Your 10 Favorite Stocks

10 high-quality ideas

The wisdom of crowds is amazing.

I asked all Partners for their favorite stocks for 2026.

Let’s see which 10 companies made the list.

The wisdom of crowds is a beautiful concept.

It means that a group of people is smarter than any individual.

Everyone has different knowledge and experiences. When you combine all opinions, you make great decisions.

That’s called the wisdom of crowds.

Think about guessing the weight of a cow at a fair. Everyone writes down a number.

Some guess too high. Some guess too low.

But when you take the average of all guesses, it is almost exactly correct.

That’s why I asked all Partners for their favorite stocks for 2026.

Let’s dive in.

10. Tesla ($TSLA)

How does the company make money?

Tesla designs and sells electric vehicles, batteries, and energy storage systems. The company also develops autonomous driving software and invests heavily in AI and robotics.Tesla is not the world’s leading electric vehicle manufacturer anymore. China’s BYD recently took the top spot.

However, Elon Musk still believes in his baby.

He thinks Tesla could be worth $8.5 trillion within the next 10 years.

Today, it’s around $1.4 trillion.

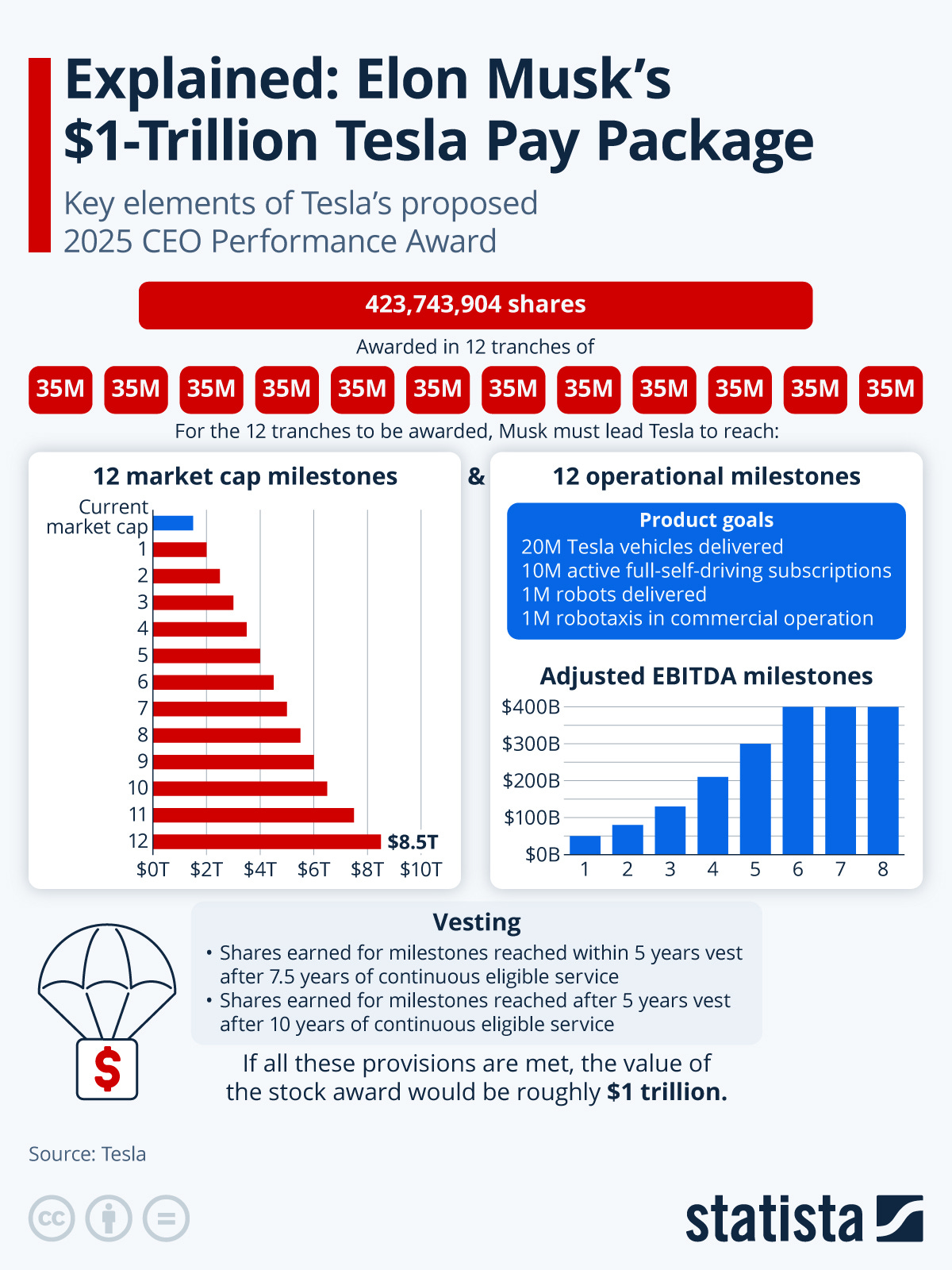

If that happens, and a few other targets are hit, Elon could receive a bonus worth $1 trillion in Tesla shares.

Here’s what his pay package would look like:

9. Kinsale Capital ($KNSL)

How does the company make money?

Kinsale Capital provides specialty insurance for unusual or high-risk situations. It specializes in covering unusual or high-risk businesses. The company uses technology to price and manage insurance efficiently.The investment thesis depends on one simple fact: Kinsale could double its market share in the next few years.

You don’t believe me?

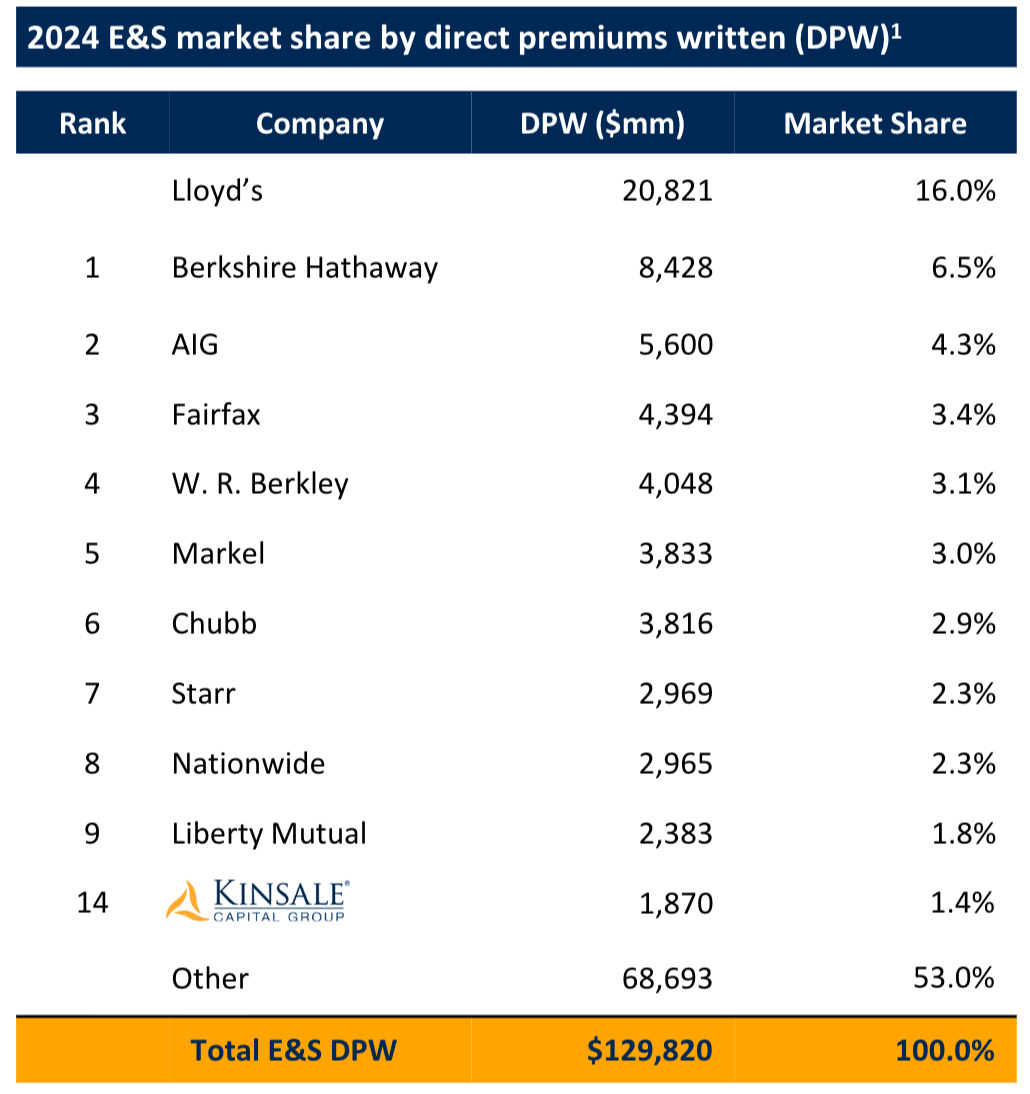

In 2024, their market share was 1.4%:

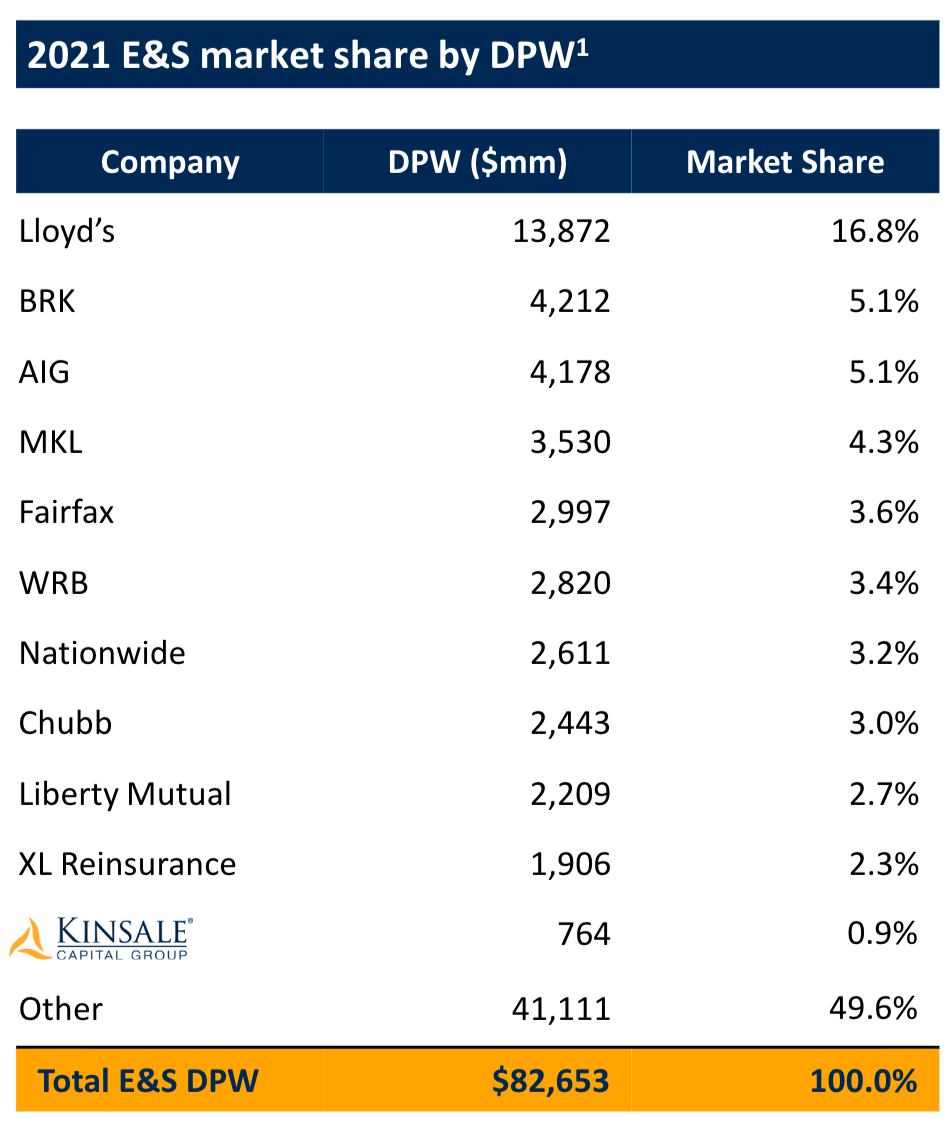

When we look at 2021, their market share was just 0.9%:

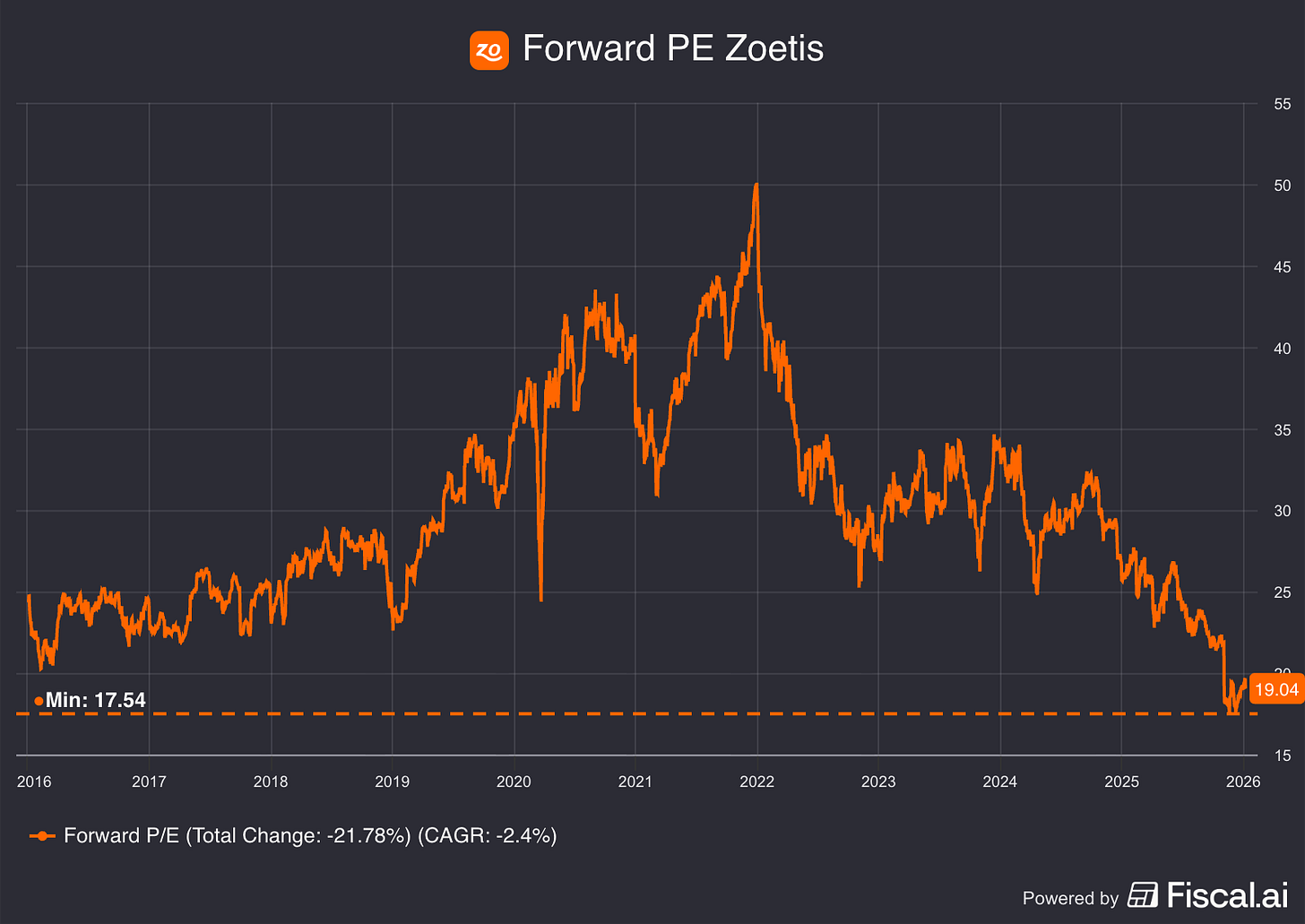

8. Zoetis ($ZTS)

How does the company make money?

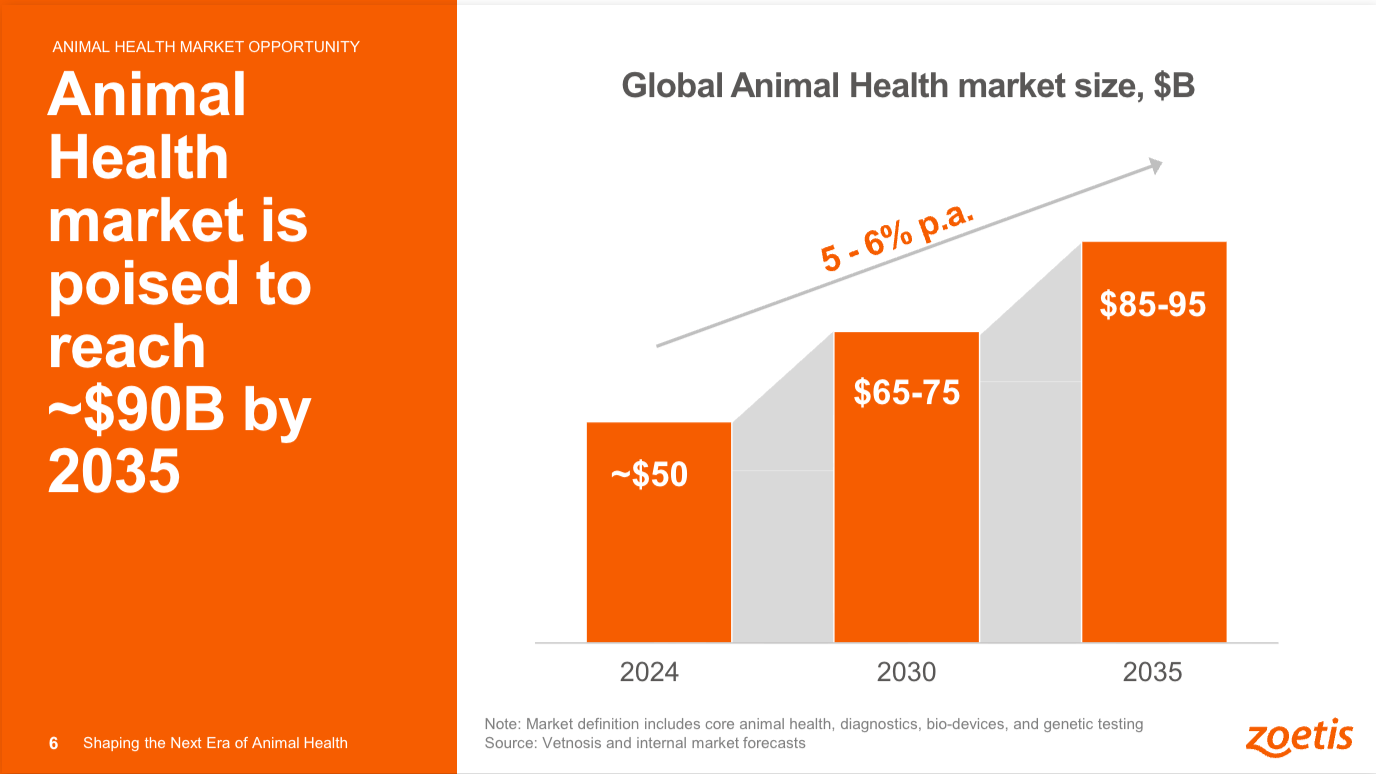

Zoetis develops medicines and vaccines for animals. Its products are used by veterinarians, farmers, and pet owners worldwide.Zoetis expects the global animal health market to almost double in the next ten years.

A company like Zoetis could fully benefit from this:

However, the market is less optimistic. The reason?

The company cut its revenue guidance. This disappointed a lot of investors.

This is just short-term noise if you ask me.

As a result, you can buy Zoetis at one of it’s cheapest valuation levels ever:

7. Alphabet Inc. ($GOOGL)

How does the company make money?

Alphabet is the parent company of Google. It makes money mainly from online advertising, search, and YouTube. It also invests heavily in artificial intelligence.According to Charlie Munger, Google has an amazing competitive advantage:

“Google has a huge new moat. In fact, I’ve probably never seen such a wide moat.” - Charlie Munger, 2009As a result, Buffett and Munger said multiple times that they regret not buying Google earlier.

Well… they finally did recently.

Berkshire Hathaway bought 18 million Google shares in 2025.

That’s a smart move as the market realizes Google is winning the AI race:

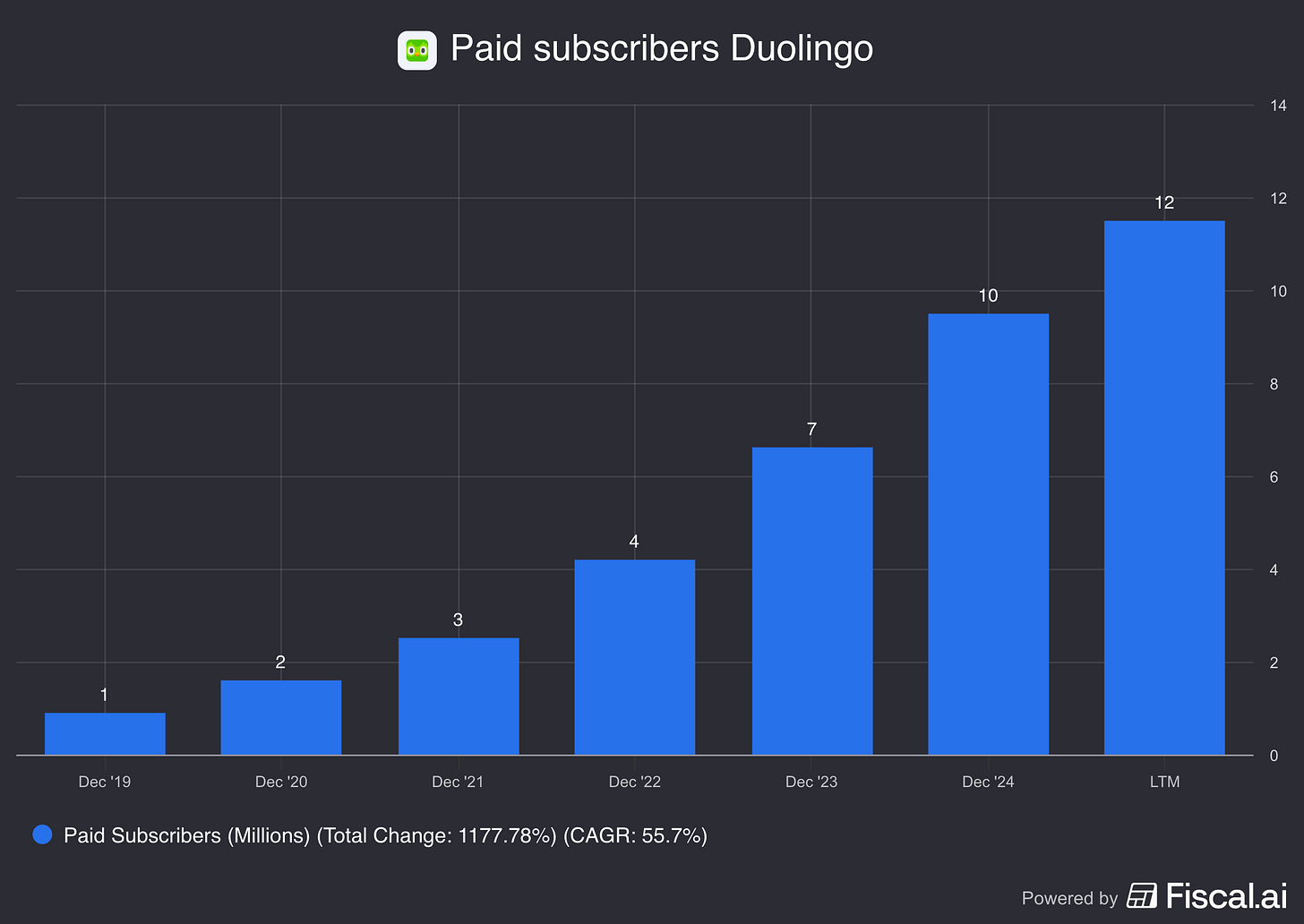

6. Duolingo ($DUOL)

How does the company make money?

Duolingo is a language-learning app. People use it to learn languages through short lessons and games. It also offers English tests and learning tools for schools.Duolingo is the world’s most popular language-learning platform.

Users keep coming back because learning feels like a game.

That’s why twelve million people now have a paid subscription. This creates high-quality recurring revenue.

Duolingo is also expanding beyond languages. The app now includes math and music, which attracts even more users.

Since 2019, the number of paying subscribers has grown by 55.7%.

5. Kelly Partners Group ($KPG)

How does the company make money?

Kelly Partners is a serial acquirer of accounting firms. It helps small and medium-sized businesses with taxes, accounting, and financial advice.One of the most interesting parts of Kelly Partners Group?

Their long runway for growth.

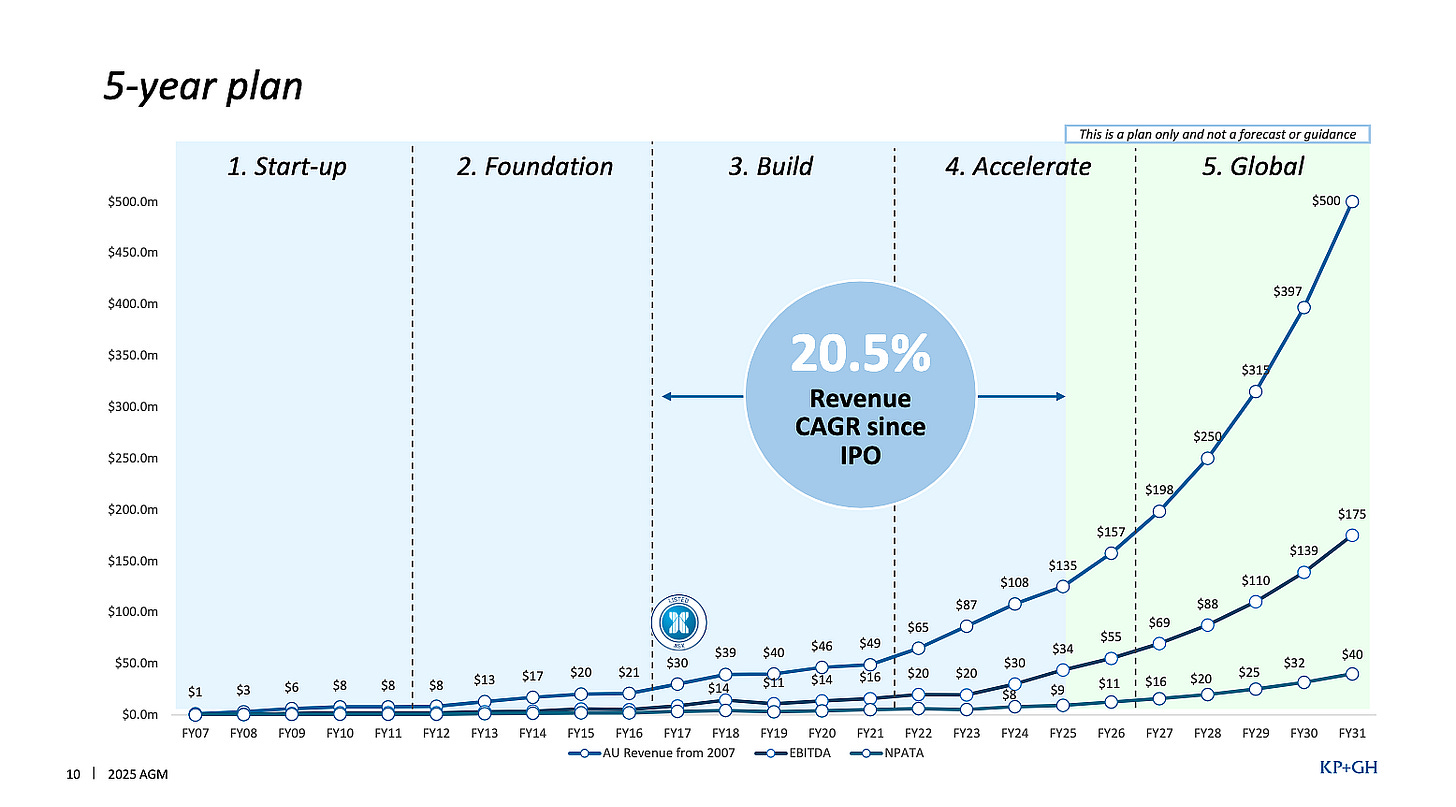

The most important slide of the last shareholder meeting was this one:

It shows the growth estimates for the next 5 years:

Revenue: $500 million

EBITDA: $175 million

NPATA: $40 million

If we compare this to the current numbers, you get the following yearly growth rates:

Revenue: +24.4%

EBITDA: +31.4%

NPATA: +28.2%

Those figures look very attractive. As a result, Kelly Partners could deliver amazing returns for shareholders.

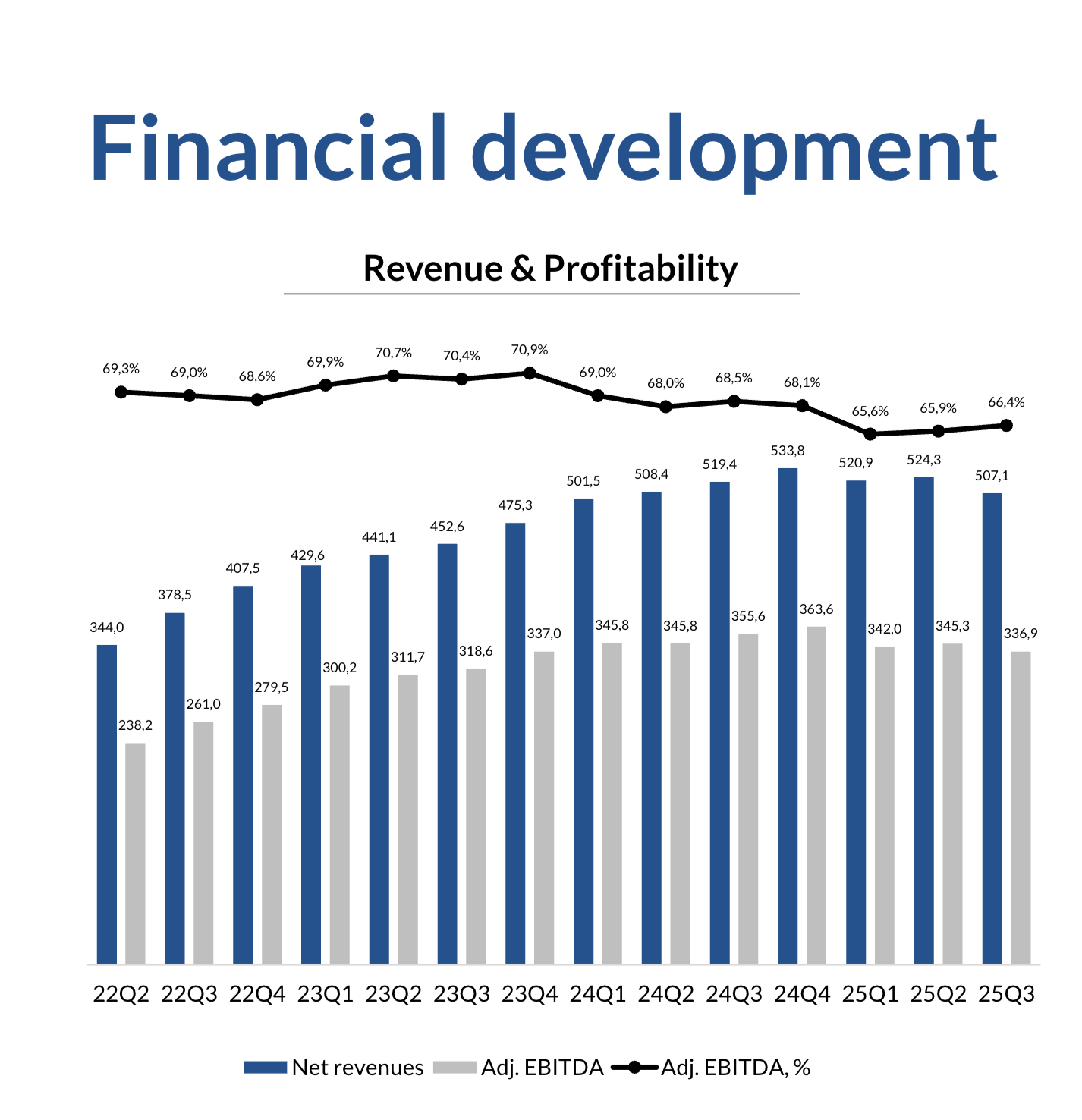

4. Evolution AB ($EVO)

How does the company make money?

Evolution AB develops online casino games. It provides live dealer games like blackjack and roulette to online gambling sites. Casinos use Evolution’s technology to run real-time games over the internet.Evolution AB is in a perfect storm right now.

The company is struggling, mainly due to issues with cybercrime.

Revenue is declining for the first time ever:

However, the company could deliver excellent returns to shareholders. Even without growth.

The current shareholder yield is over 10% (dividends + share buybacks).

That’s amazing! Especially since we expect Evolution AB to keep growing its intrinsic value.

Now let’s dive into the top 3.