In this series, we will teach you 5 things about the stock market in less than 5 minutes.

If you are reading this and are not subscribed yet, feel free to join the Compounding Quality Family via the button hereunder.

1️⃣ Warren Buffett’s portfolio

Great overview made by Genuine Impact.

2️⃣ Two mistakes investors often make

Panic selling in a bear market

Panic buying in a bull market

Do exactly the opposite.

3️⃣ One simple investment quote

Be patient and let the magic of compounding work for you.

"The big money is not in buying or selling, but in the waiting." -Charlie Munger

4️⃣ Today is a great day to buy stocks

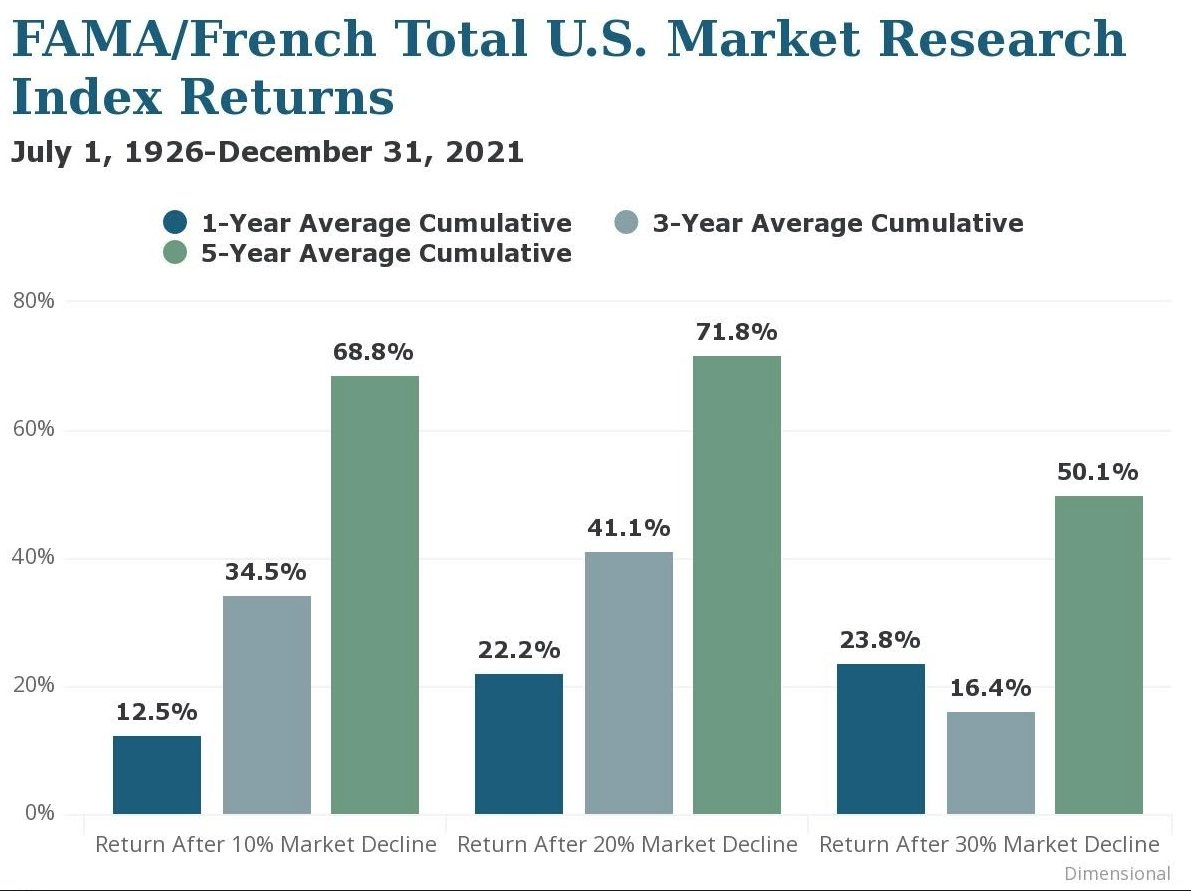

After stocks drop more than 20%, they compound on average with 11.3% per year over the next 5 years. Stay disciplined.

Today is a great day to buy stocks.

5️⃣ Example of a Quality Company

Some undervalued large-cap stocks with wide economic moats:

Question for you

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

I don´t really understand why the 3 to 5 year cumulative return after a market decline of 30% is lower that after a decline of 10% or 20%. Can you provide a link to the paper written by FAMA/French?

Thanks!