The Wisdom of Crowds is amazing.

New stock ideas are posted every single day in Our Community.

And that’s why Our Stock Picking Contest is so much fun.

Over the years, many of you have expressed interest in this, so I’m exploring the idea of launching an investment fund grounded in the principles I’ve consistently shared with you.

To better understand your interest and potential involvement, I’ve put together a quick survey.

Curious to learn more? Complete the survey to stay informed about the next steps (minimal entry amount: $250,000).Top Pick Partners Last Year

In December 2023, we launched a competition for Our Partners.

Everyone had the opportunity to pick their 3 favorite stocks for 2024.

Over 300 companies were chosen.

Some Partners reported incredible returns.

Ken Yamakawa: +123.4%

Shams J: +111.3%

Mike H: +80.9%

These returns are phenomenal. Therefore, I want to reward them.

Ken Yamakawa: A subscription for 2 years on Compounding Quality

Shams J: A 1-year subscription to Compounding Quality

Mike H: A signed book copy of The Art of Quality Investing

But which picks stood out in 2024?

Here are the best-performing stock picks of our Partners for 2024.

Let’s dive right in.

10. Lemonade ($LMND)

Company Profile

Lemonade is an insurance company that offers home, apartment, pets, and life insurance coverage.

Instead of filling out lots of paperwork, you can sign up for insurance using their app or website in just a few minutes.

They use artificial intelligence (AI) to help process claims quickly, sometimes in just a few seconds.

Lemonade gives leftover money (that’s not used for claims) to charities you choose.

Investment Rationale

Disruptive approach to the traditional insurance industry

Amazing growth: 5-year Revenue CAGR: 57.0%

Net Cash Position equal to 10.9% of the Market Cap

Stock Performance 2024: +127.4%

9. Axon Enterprise ($AXON)

Company Profile

Axon makes tools to help the police and public safety workers.

They are best known for making TASER devices. These are non-lethal tools used by police to stop dangerous situations without seriously hurting anyone.

Axon also makes body cameras that officers wear to record what happens during their work.

The police can store these recordings using Axon software. This efficiently organizes all collected evidence.

Investment Rationale

Network effects: As more police use Axon’s software, it gets more valuable

Founder Patrick Smith is still the CEO

Axon returned 33.3% (!) per year to shareholders since 2001

Stock Performance 2024: +130.1%

8. Synektik ($SYN)

Company Profile

Synektik creates special medicines called radiopharmaceuticals Their products help doctors see inside the body to find diseases like cancer.

They also make and sell advanced medical equipment, including robots that assist in surgeries. This makes operations less invasive and helps patients recover faster.

One of their most important products? Da Vinci robots. These machines assist doctors in performing precise and minimally invasive surgeries.

Synektik has exclusive rights to distribute da Vinci robots in Poland, the Czech Republic, and Slovakia until 2030.

Investment Rationale

Excellent capital allocation (ROIC: 20.3%)

Insider ownership: 51.6% of total shares outstanding

Long-term estimated EPS-Growth: 15.2%

Stock Performance 2024: +130.9%

7. TerraVest Industries ($TVK)

Company Profile

Terravest Industries is a serial acquirer in niche manufacturing markets.

They own companies in fields like energy, transportation, and industrial equipment.

Terravest helps these companies improve by providing them with resources and guidance. They look for opportunities to make these businesses more efficient and profitable.

PS Do you want to learn more about serial acquirers? Read this article.

Investment Rationale

Still a long runway ahead

Serial acquirers outperform the market in the long run on average

CAGR of the stock since IPO in 2012: 42.8%

Stock Performance 2024: +152.7%

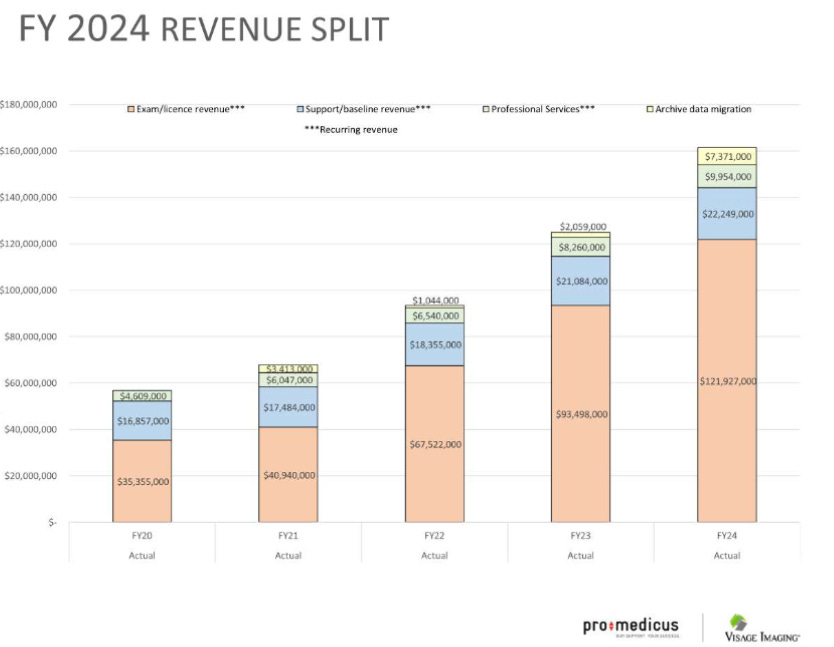

6. Pro Medicus ($PME)

Company Profile

Pro Medicus makes advanced software for doctors and hospitals to look at medical images, like X-rays, MRIs, and CT scans, on computers.

Their main product helps doctors quickly see and analyze these images so they can figure out what’s wrong with a patient faster.

They use artificial intelligence (AI) to spot problems that might be hard for doctors to notice.

Pro Medicus also makes it easy for doctors to share these images with other specialists around the world. This saves time and helps patients get the right treatment more quickly.

Investment Rationale

Excellent capital allocation (ROIC: 93.3%)

The two co-founders still own 46% of the business

The intrinsic value (Owner’s Earnings) doubled every 2 years for the last 10 years

Stock Performance 2024: +161.0%

5. Sea Ltd ($SE)

Company Profile

Sea Ltd is a tech company from Singapore.

They operate in 3 segments:

Garena - A gaming platform: They make popular games like Free Fire and also let people play and connect online.

Shopee - An online shopping app: Allows you to buy everything from clothes to electronics and have it delivered to your door.

SeaMoney - Payment Service: Helps people pay for things online or send money to others, like a digital wallet.

Investment Rationale

Sea Ltd is likely to profit from the growing middle class in Asia

Strong diversification across business lines

Amazing growth: 5-year Revenue CAGR: 55.9%

Stock Performance 2024: +162.0%

4. Nvidia ($NVDA)

Company Profile

Of course, Nvidia is part of this list.

Nvidia makes super-powerful computer chips called GPUs (graphics processing units).

These help computers create amazing visuals and run complicated programs. GPUs are mostly used for gaming, making video games look realistic and run smoothly.

Besides AI, GPUs are mostly used for gaming. Nvidia makes video games look realistic and run smoothly.

When you use ChatGPT, play video games, or run complex programs, chances are Nvidia is speeding up the process.

PS We wrote a Not So Deep Dive about Nvidia. You can read it here.

Investment Rationale

Founder Jen-Hsun Huang is an excellent CEO

There is no good alternative for Nvidia’s GPU

Exceptional profitability (Gross Margin: 75.9%)

Stock Performance 2024: +171.2%

Now let’s dive into the Top 3.