Top 20 Stocks For 2026

Stock ideas for the new year

2026 is just around the corner.

Wall Street analysts estimate the S&P 500 could hit 7,800 in 2026.

This would imply an increase of +15%.

I don’t make predictions like that. No one knows the future.

What I do know? Two things:

The best investment is always one in yourself.

Stocks compound your wealth over time.

Let’s give you some interesting investment ideas for the new year.

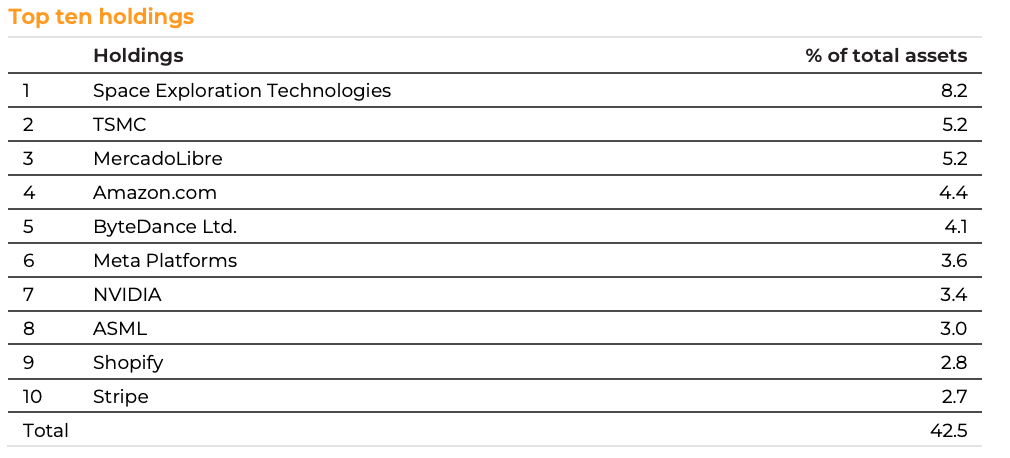

20. Scottish Mortgage Investment Trust ($SMT)

Company Profile

Scottish Mortgage is a publicly traded investment trust.

They identify and invest in ‘exceptional’ public and private companies that are building the future of the global economy.

Via $SMT, you get exposure to companies you could otherwise never get exposure to. Think about companies like SpaceX and ByteDance (TikTok).

Investment Rationale

Owns some of the world’s best public companies and private tech firms

Long holding periods allow real compounding to play out

Scottish Mortgage Trust invests in its best ideas only

19. Adobe ($ADBE)

Company Profile

Adobe makes some of the world’s most used creative and marketing tools, including Photoshop and Illustrator.

The company generates revenue primarily via subscriptions. 96% (!) of its revenue is recurring in nature.

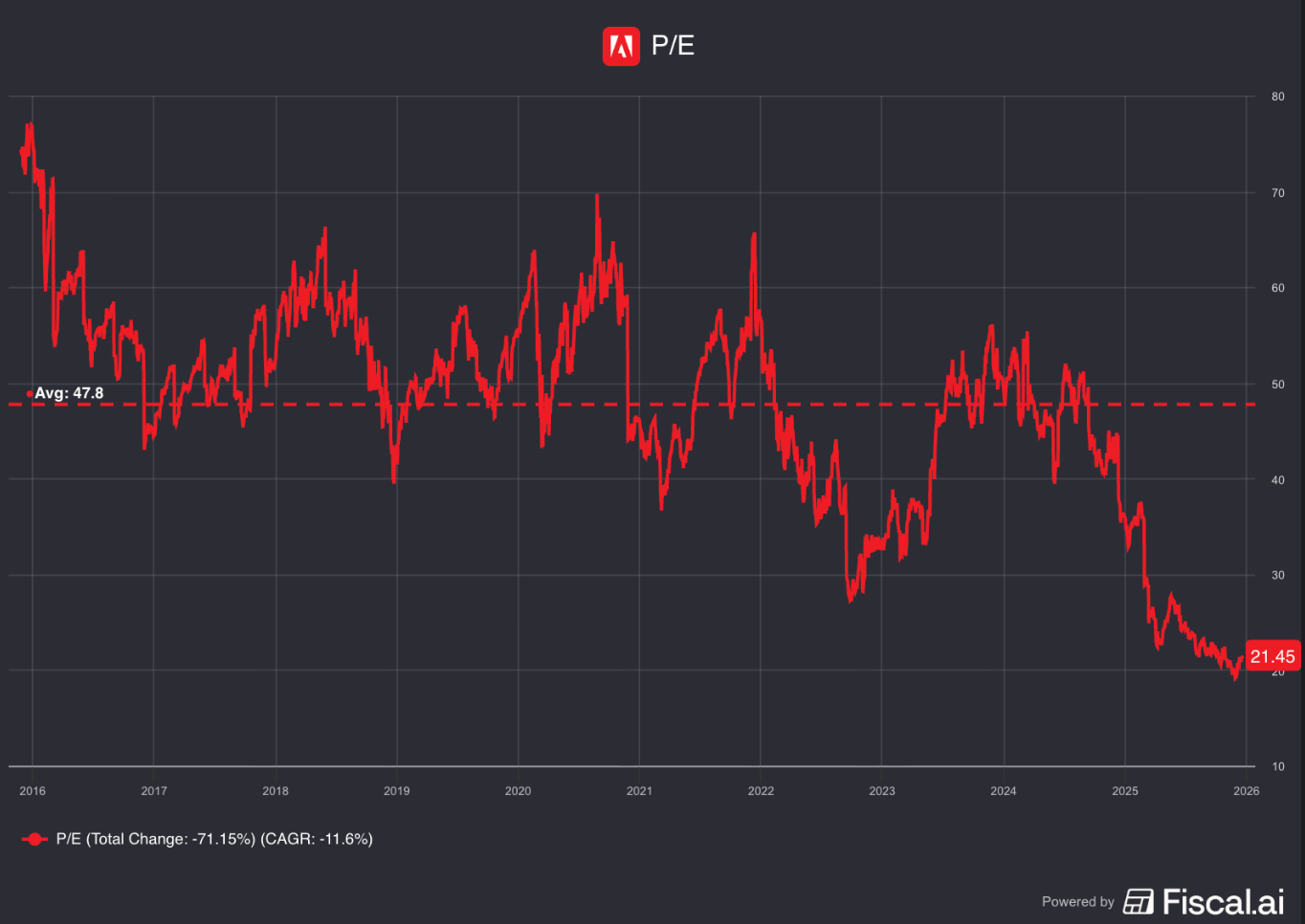

Adobe currently trades at cheap valuation levels. Management thinks the company is cheap too as they are heavily buying back shares today.

It might be an opportunity for investors who want to buy quality at low valuation levels.

Investment Rationale

Adobe’s products are the industry standard

The company profits from high customer loyalty and a strong brand name

High FCF margin (41.4%) and ROIC (35.8%)

Read the full investment case here.

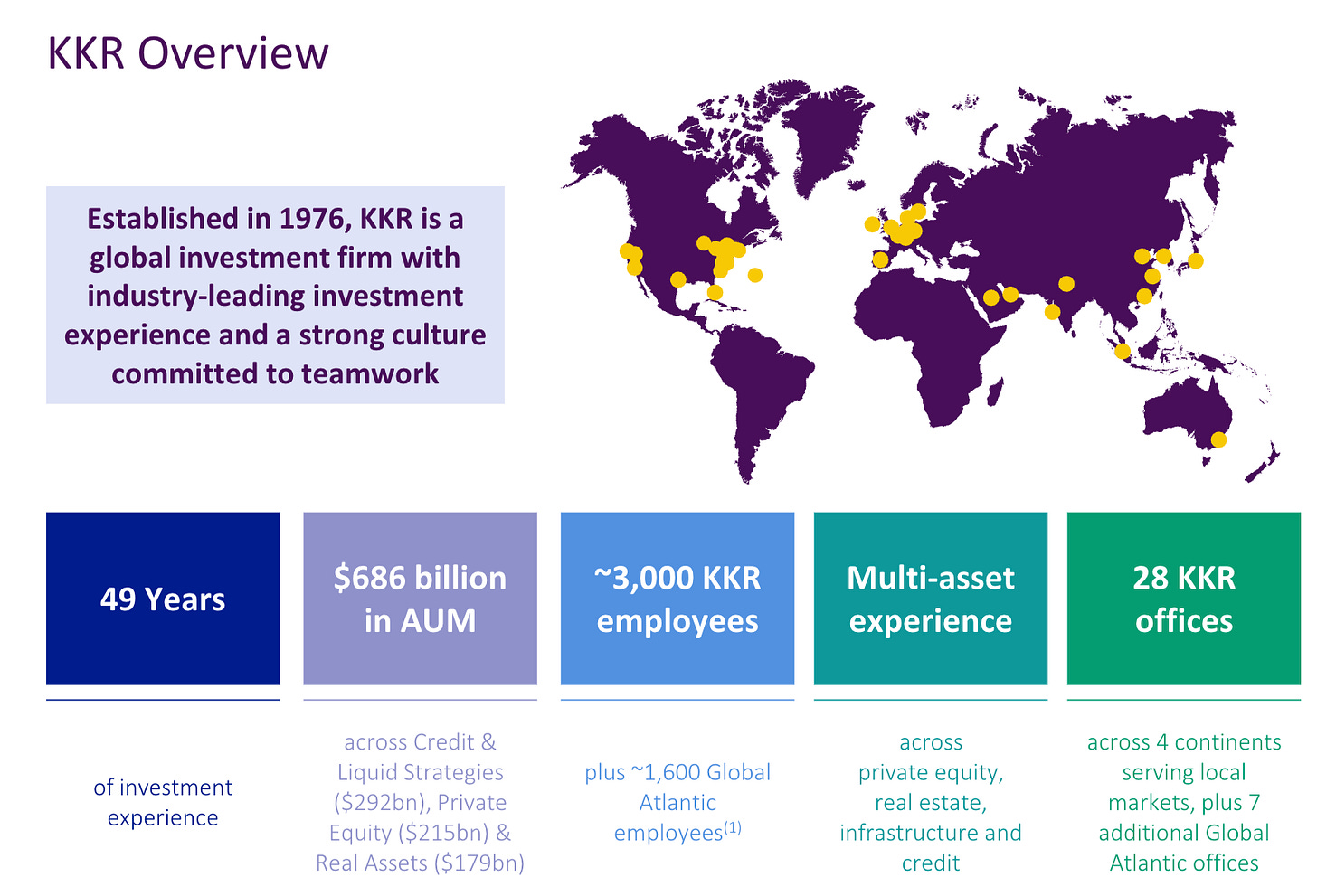

18. KKR & Co. ($KKR)

Company Profile

KKR is a global leader in alternative investing, with a strong presence in private equity, infrastructure, and real estate.

The firm makes money through management fees on large funds and performance fees when investments do well.

They invest their own capital alongside clients, keeping their interests closely aligned with its partners.

Investment Rationale

One of the largest global alternative asset managers in the world

Manages over $600 billion in assets across PE, credit, and infrastructure

Earnings scale as private markets continue to expand

Read the full investment case here.

17. Copart ($CPRT)

Company Profile

Copart is the world’s largest online marketplace for vehicle auctions and salvage sales.

It mainly works with insurance companies, selling damaged and very old vehicles to buyers around the world.

The business is very resilient. Unfortunately, car accidents happen in every economic environment.

Investment Rationale

Global leader in online vehicle auctions

Net cash position of $5.1 billion (13.5% of the market cap)

Great capital allocation metrics (ROIC: 30.0%) driven by a highly scalable platform

Read the full investment case here.

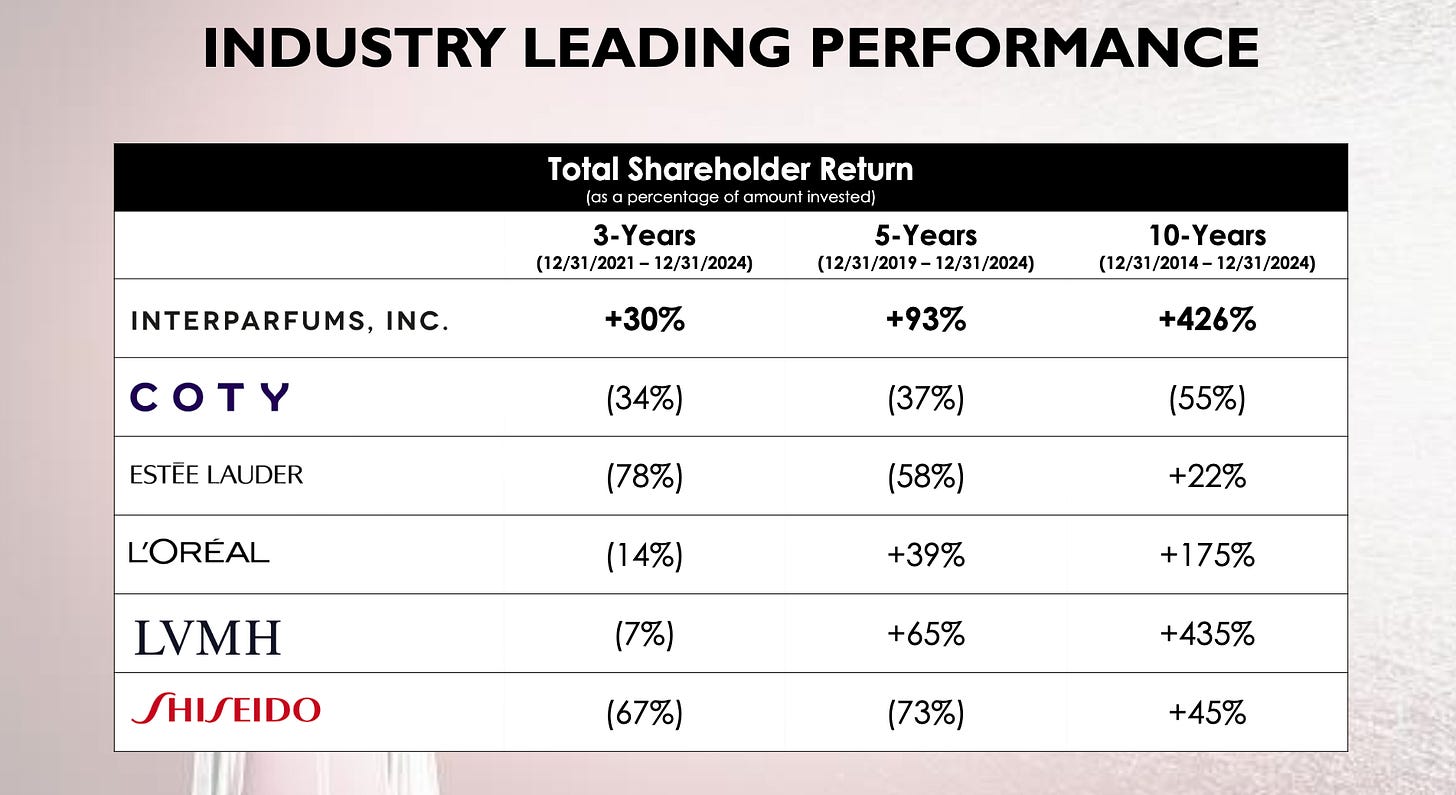

16. Interparfums ($IPAR)

Company Profile

Interparfums creates and sells premium perfumes under long-term licenses for well-known brands like Montblanc, Jimmy Choo, and Coach.

The company outsources manufacturing and focuses on product design, marketing, and global distribution.

Sales grow through regular launches of new fragrance lines and limited-edition releases.

Investment Rationale

Licensed fragrance partner to strong brands like Montblanc and Coach

Asset-light model with high profitability (Net Profit Margin: 14.1%)

Steady growth through frequent new product launches

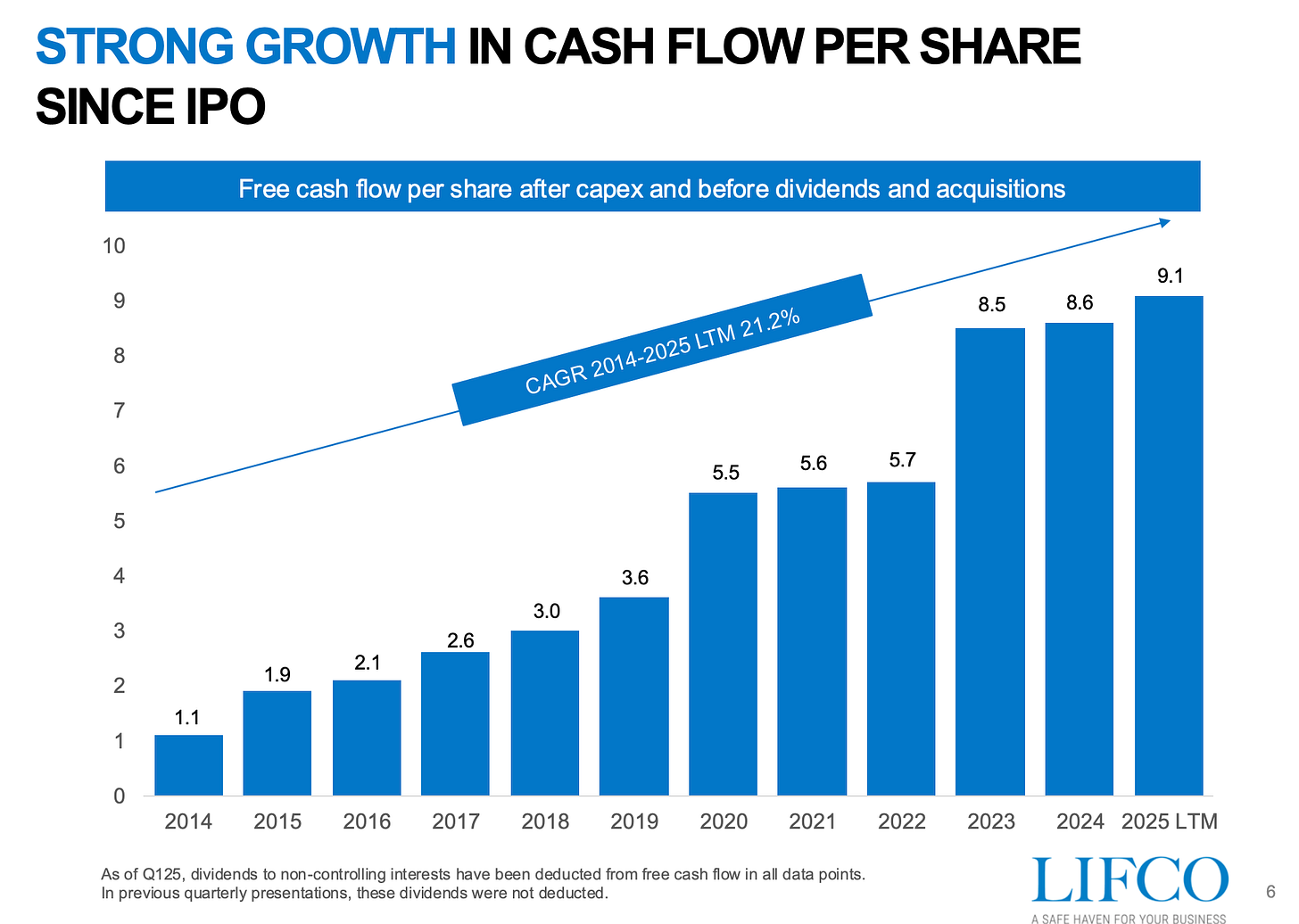

15. Lifco ($LIFCO-B)

Company Profile

Lifco is a Swedish serial acquirer that owns a decentralized group of niche market leaders.

The group operates in three main segments:

Dental

Demolition & Tools

Systems Solutions.

Lifco makes money by acquiring small-to-medium-sized private companies with sustainable profits and strong cash flows.

Investment Rationale

Acquires small, high-quality niche businesses

A Portfolio of over 200 operating companies

Long-term returns driven by disciplined capital allocation

Read the full investment case here.

14. Judges Scientific ($JDG)

Company Profile

Judges Scientific acquires and operates niche businesses in the scientific instruments sector.

These companies design and manufacture highly specialized tools for research and industry.

Judges Scientific makes money by growing these acquired companies.

Investment Rationale

Exceptional capital allocation under amazing management

Serial acquirers outperform the market in the long run on average

Judges Scientific is up +55.000% since 2003

Now let’s dive into the top 3.