Update OTC Markets

Last Wednesday, OTC Markets published its Q3 results.

It’s a company we own within the Portfolio.

Here’s what you’ll learn in today’s article:

What we learned from the 1-on-1 with CEO Crowell Coulson

An update of the Q3 Results

Our investment rationale for OTC Markets

Are you ready? Let’s hop right in.

Onepager

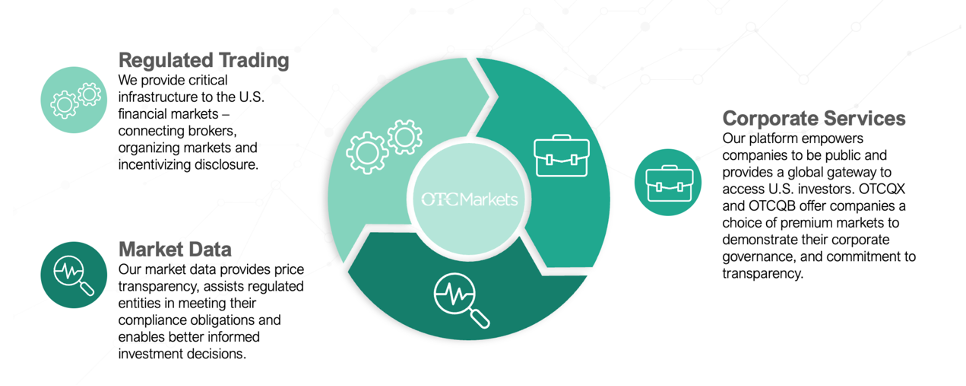

For those who aren’t familiar with OTC Markets, here’s a onepager explaining the essentials (click on the picture to expand):

In short: OTC Markets can be seen as the ‘NYSE for smaller companies’.

The company makes money by trading over-the-counter securities and providing market data. 86% (!) of their revenues are recurring in nature.

1-on-1 call with Cromwell Coulson

Two weeks ago, we had a 1-on-1 call with Cromwell Coulson. Cromwell has been the CEO of OTC Markets since 1997 and owns 34.9% of the company.

This means his stake in OTC Markets is worth $239 million!

The first thing that stood out from talking with Cromwell Coulson? He’s very funny, approachable and down-to-earth. OTC Markets isn’t about Cromwell Coulson. It’s about something bigger than himself and he puts a lot of emphasis on the importance of culture.

Coulson puts the creation of shareholder value first and thinks and acts as an investor (he actually is an investor himself). The fact that some people who invested in the Buffett Partnership (1956-1969) are shareholders of OTCM proves that the company has ‘Quality Shareholders’.

Cromwell was also constantly referring to excellent (investment) books like The Outsiders by William Thorndike and From Good to Great by Jim Collins. We love to see managers who keep learning from other excellent capital allocators and investors by reading a lot. As you know, those who keep learning will keep rising in life.

Here’s what we learned from the 1-on-1 call with Cromwell Coulson:

Capital allocation

OTC Markets will keep focusing on organic growth and paying a dividend. The company is very cost-conscious as they think and act like owners.

Over the past 5 years, OTCM’s ROIC averaged a phenomenal 56.1%.

Historical growth and outlook

When I asked Cromwell why the company’s growth stagnated last year, he answered the following:

“Because of the incompetence of the CEO and he should be punished for that.” - Cromwell Coulson

This shows that he’s willing to admit his mistakes and to report honestly to shareholders. It’s an essential characteristic of a great CEO.

The company doesn’t want to make future growth estimates as they think it will harm long-term thinking. In other words: OTC Markets doesn’t want to focus on quarterly results just like Wall Street does.

We consider this as a huge positive as well as you don’t want to invest in companies that make up the numbers to meet the quarterly estimates of analysts.

“The only value of stock forecasters is to make fortune tellers look good.” - Warren Buffett

Stock-Based Compensation

One of the minor things about the investment case of OTC Markets? They use a lot of stock-based compensation to reward their employees. In 2022, 2021, and 2020, SBCs as a percentage of net income were equal to 14.1%, 10.9%, and 16.7% respectively

Cromwell and I talked extensively about this topic. His view is that Stock-Based Compensation has to be thought of as a pillar of growth.

Cromwell wants to create a culture of ownership and giving Stock-Based Compensation to employees helps him achieve this. He said that it should be very painful for key management and employees when the stock doesn’t perform well.

That’s why EVERY employee of OTCM owns shares of the company.

“We want to have employees who think and act as shareholders.” - Cromwell Coulson

What about the competitive environment?

Obviously, companies like the New York Stock Exchange, Nasdaq, … are significantly larger than OTC Markets.

There are two questions that should arise to you as an investor:

Would these larger players ever consider acquiring OTC Markets?

Would these larger players ever want to enter the Over-the-counter (OTC) market?

OTC Markets can be seen as a market leader in a niche. They were the market leader 10 years ago and will probably still be the market leader 10 years from now. Larger players like NYSE and Nasdaq have no intention of entering this niche market.

Regarding being acquired, Cromwell Coulson said the following:

“I wouldn’t consider myself as a personal success if we sold OTCM to a larger player in the industry.” - Cromwell Coulson

Portfolio

As mentioned at the beginning of this article, OTCM can be found within our Portfolio.

The goal is to outperform the S&P 500 by 3% per year in the very long term.

So far, the Portfolio has had a Flash Start as you can see here:

While short-term performance doesn’t say anything about your investment process, it’s better to start with an outperformance of almost 6% than the other way around.

Now let’s dive into OTC Market’s Q3 results and update our investment case.