Update Novo Nordisk

Never a dull moment

Never a dull moment in the stock market.

That’s the least you could say.

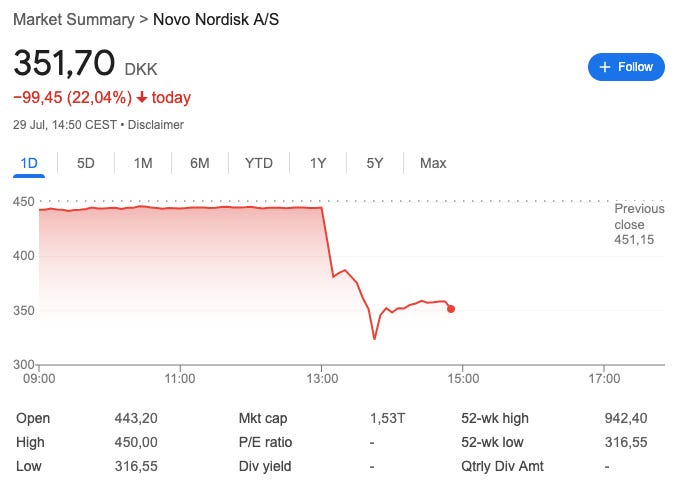

Novo Nordisk just lowered its guidance for 2025. The stock is down 22% as a result.

Let’s give you an update.

What’s happening?

Here’s what’s happening in short.

Novo Nordisk has updated its full-year outlook for 2025. You can read the official communication here.

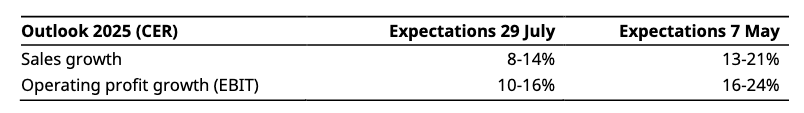

Sales growth is now expected to be 8-14% and operating profit growth is expected to be 10-16%.

Here's a comparison with the initial guidance:

The lowered sales outlook for 2025 is driven by lower growth expectations for the second half of 2025.

This is related to:

Lower growth expectations for Wegovy in the US obesity market

Lower growth expectations for Ozempic in the US GLP-1 diabetes market

Mainly due to increased competition

Lower-than-expected penetration for Wegovy® in select IO markets

Mainly due to increased competition and slower market expansion

Here’s the key issue, if you ask me:

"Even though the FDA said it had to stop by May 22, 2025, some companies are still selling fake versions of Novo Nordisk’s medicines. They act like these are “personalized,” but they’re actually homemade and unsafe. Novo is worried people could get hurt. That’s why they’re taking legal action and asking the government to help. They’re especially scared that these knockoffs might be made with illegal or fake ingredients from other countries."Should investors panic?

In short, I don’t think so.

Don’t get me wrong on this. It’s never fun to be served a lowered guidance and a stock drop of over 20% as a result.

But we should always take these pieces of wisdom from Warren Buffett into account:

If you plan to be a net buyer of stocks... You should pray for lower stock prices.

The stock market serves as a relocation center at which money is moved from the active to the patient. In any case, we enjoy the opportunity to buy at lower prices.

As long as the fundamentals remain intact for Novo Nordisk, this is a buying opportunity rather than a reason to panic.

Let’s look at the numbers.

Novo Nordisk states it expects its Free Cash Flow for 2025 to be between 35 and 45 billion DKK.

If we add Growth CAPEX (Novo Nordisk is investing heavily in future growth), Novo Nordisk will have a Free Cash Flow of 80.4-90.4 billion DKK.

This gives a FCF Yield of 5.4%-6.0% at the current stock price.

This is very cheap.

I also think it’s very important to highlight that while Novo Nordisk lowered its guidance, the growth outlook still doesn’t look very bad.

An expected EBIT growth of 10-16% in 2025 is not unattractive for a company that trades at just 13.9x earnings.

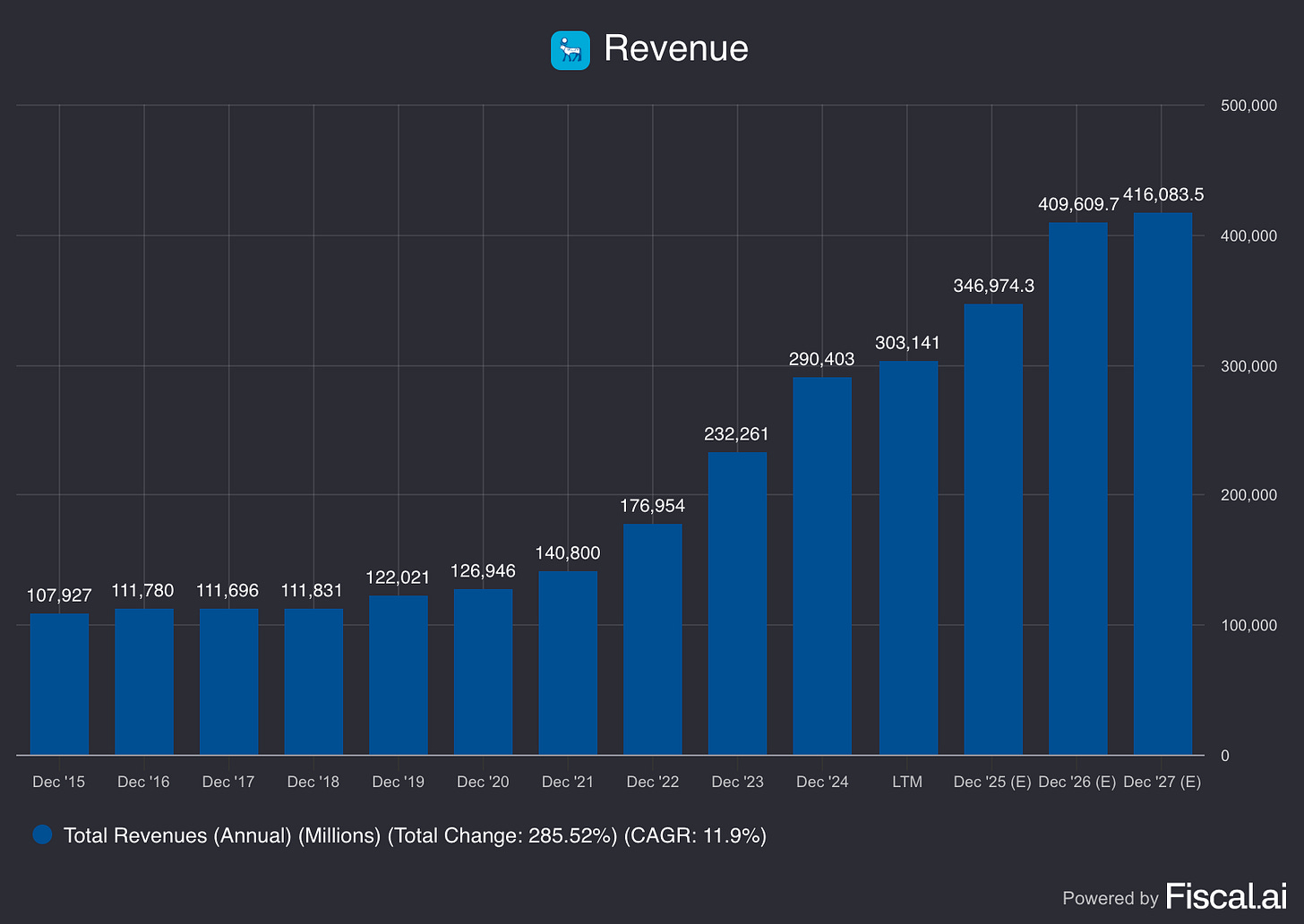

Here’s how their revenue is expected to evolve in the years ahead:

This still looks attractive if you ask me.

It looks like Novo Nordisk is valued as a no-growth company, while it should still be able to grow attractively.

Let’s now dive deeper into the valuation.

Valuation update

Forward PE: Novo Nordisk now trades at a FWD PE of 13.9x versus a 10-year average of 24.3x. This indicates an undervaluation of over 40%. This is one of the cheapest valuation levels Novo Nordisk has EVER traded at:

Forward PE based on 2025 earnings: 13.9x

Forward PE based on 2026 earnings: 12.0x

Forward PE based on 2027 earnings: 10.5x

Earnings Growth Model: Expected yearly return of 15.3% per year

This means the stock could double every 5 years

Reverse DCF: Novo Nordisk should grow its FCF by 7.3% per year to return 10% per year to shareholders. Those assumptions look conservative.