In 1994, Jeremy Siegel, professor of Finance at the Wharton School of the University of Pennsylvania, published his excellent book Stocks for the Long Run. As quality investors, we can a learn a lot from Siegel’s insights.

Grab a cup of coffee and become a better investor by these 25 investment tips.

‘I know of no way of judging the future but by the past.” – Patrick Henry (1775)

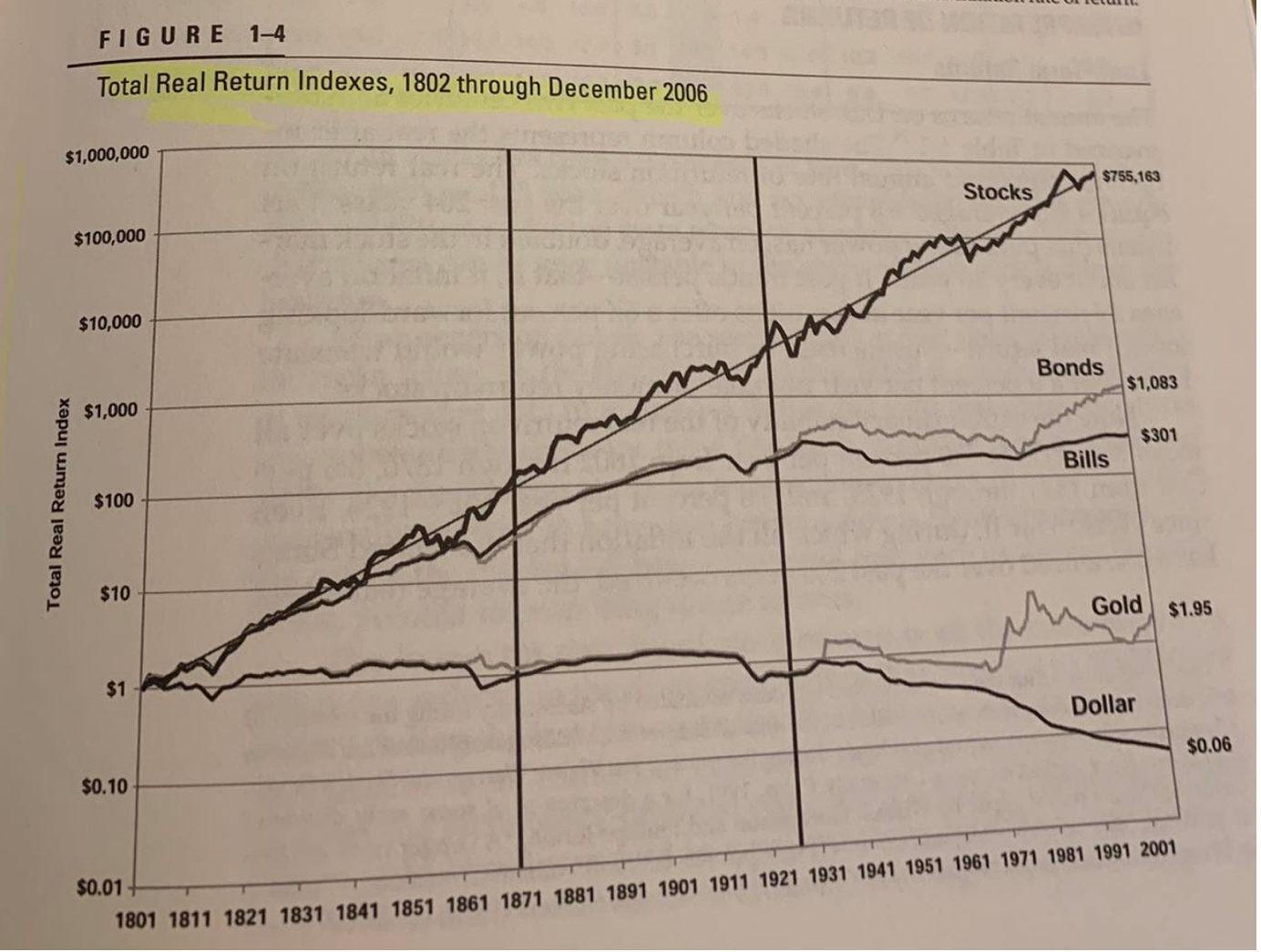

Lesson 1: Invest for the long term. In the short run, stock returns can be very volatile, but they are very robust in the long run. Over time, stocks always perform better than bonds. One dollar invested and reinvested in stocks since 1802 would have accumulated to over $12.7 million (!) by the end of 2006.

Lesson 2: On average, you double your money in the stock market every 10 years. The real return on equities (after inflation) has averaged 6.8% per year over the past 204 years. This means that purchasing power has, on average, doubled about every 10 years when you invest in equities. When you would invest in bonds, it would on average take 32 years to double your money.

Lesson 3: In the long run, stocks are less risky than bonds. For 20-year holding periods, stock returns have never fallen below inflation, while returns for bonds and bills once fell as much as 3% per year below the inflation rate for two decades. When you invest for at least 10 years, stocks have, on average, more than 80% chance to outperform bonds.

Lesson 4: Don’t try to time the market. As difficult it is to sell when stock prices are high and everyone is optimistic, it is even more difficult to buy at market bottoms when pessimism is widespread and few have the confidence to venture back into stocks.

Lesson 5: Our world continuously changes. As a quality investor, disruption is one of your worst enemies. Avoid companies who are highly exposed to rapid changing industry dynamics.

“When the Dow Jones Averages launched in 1885, 10 of the 12 stocks within the index were railroad stocks. The 10 largest companies measured by market cap continuously change over the years.” – Jeremy Siegel

Lesson 6: This time it’s not different. “The bull and bear markets of the last decade were no different from the bull and bear markets that preceded them. As stocks rose, the bulls came out of the woodwork, and at the top they fabricated theories that would support even higher prices. In the subsequent down markets, the bears would pounce with justifications for even lower prices.” – Jeremy Siegel

“Most of the change we think we see in life is due to truths being in and out of favor.” – Robert Frost (1914)

Lesson 7: Let your winners run. As an investor, you should let your winners run.

Philip Morris is a great example according to Jeremy Siegel:

”From the end of 1925 through the end of 2006, Philip Morris delivered a 17.2% compound annual return, 7.4% greater than market indices. If you had invested $1.000 in the firm in 1925, it would be worth almost $380 million in 2007.” – Jeremy Siegel

Lesson 8: Low stock prices are great for investors. If investors become overly pessimistic about the prospects of a stock, the low price enables stockholders who reinvest their dividends to buy the company on the cheap. Bear markets and corrections are great opportunities for long term investors.

Lesson 9: Invest in companies that translate most earnings into free cash flow. Earnings are an opinion, cash is a fact. Academical research found that companies that translate most earnings into free cash flow perform significantly better on the stock market.

“Sloan found that from 1962 through 2001, the difference between the firms with the highest quality earnings (lowest accruals) and those with the poorest quality earnings (highest accruals) was a staggering 18% per year. Accruals can be defined as the difference between earnings and free cash flow.” – Jeremy Siegel

Lesson 10: The fundamental determinant of stock values remains the earnings of a corporation. Between 1946 and 2006, real earnings growth (after inflation) has been equal to 3.4%. The return of you as an investor is equal to the earnings growth plus shareholder yield (dividends and buyback yield) +/- multiple expansion / contraction.

Lesson 11: Look at the equity premium. Over the past 200 years, the equity premium (the spread between the return of stocks and return of government bonds) has averaged between 3% and 3.5%.

Lesson 12: In general, small cap stocks outperform. Smaller stocks generate a higher return on the stock market. Between 1926 and 2006, the smallest decile stocks compounded at a CAGR of 14.0% compared to 10.3% for the S&P500.

Lesson 13: Cheaper stocks outperform the market. Based on the price-earnings ratio, the 20% cheapest stocks outperformed the S&P500 by 3.2% between 1957 and 2006.

Lesson 14: Do not invest in IPOs. From 1968 through 2000, a buy-and-hold strategy on IPOs underperformed the index in 29 out of 33 years that were studied.

“IPO: It’s Probably Overpriced.”

Lesson 15: Investors can outperform by using factors. There are many strategies that can be used to outperform the market (low volatility, value, quality, …). It is important to note that you should stick to your plan as no strategy outperforms all the time.

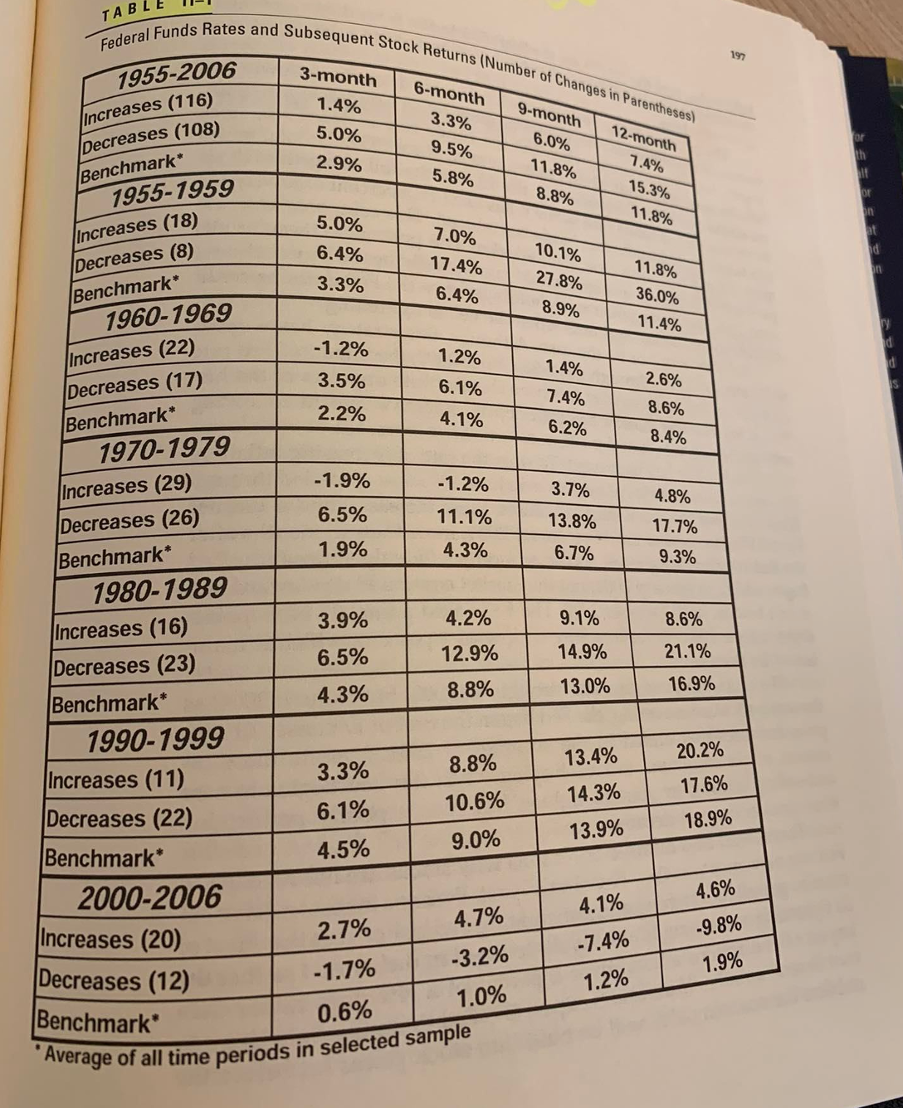

Lesson 16: In the long run, stocks are a great hedge against inflation. However, they are not in the short term. In general, the stock market performs better during interest decreases compared to interest increases. In the long run, stocks are extremely good hedges against inflation while bonds are not:

Lesson 17: The stock market is a leading indicator for the economy. On average, the lead time between what happens on the stock market and what happens in our economy is equal to 6 months.

Lesson 18: Don’t use macro-economic factors to make investment decisions.

“The worst course an investor can take is to follow the prevailing sentiment about economic activity. The reason is that it will lead the investor to buy at high prices when times are good, and everyone is optimistic and sell at the low when the recessions near its trough and pessimism prevails.” – Jeremy Siegel

Lesson 19: The short term is highly uncertain. Less than 25% of all major market movements can be linked to a news event of major political or economic importance. This confirms the unpredictability of the market and the difficulty in forecasting moves in the short term.

Lesson 20: On average, the stock market fluctuates with more than 1% one day per week.

“The percentage of trading days when the Dow Industrials changed by more than 1% has averaged 23% between 1834 and 2006, or about once per week. “ – Jeremy Siegel

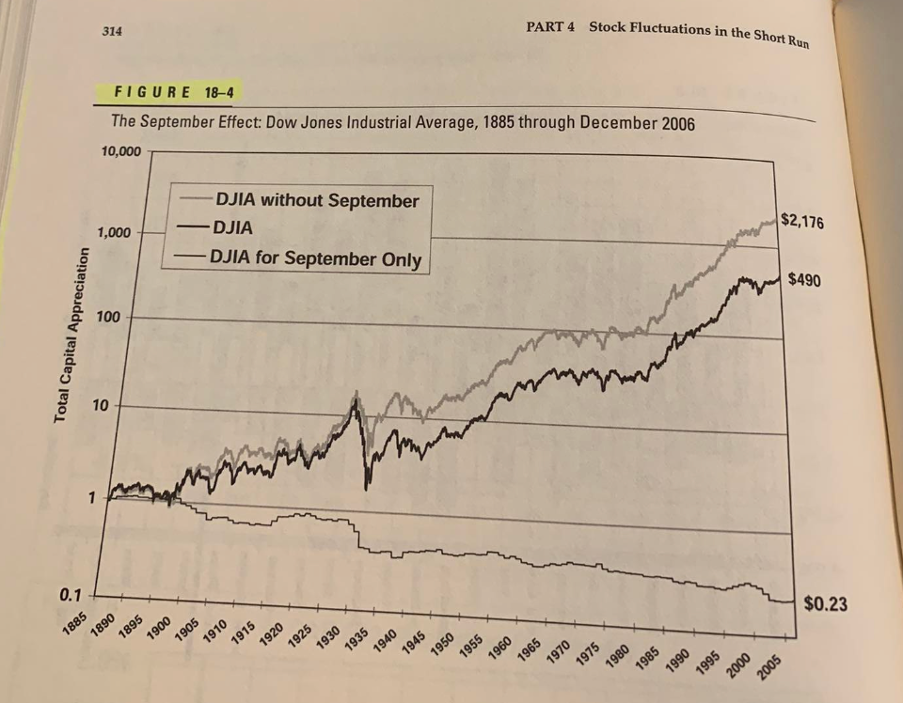

Lesson 21: Over the past 2 decades, September has been the worst month on the stock market by far.

“September is by far the worst month of the year, and in the US, it is the only month to have a negative return including reinvested dividends. September is followed closely by October, which has a disproportionate percentage of crashes (e.g., the crash of 1989). “ – Jeremy Siegel

Lesson 22: Investing between Christmas and New Year is usually a great idea. Over the past 120 years, daily price returns between Christmas and New Year have averaged 10 times the average return of normal periods.

Lesson 23: If you want to invest periodically, the best moment to do this is in the middle of the month. The reason for this is that at the beginning and end of each month, a lot of institutional investors are receiving inflows which they invest, resulting in higher stock prices.

Lesson 24: Be fearful when others are greedy and greedy when others are fearful.

“The rational man – like the Loch Ness monster – is sighted often,but photographed rarely.” – David Dreman (1998)

“The market is most dangerous when it looks best. It is most inviting when it looks worst.” – Frank Williams (1930)

In the table below you can see that the lower the investor sentiment, the better moment to invest in general:

Lesson 25: Establish firm rules to keep your portfolio on track, especially if you find yourself giving in to the emotion of the moment.

“The temptation to buy when everyone is bullish and sell when everyone is bearish are hard to resist. Most investors who trade too often have poor returns. The best investors are very disciplined.” – Jeremy Siegel

That’s it. To end up with a beautiful quote of Jeremy Siegel:

“In the long run, stocks are the best way to accumulate wealth.”

It's time for another trip through the Archives! 🙂

"Stocks for the Long Run" was the third or fourth book on investing I read. I was a total newbie when I read this book. The lessons didn't resonate with me right away. I had to see markets in action for a couple of months and then I would have moments like, "Oh, that's what he meant!. 😄 Prof. Siegel braced me for volatility and corrections, like what we saw in 2022. 📉 He also challenged my perception of the mechanics of investing. I always had this idea that I would be drilling on my keyboard and spinning my mouse in 100 km arcs trying to bend the second by second fluctuations in index and price movements to my favor. The market of stocks we call "the stock market" is ~waay~ bigger than any one single person. 👍 You're here for the ride and Prof. Siegel is here to tell you what the ride is all about. 🎢

Amazing work :)