9 Investing truths to remember

Investing paradoxes

The world of investing is full of contradictions.

What seems smart is often wrong, and what feels risky might be your safest bet.

In this article you’ll find 9 investing truths to remember.

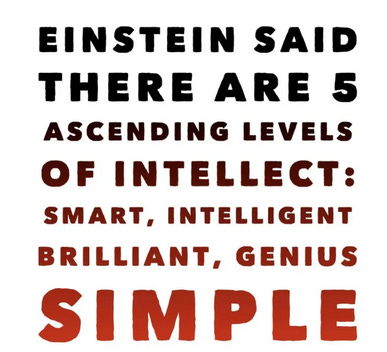

"Successful investing is having everyone agree with you... later." - Jim Grant1. The IQ paradox

The smarter you are, the easier it is for you to make complex decisions.

As a result, the better your investment returns.

It sounds obvious, but it’s often wrong in reality.

Some of the worst mistakes are made by very smart people.

And those wonderful, complicated Excel sheets? Most of them should be in the trash bin.

As an investor, complexity is your enemy, not your edge.

One of Peter Lynch’s golden rules was to explain his investment ideas to a fourteen-year-old.

This forces you to keep things simple.

The smartest people on Earth, like Warren Buffett and Charlie Munger, seek simplicity:

"Warren and I have three baskets for investment ideas: “yes”, “no” and “too hard to understand.” - Charlie MungerFun fact: The Oracle of Omaha has a ‘too hard box’ on his desk:

If someone as smart as Buffett has a ‘too hard box’ to keep things simple, you should too.

Simplicity is the main reason why amateurs can outperform professionals in the stock market.

Paradoxically, a high IQ can sometimes cause a low IQ move.

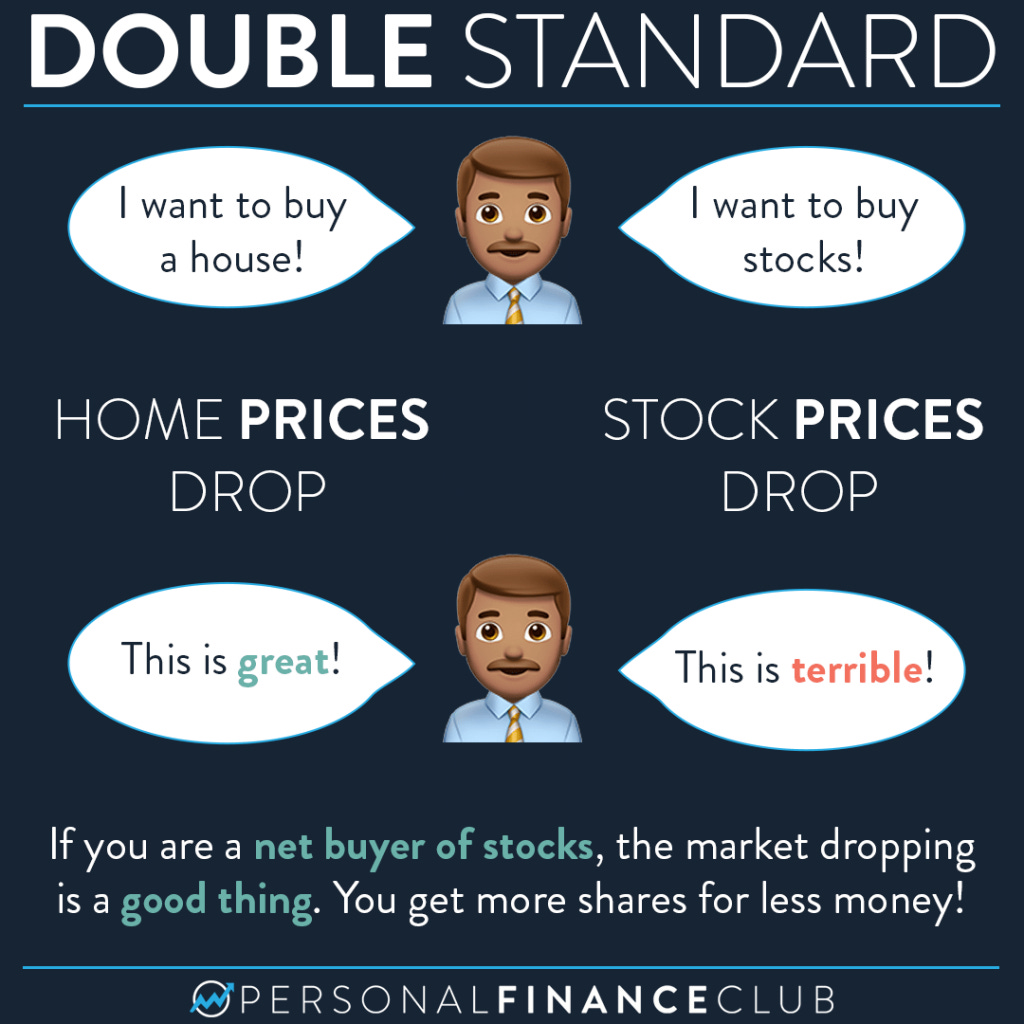

"I want the guy with an IQ of 130 who thinks it's 120, not the guy with 150 who thinks it's 170." - Charlie Munger2. The discount paradox

Do you know how shopkeepers get women into the city? Large discounts.

Women love to buy beautiful clothes at cheaper prices.

You should think the same about stocks. Declining prices are a good thing for you as a long-term investor.

It sounds so logical: when prices go down, it becomes attractive to buy more.

When stock prices decline heavily, people panic. They think it’s game over.

But in the long term, stocks always go up.

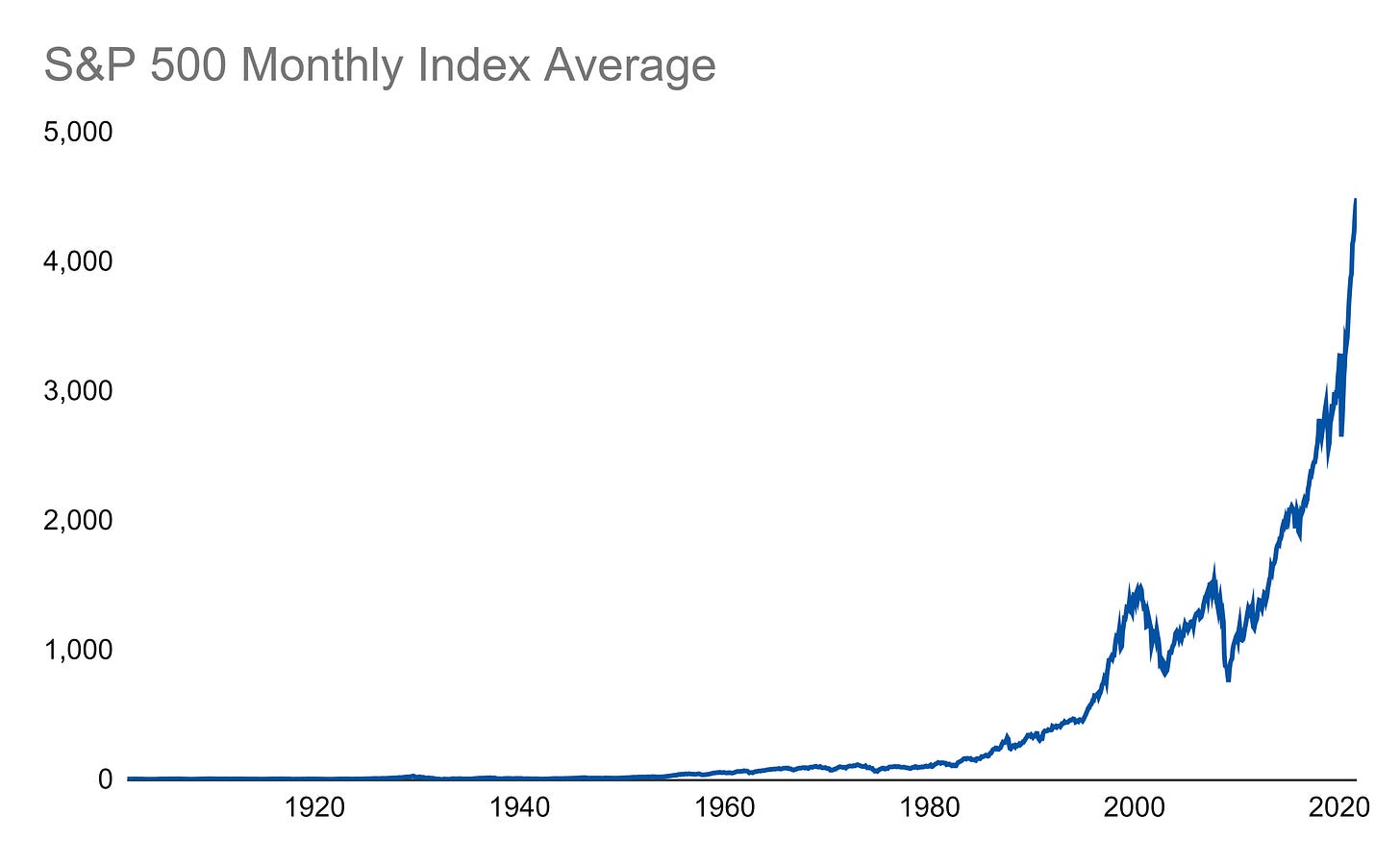

You don’t believe me? Let’s play a game.

Below is the chart of the S&P 500.

You need to put the following events on the chart:

World War I

The Great Depression

World War II

The Oil Crisis

Black Monday

(Hint: these events were extremely painful, so look for large price drops.)

Did you notice it? You can’t even see a drop during World War I.

The same is true for the Great Depression, World War II, and all the other big crises mentioned.

In the long run, the market makes you money, especially if you buy at large discounts during crises.

But strangely enough, the stock market is the only place where people buy less at cheap prices.

3. The herd paradox

Ask 1,000 physicists what the boiling point of water is.

If they all say it’s 212 °F (100°C), you can be confident that’s the correct answer.

Now ask 1,000 investors if a stock is a good buy.

If they all say ‘yes’, it’s probably not a good investment.

Following the herd is a very costly strategy in the stock market.

But don’t take my word for it. Just look at what the best in the game have said.

Warren Buffett has a famous saying on this topic:

Or in Charlie Munger’s words:

“The wise man looks for what he can learn from the herd, and the first thing he learns is to avoid following the herd."Napoleon even won wars by not following the herd blindly:

4. The winning paradox

Looking for great investments is what investors do all day.

Some are looking to find potential 100-baggers.

Others want to buy heavily undervalued stocks.

And I am looking for wonderful companies at a fair price.

Everyone is trying to figure out which stocks they should buy.

But let’s invert it.

An even more important question to ask yourself is what you don’t want in your portfolio.

Nobody wants big losers.

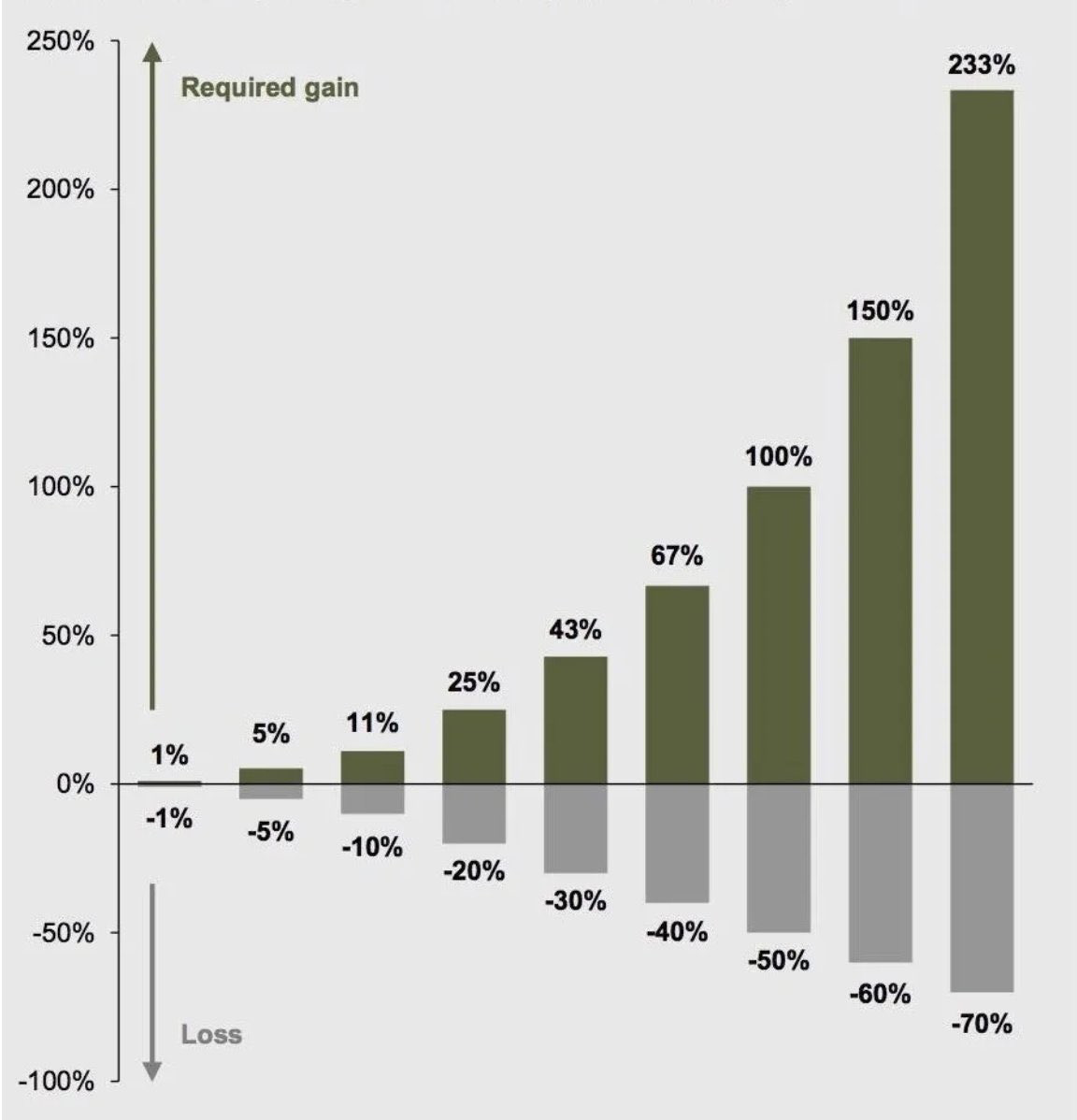

"Over the long term, avoiding big mistakes is more important than finding big winners.” - Joel GreenblattIf you lose 50% of your investment, you need to double your money to break even.

It sounds counterintuitive, but avoiding losers is one of the best ways to win in investing.

Or in Warren’s words:

5. The CEO paradox

How you think the best CEOs on Earth look like:

What they actually look like:

Here’s what David Glass, a former Walmart CEO, wrote:

"Does Sam have money? I've been traveling with him for thirty years, and you could never tell it by me. If I didn't read the proxy statement every year, I'd swear he was broke."But who is this Sam he is talking about? Sam Walton. The founder of Walmart who started it from scratch.

At one point, he was the richest man in America. But you’d never know it.

He drove an old pickup, wore simple clothes, and flew economy class.

Great CEOs don’t always look like great CEOs.

They don’t try to impress, they execute.

“Why do I drive a pickup truck? What am I supposed to haul my dogs around in, a Rolls Royce?" - Sam Walton6. The certainty paradox

Howard Marks once said the following:

"A gambler bet everything on a race with only one horse. Confident he'd win, he watched as the race began. Halfway through, the horse jumped the fence."The paradox here? The only certainty is that there’s no certainty.

In investing, there’s no such thing as a sure thing.

Sometimes you become so confident in your next investment idea, it almost feels like you're guaranteed to make a lot of money.

If you ever feel that way, remember this: every time you’re buying shares, someone else is selling them.

There is no such thing as a free lunch on the stock market.

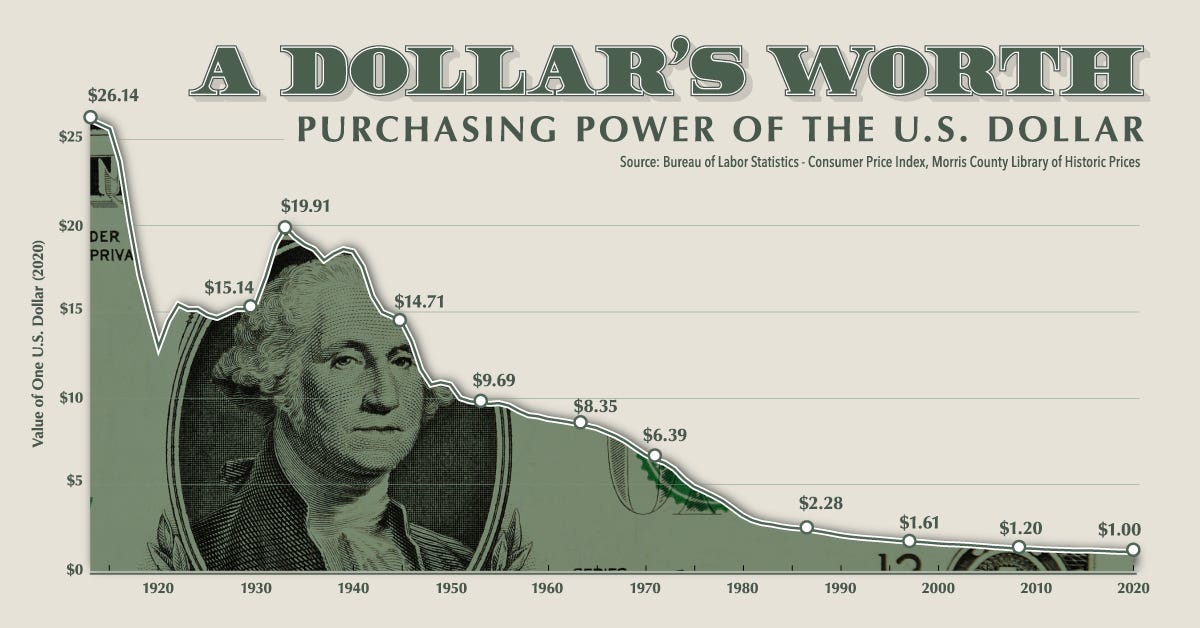

7. The risk paradox

Every investor has heard it countless times: diversify to avoid risk.

But there’s a point where diversification turns into diworsification. Buying too many stocks doesn’t reduce risk, it just dilutes your returns.

As Warren Buffett said:

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.”True investing isn’t about avoiding risk entirely, it’s about managing it wisely.

Ironically, avoiding all risk is one of the riskiest things you can do.

And here's what’s even more counterintuitive: not investing at all is incredibly risky.

Just look at how the value of your money erodes over time:

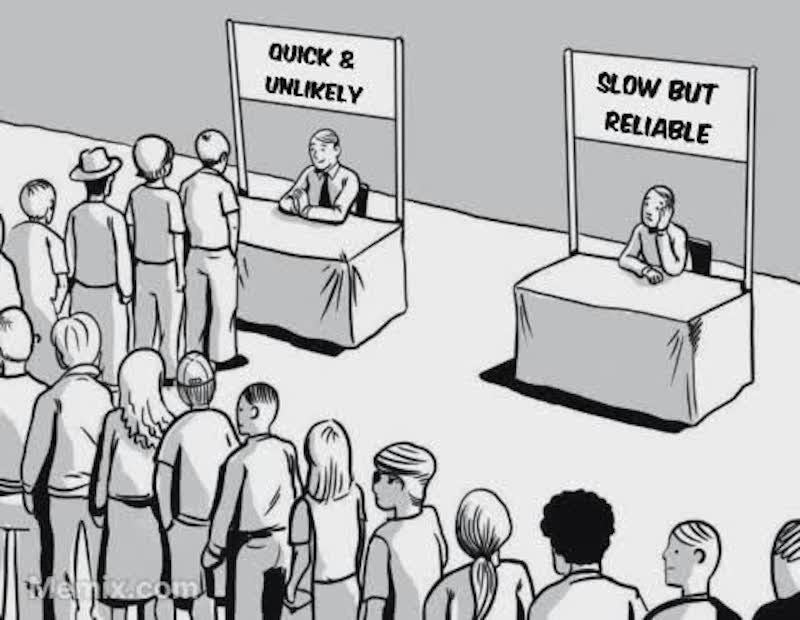

8. The speed paradox

In the U.S. military, there's a saying:

“Slow is smooth, smooth is fast.”It means that by slowing down, you gain control. With control comes precision. And with precision, you move faster by avoiding mistakes.

In other words, slowing down allows you to go faster.

The same principle applies to investing.

Morgan Housel puts it this way:

"The quickest way to get rich is to go slow" - Morgan HouselThat’s exactly what Buffett said to Jeff Bezos:

Jeff Bezos: “Warren, you are the second richest man in the world, and yet you have the simplest investment thesis. How come others didn’t follow you?”

Warren Buffett: “Because no one wants to get rich slowly.”

Want to get rich fast? Go slow!

9. The activity paradox

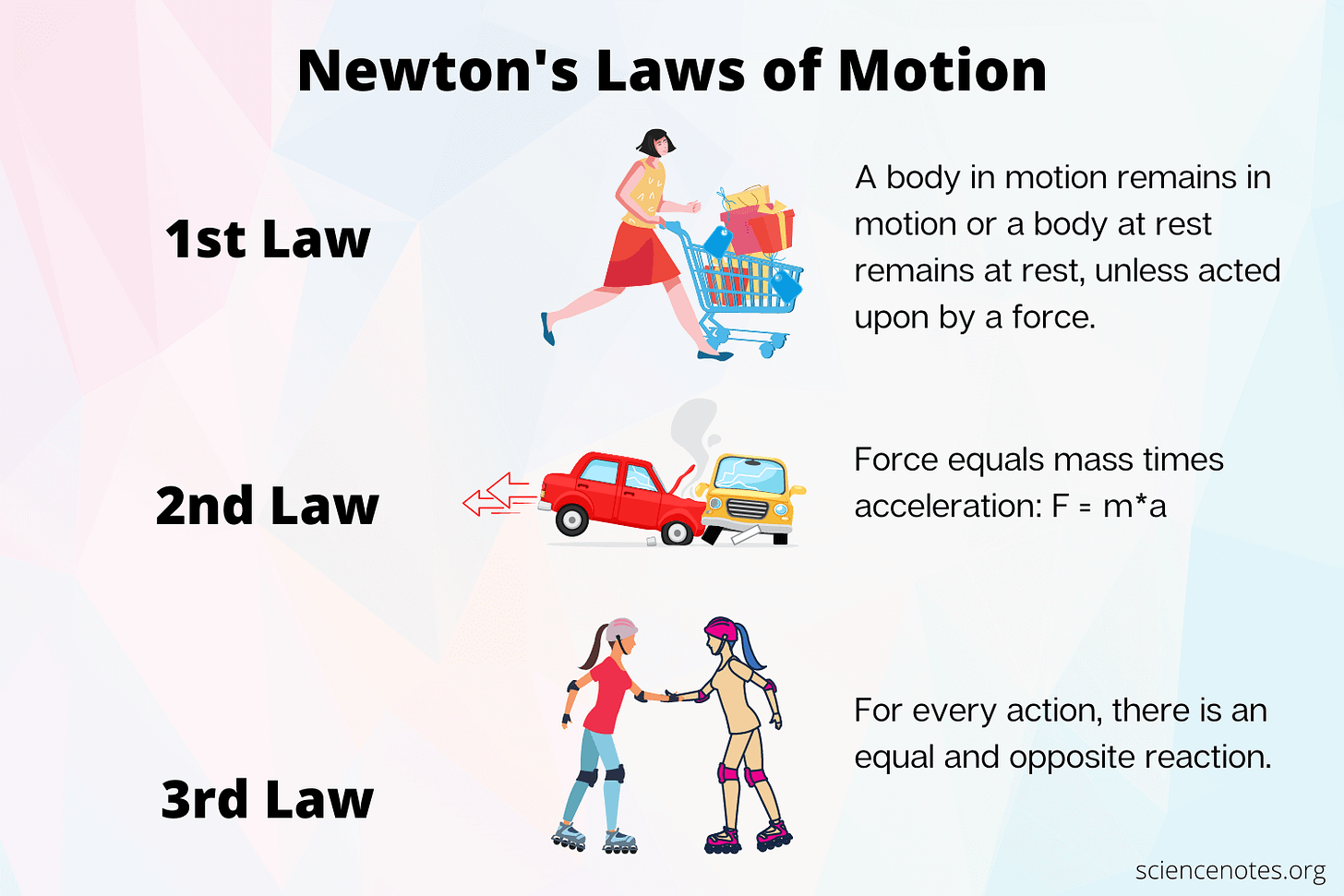

Isaac Newton has three laws of motion:

Things stay still or keep moving at the same speed unless there’s a net force

The force acting on an object is equal to its mass times its acceleration, F=ma

For every action, there is an equal and opposite reaction

Warren Buffett added a fourth law for investors:

The higher the movement, the lower the returns

This is so hard to get because, as a child, you learned the exact opposite.

Let’s go back to your childhood for a minute. How often did your parents shout, “Don’t just sit there, do something!” I heard it a lot of times.

In investing, that’s some of the worst advice you can follow.

The truth is the exact opposite: Sit there. Don’t just do something.

It sounds weird, but doing less gets you better investment results.

In other words, the best investor is a dead investor.

Conclusion

That’s it for today.

Here are the nine investing paradoxes in one sentence:

Very smart people can make very dumb investment decisions

Declining stock prices are a good thing

Doing the average thing can deliver exceptional results

To win, you need to avoid losing

The most exceptional CEOs look like the most normal people

The only certainty is that there is no certainty

Not taking any risk is incredibly risky

If you want faster results, go slower

Do less and get better investment returns

Everything in life compounds

Pieter (Compounding Quality)

PS You want to learn more about Compounding Quality? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Great article that nails a key truth: our brains are wired to be bad investors, just as our taste buds are hardwired to be poor selectors of healthy food. Overcoming that is the real challenge, and these 9 insights are a perfect guide. Classic behavioral finance in action

The activity paradox (#9) really hit home for me. It's counterintuitive but true - my best investments have been the ones I simply held through volatility rather than constantly tinkering. The Newton's fourth law framing is clever. Also appreciate the IQ paradox discussion - I've seen brilliant analysts overthink themselves into poor positions by building elaborate models that miss the forest for the trees. Simplicity is underrated in investng.