A New Chapter For Our Portfolio

How will the Portfolio evolve from here?

In the past two weeks, you received an extensive Portfolio Update.

The Portfolio is well positioned for future performance.

Let’s answer this question today:

What's next for Compounding Quality? How will the Portfolio evolve from here?Portfolio Update

The Portfolio Update was super detailed.

It included 5 full articles (!)

So I bundled everything into a handy PDF. That way, you can easily find what matters most.

You can find the PDF here:

Why I’m so comfortable

Let me confess something to you, Partner.

I feel very comfortable with the way we’re positioned right now.

There are two main reasons for this:

Our Portfolio is bringing in more and more cash every year

We own amazing companies

1. Bringing in more cash

In the end, stock prices follow business performance.

Our companies keep generating more cash flow every year.

As a shareholder you are the owner of the companies you invest in.

Look at yourself as the passive CEO of companies like Medpace, Kelly Partners Group, …

What each company makes for us per year = Number of shares we own * FCF per shareEvery month, we do this exercise for Our Entire Portfolio.

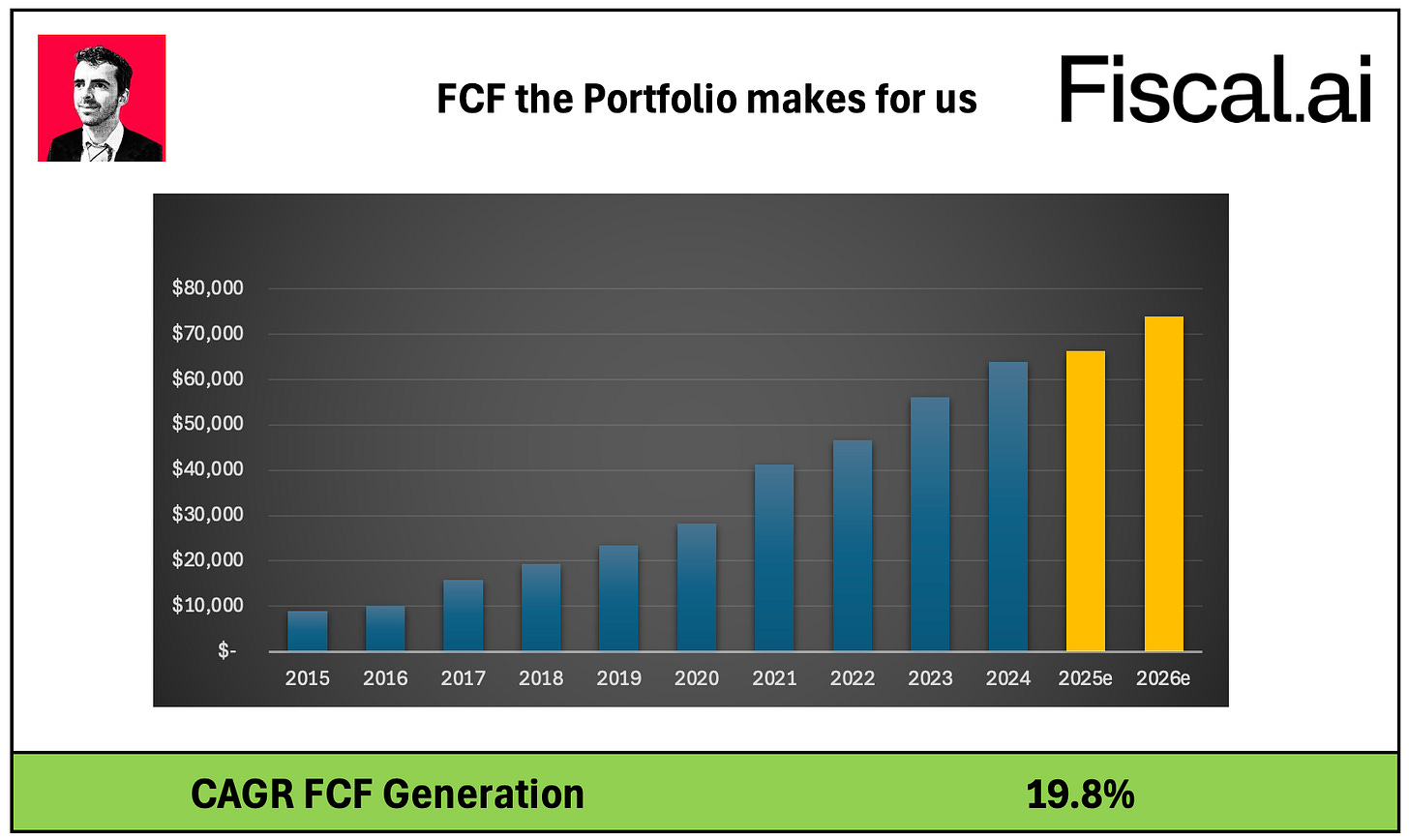

The evolution looks as follows:

2017: $15,857.3

2018: $19,354.7

2019: $23,378.6

2020: $28,310.6

2021: $41,186.7

2022: $46,637.9

2023: $56,186.7

2024: $63,913.0

2025 (estimated): $66,311.6

2026 (estimated): $73,854.6

Since 2017, Our Portfolio has evolved from making $15,857.3 in Free Cash Flow per year to $73,854.6 in 2026.

What else do you need to make you feel comfortable?

We are literally making money while we sleep.

A yearly Free Cash Flow of $73,854.6 means we make:

$6,154.5 per month

$202.3 per day

$67.4 per night of sleep (8 hours)

The goal? Generate at least $10,000 in monthly free cash flow.

I expect this will be the case in 2027 or 2028 depending on how much we can add to Our Portfolio.

2. We own amazing companies

You might know this phenomenal quote from Jesse Livermore:

Well… Wouldn’t you sleep like a baby every single night knowing you’re invested in the best companies in the world?

Because that’s what we’re doing at Compounding Quality.

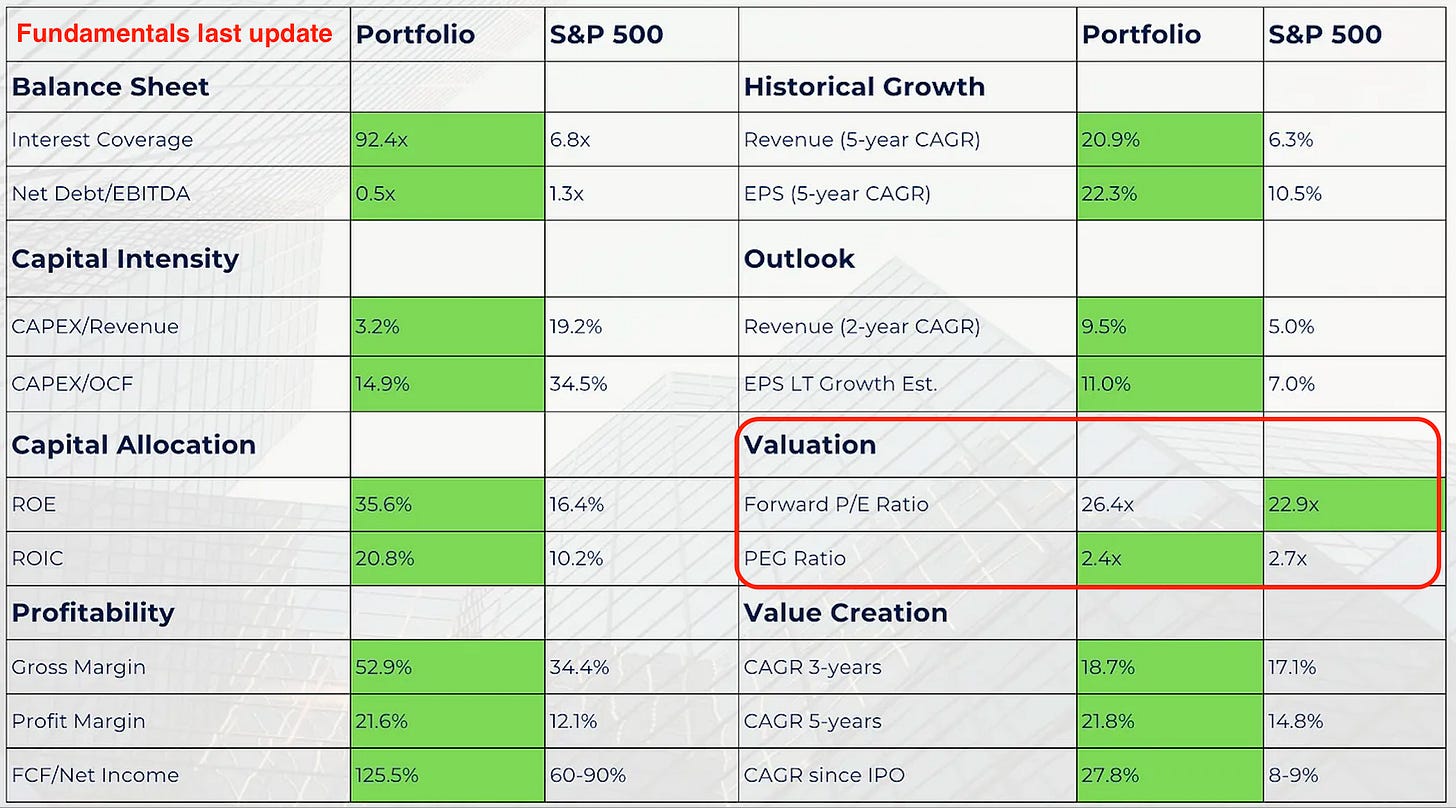

In August, Our Portfolio Fundamentals looked as follows:

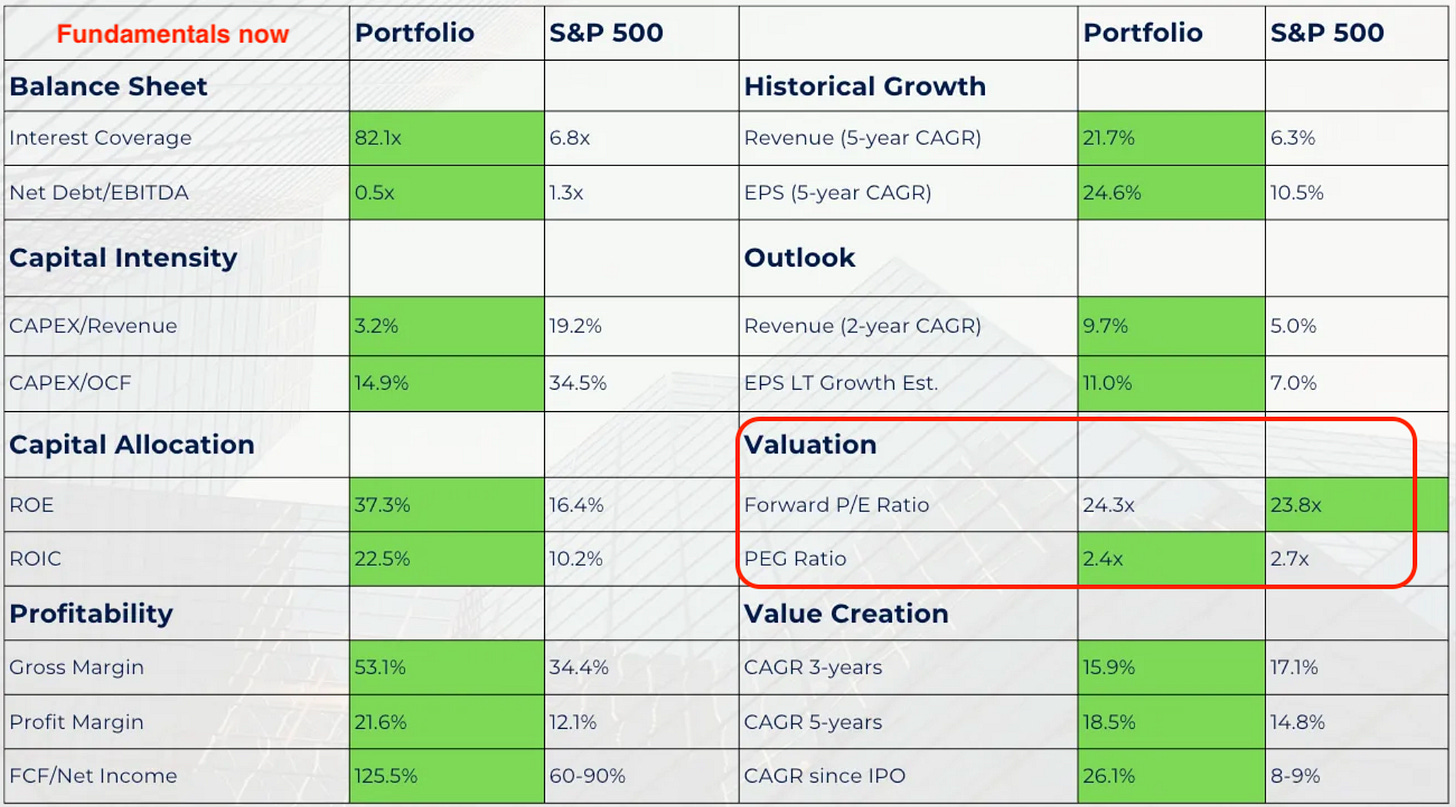

And today?

The S&P 500 seems to have reached an ‘Extreme Greed’ phase.

Mathieu shared this chart in the Community:

It might be indication that the market is exaggerating nowadays.

What stems me positive? Our companies are way better, but still cheaper than the index.

That gives me a lot of confidence.

It sets us up for outperformance.

How will the Portfolio evolve?

I receive this question a lot:

"We own 16 high-quality stocks and we want to let our winners run. So how will the Portfolio evolve in the future?"It’s a very fair question.

And also a question we need to ask ourselves.

The essentials of the Portfolio will always remain the same, as outlined in the Owner’s Manual:

✅ The portfolio will invest worldwide (developed countries only)

✅ We’ll own 15-20 stocks

✅ The portfolio is aiming to invest in the best companies in the world

✅ We won’t trade a lot. Activity and costs harm our results

In the coming weeks, we’ll likely make a few tweaks to the Portfolio.

Some stocks might be sold and replaced.

We will add 2-4 new names to the Portfolio

1. Selling and replacing companies

In general, I think there are 5 main reasons to buy a stock and 7 main reasons to sell a stock.

You can find these reasons here:

The main reason to sell a stock? When your investment thesis is no longer intact.

When you thought a certain company had a moat, but the moat is shrinking. That’s exactly why we sold Text SA in the past.

Another reason to potentially sell a stock? When you find another, more attractive investment opportunity.

2. Adding new names

Investing is a beautiful intellectual journey that never stops.

It goes without saying that we’re always looking for new names to add to the Portfolio.

To stand still is to go backwards, especially in investing.

I expect that over the next few weeks, two to four names will be added to the Portfolio.

You can see Our Shopping List here: