🏰 Warren Buffett on growth versus value

#QualityTuesday

It’s #QualityTuesday!

In this series, we will teach you 5 things about the stock market in less than 5 minutes.

1️⃣ Warren Buffett on growth 🆚 value

All intelligent investing is value investing. You try to buy things for less than what they’re worth.

The intrinsic value of a company can always be calculated as follows: the discounted value of the cash that can be taken out of a business during its remaining life.

This also means that growth is always a component of value as it will increase the future cash flows.

2️⃣ Don’t be like this

Delayed gratification is one of the core principles of investing.

However, you should never ignore other important aspects in life such as health, family and friends, and kindness.

Life is all about seeking balance.

3️⃣ One simple investment quote

There are only 2 sorts of people who can time the market: dreamers and liars.

Timing the market is a fools game.

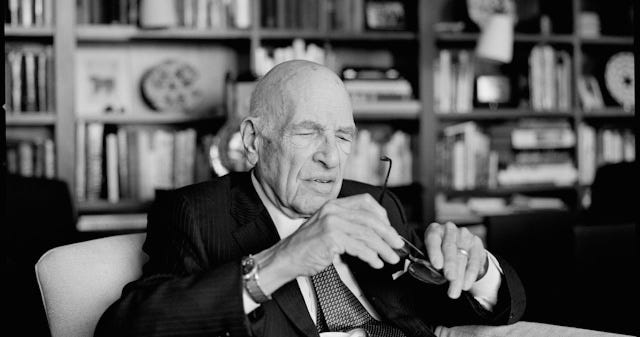

“Most people who have been really successful in the stock market say the same thing – that they’re not smart enough to get into the market and out of it. So they tend to remain more or less in the market at all times.” – Walter Schloss

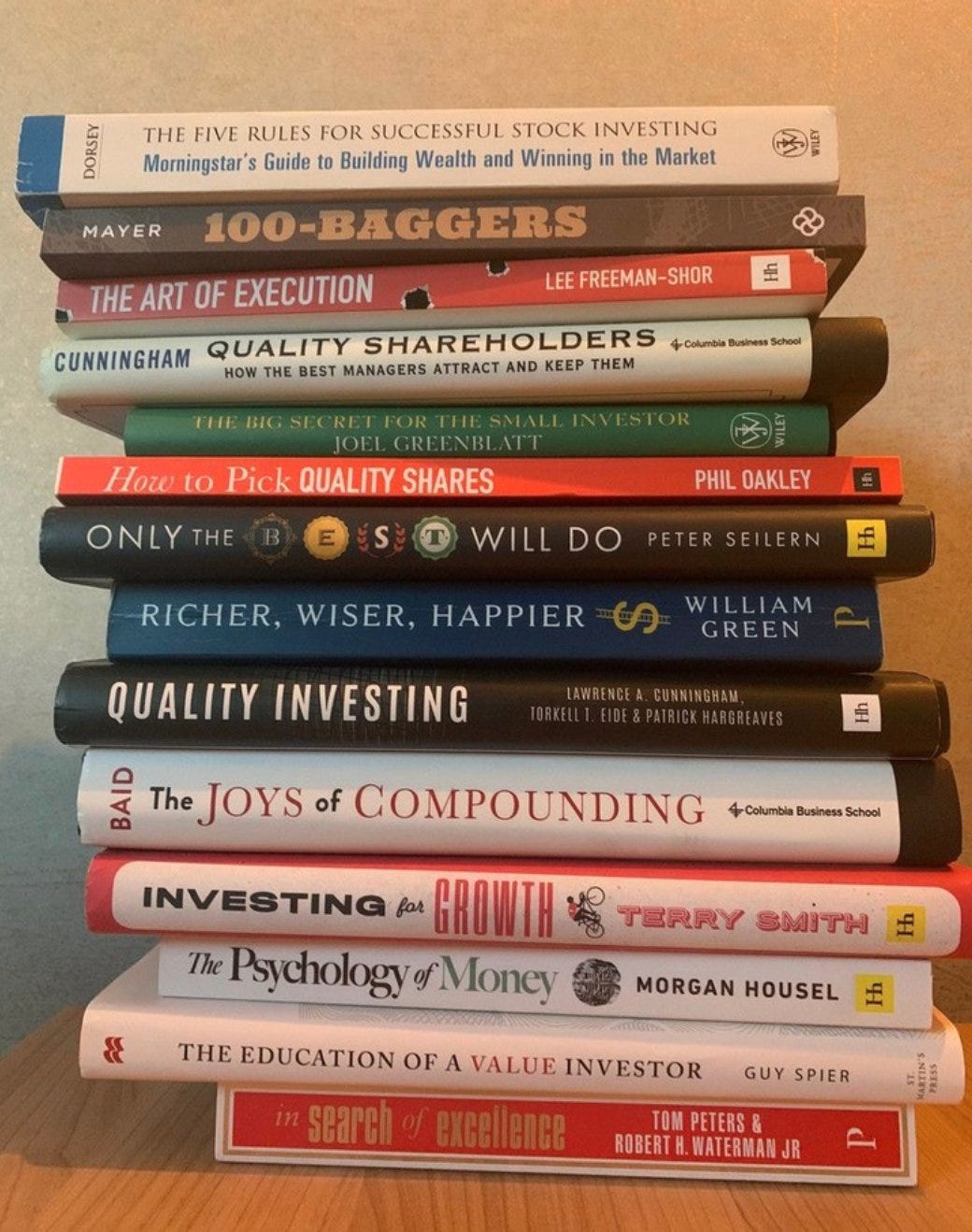

4️⃣ Reading inspiration

Looking for good books to read?

Take a look here:

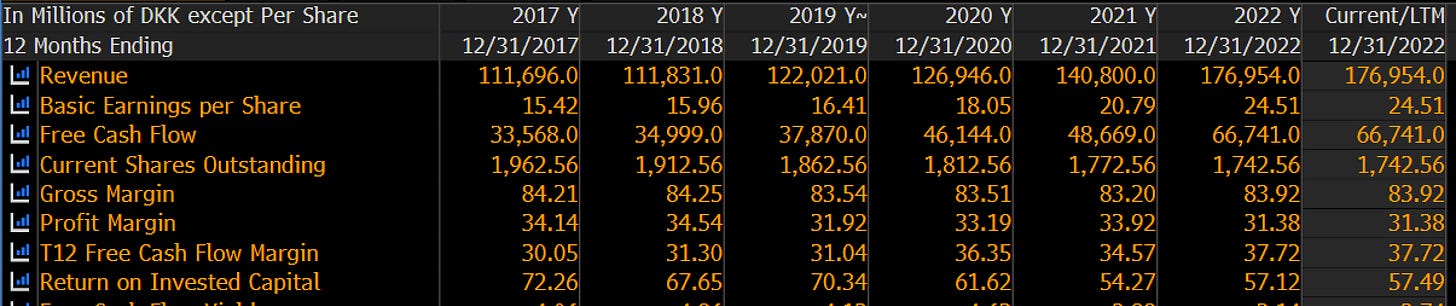

5️⃣ Example of a Quality Company

Novo Nordisk is active in diabetes treatment. More and more people will suffer from diabetes due to our aging population and obesity.

FCF margin: 34.6%

ROCE: 101.9%

FCF yield: 2.7%

Exp. FCF growth (3 yr): 15.6%

CAGR since IPO: 19.9%

As you can see in this chart with data of Novo Nordisk, in the long term the stock price (white line) always follows the earnings growth (blue line) of a company.

More articles from Compounding Quality

Do you want to read more? Here are our 5 latest articles:

Contact details

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

"There are only 2 sorts of people who can time the market: dreamers and liars. "😂

Thank you for sharing all the wisdom.