📈 Is Visa an interesting stock?

Not So Deep Dive Visa

Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Visa and Mastercard are two beautiful businesses.

They operate in a duopoly and dominate the entire electronic payment industry.

Is Visa an interesting investment? Let’s find out today.

Visa - General Information

👔 Company name: Visa

✍️ ISIN: US92826C8394

🔎 Ticker: V

📚 Type: Oligopoly

📈 Stock Price: $256

💵 Market cap: $507 billion

📊 Average daily volume: $1.6 billion

Onepager

Here’s a onepager with the essentials of Visa

You can click on the picture to expand:

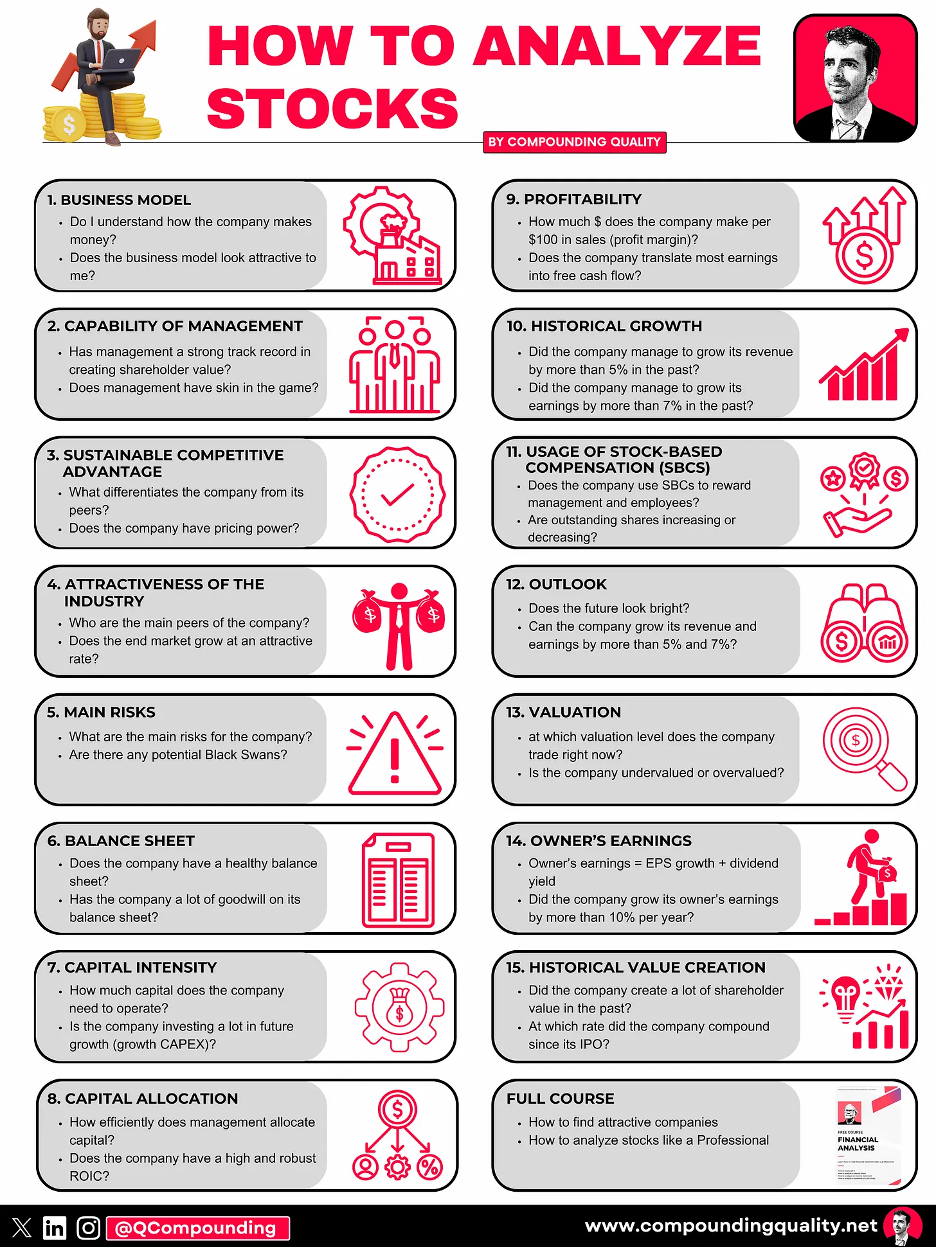

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Visa a score on each of these 15 metrics.

Should we consider buying the company?

1. Do I understand the business model?

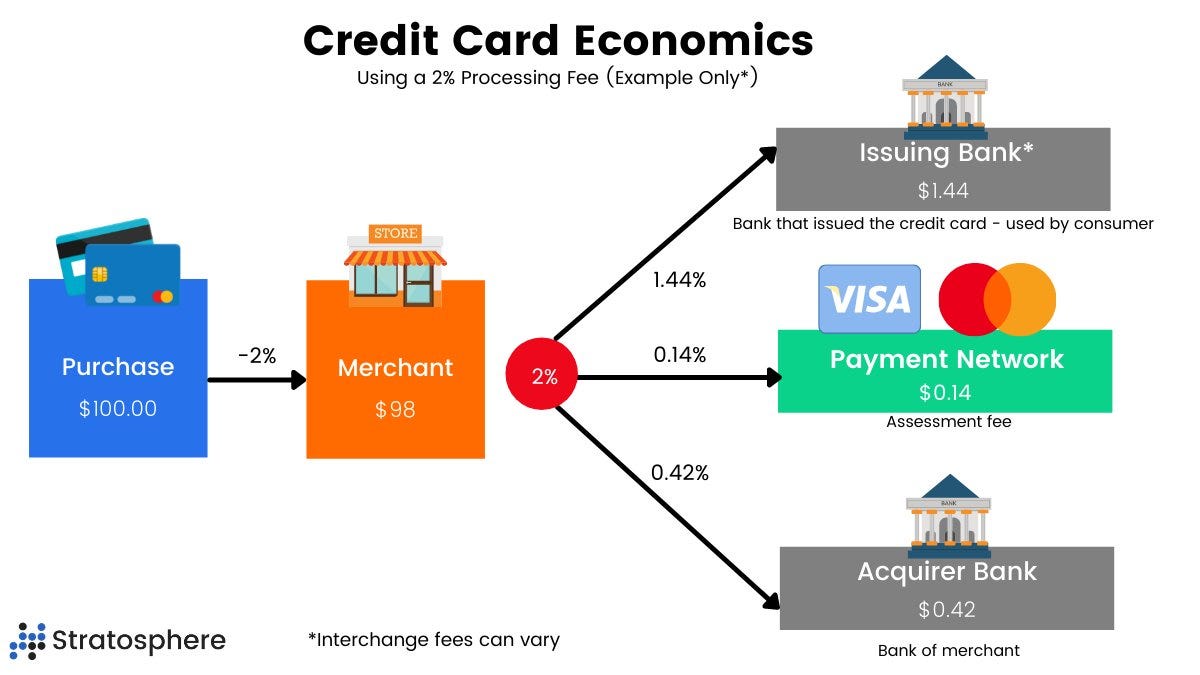

Visa is a global payments technology company. They provide electronic payment solutions through a network of branded credit and debit cards.

Like Mastercard, Visa’s core function is to operate a payment network connecting merchants, banks, and cardholders.

When you purchase something via your Visa card, the merchant pays Visa a fee to process the transaction.

Source: Finchat (Stratosphere is the former name of Finchat)

Banks and financial institutions pay fees to access Visa’s payment network.

Last year, 276 billion payments and cash transactions were made via Visa’s payment network.

This means Visa executed 757 million transactions per day!

2. Is management capable?

Ryan McInerney has been the CEO of Visa since February 2023. He joined the company in June 2013 as the President of the company.

Chris Suh is the CFO of Visa. Suh joined Visa in July 2023. Before, he was the CFO of Electronic Arts.

In total, insiders own roughly 3 million shares (value: $837 million). This is equal to around 0.15% of the company.

3. Does the company have a sustainable competitive advantage?

Visa has a wide moat. They mainly benefit from network effects. The more clients and merchants use Visa’s payment network, the more valuable the payment network becomes.

Today, Visa and Mastercard’s moat has become so wide that it has become (almost) impossible for competitors to take away the market-leading position of both companies.

Besides network effects, Visa also benefits from pricing power and barriers to entry.

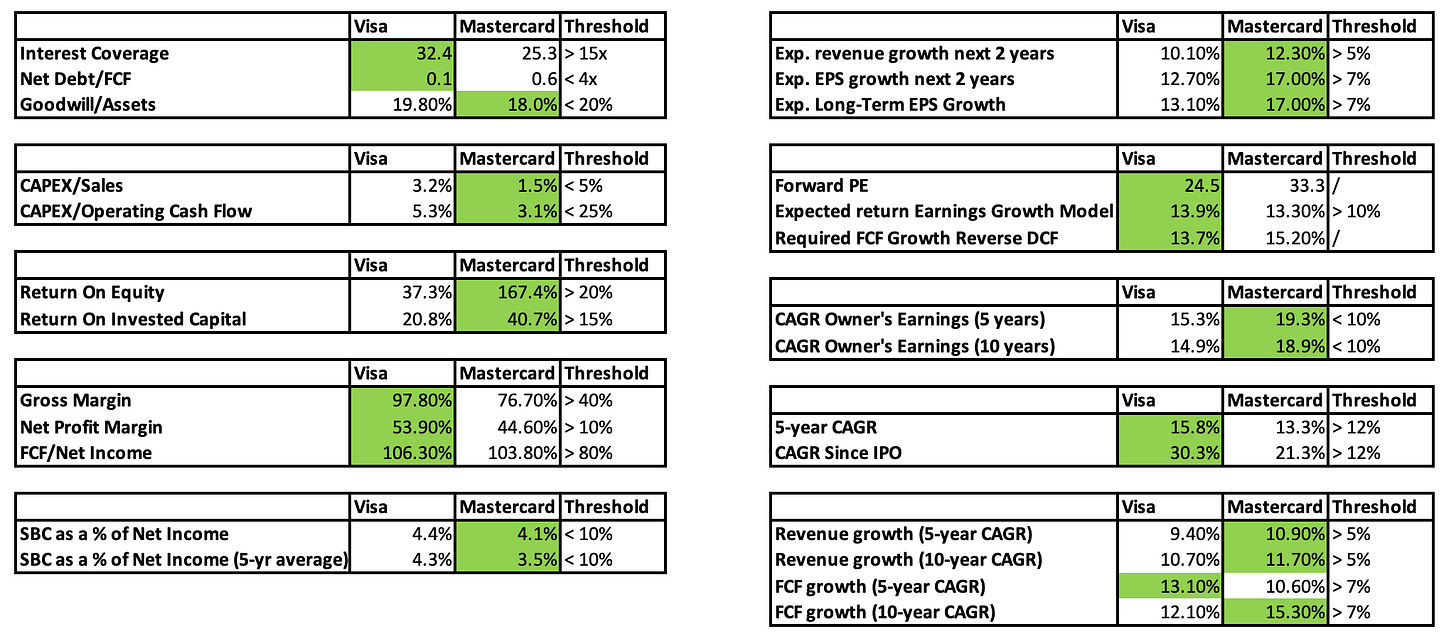

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin and ROIC:

Gross Margin: 79.6% (Gross Margin > 40%? ✅)

ROIC: 25.3% (ROIC > 15%? ✅)

4. Is the company active in an attractive end market?

Grand View Research estimates that the global digital payment market size will grow at a CAGR of 21.1% (!) until 2030.

This indicates Visa is active in an attractively growing end market.

Visa operates in an oligopoly together with Mastercard.

Here’s a brief comparison between both companies:

As you can see, Visa is more profitable and valued cheaper while Mastercard can grow at more attractive rates.

5. What are the main risks for the company?

Here are some of the main risks for Visa:

Dependence on global economic conditions

Legal and regulatory risks

Data security risks

Merchant Acceptance Risks

Rapid advancements in technology and changes in payment methods

Cybersecurity and data privacy risks

Dependence on partners (bans, merchants, and other partners)

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of Visa’s balance sheet:

Interest Coverage: 36.2x (Interest Coverage > 15x? ✅)

Net Debt/FCF: 0.1x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 19.8% (Goodwill/assets not too large? < 20% ✅)

Visa’s balance sheet looks very healthy.

Source: Finchat

7. Does the company need a lot of capital to operate?

We prefer to invest in companies with CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Visa:

CAPEX/Sales: 3.4% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 5.5% (CAPEX/Operating CF? < 25% ✅)

As you can see, Visa has a very low capital intensity.

Source: Finchat

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

Look for companies that put the money of shareholders to work at an attractive rate of return.

Visa:

Return On Equity: 46.5% (ROE > 20%? ✅)

Return On Invested Capital: 25.3% (ROIC > 15%? ✅)

These numbers look attractive.

Source: Finchat

Now let’s dive into the most important fundamentals of Visa and determine at which price we would be interested in buying the company.