🏆 15 Quality stocks you've never heard of

The biggest edge of investors like you and me?

We are able to invest in smaller companies.

In this article you’ll find a list with 15 Quality Stocks you’ve never heard of.

I am quite comfortable to state that this list will outperform the S&P500 over the next decade.

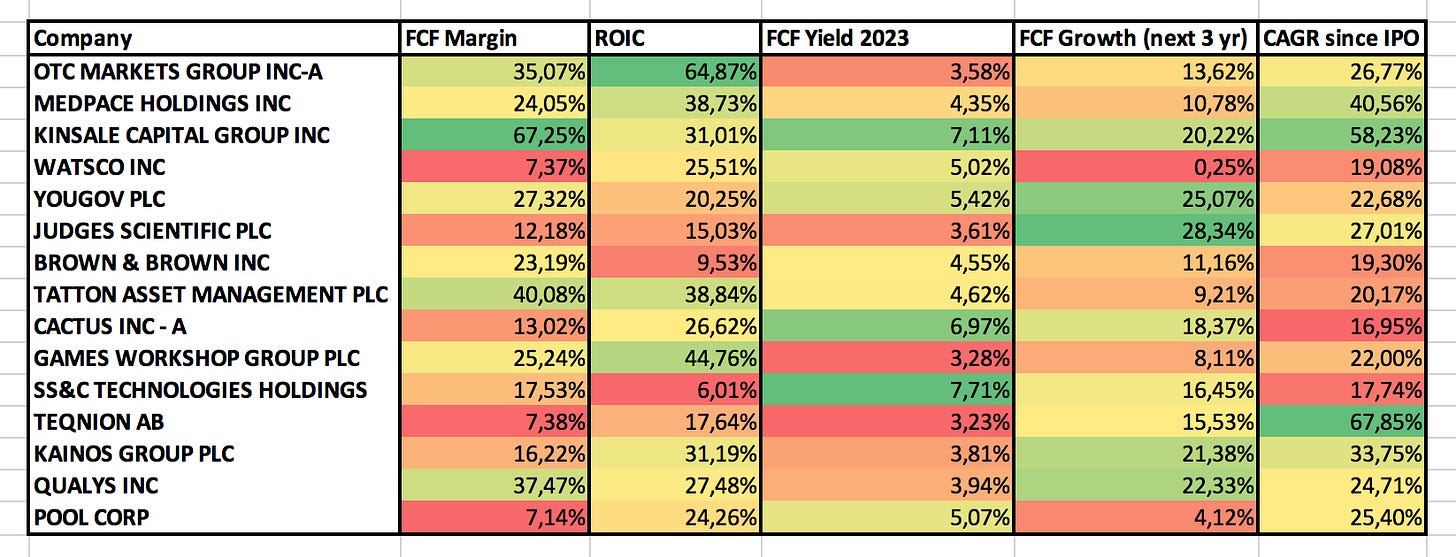

1. OTC Markets ($OTCM)

OTC Markets Group operates the traded securities markets. The Company regulates the trading systems and connects a diverse network of broker-dealers that provides liquidity and execution services.

FCF Margin: 35.1%

ROIC: 64.9%

FCF Yield: 3.6%

Exp. FCF Growth (3 yr): 13.6%

CAGR since IPO: 26.8%

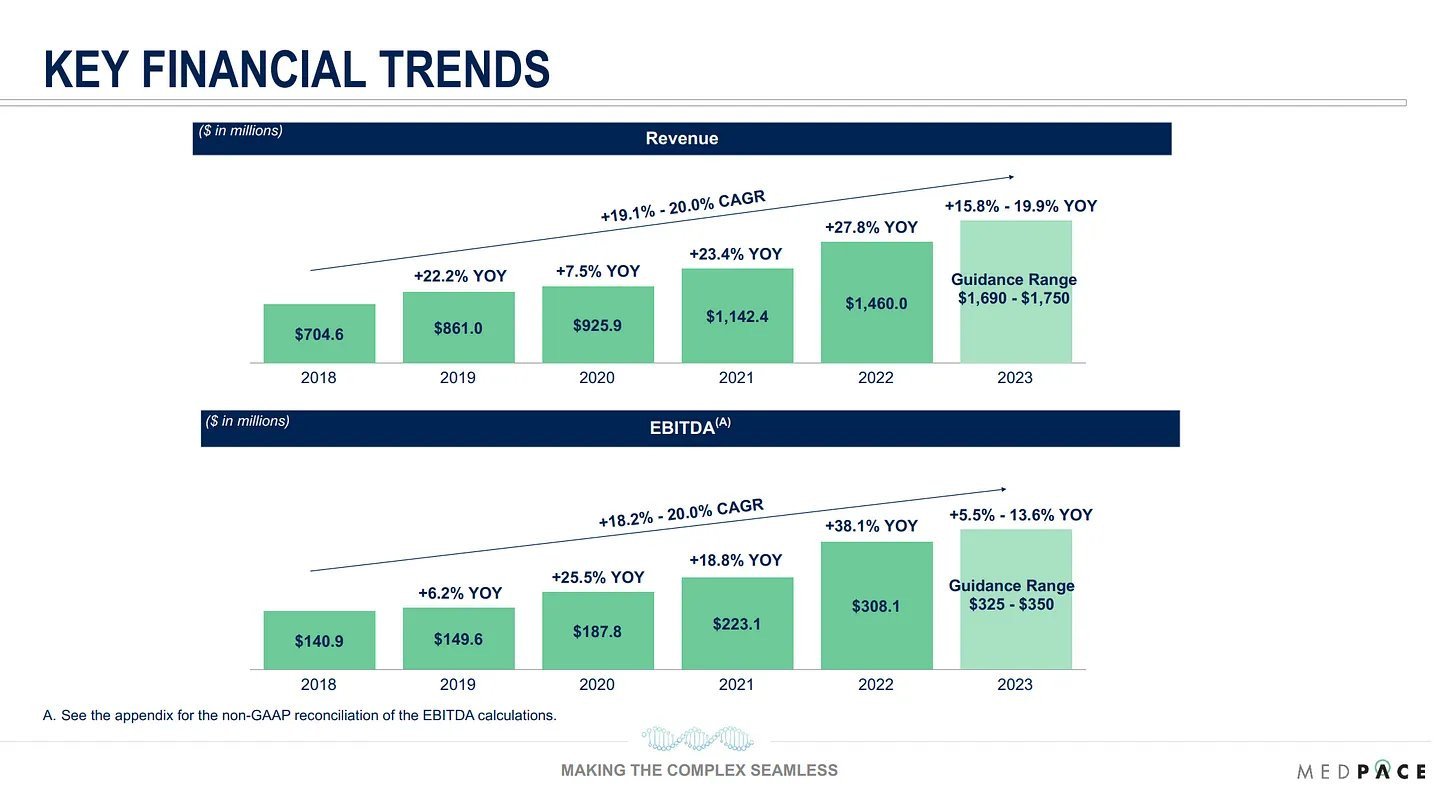

2. Medpace ($MEDP)

Medpace operates as a holding company. The Company provides cardiovascular, hematology, oncology, neurology, pediatrics, nephrology, and diagnostic services. Medpace Holdings serves patients worldwide.

FCF Margin: 24.1%

ROIC: 38.7%

FCF Yield: 4.4%

Exp. FCF Growth (3 yr): 10.8%

CAGR since IPO: 40.6%

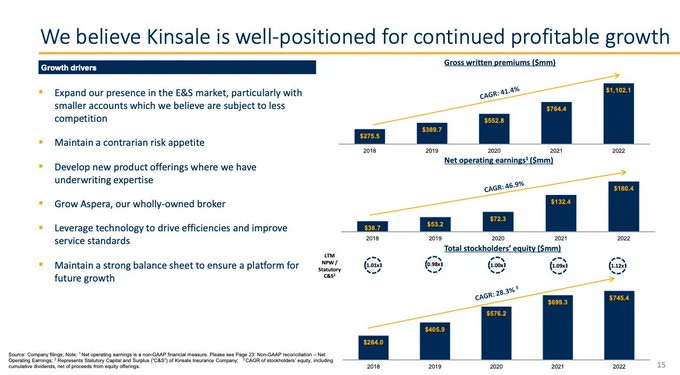

3. Kinsale Capital ($KNSL)

Kinsale Capital Group operates as a specialty insurance company. The Company markets and sells property, casualty, and specialty risk insurance products through a network of independent insurance brokers.

FCF Margin: 67.3%

ROIC: 31.0%

FCF Yield: 7.1%

Exp. FCF Growth (3 yr): 20.2%

CAGR since IPO: 58.2%

4. Watsco (WSO)

Watsco distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies. The Company operates various locations in the United States, with primary markets in the Sunbelt.

FCF Margin: 7.4%

ROIC: 25.5%

FCF Yield: 5.0%

Exp. FCF Growth (3 yr): 0.2%

CAGR since IPO: 19.1%

5. Yougov ($YOU)

YouGov is a research company using online panels to provide research for public policy, market research, and stakeholder consultation. The Company's products include market research, opinion research, stakeholder consultation, and indices.

FCF Margin: 27.3%

ROIC: 20.2%

FCF Yield: 5.4%

Exp. FCF Growth (3 yr): 25.1%

CAGR since IPO: 22.7%

6. Judges Scientific ($JDG)

Judges Scientific is a serial acquirer in niche scientific instruments. The Company's products include instruments that prepare samples for examination in electron microscopes and instruments used to create motion, heating and cooling within ultra-high vacuum chambers.

FCF Margin: 12.2%

ROIC: 15.0%

FCF Yield: 3.6%

Exp. FCF Growth (3 yr): 28.3%

CAGR since IPO: 27.0%

7. Brown & Brown ($BRO)

Brown & Brown provides a range of insurance and reinsurance products and services. The Company also provides risk management, employee benefit administration, and managed health care services.

FCF Margin: 23.2%

ROIC: 9.5%

FCF Yield: 4.6%

Exp. FCF Growth (3 yr): 11.2%

CAGR since IPO: 19.3%

8. Tatton Asset Management ($TAM)

Tatton Asset Management offers a range of services to directly authorized financial advisers in the United Kingdom. The Company provides on-platform portfolio management, regulatory, compliance, and business consulting services.

FCF Margin: 40.1%

ROIC: 38.8%

FCF Yield: 4.6%

Exp. FCF Growth (3 yr): 9.2%

CAGR since IPO: 20.2%

9. Cactus ($WHD)

Cactus Inc. manufactures control equipment. The Company offers wellhead systems, valves, and flow control products. Cactus markets its products worldwide.

FCF Margin: 13.0%

ROIC: 26.6%

FCF Yield: 7.0%

Exp. FCF Growth (3 yr): 18.4%

CAGR since IPO: 17.0%

10. Games Workshop ($GAW.L)

Games Workshop Group manufactures and retails tabletop war-game systems and fantasy miniatures. The Company offers battle game box sets, merchandises, and virtual vouchers. Games Workshop Group serves customers worldwide.

FCF Margin: 25.2%

ROIC: 44.8%

FCF Yield: 3.3%

Exp. FCF Growth (3 yr): 8.1%

CAGR since IPO: 22.0%

11. SS&C ($SSNC)

SS&C Technologies develops and markets computer software for financial services providers. The software enables trading and modeling, portfolio management and reporting, accounting, performance measurement, reconciliation, reporting, processing, and clearing.

FCF Margin: 17.5%

ROIC: 6.0%

FCF Yield: 7.7%

Exp. FCF Growth (3 yr): 16.5%

CAGR since IPO: 17.7%

12. Teqnion ($TEQ)

Teqnion distributes industrial equipment. The Company offers machines, systems, connectors, breaks, clutches, earthing materials, and lighting protection equipment. Teqnion can be seen as a serial acquirer.

FCF Margin: 7.4%

ROIC: 17.6%

FCF Yield: 3.2%

Exp. FCF Growth (3 yr): 15.5%

CAGR since IPO: 67.8%

13. Kainos ($KNOS)

Kainos Group provides information technology services, consulting, and software solutions. The Company specializes in development of digital technology solutions, software design and agile software development, third-party software integration and implementation services, and technology support services.

FCF Margin: 16.2%

ROIC: 31.2%

FCF Yield: 3.8%

Exp. FCF Growth (3 yr): 21.4%

CAGR since IPO: 33.8%

14. Qualys ($QLYS)

Qualys provides information technology security risk and compliance management solutions. The Company offers products for vulnerability management, policy compliance, web application scanning, malware detection, and associated security products.

FCF Margin: 37.5%

ROIC: 27.5%

FCF Yield: 3.9%

Exp. FCF Growth (3 yr): 22.3%

CAGR since IPO: 24.7%

15. Pool Corporation ($POOL)

Pool Corporation distributes swimming pool supplies, equipment, and related products. The Company offers a diverse range of products from construction materials, replacement parts, and fencing to pool care products and spas.

FCF Margin: 7.2%

ROIC: 24.2%

FCF Yield: 5.1%

Exp. FCF Growth (3 yr): 4.1%

CAGR since IPO: 25.4%

Overview

Here’s an overview of all companies mentioned:

More inspiration

Looking for even more inspiration?

In this free course I share more than 100 (!) examples of Quality Companies:

The end

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

Thanks for sharing, what’s are good filters to screen these gems?

#1 is fantastic. Great list btw.