Update Buy-Hold-Sell List: September 2025

Undervalued stocks

The S&P 500 just hit a new record.

Today, it’s time to update our Buy-Hold-Sell List.

Right now, 38 stocks on Our Watchlist have a ‘Buy’ Rating.

Taking Compounding Quality to the next level

The key goal over the next few weeks? Take Compounding Quality to the next level.

We are currently working on the following:

- An extensive update on every company in Our Portfolio

- A monthly Q&A sessions where you can ask questions

- Deep Dives on high-quality companies (Constellation Software, Brookfield Corporation, Fortinet, MSCI, Old Dominion Freight, ...).

I hope you're as excited as I am!Quality over everything

Do you know this football player (soccer)?

His name is Jeremy Doku.

He’s one of the fastest players in the world. His acceleration is unmatched. In the first 10 meters, nobody beats him.

It’s why he’s worth around $77 million today.

But imagine this: What if he were just 10% slower?

Would his value drop 10%?

No. It could drop by 90%. Or more. Maybe he’d even never become a professional football player.

A small edge can be the difference between superstar or substitute.

And here’s the clue: The exact same thing applies to companies.

A small edge, such as very loyal clients or better products, can make all the difference.

Lose that edge? The whole thing might fall apart.

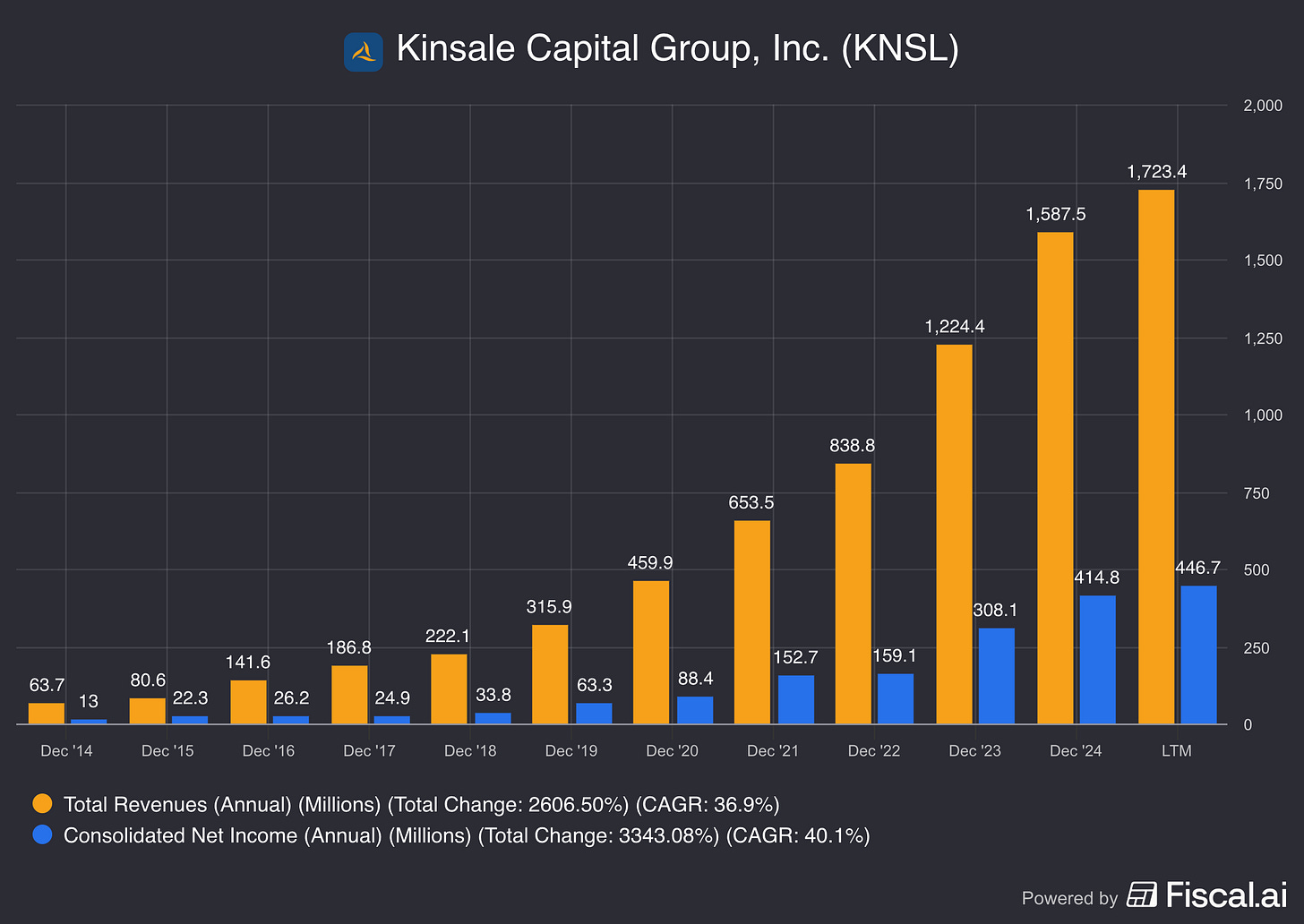

Take Kinsale Capital.

Their combined ratio is approximately 10% lower than the one of its competitors.

What is the combined ratio?

The combined ratio is a key number for insurance companies. The lower this ratio, the better.

You can calculate the combined ratio by taking the sum of all expenses and incurred losses and dividing this number by the total premiums an insurance company receives.As you can see here, Kinsale Capital has the lowest combined ratio in the industry:

You can make a huge difference in the long run by being just 10% more efficient:

That’s exactly why only the best of the best is good enough for us.

Our entire Buy-Hold-Sell List consist solely of high-quality companies.

Buy-Hold-Sell List

The Buy-Hold-Sell List is a list of quality companies.

Here’s an overview of this series:

We look for cheap Quality Stocks based on three valuation methods:

Comparing the Forward PE multiple to its historical average

Earnings Growth Model

Reverse Discounted-Cash Flow

Based on this, we give each company a Buy, Hold, or Sell recommendation.

Update September 2025

Since the last update, I’ve removed FDM Group from the Buy-Hold-Sell list.

FDM Group ($FDM): The results are too volatile and the quality might be lower than I initially thought

I also updated the recommendations for some companies since last time.

Five companies went from Hold to Buy:

Alarm.com ($ALRM): Provides cloud-based security and smart home solutions

Automatic Data Processing ($ADP): Global provider of payroll and HR outsourcing services

Copart ($CPRT): Online auction platform for used and salvaged vehicles

Pool Corporation ($POOL): Distributor of swimming pool and outdoor living products

Old Dominion Freight Line ($ODFL): Less-than-truckload carrier specializing in freight

ASML ($ASML) went from Buy to Hold.

The stock rose 22% recently as demand for chip tools keeps increasing.

You can download the entire Buy-Hold-Sell List here: