Update Buy-Hold-Sell List: February 2026

Crazy times on the stock market right now.

While tech stocks are having a very hard time, other companies are trading at all-time highs.

I’ve never been more excited about the great opportunities I’m seeing in the market right now.

Which ones? Let’s dive into our Buy-Hold-Sell List.

Crazy times for silver

What’s happening with the silver price is crazy.

It seems to be a very speculative market.

Silver is now trading at $79 per troy ounce.

One year ago, silver traded at just $29 per troy ounce. This means the price almost tripled.

Silver is used in a lot of industrial products. Think about things like:

Solar panels

Electronics

Electric Vehicles & batteries

Industrial equipment

So when silver moves sharply, it can influence:

The costs for suppliers

The profit margins of producers

The pricing power of companies

But now let’s talk about quality stocks.

While silver looks expensive and speculative right now, a lot of quality companies are trading at low valuation levels.

I believe the market offers us incredible opportunities today.

Just look at the situation for Our Portfolio.

The average company within Our Portfolio increased its intrinsic value by +13.8% last year.

Stock prices didn’t follow. This means the expected return of our companies increased.

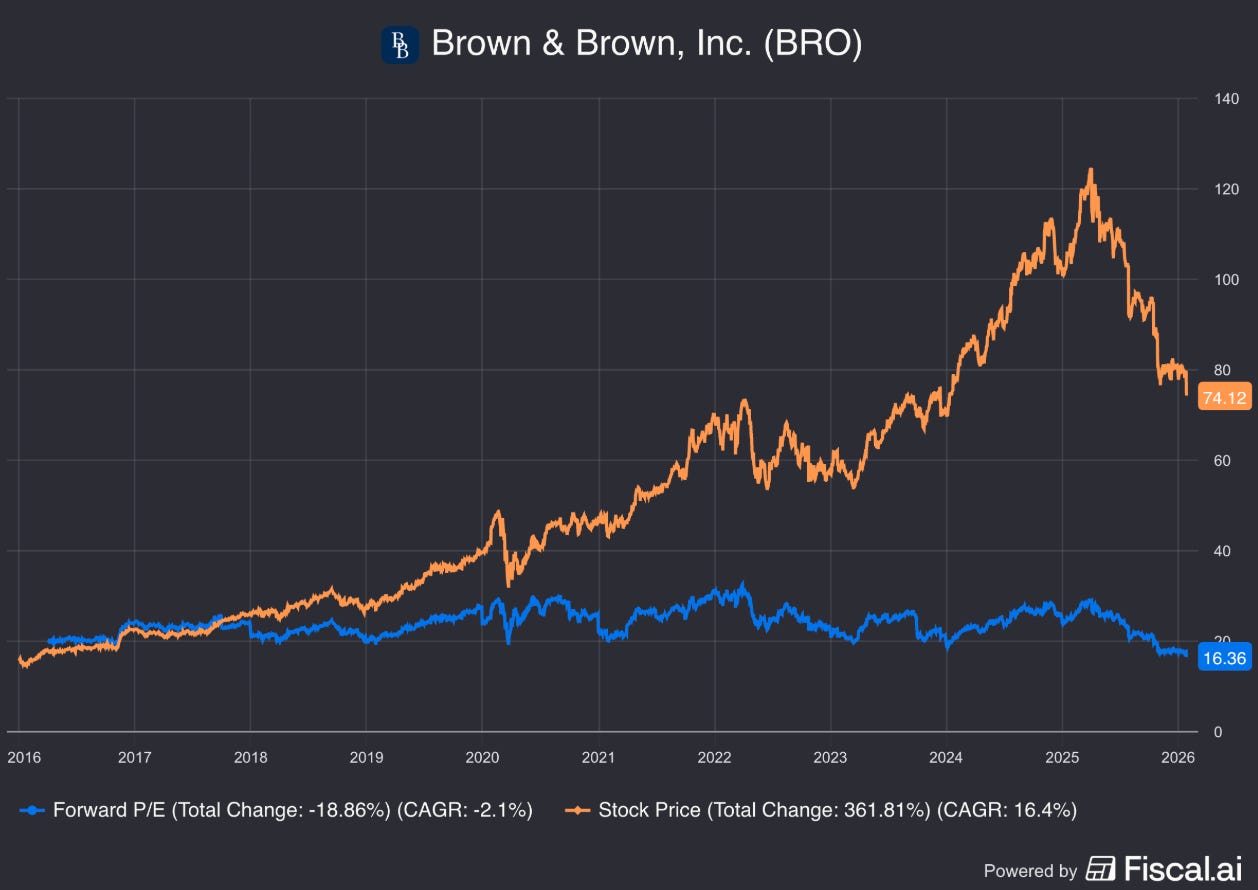

Just take Brown & Brown ($BRO) for example:

Increase intrinsic value in 2025: +13.6%

Stock price in 2025: -21.9%

As a result, the stock became 35% (!) cheaper.

This is great news for long-term quality investors like ourselves.

Buy-Hold-Sell List

The Buy-Hold-Sell List is a list of quality companies.

Here’s an overview of this series:

We look for cheap Quality Stocks based on three valuation methods:

Comparing the Forward PE multiple to its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

Based on this, we give each company a Buy, Hold, or Sell recommendation.

Update February 2026

Since the last update, there have been some changes in our list:

Five companies went from Hold to Buy:

Mastercard ($MA): Duopoly in digital payments together with Visa

RH ($RH): Luxury furniture brand

Hamilton Lane ($HLNE): Private markets investment firm

Esquire Financial Holdings ($ESQ): A specialty bank focused on the legal industry

Intercontinental Exchange ($ICE): Global exchange and market data operator

Two companies went from Buy to Hold:

Chemed ($CHE): Healthcare services company operating hospice care

Pool ($POOL): Leading consolidator and distributor in the swimming pool supplies

You can download the entire Buy-Hold-Sell List here: