💎 3 Portfolios to Grow Rich

Which Portfolio Fits You?

Investing is one of the most wonderful things in the world.

But there’s not just one ‘right’ way to do it. Multiple roads lead to heaven.

Today, I’m sharing three different types of investment portfolios with you.

Loyal readers know there are three main investment strategies you can use:

Living Rich: Great companies that are paying an attractive dividend

Staying Rich: Established quality stocks that are still growing attractively

Getting Rich: Small quality companies that are growing very quickly

Let’s dive into each strategy and share a Portfolio of 25 companies for each one.

1. Living Rich (Compounding Dividends)

Compounding Dividends focuses on growing your wealth while receiving an attractive dividend so you can retire comfortably.

The goal is to build a Dividend Growth Portfolio that generates more dividend income than your monthly expenses.

Compounding Dividends is all about ‘Living Rich’.

How to find Living Rich stocks?

We use these criteria:

💸 Dividend yield > 2%

💰 Payout ratio < 80%

📈 Dividend growth > 10% per year (last 5 years)

📊 Profit margin > 5%

🏆 ROIC > 10%

⚖️ Net Debt / Free Cash Flow < 4x

Let’s highlight two companies that match these criteria.

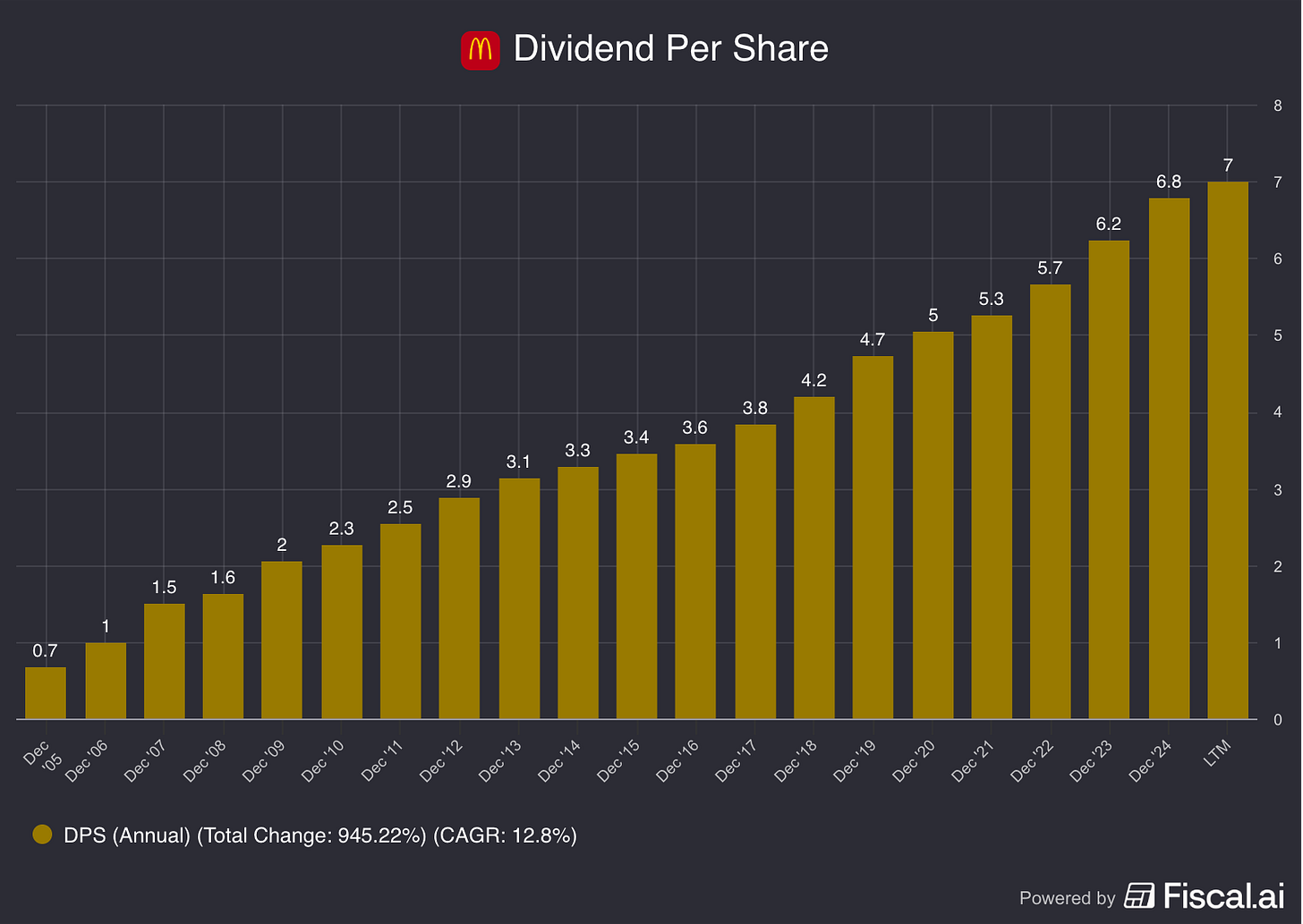

🍔 McDonald’s ($MCD)

Let’s start with McDonald’s.

You already know the brand. It has over 43,000 restaurants in 115 countries.

About 60% of its money is generated via franchising.

It means other people run the restaurants, and McDonald’s earns a fee.

It’s a simple and very profitable model that gives McDonald’s steady income, high margins, and low costs.

McDonald’s has three big advantages:

A world-class brand

Huge economies of scale

Strong focus on efficiency

McDonald’s is also investing a lot in digital tools.

Today, 40% of its sales come from digital channels, and its loyalty program already has 175 million members (!).

McDonald’s has raised its dividend every single year since 1976.

Right now, the dividend is about $7 per year, which is a 2.2% yield at today’s price.

We expect McDonald’s to keep growing its dividend for many years to come.

🏪 Realty Income ($O)

Another great example is Realty Income.

They call themselves “The Monthly Dividend Company”, and for a good reason.

Realty Income is one of the largest real estate investment trusts (REITs) in the US, owning more than 15,600 properties.

Most of these buildings are rented to big, stable tenants like supermarkets, pharmacies, and fast-food chains.

What makes Realty Income special is its triple-net lease model.

In this model, the tenants pays:

Property taxes 🏦

Insurance 💼

Maintenance costs 🔧

So Realty Income collects rent without a lot of extra costs.

This makes their income steady and low-risk.

Realty Income has paid a monthly dividend for over 50 years.

And just like McDonald’s, they have increased it every single year.

That almost never happens in real estate.

Today, the Dividend Per Share equals $3.20 per share. This means the Dividend Yield equals 5.3%.

Living Rich Portfolio

I created a Living Rich Portfolio with 25 stocks that might be interesting to look into.

You can find them here:

* Please note that this is a sample Portfolio. It consists of stocks worth taking a look at. The one I’m the most excited about? The ones in the Portfolio of Compounding Dividends, of course. Partners of Compounding Dividends can find The Official Portfolio here.

2. Staying Rich

Staying Rich stocks are established Quality Stocks that are still growing attractively.

This is what Compounding Quality is all about.

Some examples? Visa and Mastercard. They continue to beat the market while delivering very consistent results.

How to screen for Staying Rich stocks?

We use these criteria:

📈 Revenue growth > 5% per year

💰 Profit growth > 7% per year

💵 Free cash flow / Net Income > 80%

🏆 ROIC > 15%

⚖️ Net Debt / Free Cash Flow < 4x

📊 Debt / Equity < 80%

Let’s highlight two companies that match these criteria.

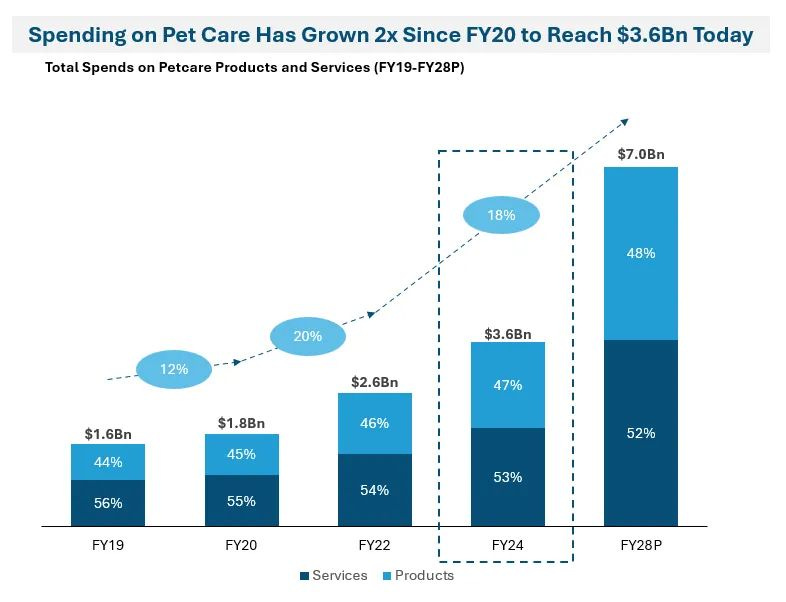

🐾 Zoetis ($ZTS)

Zoetis is a global leader in animal health.

They make medicines, vaccines, and diagnostics for both pets and livestock.

Today, about 65% of their revenue comes from companion animals like dogs and cats.

That number keeps growing. Why?

People are treating their pets like full family members nowadays.

They want the best care for them, and they’re willing to pay for it.

Zoetis was once part of Pfizer.

Now, it’s a standalone company with a huge competitive advantage:

✅ Over 5,800 patents.

✅ Trusted by vets around the world.

✅ A strong brand that allows premium pricing

Curious to find out more? You can download a Deep Dive about the company here*.

💳 Visa ($V)

Another perfect example of a Staying Rich stock? Visa.

You probably use their services every day, without even thinking about it.

Visa is the largest payment processor on the planet.

They operate in over 200 countries and handle nearly $16 trillion (!) in annual transactions.

Every single year, Visa processes more payments.

Every time someone swipes a Visa card, they earn a small fee.

Think of it as a toll bridge for global payments.

Visa’s real strength lies in its network effect.

The more people use Visa, the stronger the network becomes.

Together with Mastercard, Visa completely dominates this space.

In most regions, they hold more than 50% market share.

You can read a Not So Deep Dive about Visa here.

Staying Rich Portfolio

I created a Staying Rich Portfolio with 25 stocks that might be interesting to look into.

You can find them here:

* Please note that this is a sample Portfolio. It consists of stocks worth taking a look at. The one I’m the most excited about? The ones in the Portfolio of Compounding Quality, of course. Partners of Compounding Quality can find the Official Portfolio here.

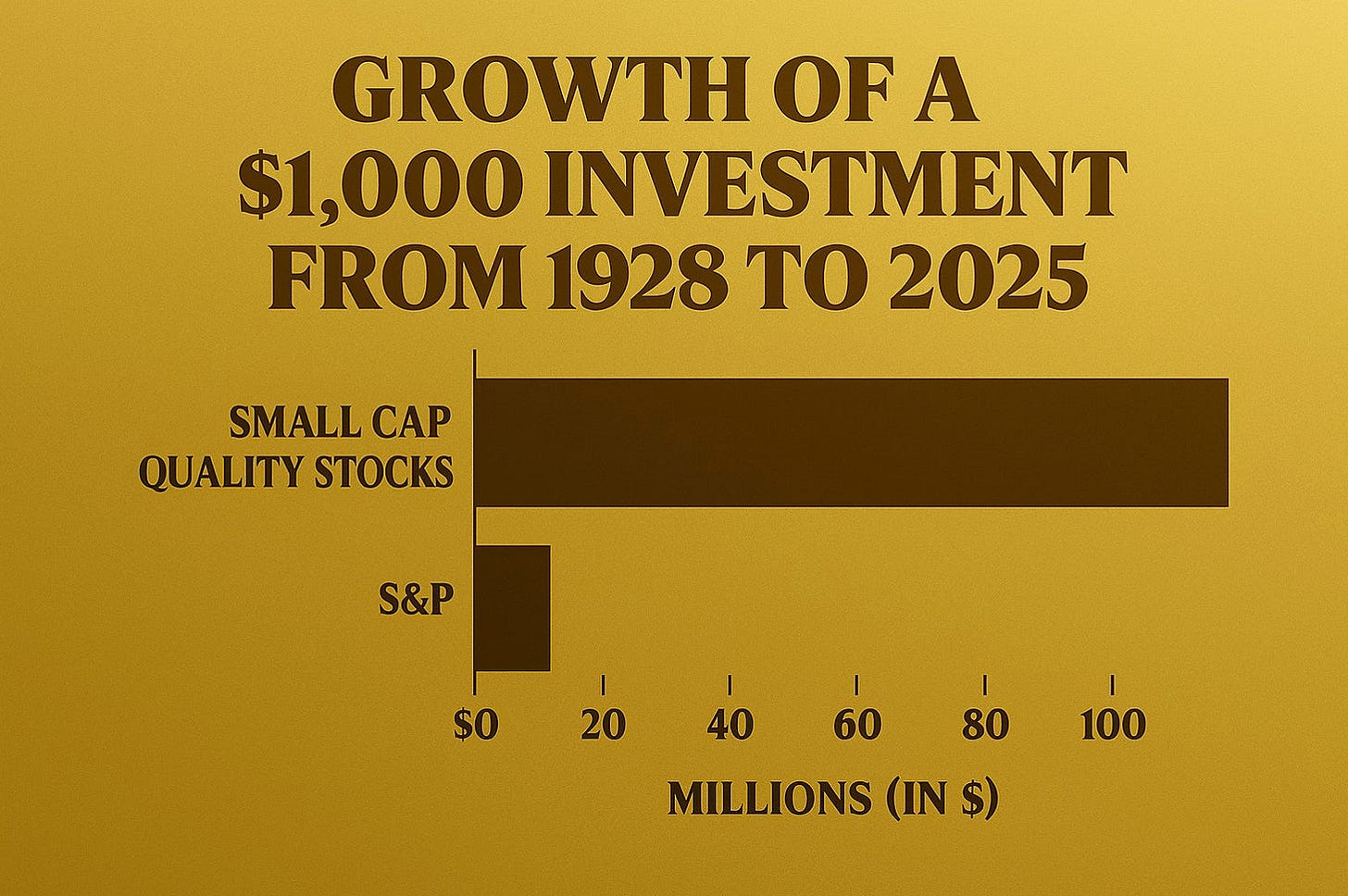

3. Getting Rich

Tiny Titans uses the same philosophy as Compounding Quality, but applies this strategy to smaller companies.

The upside potential of this strategy is higher, but there are also more risks involved. The goal is to find a few stocks that can 10x in the future.

Tiny Titans is all about ‘Getting Rich’.

This is the strategy that delivers the highest return in the long term:

How to screen for Getting Rich stocks?

We use these criteria:

📈 Revenue growth > 9% per year

💰 Profit growth > 12% per year

💵 Earnings Quality (Free Cash Flow / Net Income) > 80%

📊 Net Profit Margin > 10%

🏆 ROIC > 15%

⚖️ Net Debt / Free Cash Flow < 4x

These numbers help us find high-quality companies with a lot of growth potential.

Two examples of Tiny Titans?

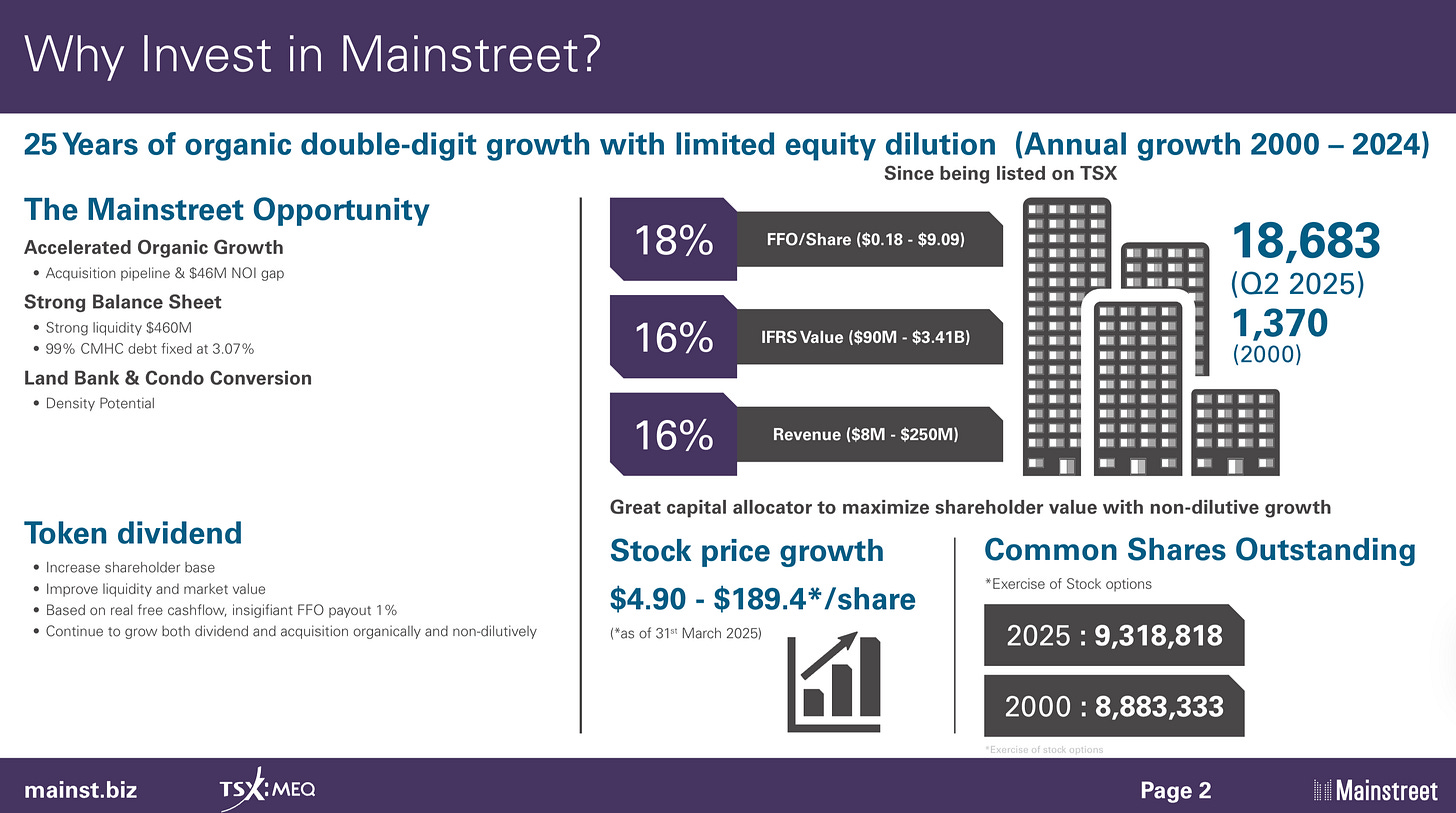

🏢 Mainstreet Equity (TSX: MEQ)

Mainstreet Equity is a Canadian real estate company focused on mid-market apartment buildings.

The company has spent decades acquiring underperforming rental properties, renovating them, and raising their value.

The company targets affordable housing in growing cities across Western Canada, where demand for rental units continues to rise.

Their strategy is simple but powerful: buy undervalued assets, improve them efficiently, and hold for the long term.

This model works really well, and it’s repeatable.

Bob Dhillon, the founder and CEO, still leads the company. He’s been at it for years, and knows exactly what he’s doing.

Here’s Mainstreet in a nutshell:

⚙️ TerraVest Industries (TSX: TVK)

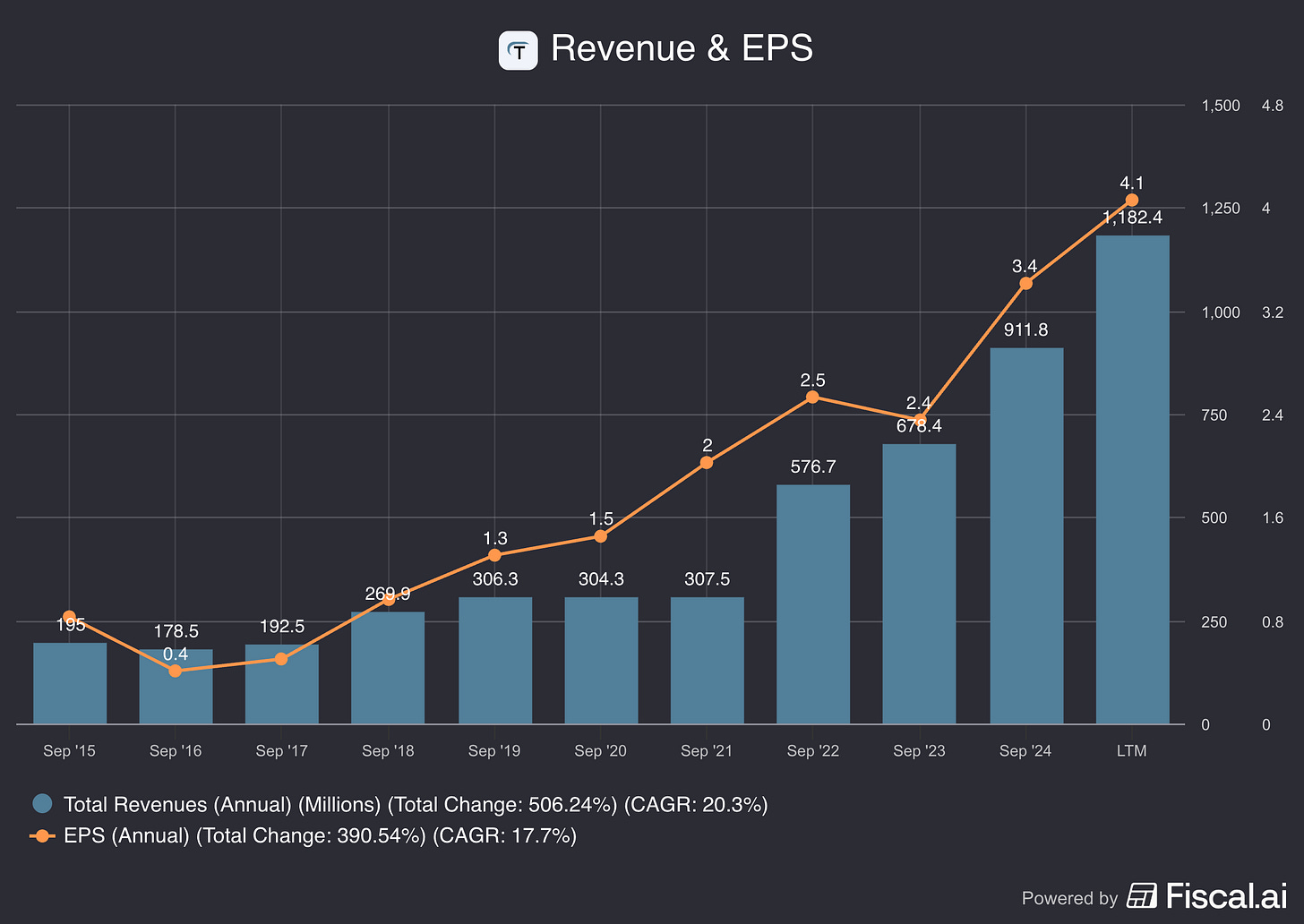

TerraVest is a Canadian industrial company built on steady, profitable growth.

They make pressure vessels, fuel tanks, and equipment for energy, agriculture, and transport.

The company focuses on niche markets that big players often ignore, and dominates them.

Led by Dustin Haw, TerraVest grows through smart acquisitions and strong execution.

Since 2014, revenue has compounded at 20.3% per year. That’s exactly what you want to see.

It’s a true Tiny Titan: simple business, smart capital allocation, and consistent growth.

Getting Rich Portfolio

I created a Getting Rich Portfolio with 25 stocks that might be interesting to look into.

You can find them here: