Hi Friend 👋

Just wanted to write you a short email highlighting Warren Buffett’s recent transactions.

Berkshire Hathaway sold one quality stock and also bought two new ones.

Sell: Ulta Beauty

Berkshire Hathaway sold its position in Ulta Beauty, a leading beauty retailer in the United States.

This is a remarkable move as Berkshire only owned the stock for a few months.

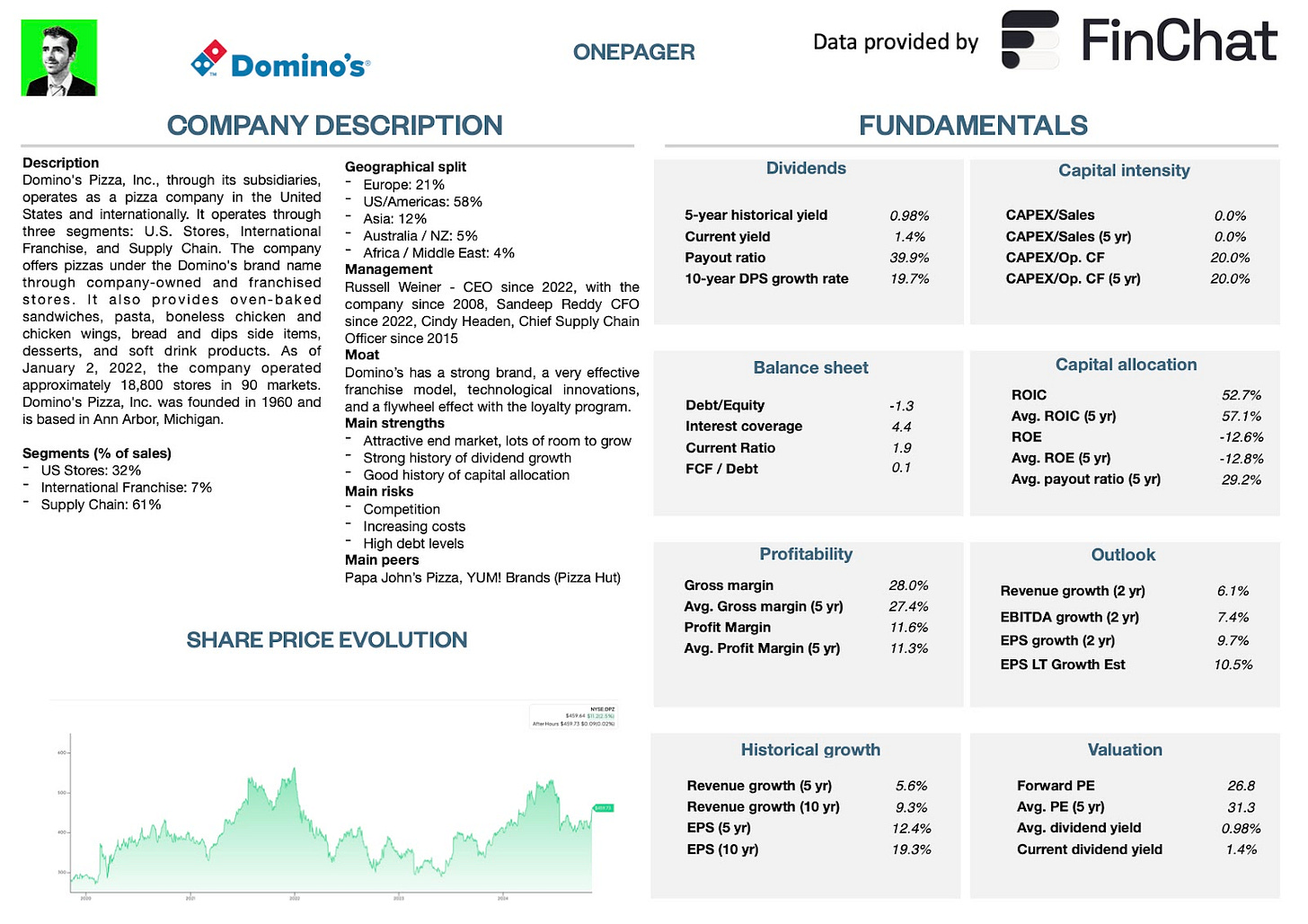

Buy: Domino’s Pizza

Domino’s Pizza is one of the best pizza franchises in the world.

It’s on our radar for Compounding Dividends. Berkshire Hathaway bought 1.3 million shares for roughly 0.2% of his Portfolio.

Buy: Pool Corporation

Pool Corporation is a wholesale distributor of swimming pool supplies and equipment.

It’s one of the best-performing stocks in the United States over the past 20 years.

Berkshire Hathaway bought roughly 400K shares for $127 million.

Conclusion

In Q3 2024, Berkshire Hathaway sold Ulta Beauty while buying Domino’s Pizza and Pool Corporation.

It’s important to understand that these transactions won’t move the needle for Warren Buffett.

However, it’s still very interesting to see. We love the fact that all the companies mentioned are part of our investable universe.

Tomorrow, Partners of Compounding Quality will get an update on our investable universe.

Twenty companies are strongly undervalued according to our model.

Let’s walk our investment journeys together. Make sure you become a Partner and don’t miss out:

Everything In Life Compounds

Pieter

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Disclaimer

As a reader of Compounding Quality, you agree with our disclaimer. You can read the full disclaimer here.

·