🏰 Why do most investors fail?

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes.

If you are reading this and are not subscribed yet, feel free to join our Compounding Quality Family via the button hereunder.

1️⃣ Invest, don’t speculate

Speculators think on the short term, investors think on the long term.

Be the right picture and not the left one.

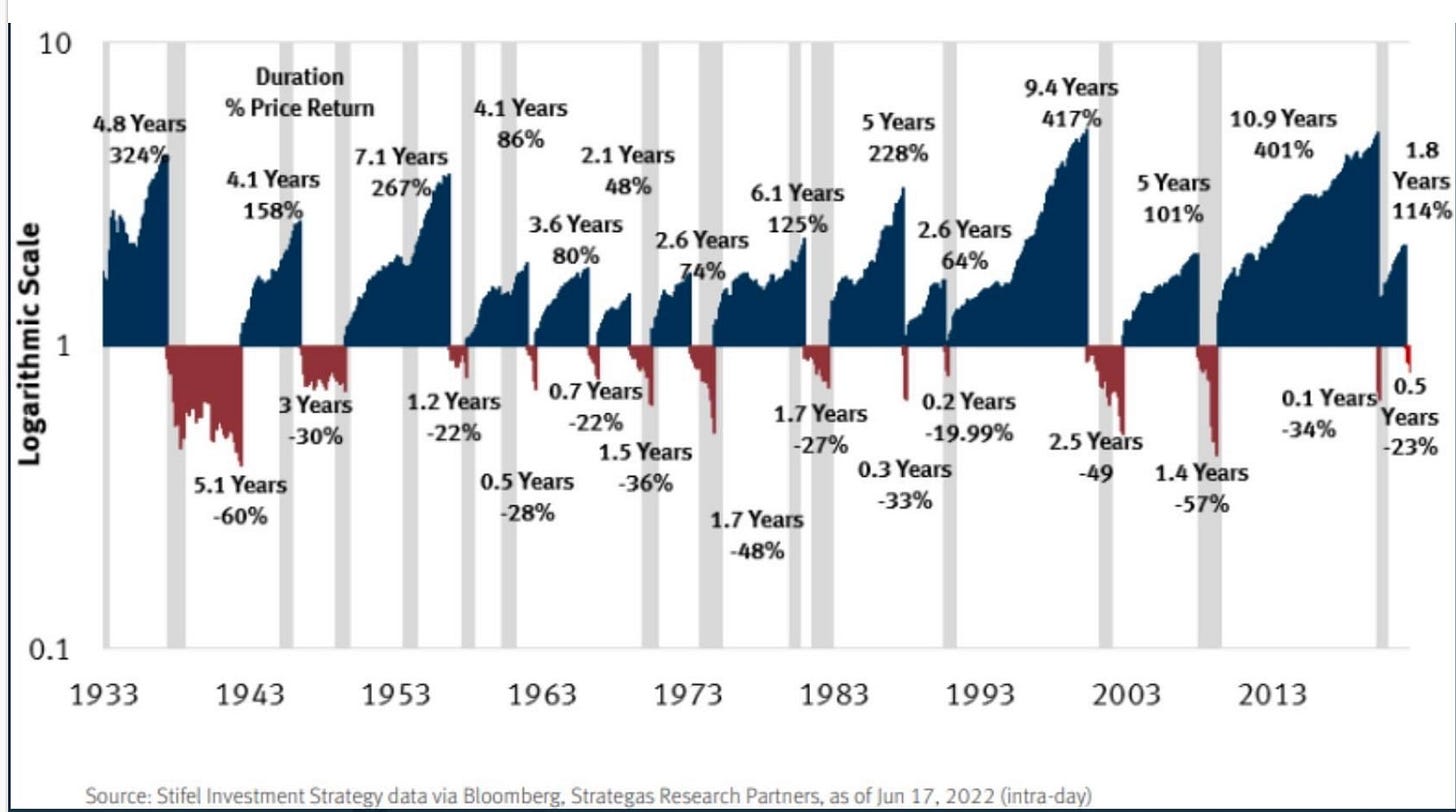

2️⃣ Overview of historical bull and bear markets

Every decade there will be bull and bear markets. And in the end… you’ll do fine as long as you invest with a long term mindset.

3️⃣ One simple investment quote

Why do most investors fail?

"Over time people get smarter but not wiser. They don't get emotionally stable. You can teach people all you want, tell them to read Graham's book, you can send them to graduate school, but when they are scared, they really get scared." - Warren Buffett

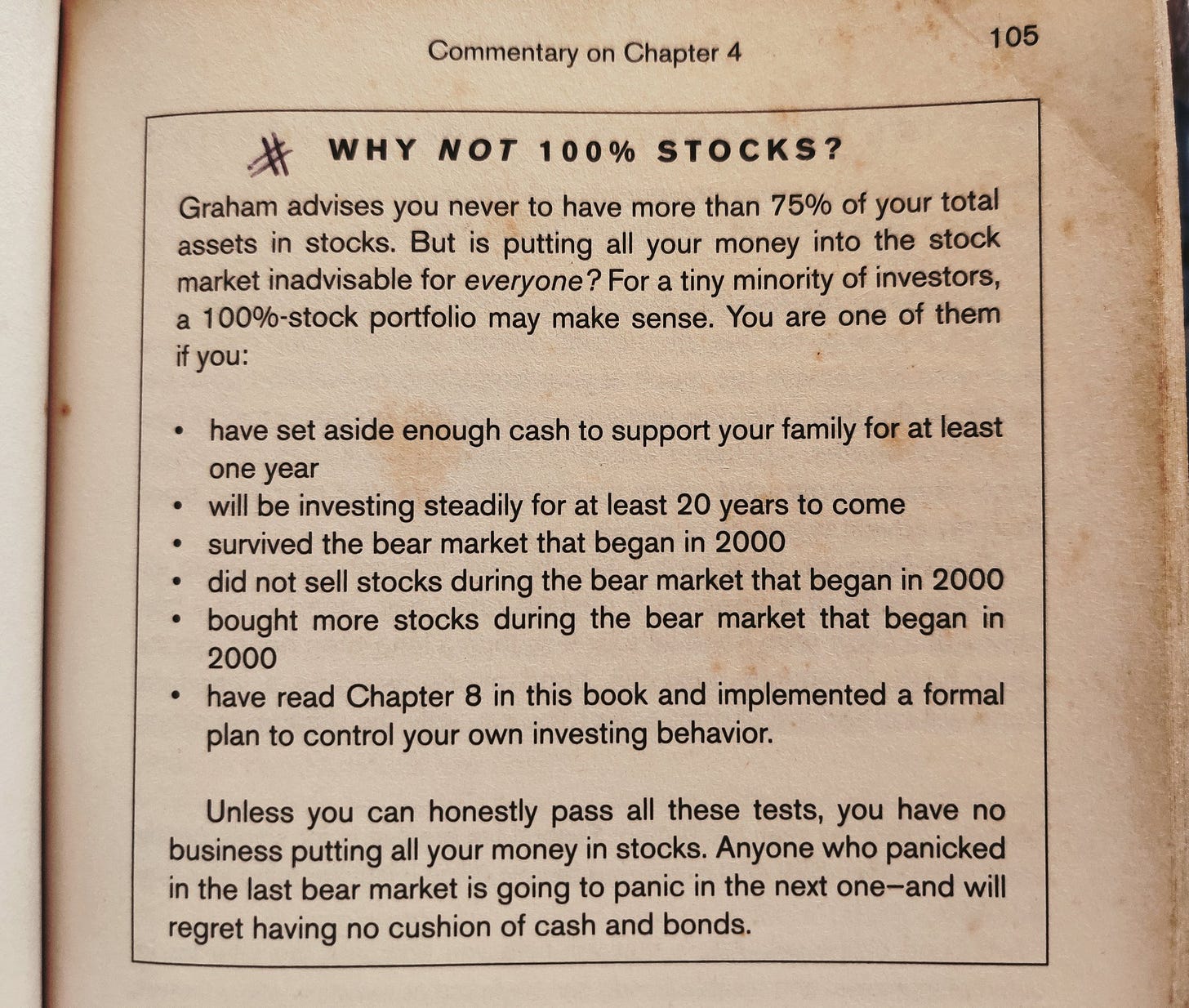

4️⃣ Can you pass this test?

If you pass this test, you can invest all your money in stocks.

5️⃣ Example of a Quality Company

Copart provides vehicle suppliers with services to sell vehicles . The company dominates the market for online car auctions.

FCF margin: 24.0%

ROCE: 27.4%

FCF yield: 3.2%

Exp. FCF growth (3 yr): 8.2%

CAGR since IPO: 20.0%

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

The only addition I’d make is to put extra emphasis on the long-term. For the average Joe, investing in the SP500 (dollar cost averaging) for a really long time (30-50 years) will provide excellent results and make him rich.