10 Lessons from 2025

A recap of the year

2025 was an amazing (investing) year.

The S&P 500 increased by +18% this year.

What have we learned this year? Let’s share 10 crucial investment insights.

Serious investors

I am looking for a few interested investors who want to step up their investment game in 2026. You can apply here if you think it’s something for you.1. Time in the market > timing the market

Timing the market is a fools game.

The only role of market timers, is to make fortunetellers look good.

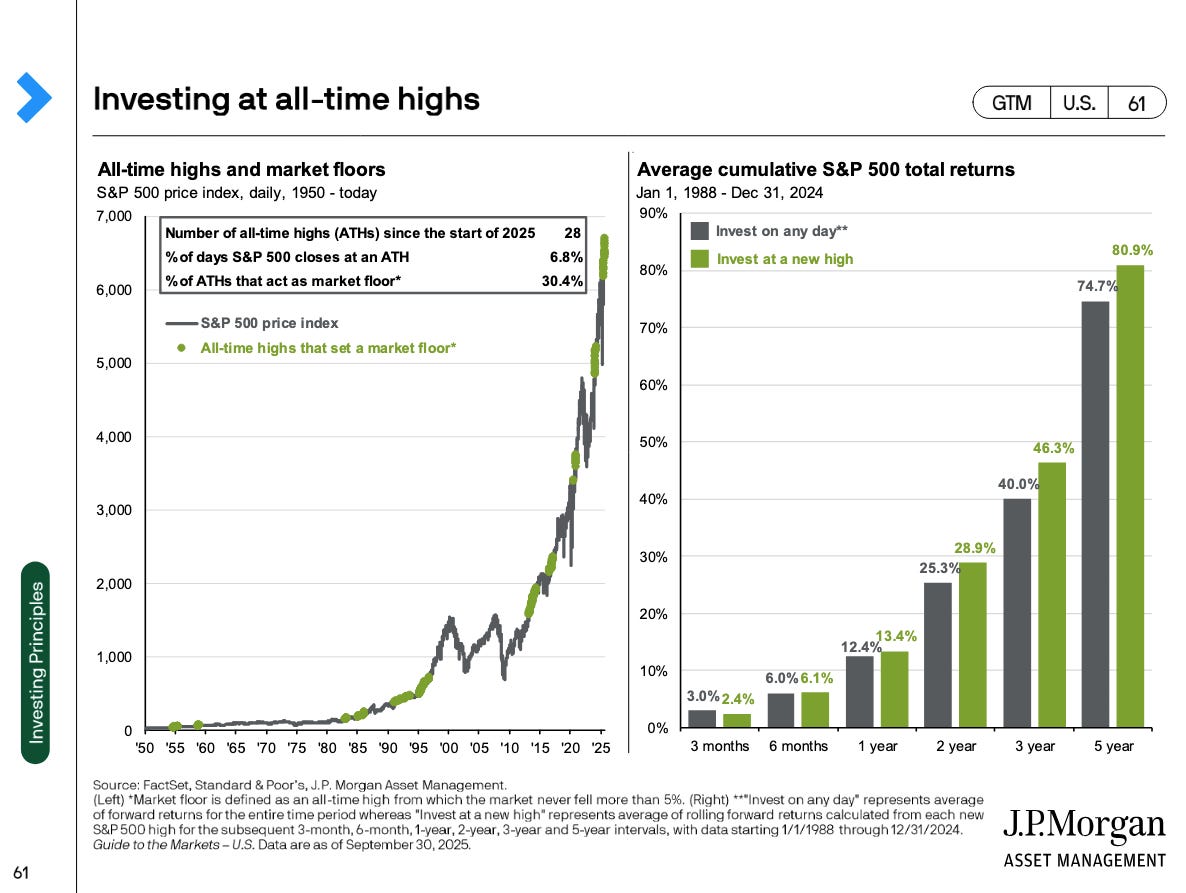

As you can see in the chart below, you actually slightly outperform the market by investing at all-time highs:

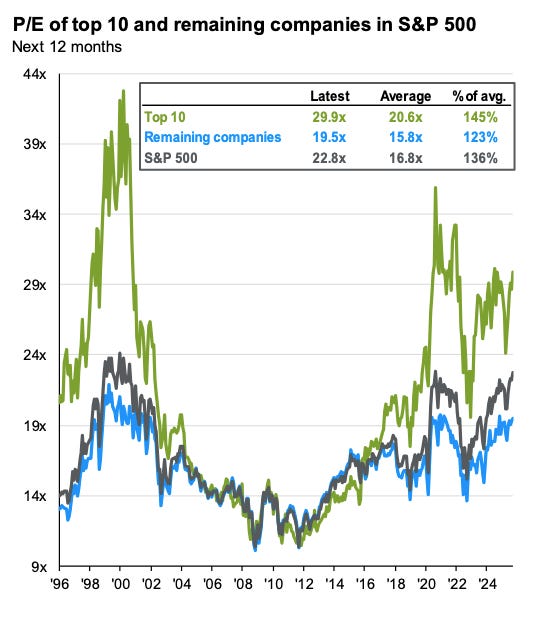

2. The market looks expensive

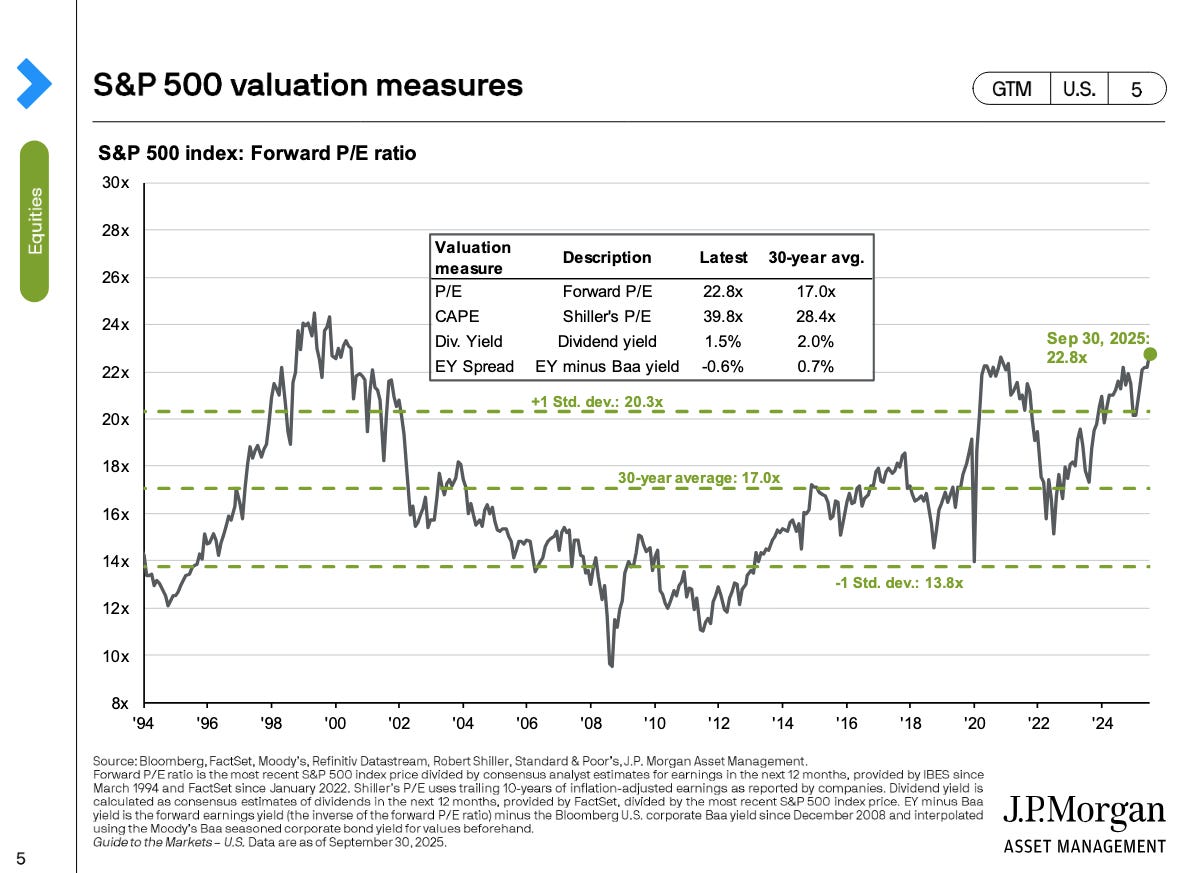

The S&P 500 looks richly valued today:

As a result, the expected return for the S&P 500 looks rather low.

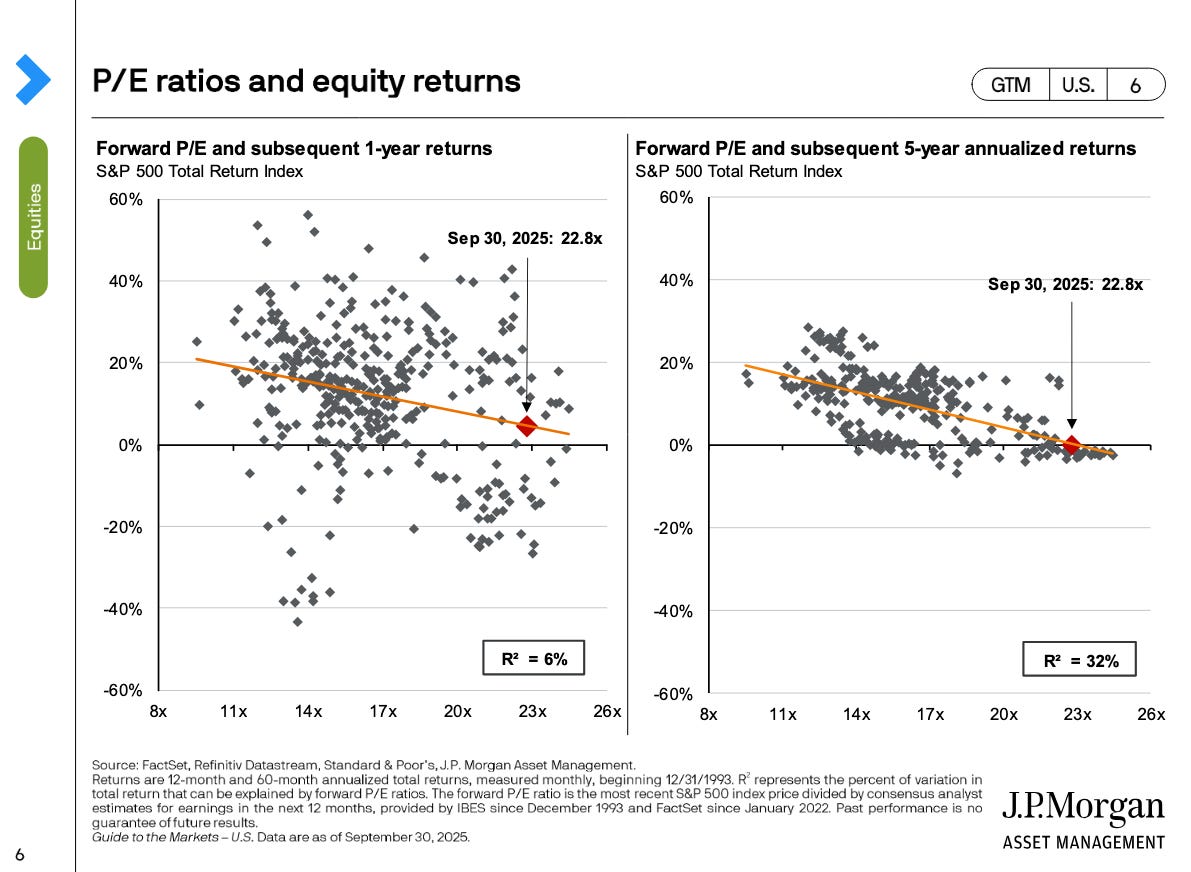

JP Morgan even says you could expect a return of 0% (!) over the next 5 years:

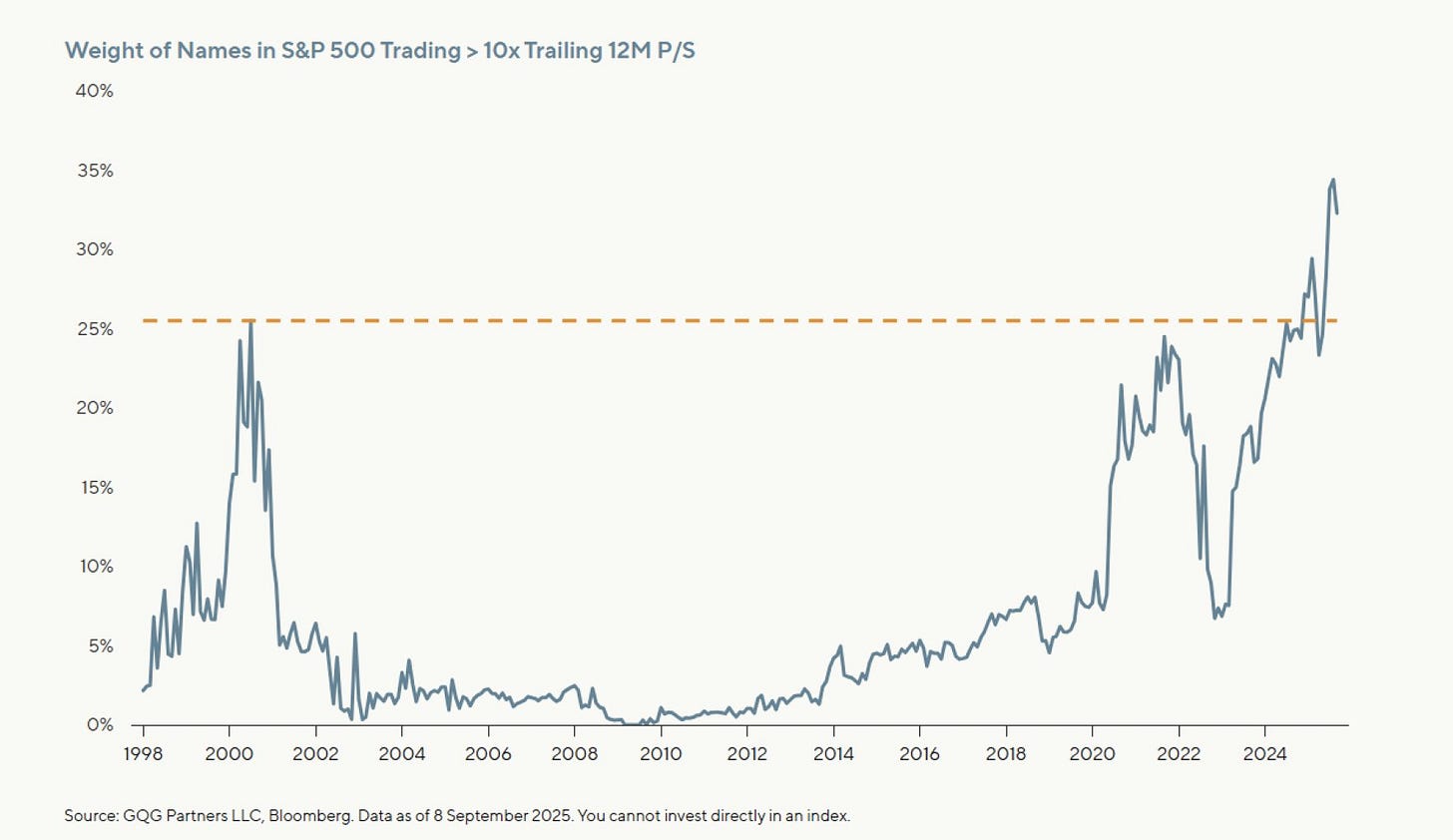

There have never been more companies within the S&P 500 trading at a Price-to-Sales ratio over 10x:

The good news? If you exclude Big Tech stocks, valuation levels already look way more reasonable:

I don’t think the outperformance of Big Tech can continue.

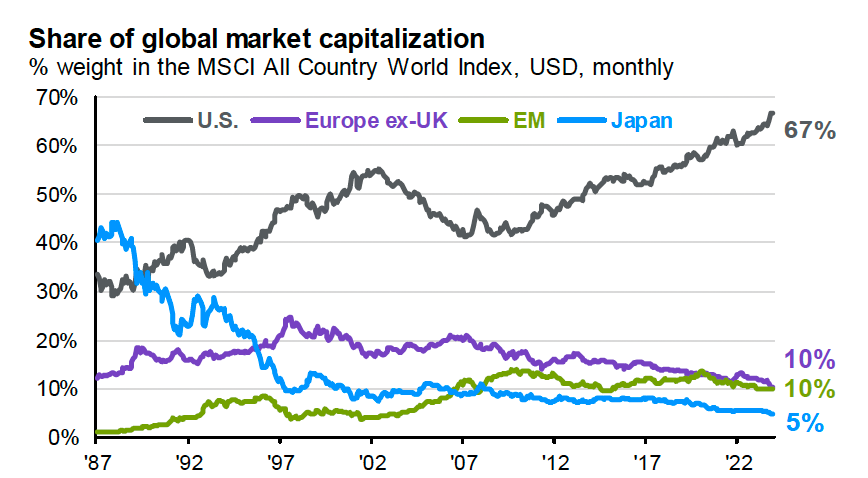

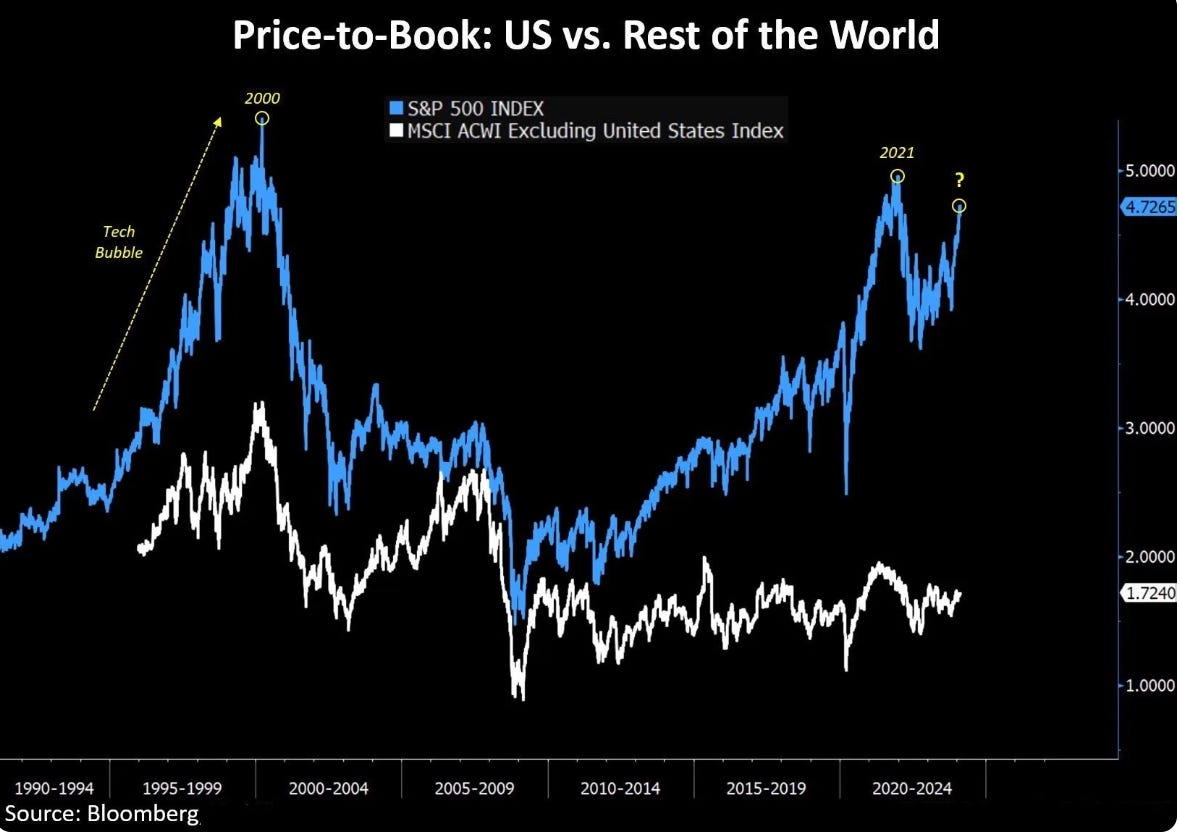

3. International stocks look cheap

The weight of US stocks in global market capitalization has reached its highest level since 1987:

It’s important to highlight that non-US stocks are significantly cheaper than US stocks:

My key thinking?

There will come a time that non-US stocks start outperforming again.

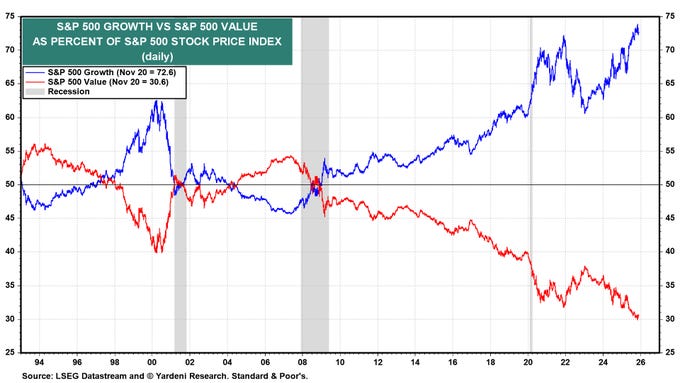

4. Growth versus value

The chart shows the weight of growth stocks (blue line) versus value stocks (red line) in the S&P 500.

It has never happened over the past 30 years that value stocks had such a low weight in the index:

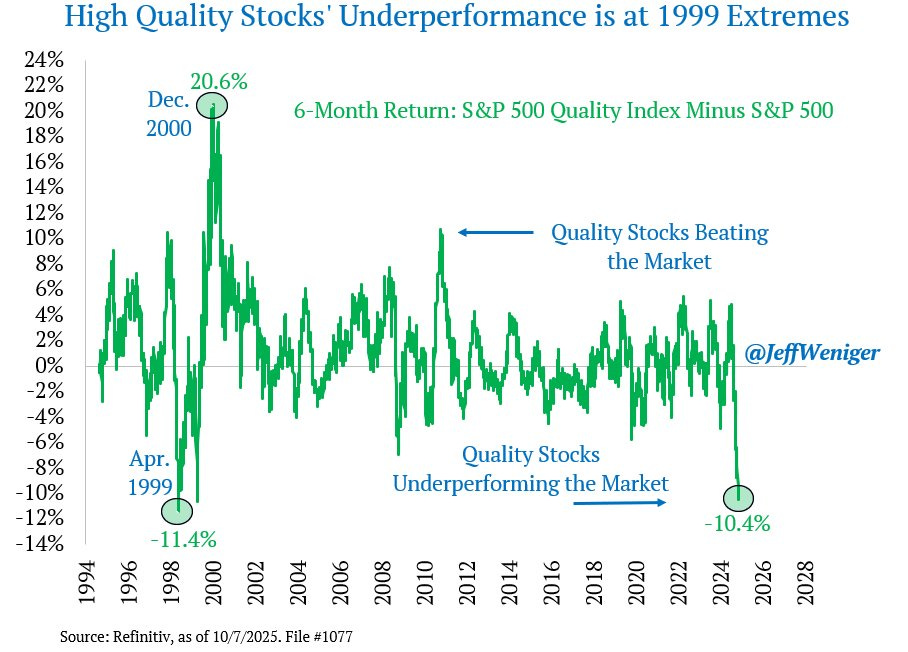

5. Quality looks interesting

It has not happened since 1999 (!) that Quality Stocks underperformed the market by so much as today.

We all know what happened just after 1999.

The result? The expected return for Our Portfolio looks very attractive.

This makes me very optimistic for 2026.

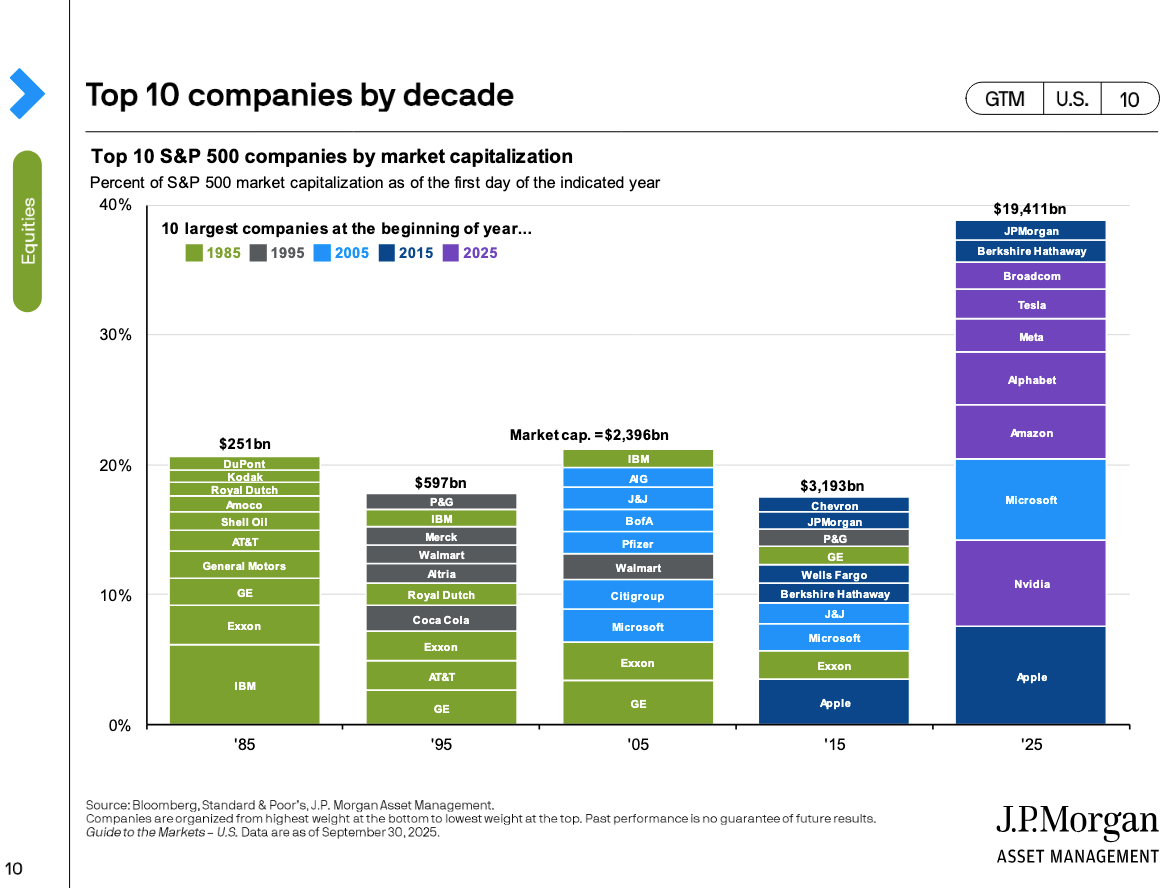

6. The Nvidia Era

Over the past 50 years, there has never been a company that had such a high weight in the S&P 500 as Nvidia.

Today, Nvidia weighs 6.9% (!).

A dangerous thing if you ask me. Reversion to the mean will take place eventually.

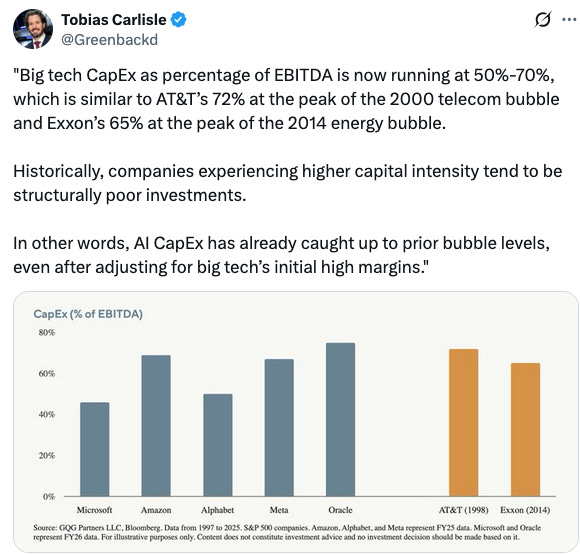

7. Is AI a bubble?

All Big Tech companies are massively investing in AI:

This is what Tobias Carlisle has to say about this topic:

A lot of people are asking whether we’re in a bubble today.

The honest answer? I don’t know. AI is in my ‘too hard’ pile.

We prefer to invest in very ‘boring’ companies with predictable cash flows.

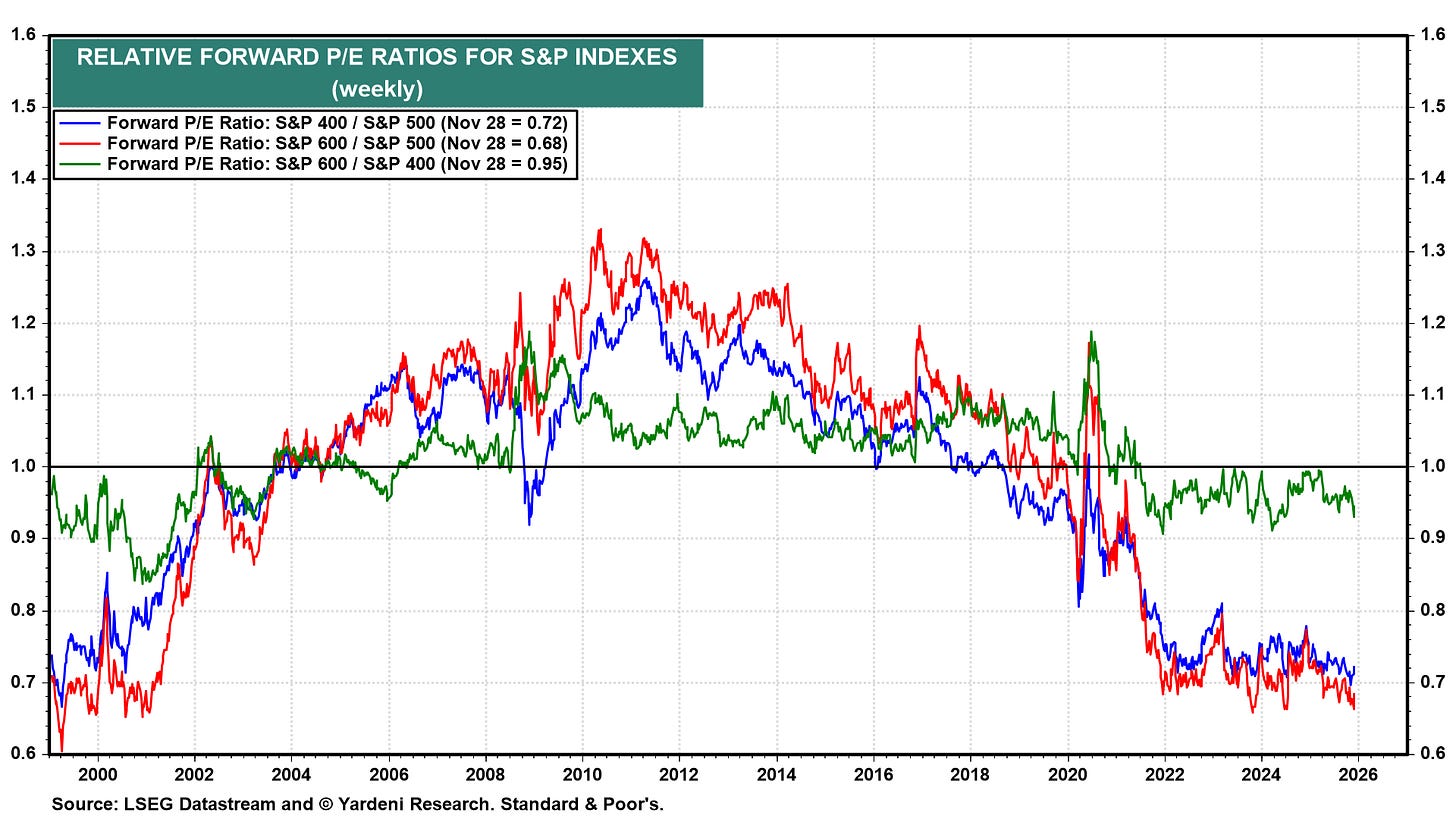

8. The decade of small caps

Small caps tend to outperform the market in the long term.

$10.000 invested 40 years ago:

General market: $122.309

Small caps: $261.330

And guess what?

Small caps have never been cheaper compared to large caps over the past 30 (!) years:

Identifying high-quality small caps is exactly what we try to do at Tiny Titans.

Interested? If you aren’t a Partner yet, you can add yourself to the application list here.

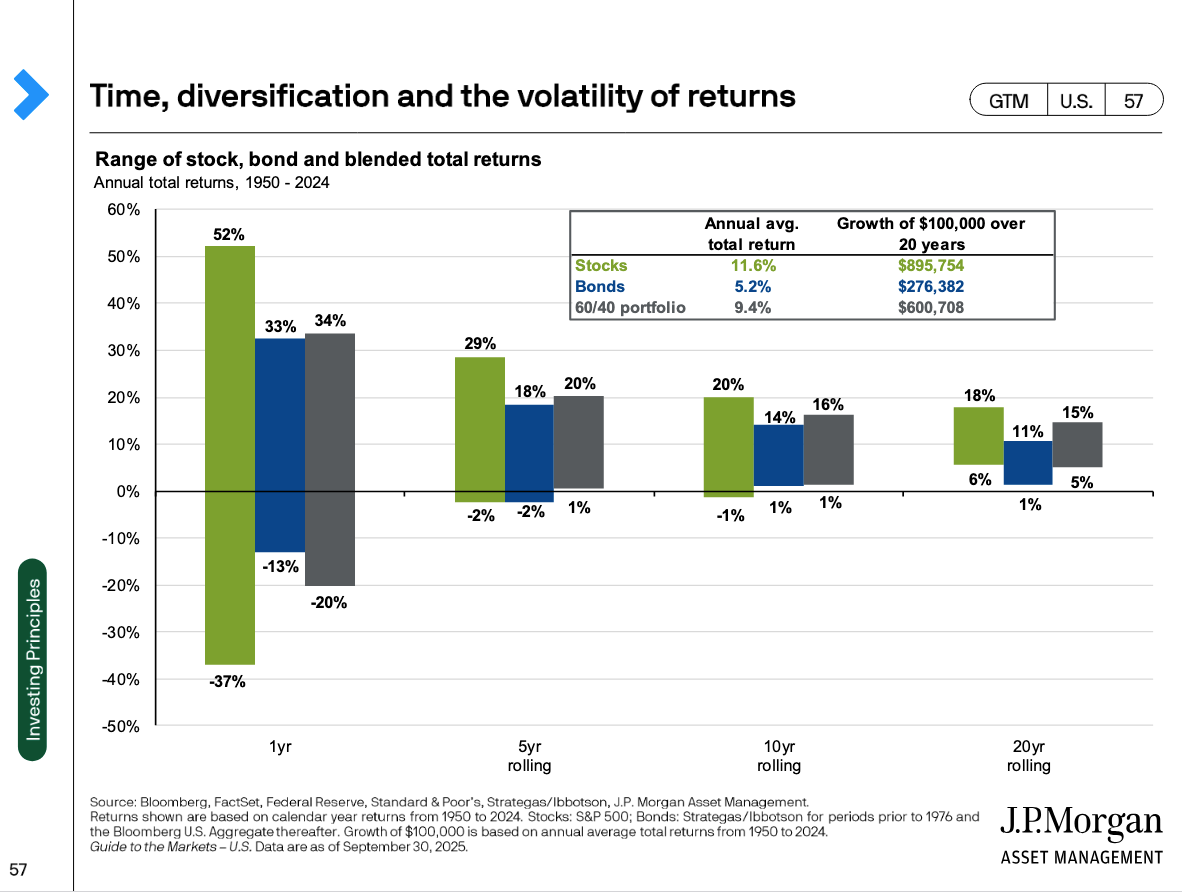

9. Not investing is risky

In the short term, investing is risky.

In the long term, not investing is risky.

Can you guess the average yearly return on the stock market since 1950 when you invest for at least for 20 years?

It’s between 6% and 18% per year.

10. The incredible value of the community

One of the most valuable things of Compounding Quality? The Community.

In the Community, all Partners gather to become smarter.

You can ask questions, share investment ideas, …

It’s how we let the wisdom of crowds work in Our Favor.

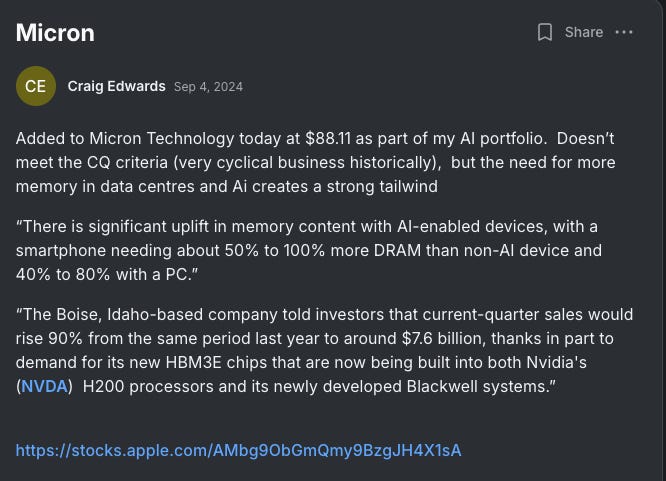

An example? Craig Edwards pitched Micron ($MU) as an interesting idea in September 2024.

The stock is up +219% since then.

You are not a member of the Community yet? You can join here:

Everything in life compounds

Pieter (Compounding Quality)

PS I am looking for a few interested investors who want to step up their investment game in 2026. You can apply here if you think it’s something for you.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

https://open.substack.com/pub/tradernation/p/bidu-the-ai-robotaxi-beast-nobodys?r=4atcwp&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

Thank you for sharing! Do you know which etf like sp500 but excluding tech companies?