Hi Partner 👋

Welcome to this week’s 🔒 paid edition 🔒 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and talk about October’s favorite stocks.

September 2024

In September, the S&P 500 increased by 2.5%.

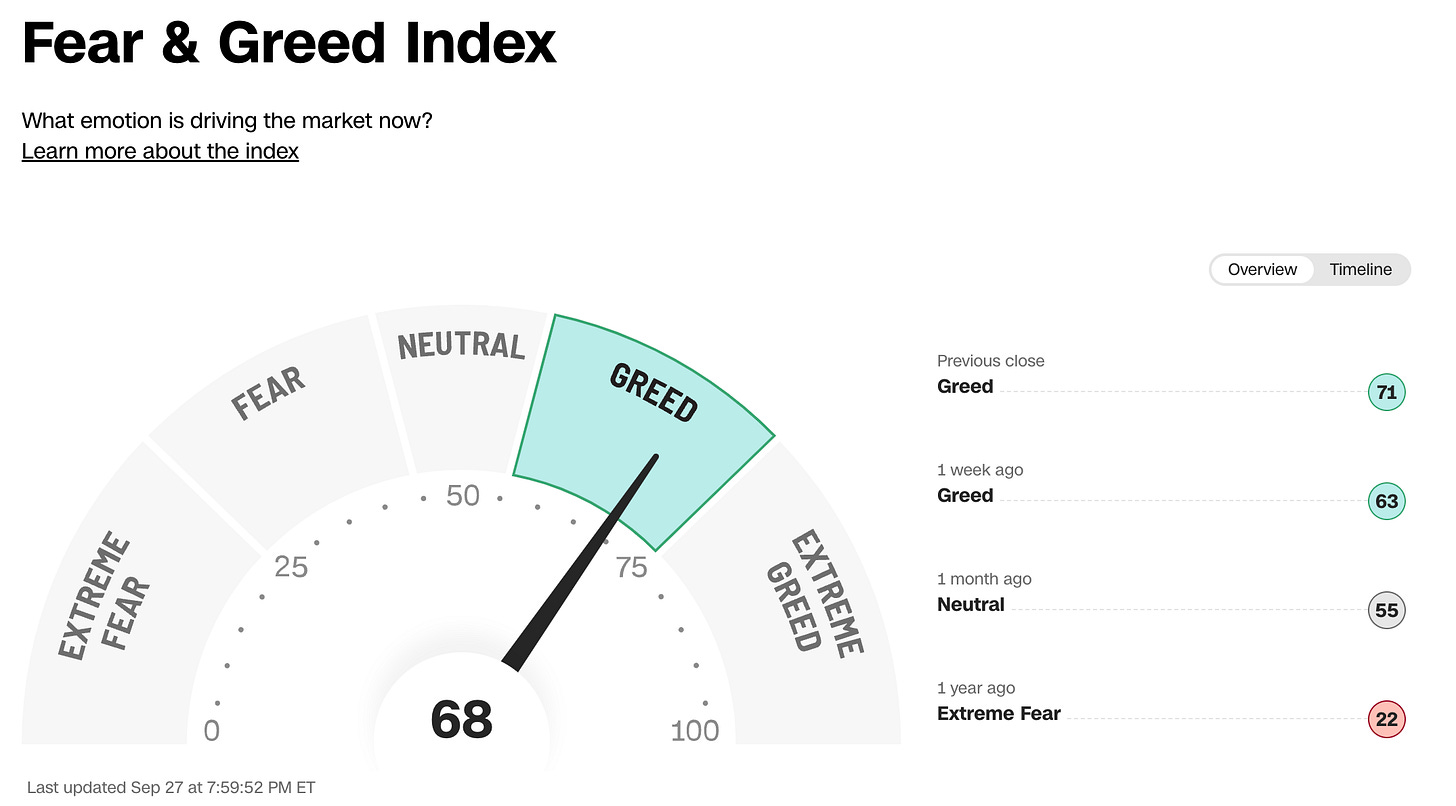

The Fear & Greed Index indicates that we are currently in ‘Greed’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the more we like it.

The company that stands out to me? Adobe.

Best Performers

Company Spotlight: Lululemon Athletica

This month’s company in the spotlight? Lululemon Athletica.

Lululemon Athletica makes and sells athletic clothes, shoes, and accessories.

The American company offers pants, shorts, tops, and jackets for an active lifestyle. This includes yoga, running, training, and more.

We wrote a Not So Deep Dive on Lululemon in the past. You can read it here.

We highlight the company today because it’s valued very cheaply:

Forward PE: Lululemon is 66.1%(!) undervalued Based compared to its historical average

Earnings Growth Model: Expected yearly return of 10.4% per year

Reverse DCF: Lululemon should grow its FCF by 8.3% per year to return 10% per year to shareholders.

These valuations are based on our Buy-Hold-Sell list. You can find the entire list here:

Source: Finchat

Two extra positives for Lululemon Athletica?

The company is buying back shares

CEO Calvin McDonald increased his stake by 4.7% ($1.1 million)

But if Lululemon Athletica is so attractive… Why don’t you own the company?!

I’ve been breaking my head about Lululemon Athletica. I’ve concluded that I don’t know…

… I don’t know what the industry will look like 10 years from now.

As Warren Buffett said: “If you aren't thinking about owning a stock for 10 years, don't even think about owning it for 10 minutes.”

And that’s why I’m keeping my hands off the company.

For investors with a higher risk appetite, Lululemon might be an interesting idea.

Best Buys October 2024

Now let’s dive into our favorite stocks for October 2024.

We won’t talk about the companies in Our Portfolio.

Why? We love to own them all. You can find the latest Portfolio Update here.

Here are our 5 Best Buys of the month.

5. Qualys

How does Qualys make money?

Qualys provides security tools for businesses.

The company makes money by providing businesses with cloud-based software to monitor and secure their IT systems. They charge a subscription fee for this (recurring revenue).

It helps companies protect their data from hackers. Qualys scans networks to find weaknesses.

It can also check if systems are updated. Their tools help companies follow security rules.

Qualys operates in the cloud, so there is no need to install software.

Why is Qualys a quality business?

Qualys enjoys a secular trend (cybersecurity)

Net cash position: 10.8% of the Market Cap is pure cash

They generate $0.43 (!) of Free Cash Flow for every $1 in revenue

Valuation

Forward PE: 23.1x (5-year average: 34.7x)

Earnings Growth Model: expected return of 12.0% per year

Reverse DCF: Qualys needs to grow its FCF by 10.2% per year to return 10% per year to shareholders

Why is Qualys in our Top 5 right now?

The stock declined by 33% YTD and trades at one of its cheapest valuation levels ever.

4. Kainos Group

How does Kainos Group make money?

Kainos Group provides IT services to businesses.

The company makes money by helping businesses move to the cloud and build software. They charge a subscription fee for their services (recurring revenue).

Kainos helps companies improve their systems. It builds custom software and helps with cloud computing.

Kainos works with both small and large companies. Its services make it easier for businesses to use new technology.

Why is Kainos Group a quality business?

Kainos is an Owner-Operator stock

Excellent capital allocation skills (ROIC: 52.7%)

CAGR since IPO in 2015: 21.2%

Valuation Kainos Group

Forward PE: 18.7x (5-year average: 31.4x)

Earnings Growth Model: expected return of 12.3% per year

Reverse DCF: Kainos Group needs to grow its FCF by 3.8% per year to return 10% per year to shareholders

Why is Kainos Group in our Top 5 right now?

Kainos Group is an excellent business. The stock has dropped 58.3% since 2021 and trades at one of its cheapest valuation levels ever.

Now let’s dive into the top 3 (Our Next Buy is probably in here):