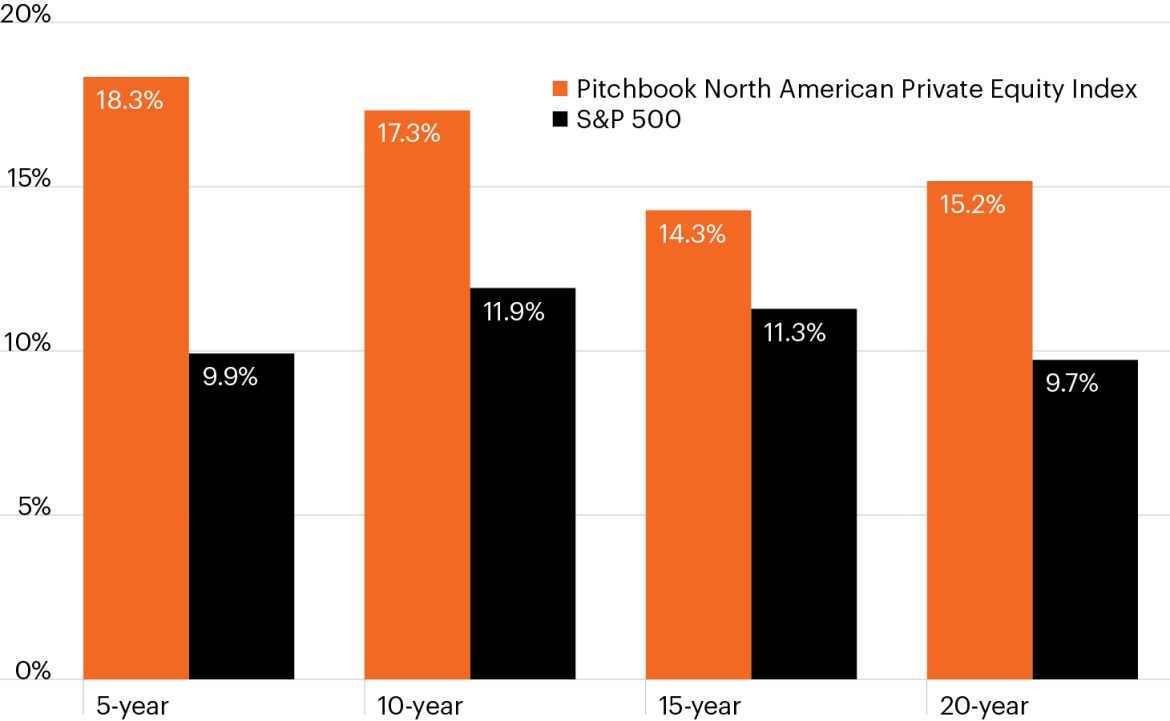

Private Equity is an exciting industry.

In the long term, it outperforms public markets:

Investment Rationale

KKR wants to become a mini Berkshire Hathaway

Co-founders Kravis and Roberts are still active in the company

The company’s Assets Under Management have compounded by 18% per year since 2010

7. Brookfield Corporation ($BN)

How does Brookfield Corporation make money?

Brookfield invests in real estate, infrastructure (such as bridges and pipelines), renewable energy and Private Equity. With more than $900 billion under management, they are one of the largest investment companies in the world.Brookfield came on my radar when I saw their approach to long-term compounding:

Invest in good businesses

Run the businesses well

Allocate excess Free Cash Flow wisely

Align everyone with long-term objectives

Keep evolving with the world around us

And it works. The company has an excellent track record.

They performed significantly better than Berkshire Hathaway over the past 30 years:

Investment Rationale

The stock returned 18% per year for the last 30 years

Insiders own 11.2% of the total shares outstanding

Brookfield expects to compound at 15% per year in the future

6. MBB ($MBB)

How does MBB make money?

MBB SE is a German holding company that acquires and manages medium-sized industrial and technology businesses with long-term growth potential. They use a decentralized approach to let subsidiaries operate independently.MBB is a family-owned company that invests in other family businesses.

The Freimuth family owns 73% (!) of the shares via their investment vehicle MBB Capital Group GmbH.

What’s very interesting?

They focus on secular trends such as the energy transition and cybersecurity. These themes will only become more important over the next few decades.

Investment Rationale

The company benefits from secular trends

The Freimuth family owns 73% (!) of the company

Annual Revenue growth over the past 10 years: 16.7%

5. Exor ($EXO)

How does Exor make money?

Exor is an Italian holding that invests in industry, automobiles, media and health care. The company owns well-known businesses like Ferrari, Stellantis (which includes Fiat and Jeep), and soccer club Juventus.Ferrari is a quality stock I would like to own.

The only problem? Ferrari trades at 50 times earnings.

Via Exor, you can buy Ferrari at a large discount, as 43% of Exor’s portfolio consists of Ferrari stock.

Exor currently trades at a discount of 52% (!) compared to its fair value.

Next to Ferrari, you should also look at the other companies Exor owns.

Here’s what their portfolio looks like:

Investment Rationale

Ferrari is an amazing quality stock

Exor trades at a discount of more than 50%

The holding is doing share buybacks

4. Investor AB ($INVE-B)

How does Investor AB make money?

Investor AB is a Swedish holding company that has been around since 1916. They own major Swedish companies such as Atlas Copco, ABB and AstraZeneca.Investor AB is owned by the wealthy Wallenberg family. They own 20.1% of the total shares outstanding.

The Swedish holding consists of three parts:

Stock-listed companies (69% of the Portfolio): Investing in large, mostly Swedish, publicly traded companies like ABB and Atlas Copco

Patricia Industries (21% of the Portfolio): Serial Acquirer of niche companies in healthcare and robotics

EQT (10% of the Portfolio): Private Equity firm investing in technology, healthcare, energy, and services

Investor AB grew attractively in the past:

Investment Rationale

When Investor AB talks long term, they mean 100 years

The company has a history going back to 1856!

The Wallenberg family owns 20.1% of the company

Top 3

The Top 3 holdings are only available for Partners of Compounding Quality.

You want to test out Compounding Quality risk-free? More information can be found here:

You want to learn more first?

On Tuesday, June 10th at 2 PM ET / 8 PM CET, I’m hosting a live session where I’ll share all my investing secrets.

It’s free, and it’s for anyone who wants to become a better investor.

Here’s what we’ll cover:

📈 How I build my investment Portfolio

🔍 How to spot the best companies in the world

💰 My 3 favorite stocks right now

🎁 A special surprise

Reserve your spot here:

Everything In Life Compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data