Hi Partner 👋

Welcome to this week’s 🔒 paid edition 🔒 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

I consider my family to be very traditional.

My mom is a nurse while my dad is a human resources manager for a construction company.

While they have always lived frugally, they were afraid of investing.

“Investing is dangerous. Just look at what happened during the Financial Crisis.”

And

”Your grandparents lost a lot of money during Black Monday (19 October 1987)”

You know what’s funny?

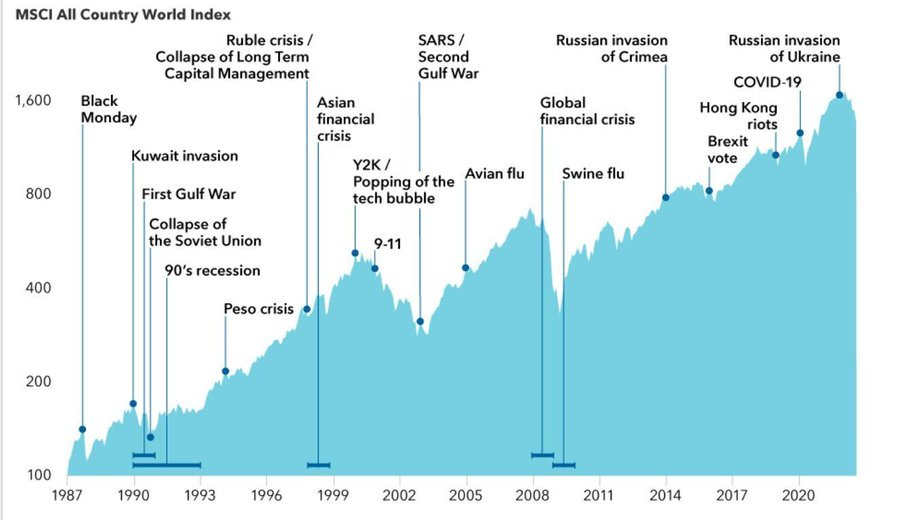

You would have quadrupled your money if you had bought the S&P 500 just before the Financial Crisis.

And $10,000 would have turned into $200,000 when you invested just before the Black Monday crash.

Great things happen to those who invest with a long-term mindset.

The best time to buy stocks is when blood runs through the streets.

As my parents don’t know anything about investing and didn’t want to spend too much time on it, they started buying IWDA every single month since September 2017.

IWDA?

IWDA is the ticker for the iShares MSCI World ETF that tracks the MSCI World Index.

By investing in IWDA, you buy the 1,500 largest companies across 23 developed countries (mainly the US and Europe).

Another positive? You only pay 0.2% in yearly fees.

The performance for every transaction executed in 2017, 2018, and 2019 of my parents looks like this:

As you can see, the first investment in IWDA in September 2017 returned 129%.

The key lesson? Everyone can invest.

It’s one of the best ways to become wealthy.

Monopolies and Oligopolies ETF (TOLL)

In the Community, some Partners talked about the TOLL ETF.

It’s an ETF focusing on quality companies with dominant and durable moats active in a monopoly or oligopoly.

Sounds interesting. Doesn’t it?

But let’s dig in a bit more.

Key information:

ISIN: US87975E1073

Ticker: TOLL

AUM: $12 million

TER: 0.55%

# of holdings: 33

The objective of the ETF

TOLL wants to provide long-term growth by investing in quality companies with dominant and durable moats.

These companies are characterized by:

A sustainable competitive advantage

Tangible barriers to entry

Defensive earnings streams

As a result, they tend to generate high returns on invested capital that compound over long periods.

Positioning

The Portfolio Essentials for the ETF look like this:

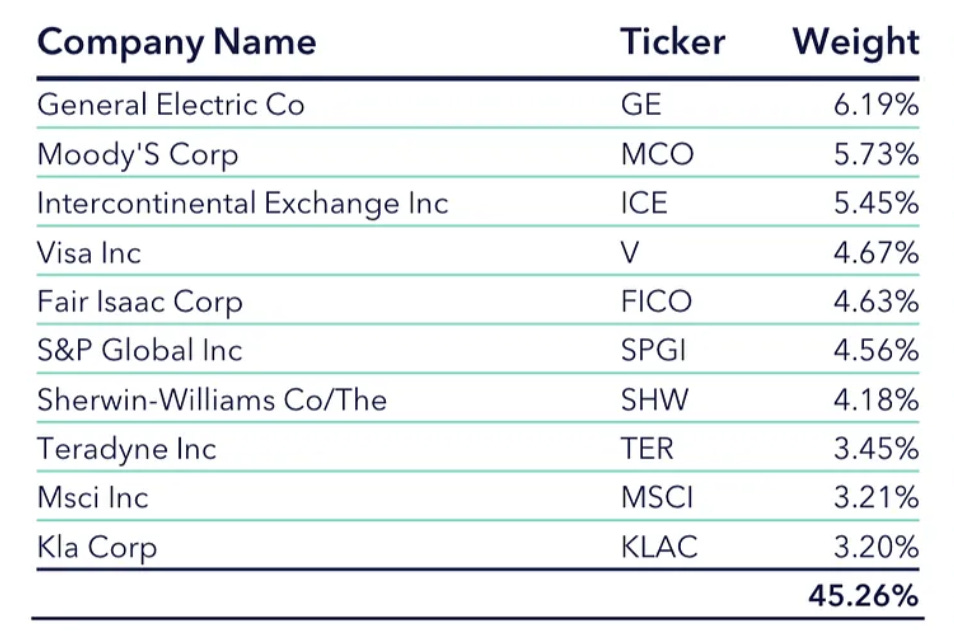

The ETF invests in 33 positions and has a lot of exposure to financials like Visa, Fair Isaac, S&P Global, and Moody’s.

Here are the top 10 positions:

The companies mentioned above can be seen as quality if you ask me.

Performance

The ETF wants to perform better than the MSCI World Index in the long term.

As TOLL launched in October 2023, the track record is still too short to tell anything meaningful about the performance.

However, I would expect this strategy to do well in the long term.

All positions

Here’s an overview of all companies within the ETF:

Bringing it together

Let’s bring everything together for this ETF.

I think TOLL is an interesting ETF and I would expect them to do well in the long term.

The two negatives:

The Total Expense Ratio (TER) is quite high (0.55%)

The low size of the ETF (AUM: $12 million).

Please note that only US investors can buy TOLL. I would consider buying the ETF when I would live in the US (which I don’t).

ETF Portfolio

Now let’s give an update about our ETF Portfolio.