🏆 15 Quality stocks still run by their founder

This list compounded at more than 30% per year since 2017

Are you looking for investment inspiration?

Quality companies outperform the market and so do owner-operator stocks. When you combine both metrics, you get something magical.

In this article you can find 15 quality stocks which are still run by their founder. This list compounded at more than 30% (!) per year since 2017.

1. Regeneron Pharmaceuticals ($REGN)

Regeneron Pharmaceuticals is a biopharmaceutical company active in pharmaceutical products for the treatment of serious medical conditions. Regeneron Pharmaceuticals serves the healthcare sector in the United States.

Profit Margin: 35.6%

ROIC: 19.2%

Earnings yield: 5.0%

Expected yearly EPS Growth (next 3 years): 3.5%

CEO Tenure: 35.3 years

CAGR since IPO: 12.1% (1991)

2. Check Point Software ($CHKP)

Check Point Software Technologies is a technology company offering its customers network and gateway security solutions, data and endpoint security solutions and management solutions.

Profit Margin: 34.2%

ROIC: 24.5%

Earnings yield: 5.9%

Expected yearly EPS Growth (next 3 years): 13.2%

CEO Tenure: 29.8 years

CAGR since IPO: 13.9% (1996)

3. Cerillion ($CLLN)

Cerillion PLC designs and develops customer management systems. The Company offers network asset management, billing operations, certification, digital transformation, cable, subscription, support, and maintenance services.

Profit Margin: 28.6%

ROIC: 30.9%

Earnings yield: 3.1%

Expected yearly EPS Growth (next 3 years): 16.0%

CEO Tenure: 24.4 years

CAGR since IPO: 50.8% (2016)

4. Gildan Activewear ($GIL)

Gildan Activewear manufactures and markets undecorated blank activewear. The Company offers t-shirts, sport shirts, and fleeces, which are subsequently decorated by screen printing companies with designs and logos.

Profit Margin: 16.7%

ROIC: 20.8%

Earnings yield: 9.5%

Expected yearly EPS Growth (next 3 years): 8.8%

CEO Tenure: 19.3 years

CAGR since IPO: 19.2% (1998)

5. Atoss Software ($AOF)

Atoss Software AG develops computer software. The Company offers IT consulting, design, and management planning services for enterprises. Atoss Software serves customers worldwide.

Profit Margin: 17.0%

ROIC: 33.9%

Earnings yield: 1.8%

Expected yearly EPS Growth (next 3 years): 26.6%

CEO Tenure: 9.3 years

CAGR since IPO: 15.8% (2000)

6. New Wave Group($NEWA-B)

New Wave Group is active in corporate profiling. The Company works within two business areas: wholesales sportswear and uniforms with business names and logos, as well as corporate image products and business gifts.

Profit Margin: 13.2%

ROIC: 17.1%

Earnings yield: 9.7%

Expected yearly EPS Growth (next 3 years): 4.6%

CEO Tenure: 14 years

CAGR since IPO: 13.3% (2000)

7. Monolithic Power Systems($MPWR)

Monolithic Power Systems designs and manufactures power management solutions. The Company provides power conversion, LED lighting, load switches, cigarette lighter adapters, chargers, position sensors, analog input, and other electrical components.

Profit Margin: 24.4%

ROIC: 29.5%

Earnings yield: 2.8%

Expected yearly EPS Growth (next 3 years): 27.3%

CEO Tenure: 25.8 years

CAGR since IPO: 25.5% (2004)

8. Verisign($VRSN)

VeriSign operates as a provider of domain name registry services and internet infrastructure. The Company enables the security, stability, and resiliency of key internet infrastructure and services.

Profit Margin: 47.3%

ROIC: 44.5%

Earnings yield: 3.2%

Expected yearly EPS Growth (next 3 years): 11.4%

CEO Tenure: 14.9 years

CAGR since IPO: 15.7% (1998)

9. Yougov($YOU)

YouGov provides online research and consulting services for companies, governments, and institutions internationally. Yougov focuses on internet-based market research and data analytics.

Profit Margin: 7.7%

ROIC: 20.3%

Earnings yield: 4.4%

Expected yearly EPS Growth (next 3 years): 26.1%

CEO Tenure: 13.3 years

CAGR since IPO: 21.6% (2005)

10. Paycom($PAYC)

Paycom Software designs and develops software solutions. The Company provides data analytical software products to manage the employment life cycle from recruitment to retirement.

Profit Margin: 20.5%

ROIC: 24.8%

Earnings yield: 2.5%

Expected yearly EPS Growth (next 3 years): 31.2%

CEO Tenure: 25.4 years

CAGR since IPO: 39.2% (2014)

11. Livechat Software($LVC)

LiveChat Software is a software company that provides communication tools for companies and their websites. The Company offers live chat rooms and unique greetings which gives businesses the ability to communicate with their customers.

Profit Margin: 53.5%

ROIC: 100.7%

Earnings yield: 5.0%

Expected yearly EPS Growth (next 3 years): 16.5%

CEO Tenure: 11.9 years

CAGR since IPO: 29.4% (2014)

12. iRadimed($IRMD)

iRadimed develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices, and related accessories and services in the United States and internationally.

Profit Margin: 24.1%

ROIC: 16.4%

Earnings yield: 3.1%

Expected yearly EPS Growth (next 3 years): 15.5%

CEO Tenure: 3 years

CAGR since IPO: 24.9% (2014)

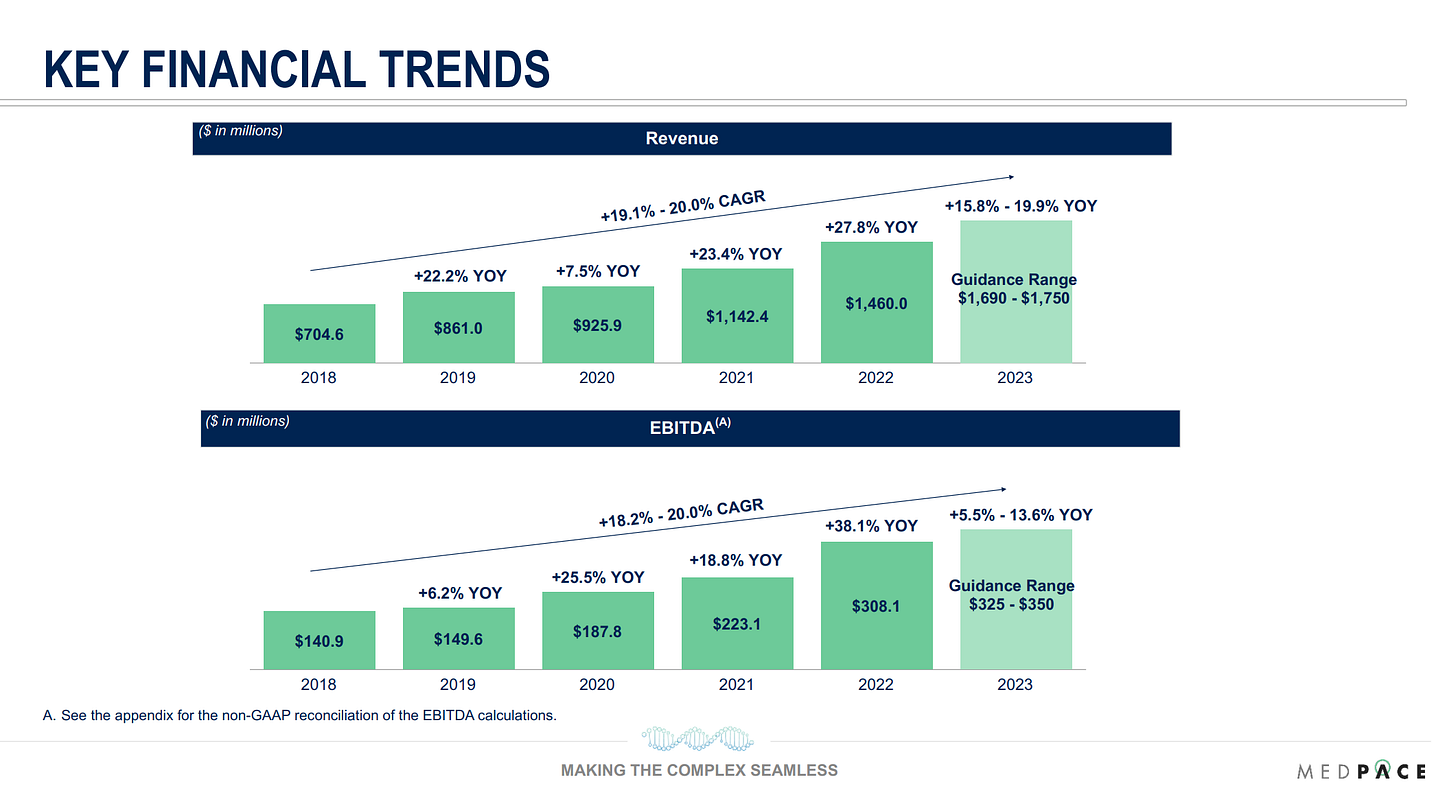

13. Medpace($MEDP)

Medpace Holdings, Inc. operates as a holding company. The Company, through its subsidiaries, provides cardiovascular, hematology, oncology, neurology, pediatrics, nephrology, and diagnostic services.

Profit Margin: 16.8%

ROIC: 29.8%

Earnings yield: 3.9%

Expected yearly EPS Growth (next 3 years): 14.7%

CEO Tenure: 31.4 years

CAGR since IPO: 37.4% (2016)

14. Kinsale Capital($KNSL)

Kinsale Capital operates as a specialty insurance company. The Company markets and sells property, casualty, and specialty risk insurance products through a network of independent insurance brokers.

Profit Margin: 19.4%

ROIC: 29.2%

Earnings yield: 3.1%

Expected yearly EPS Growth (next 3 years): 21.1%

CEO Tenure: 13.9 years

CAGR since IPO: 56.4% (2016)

15. Meta Platforms($META)

Meta Platforms (Facebook) is a market leader in digital advertising and is investing heavily in the metaverse.

Profit Margin: 19.9%

ROIC: 15.6%

Earnings yield: 5.4%

Expected yearly EPS Growth (next 3 years): 16.7%

CEO Tenure: 19.3 years

CAGR since IPO: 17.2% (2012)

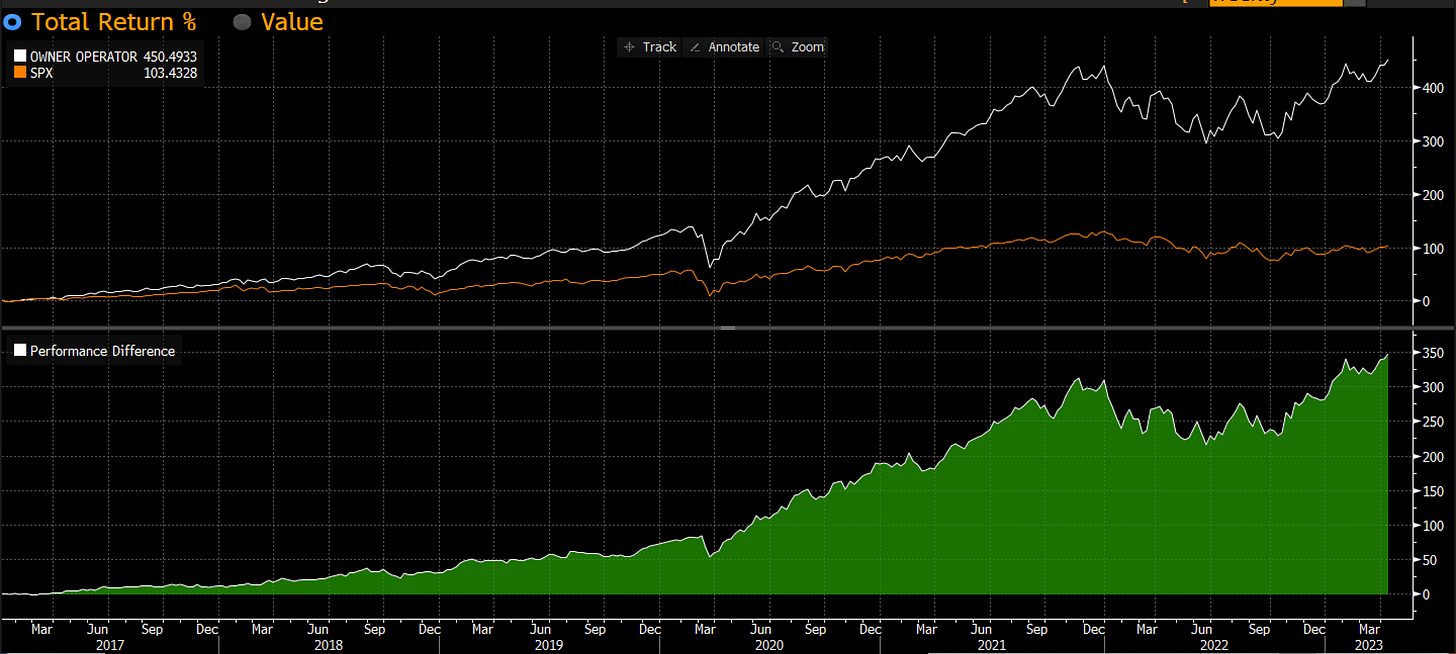

Clear outperformance

The million dollar question is how this list would have performed in the past, and how it will perform in the future.

Since 2017, a portfolio with these 15 quality stocks would have returned 450% (!) to shareholders compared to ‘only’ 103% for the S&P500.

This is equal to an annual return of 31.1% versus 11.9% for the S&P500!

We are not saying that this list will outperform as much as it did since 2017, but we’re quite comfortable to say that in the long term this portfolio will continue to outperform the S&P500.

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Fantastic list! I appreciate you providing us insight on some companies that are not talked about very much!!

Thank you for the list, much appreciated!