✅ Monday Minute: 120 years of stock market history in one chart

In this series, we will give a weekly recap in less than 5 minutes. We would like to welcome the more than 1500 subscribers who joined our Substack as of today. If you are reading this and are not subscribed yet, feel free to do this via the button hereunder:

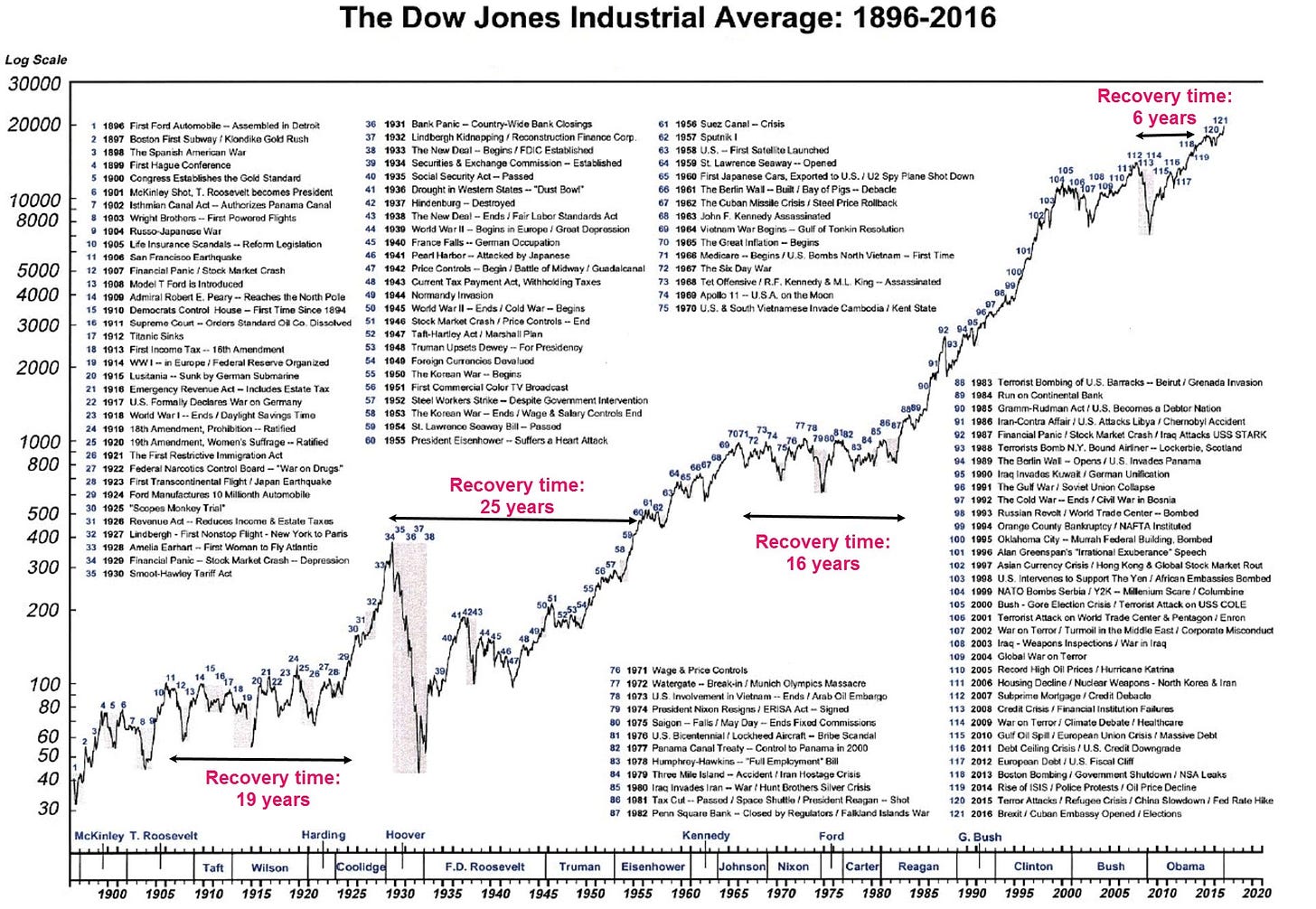

✅ 120 years of stock market history in one chart

In the long run, stocks are the best way to build wealth. If you invest $1000 today for 120 years at a return of 8% per year, you’ll end up with more than $14 million.

✅ 20 Golden investment rules from Peter Lynch

Do you want to become a better investor? Learn from Peter Lynch, one of the best investors of all time:

✅ One simple investment quote

"In bear markets, stocks return to their rightful owners." - J.P. Morgan

✅ Book recommendation: Only the Best Will Do

Only the Best Will Do from Peter Seilern is a great Quality Investment Book. In this book you learn how you can find companies that reliably deliver steady and strong growth for the long term. According to Peter Seilern, quality growth businesses are the ultimate assets for those serious about making their investments work for them over the long term while minimizing the risk of permanent loss of capital.

Example of a quality company

OTC Markets Group operates the traded securities markets. The Company regulates the trading systems and connects a diverse network of broker-dealers that provides liquidity and execution services.

FCF Margin: 35.1%

ROIC: 64.9%

FCF Yield: 3.6%

Exp. FCF Growth (3 yr): 13.6%

CAGR since IPO: 26.8%

More from us

This was our first Monday Minute. Feedback is more than welcome as we would like to know which content you like and don’t like. Feel free to give your opinion in the comments or send an email to compoundingquality@gmail.com.

Over the next few months, we will try to continue educating investors. Which content would you like to see from Quality Compounding?

I'm really surprised there are no comment here! 😳

Fine ... let me be the first then! 😎

A professor could model a university course after the chart of the Dow Jones Industrial Average from 1896 to 2016 you posted here. Look at all the historical events from war to scandal to innovation to political upheaval and look at what the DJIA did in the long run. For as bad as those events are (and some are indeed very bad) the index went up, up, and up. It is impossible to stop capitalism when it has clear rules and guidelines to operate with. The rules help. Look at the recovery time for the Great Depression. It was 25 years and we know there were a lot of what we would consider nefarious behaviors at the time.

The Stagflation of the 70s spoiled markets for 16 years. That's a unique case. Lots of rules in place but I think we now question who followed them and who didn't. This period saw China entering the global economy and sucking inflation out of it with their extremely cheap labor. With inflation gone, the index has seen a bull run from 1986 onward. The crash of 1987 looks like a blip!

It would be interesting to see an updated chart one day showing the COVID crash to see how it scales in.

The quotes from Peter Lynch are cool. In fact, quotes like these are always fun to read. They almost read like cliches because we take them for granted as being true. It's good to be reminded of them!