10 Hidden Small-Cap Gems To Buy Now

Undiscovered Small-Cap Stocks

Hi Partner 👋

Welcome to this week’s 🔒 paid edition 🔒 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

Size matters.

If you had invested $10,000 from 1926 until 2006::

Regular market: $10,000 turned into $36.6 million

Small Caps: $10,000 turned into $685 million

A difference of almost $650 million!

That’s because Small Caps outperformed by 3.7% per year on average.

Let’s share 10 attractive small-cap stocks with you today.

10. OTC Markets ($OTCM)

OTC Markets Group runs a marketplace where people can buy and sell stocks of smaller companies. These stocks are not listed on big stock exchanges like NASDAQ or NYSE.

The platform helps make trading easier and provides investors with a lot of data. OTC stands for Over-The-Counter (securities).

A few months ago, I had the chance to interview CEO Cromwell Coulson. You can read the summary here.

Investment Rationale

CEO Cromwell Coulson owns 35.3% of total shares outstanding

Very profitable business model

Market leader in a niche

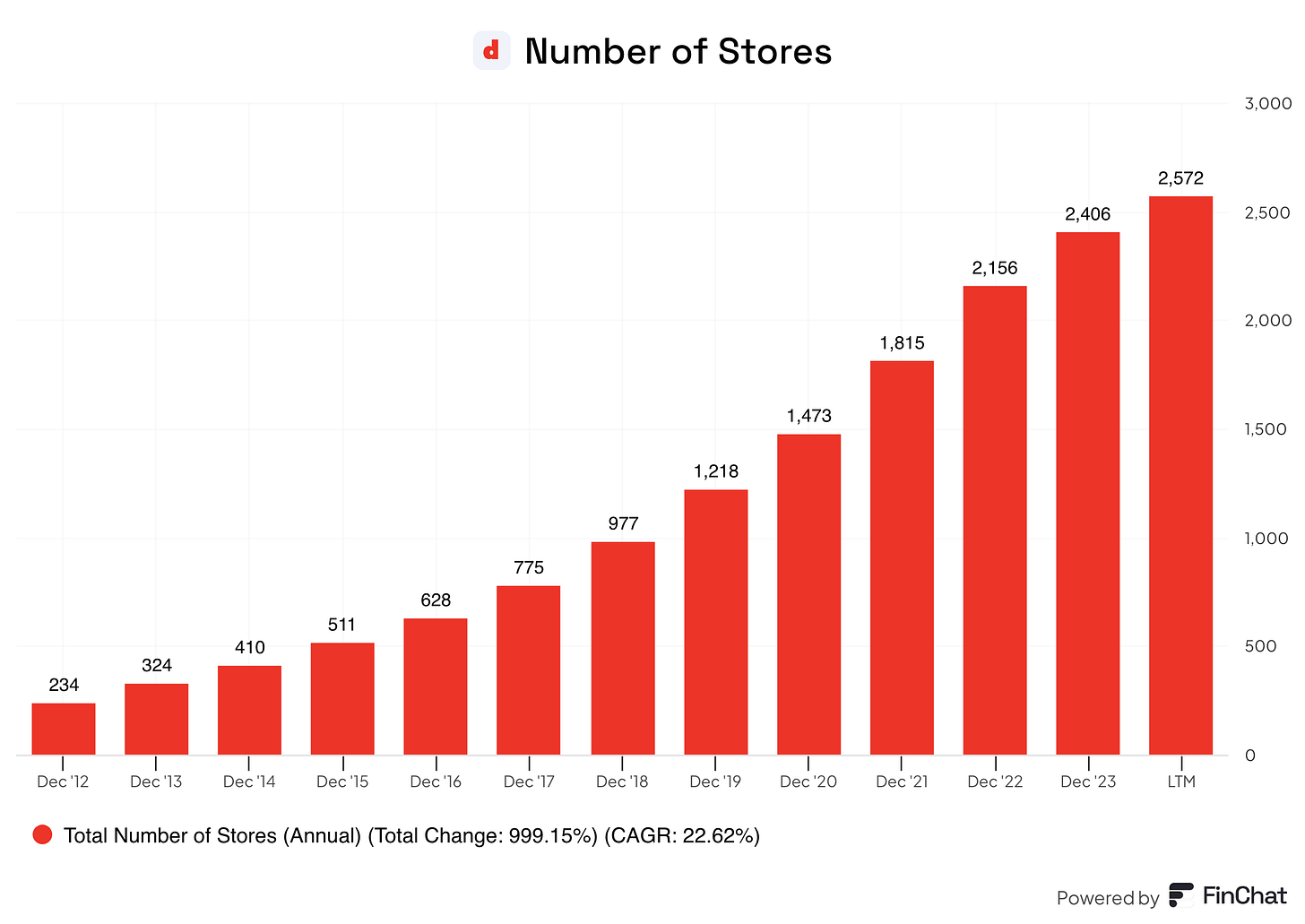

9. Dino Polska ($WSE:DNP)

Dino Polska operates a chain of grocery stores in Poland.

The company builds medium-sized stores in smaller towns, to serve people in rural areas.

They offer fresh products, including fruits, vegetables, and bakery goods.

Dino Polska also has its own distribution network to ensure quick delivery to stores. Their goal is to provide affordable, high-quality goods close to customers' homes.

Investment Rationale

Poland has one of the fastest-growing economies in the world

The CEO has a frugal mindset (something we like to see)

Reinvests almost all Free Cash Flow into organic growth

8. Auto Partner ($WSE:APR)

Auto Partner is a leading importer and distributor of automotive parts in Poland, operating an extensive logistics network to quickly supply parts to workshops and retailers.

Currently, Mr Market is pessimistic about European car companies. This could provide opportunities:

Investment Rationale

Still a long runway ahead

Insider ownership: 43.9%

Amazing growth - 10-year Revenue CAGR: 26.3%

7. Mader ($ASX:MAD)

Mader Group Limited is an Australian company that offers technical services in the mining, energy, and industrial sectors.

They maintain heavy machinery and fixed infrastructure, to ensure equipment runs smoothly.

Their services include on-site support, major overhauls, and team training.

They also work in rail, road transport, marine, and power generation sectors. Mader Group serves clients worldwide.

Investment Rationale

Founder-led company with high insider ownership

Mader provides high-quality services at low prices

Amazing growth - 10-year Revenue CAGR: 27.6%

6. MIPS AB ($STO:MIPS)

Have you ever wondered how helmets protect you from brain injuries? That’s where MIPS AB comes into play.

MIPS AB designs safety technology for helmets to protect your head while cycling or skiing.

By adding a thin, sliding layer inside helmets, they make head protection smarter and safer. You’ll find MIPS technology in helmets from top brands around the world.

Investment Rationale

Excellent capital allocation (ROIC: 76.9%)

MIPS is very profitable (Gross Margin: 71.9%)

Net Cash Position equal to 2.3% of the Market Cap

5. Lumine Group ($CVE:LMN)

Lumine Group is the business version of a team coach: the company acquires and grows software companies in industries like data, communications, and analytics.

Just like Topicus, Lumine Group is a spin-off from Constellation Software.

Lumine’s companies provide tools to help businesses run smarter and more efficiently. This makes it easier for organizations to manage data and improve operations.

Investment Rationale

Constellation Software owns 61.4% of the company

Lumine Group still has a long runway

Amazing growth: 3-year Revenue CAGR: 44.3%

4. Cerillion ($LON:CER)

Cerillion makes software that helps businesses, especially telecom companies, manage their customers and services.

Think of it as the behind-the-scenes tech that keeps your phone bill accurate and your Netflix subscription running smoothly.

Cerillion helps companies handle payments, subscriptions, and customer service all in one system.

Investment Rationale

Excellent capital allocation (ROIC: 34.9%)

Founder-led company with skin in the game

Moat based on high switching costs

Now let’s dive in the Top 3.

Number 1 is a serious candidate for Our Portfolio.