Compounding Quality is all about investing in the best companies in the world.

Did you know that you can become a Partner risk-free? Activate your trial here. Some companies are almost untouchable.

During my exams in high school, my teachers always told me: “Pieter, you cannot steal from other students.”

Now, as an investor, I can. And as a matter of fact, it’s even better…

… I can steal from the best investors in the world.

Let’s take a look at which stocks the best investors in the world bought recently.

“I'm a shameless copycat. Everything in my life is cloned … I have no original ideas.” - Mohnish PabraiOur Portfolio’s Performance

Since launching in October 2023, Our Portfolio is up 51.9%, beating the S&P 500’s 37.9%—a 14% outperformance.

One reason? I use the best broker for smart investors: Interactive Brokers.

Here’s why:

✅ Ultra-low fees – Keep more of your gains

✅ Global access – Invest in 150+ markets worldwide

✅ Pro trading tools – Advanced features at your fingertips

✅ Unmatched reliability – Trusted by hedge funds & institutions

Whether you’re a beginner or expert, the right broker can make a huge difference.

🔻 Click below to see why thousands are switching today.The Magic of Copying

Superinvestors are the best investors in the world.

They are the LeBron James, Tiger Woods, and Lionel Messi of investing.

Their long, successful track record proves they know what they're doing. They have devoted their entire lives to investing.

Spotting trends in their trades can be very valuable.

Warren Buffett

Last quarter, Warren Buffett bought a new stock for Berkshire Hathaway:

Constellation Brands ($STZ)

How does the company make money?

Constellation Brands owns a diversified portfolio of well-known alcoholic beverages. Most of their revenue comes from beer, wine and spirits.Investment rationale:

A very recession-proof business, no matter what happens, people will always drink

Strong brands like Corona Extra create a wide moat

The valuation came down a lot recently

Other interesting moves? Warren added to his positions in Pool Corp, Domino’s Pizza, and Occidental Petroleum.

This is what Berkshire’s portfolio looks like today:

Terry Smith

Just like Warren Buffett, Terry Smith bought a new company for his Portfolio.

Medpace ($MDP)

How does the company make money?

Medpace is a Clinical Research Organization (CRO). It helps biotech companies research and develop new drugs. Unlike biotech firms, Medpace does not rely on a drug’s success. This makes it less risky.Investment rationale:

August Troendle is an excellent CEO with a lot of skin in the game

Medpace has grown its Earnings per Share (EPS) at a CAGR of 37.3% in the last 10 years

The balance sheet is very healthy with a Net Cash Position

Other interesting moves? Just like Buffett, Terry Smith is selling Apple. He also reduced his stake in Visa and Microsoft.

This is how things look like for Fundsmith:

Chuck Akre

Chuck Akre doesn’t trade a lot.

His inactivity is a great sign to me.

A good investment strategy involves few buys and even fewer sells.

But last quarter, he did buy CoStar Group.

CoStar Group ($CSGP)

How does the company make money?

CoStar Group is a real estate data and analytics company. Real estate firms pay a subscription fee to use their platforms. Investment rationale:

Subscription revenue is recurring, which gives stability

CoStar has a very healthy balance sheet with a Net Cash Position of $3.5 billion

Real estate had a very tough time in 2008 but the product was still in need

Other interesting moves? Chuck is selling Mastercard, KKR & CO, and Moody’s.

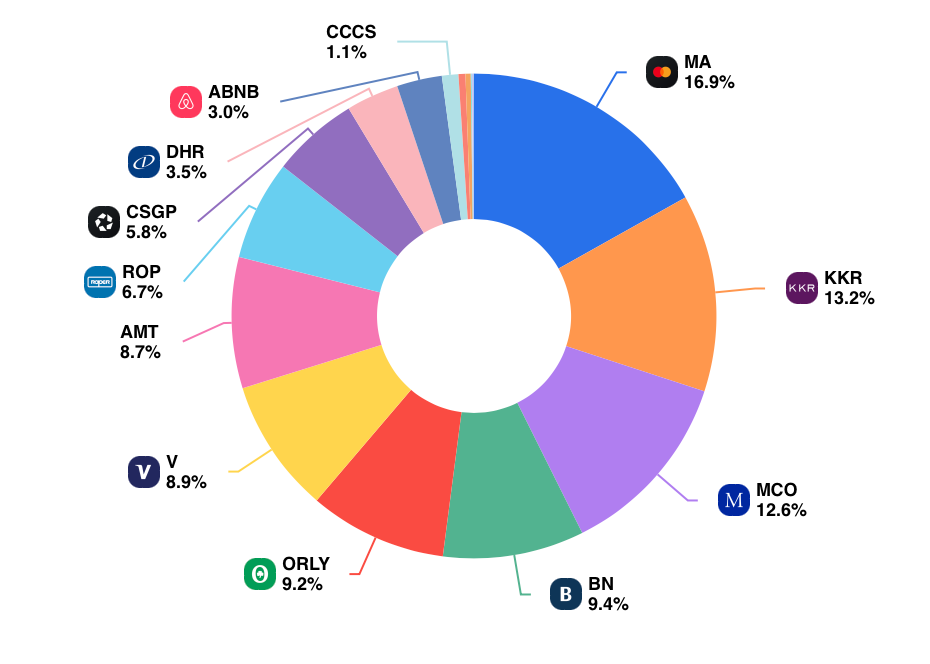

Here is his portfolio:

François Rochon

A new position in François Rochon’s portfolio?

Brown & Brown ($BRO)

How does the company make money?

Brown & Brown offers insurance and reinsurance products. They also provide risk management, employee benefits, and healthcare services. A big part of the growth engines is doing great acquisitions.Investment rationale:

The Brown family is still involved, which makes it a real family business

Brown & Brown is really profitable with a Free Cash Flow Margin of 23.2%

Historical return of 14.0%

Other interesting moves? Just like Terry Smith, François Rochon bought Medpace.

It’s a great reconfirmation of our long term investment thesis.

Here is his entire portfolio:

Dev Kantesaria

Does this name ring a bell?

Dev is one of the best quality investors on the planet.

Don’t take my word for it, just look at the numbers.

At Valley Forge, Dev manages over $4.0 billion and compounded by 15.0% per year since 2007.

This is his investing philosophy:

"I seek to buy companies that are 'compounding machines', which can grow their intrinsic values over a multi-year period. I generally avoid 'cigar butt' stocks, which look cheap but are in fact value traps. These companies lack significant organic growth, and their business quality rarely improves, even in the hands of strong management."Dev opened a new position last quarter.

MSCI ($MSCI)

How does the company make money?

MSCI creates indexes for international stock markets. They make money from every dollar invested in an ETF that includes ‘MSCI’ in its name.Investment rationale:

MSCI is very profitable with A Free Cash Flow Margin of 51.7%

The index provider has a very light capital business model

They are buying back their own shares

Other interesting moves? Dev bought more S&P Global and Moody’s shares. He seems to love the finance industry.

These are the current holdings of Valley Forge:

Conclusion

That’s it for today.

Looking at the trades of superinvestors is a great source for new investment ideas.

Here’s what the best investors in the world are buying:

Warren Buffett: Constellation Brands ($STZ)

Terry Smith: Medpace ($MDP)

Chuck Akre: CoStar Group ($CSGP)

François Rochon: Brown & Brown ($BRO)

Dev Kantesaria: MSCI ($MSCI)

However, focusing on just one person can be risky.

That’s why we especially look at what they have in common.

One key lesson they all share is clear: patience pays.

Compounding Quality Partners also know that the superinvestors are buying some of the businesses that we already own. This is interesting to see.

Whenever you’re ready

That’s it for today.

Do you want to walk our investment journeys together?

Test out Compounding Quality risk-free.

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

📊 Access to the Community

✍️ And much more!

Activate your trial here:

Everything In Life Compounds

Pieter

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data