🏰 Warren Buffett retired

Don't just do something; sit there

It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

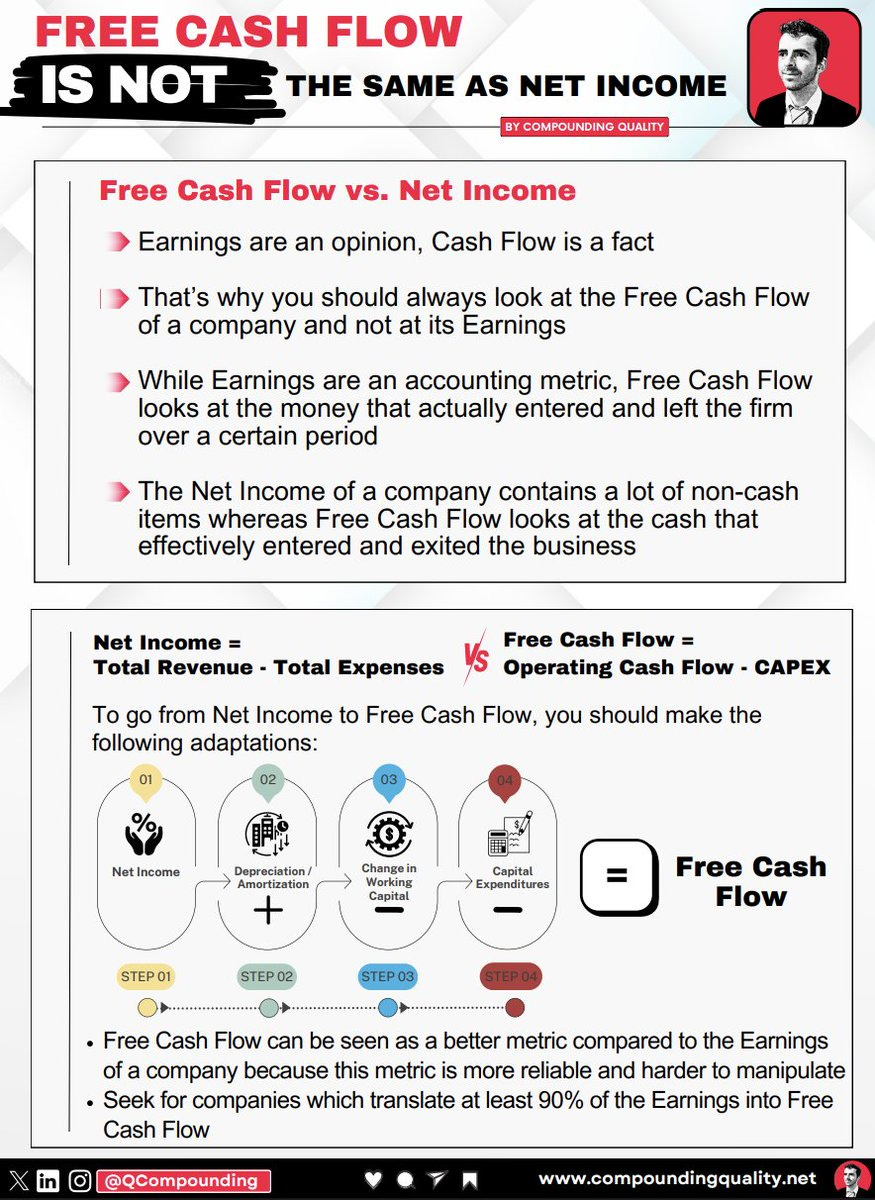

1️⃣ Free Cash Flow ≠ Net Income

Profit is an opinion, cash (flow) is a fact.

Many investors confuse Free Cash Flow with Net Income.

Knowing the difference between these two is crucial.

2️⃣ Podcast interview

Recently I was a guest in the Stansberry Research Podcast.

We discussed the following:

AI and market momentum

A company I’m excited about right now

And much more

Happy listening!

3️⃣ One simple investment quote

Your investment portfolio is like a bar of soap.

The more you touch it, the smaller it gets.

That's why doing nothing is often your best bet.

Time in the market always beats timing the market.

4️⃣ Warren Buffett: A Life and Legacy

A must watch this week?

The documentary ‘Warren Buffett - A Life and Legacy’.

It’s full of wisdom. Both for life as investing.

5️⃣ Stock Pitch: Markel ($MKL)

How does the company make money?

Markel makes money by selling specialty insurance. It collects premiums first and, over time, pays out less in claims than it takes in to generate a profit. The premiums it holds before paying claims (“float”) are then invested in stocks, bonds, and private businesses to make more money.Markel ($MKL) is often called a mini-Berkshire Hathaway.

It specializes in niche insurance markets the company prices risks better than competitors.

But Markel doesn’t stop at insurance.

It reinvests its float into a high-quality investment portfolio and wholly owned businesses.

This combination of insurance and investing is what makes Markel very powerful.

It’s built to compound over the long run.

Everything in life compounds

Pieter (Compounding Quality)

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

When I think of #3, I always remember that “Time in the market beats timing the market.”

I forget who said it, but I picked it up in one of the books I read along the way.

I agree and highly recommend the Buffett interview (not new, but I doubt he will do another).