Sometimes, you really have to wonder what investors are thinking.

Evolution AB, the absolute leader in online casinos, reported earnings last week.

Results were very good.

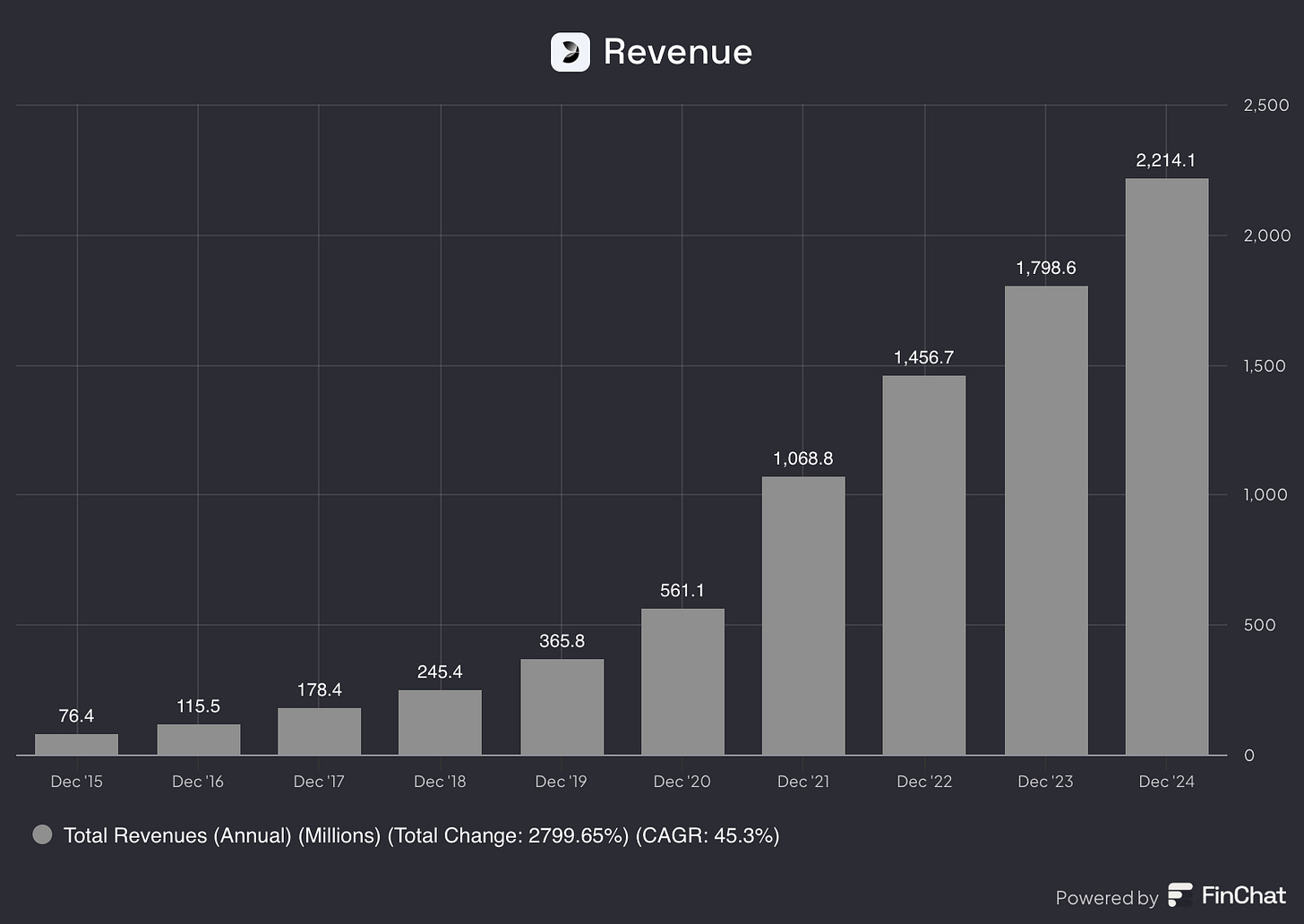

Revenue? +23%!

Profit? +16%!

EBITDA margin? 70% (as if it's nothing)

And what does the market do? The stock drops.

I honestly don't understand this.

A company that literally prints money, has no debt, and delivers a return on invested capital that would make Warren Buffett dizzy...

And yet the stock price falls because a few analysts think it's “not good enough.”

A Monopoly with a Money Machine

Let’s be clear: Evolution is a machine.

This isn’t some small-time gambling company operating in the shadows.

This is the undisputed world leader in online casino games.

They dominate the live casino sector the way Google controls search.

And what’s the key to their success? Scaling. Over and over again.

Every new live gaming table they open brings in extra profit without significantly increasing costs.

And they just keep expanding:

They now have 1,700 live tables (compared to 1,600 last year).

They're opening new studios in Brazil and the Philippines.

They’re launching a new wave of games soon, including Fireball Roulette and a Crash game that is guaranteed to be a hit.

And yet, this company trades at a P/E ratio of just 13x.

For a business with 70% profit margins and virtually unlimited growth potential. That’s ridiculously cheap.

A Goldmine for Shareholders

Evolution isn’t just a profit machine—it’s a cash cow.

This year, the dividend is being raised again to €2.80 per share, and they’re planning a €500 million share buyback program. They are literally swimming in cash.

And still, investors decided to sell this week. Apparently, earnings need to grow by 50% per quarter before the market is satisfied. Absurd.

The Market Sleeps, We Buy

We've seen this before: Wall Street is a herd of sheep.

They chase hype until it reaches ridiculous levels (hello Nvidia at 30x revenue?), but they ignore a cash-flow beast like Evolution because “growth is slowing slightly.”

This is exactly the kind of opportunity smart investors wait for. Evolution is dirt cheap, keeps growing, and returns massive amounts of cash to shareholders.

The dumb investors sell.

The smart investors buy.

You want more research like this? Consider becoming a Partner of Compounding Quality.

You can test it risk-free as there is a 90-day money-back guarantee.

The price? $399 per year instead of $499 per year.

Everything In Life Compounds

Pieter

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data