Stocks active in oligopolies (where a few players dominate the entire market) outperform the benchmark.

In this article, you’ll find 20 great undervalued quality stocks which are active in an oligopoly.

Company 1: S&P Global ($SPGI)

S&P Global provides clients with financial information services (credit ratings, benchmarks, and analytics) in the capital and commodity markets.

FCF margin: 42.9%

ROCE: 126.3%

FCF yield: 4.4%

Expected FCF growth (next 3 years): 16.9%

CAGR since IPO: 13.7%

Company 2: ASML ($ASML)

ASML is a monopolistic player in semiconductor chip machines through lithography. Over the next years and decades, demand for semiconductors will explode and ASML will clearly benefit from this.

FCF margin: 53.4%

ROCE: 41.5%

FCF yield: 2.5%

Expected FCF growth (next 3 years): 18.3%

CAGR since IPO: 25.3%

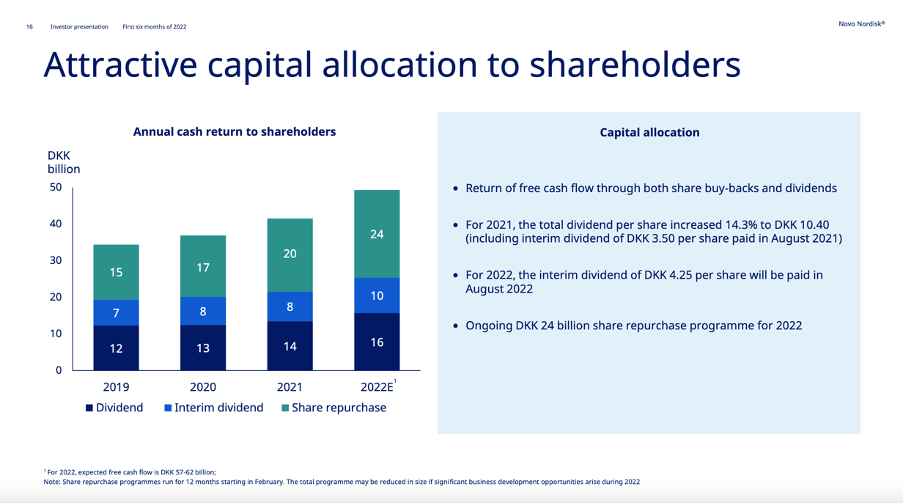

Company 3: Novo Nordisk ($NOVO-B)

Novo Nordisk is a dominant market leader in diabetes care offering. Due to the aging population and obesity, more and more people will suffer from diabetes in the future.

FCF margin: 34.6%

ROCE: 101.9%

FCF yield: 3.2%

Expected FCF growth (next 3 years): 15.6%

CAGR since IPO: 19.9%

Company 4: Mastercard ($MA)

Mastercard provides financial transaction processing services for credit and debit cards. Together with Visa, Mastercard dominates this attractive market.

FCF margin: 48.0%

ROCE: 188.5%

FCF yield: 3.2%

Expected FCF growth (next 3 years): 15.8%

CAGR since IPO: 31.0%

Company 5: Microsoft ($MSFT)

Everyone knows Microsoft and you will probably use it on a daily basis. Microsoft has a very wide moat in software applications, cloud storage, and advanced security solutions.

FCF margin: 32.9%

ROCE: 45.4%

FCF yield: 3.6%

Expected FCF growth (next 3 years): 15.3%

CAGR since IPO: 23.0%

Company 6: Blackrock ($BLK)

Do you own an ETF from iShares? That’s a Blackrock product. BlackRock provides investment management services to institutional clients and retail investors through various investment vehicles.

FCF margin: 23.8%

ROCE: 11.7%

FCF yield: 5.9%

Expected FCF growth (next 3 years): 12.3%

CAGR since IPO: 19.8%

Company 7: Thermo Fisher ($TMO)

Thermo Fisher Scientific manufactures scientific instruments, consumables, and chemicals. The company has a wide moat and operates at attractive margins.

FCF margin: 17.3%

ROCE: 46.1%

FCF yield: 3.3%

Expected FCF growth (next 3 years): 10.1%

CAGR since IPO: 13.5%

Company 8: Automatic Data Processing ($ADP)

Automatic Data Processing is a global provider of business outsourcing solutions. ADP’s services include a wide range of human resource, payroll, tax, and benefits administration solutions.

FCF margin: 17.7%

ROCE: 132.6%

FCF yield 3.3%

Expected FCF growth (next 3 years): 12.5%

CAGR since IPO: 14.9%

Company 9: Zoetis ($ZTS)

Zoetis is active in the market for animal health medicines and vaccines. More and more people are treating their pets as a full family member, and Zoetis fully benefits from this.

FCF margin: 22.3%

ROCE: 32.9%

FCF yield: 2.9%

Expected FCF growth (next 3 years): 10.6%

CAGR since IPO: 20.9%

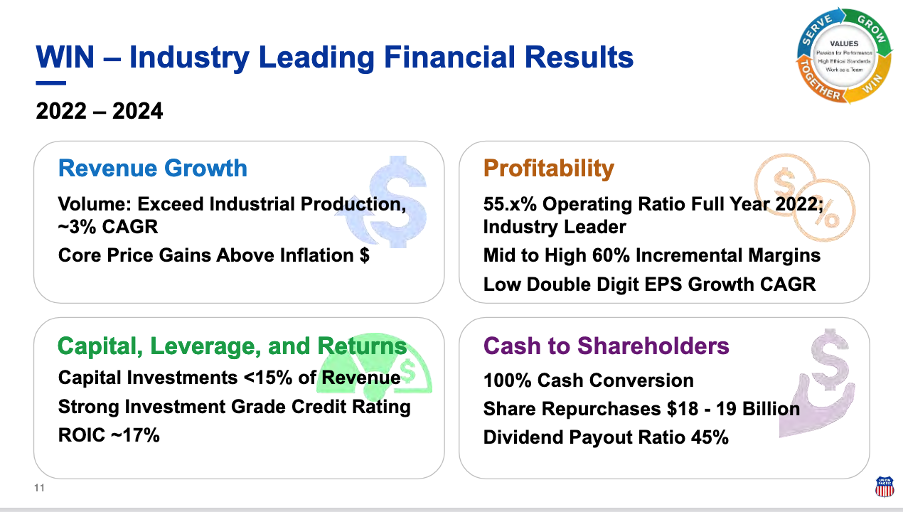

Company 10: Union Pacific ($UNP)

Union Pacific is a rail transportation company. The company is active since 1969 and operates in an oligopoly together with among others BNSF (part of Berkshire Hathaway).

FCF margin: 28.0%

ROCE: 14.2%

FCF yield: 5.1%

Expected FCF growth (next 3 years): 8.5%

CAGR since IPO: 13.3%

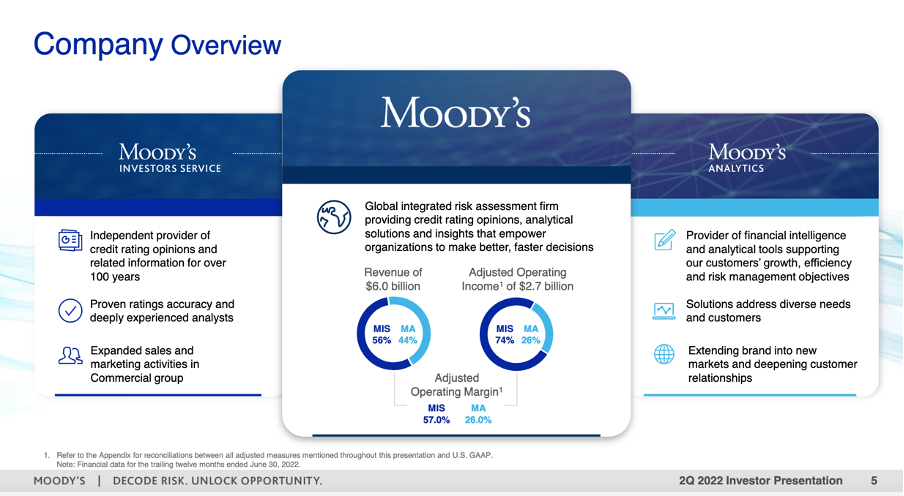

Company 11: Moody’s ($MCO)

Just like S&P Global, Moody’s is a credit rating company. S&P Global, Moody’s and Fitch dominate the credit rating market. They were the market leaders in 1980, and probably will still be in 30 years from now.

FCF margin: 30.0%

ROCE: 72.8%

FCF yield: 3.0%

Expected FCF growth (next 3 years): 10.0%

CAGR since IPO: 14.8%

Company 12: Sonova ($SOON)

Together with Demant, Sonova is a market leader in the market for premium hearing aids. Due to our aging population, more and more people are suffering from hearing problems.

FCF margin: 24.3%

ROCE: 50.7%

FCF yield: 4.4%

Expected FCF growth (next 3 years): 13.3%

CAGR since IPO: 15.5%

Company 13: Visa ($V)

Everyone knows this company. Visa is a great quality business with a wide economic moat and incredible profit margins. The secular trends toward electronic payments gives Visa a lot of tailwinds.

FCF margin: 60.2%

ROCE: 105.3%

FCF yield: 4.5%

Expected FCF growth (next 3 years): 15.5%

CAGR since IPO: 22.3%

Company 14: Danaher ($DHR)

Danaher is a great acquirer active in medical instruments and life sciences. Furthermore, they also provide COVID tests.

FCF margin: 24.0%

ROCE: 60.9%

FCF yield: 4.0%

Expected FCF growth (next 3 years): 9.5%

CAGR since IPO: 19.6%

Company 15: TransUnion ($TRU)

TransUnion operates as a credit reporting agency offering consumer reports, risk scores, analytical services, and decision capabilities. The company is an industry leader in an oligopoly together with Experian and Equifax.

FCF margin: 19.7%

ROCE: 151.7%

FCF yield: 4.1%

Expected FCF growth (next 3 years): 25.9%

CAGR since IPO: 15.1%

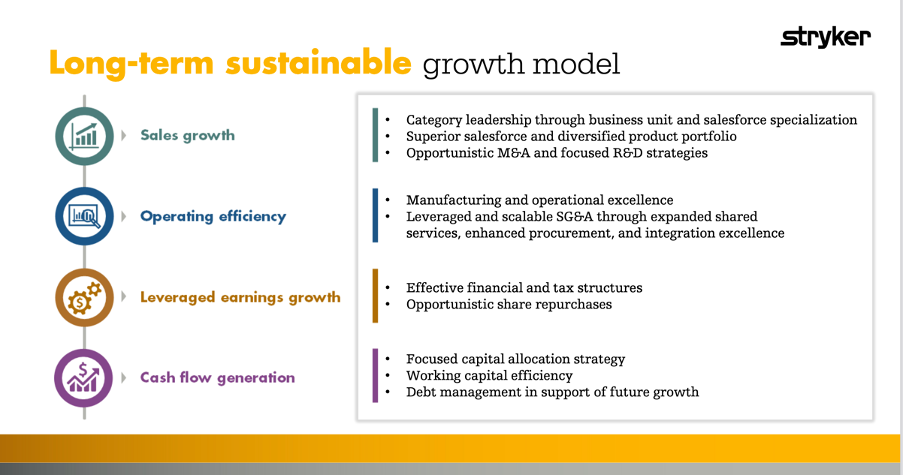

Company 16: Stryker ($SYK)

Stryker is active in the market for specialty surgical and medical products. They sell implants, surgical navigation, and so on. Hospitals are very loyal clients giving Stryker a strong competitive advantage.

FCF margin: 16.0%

ROCE: 9.1%

FCF yield: 3.0%

Expected FCF growth (next 3 years): 12.8%

CAGR since IPO: 17.9%

Company 17: IDEXX ($IDXX)

Together with Zoetis, IDEXX dominates the American market for animal health medicines and vaccines. This results in very high margins and an attractive growth outlook.

FCF margin: 19.8%

ROCE: 86.5%

FCF yield: 2.0%

Expected FCF growth (next 3 years): 13.0%

CAGR since IPO: 20.7%

Company 18: Rightmove ($RMV)

Rightmove is the clear number 1 in the market for selling listed properties in the United Kingdom. Rightmove also publishes the House Price Index in Great Britain.

FCF margin: 63.7%

ROCE: 287.4%

FCF yield: 5,12%

Expected FCF growth (next 3 years): 7.4%

CAGR since IPO: 19.1%

Company 19: Adobe ($ADBE)

Adobe is a true compounding stock active in computer software products and technologies. Adobe’s products allow users to express and use information across all print and electronic media.

FCF margin: 43.6%

ROCE: 125.2%

FCF yield: 5.1%

Expected FCF growth (next 3 years): 20.0%

CAGR since IPO: 17.6%

Company 20: Copart ($CPRT)

Copart provides vehicle suppliers, primarily insurance companies, with a variety of services to process and sell salvage vehicles through auctions. Copart dominates the market for online auctions.

FCF margin: 24.0%

ROCE: 27.4%

FCF yield: 3.2%

Expected FCF growth (next 3 years): 8.2%

CAGR since IPO: 20.0%

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Quality will always prevail in the end. Thank you for your interesting insights.

Here is my current list of stocks:

01 Taiwan Semiconductor

02 Microsoft

03 Copart

04 Accenture

05 Partners Group Holding

06 ASML

07 Games Workshop

08 InMode

09 Amphenol

10 Edwards Lifesciences

11 Laboratorios Farmaceuticos Rovi

12 Lululemon Athletica

13 Robert Half International

14 Alphabet

Best wishes

My personal top 10 selection:

1. Microsoft

2. Alphabet

3. Salesforce

4. Nvidia

5. Qualys

6. Johnson & Johnson

7. The Trade Desk

8. Perion

9. Fortinet

10. Procter & Gamble