👑 Reasons to buy a stock

It’s not hard to find quality companies.

But when should you buy them?

In today’s article, we’ll cover 5 reasons to buy a stock.

Value versus growth

All intelligent investing is value investing.

You try to buy stocks for less than what they’re worth.

The intrinsic value of a company can always be calculated as follows:

Intrinsic value = The discounted value of the cash that can be taken out of a business during its remaining life

This also means that growth is always a component of value as it will increase future cash flows.

Here’s what Warren Buffett has to say about the value versus growth debate:

So in theory, investing is very easy: buy stocks below their intrinsic value.

It’s so easy in theory, but it can be very hard in practice.

As a way to help you, I am covering 5 potential triggers to buy a stock in today’s article.

“Investing is simple, but not easy.” - Warren Buffett

5 Reasons to buy a stock

Here are 5 reasons to buy a stock:

The stock is undervalued

Fundamentals are improving

The moat is strengthening

The future looks bright

Insiders are heavily buying

1. The stock is undervalued

In the short term, stock prices fluctuate way more than the intrinsic value. As Benjamin Graham beautifully stated: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Most stocks fluctuate with more than 50% every single year.

As a result, volatility can offer a lot of opportunities for rational investors.

But how can you know whether a stock is undervalued?

A good starting point is to look at the current valuation level of a company compared to its historical valuation.

You can easily do this via free websites such as Morningstar.

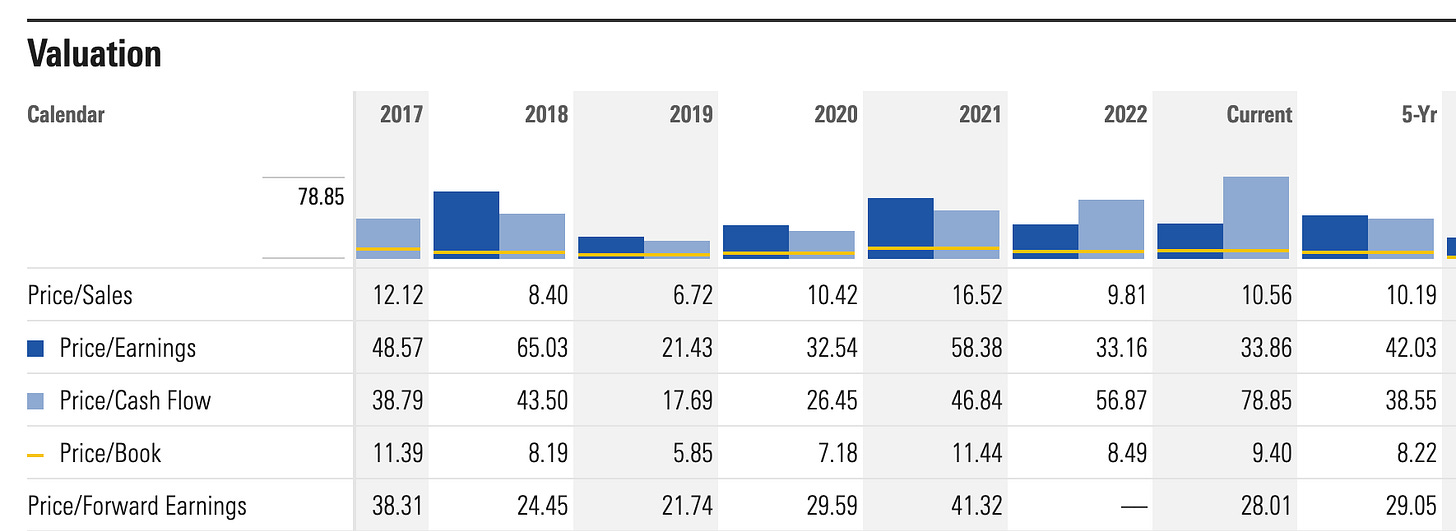

Let’s take Arista Networks as an example.

Via the Valuation tab on Morningstar’s website, you see that Arista Networks currently trades at a forward PE of 28. Over the past 5 years, the stock traded at an average forward PE of 29.1.

This indicates that Arista Networks is reasonably valued compared to its own historical average.

Obviously, looking solely at the current valuation level of a company compared to the historical valuation isn’t enough to determine whether a stock is undervalued.

You can take a look at these 2 articles if you want to learn more:

2. Fundamentals are improving

Over time, stock prices always follow the evolution of the intrinsic value.

That’s why the fundamentals are by far THE most important thing to track as an investor.

Let’s say that a company called Quality Inc. has the following characteristics:

Profit margin 10%

Earnings per share (EPS): $10

P/E ratio: 15x

Stock price = EPS * P/E ratio: $150

Now assume that over the next 3 years Quality Inc. is able to double its profit margin from 10% to 20%.

Due to the fact that Quality Inc. doubled its profit margin (and as a result its earnings), investors are also willing to pay more for the company. As a result, the price-to-earnings ratio increases from 15x to 25x.

Can you guess how much Quality Inc.’s stock price would have increased in this example?

Here’s the performance of Quality Inc:

Stock price = EPS * P/E Ratio

Stock price Quality Inc. = $20 million * 25 = $500

As you can see, Quality Inc’s stock price more than tripled thanks to the profit margin increase from 10% to 20%!

This example beautifully shows why your return as an investor can be very satisfactory if you invest in companies which can improve their fundamentals.

When you are looking for companies which are improving their fundamentals, look at these metrics:

The balance sheet is strengthening (look at Net Debt / FCFF)

Capital intensity decreases (look at CAPEX/Sales)

Capital allocation improves (look at ROIC)

Profitability improves (look at profit and/or FCF margin)

3. Moat is strengthening

For quality investors, a moat is essential.

Determining the existence and durability of a competitive advantage is key to make good investment decisions.

When you invest in companies which can widen their moat, your results will be very satisfactory.

Very recently, Michael Mauboussin has written a new paper about this topic. You can read it here.

I’ll summarize the paper of 30 pages in 2 bullet points for you:

Companies with a high ROIC outperform companies with a low ROIC

Companies which manage to increase their ROIC significantly outperform all other companies

You can also see this in the table below.

Companies which managed to go from the lowest ROIC quintile to the highest ROIC quintile outperform all other companies by a wide margin.

Take a look at these articles if you want to learn more:

4. The future looks bright

In the long term, earnings growth is the main driver for stock prices.

This also means that the longer your companies can grow their earnings at attractive rates, the better.

Via the formula below, you can calculate your expected return as an investor.

Expected return = EPS Growth + Shareholder Yield (Dividend yield + Buyback yield) +/- Multiple expansion (contraction)

This means that if you pay a fair price for a stock that can grow its earnings per share with 10% per year and pays a dividend of 2% per year, your expected return is equal to 12%.

Here’s a great practical example from François Rochon:

As you can see in the table above, the companies within Rochon’s portfolio have grown their value (EPS growth + dividend yield) by 2474% while his portfolio has achieved a total return of 2817%.

5. Insiders are heavily buying

When an insider sells its own stock, there can be multiple reasons. The person might need money to finance the wedding of his daughter, he wants to buy a second house, …

However, there is only 1 possible reason why an insider buys its own stock: he thinks the stock is undervalued.

And guess what… there is no person who can determine the intrinsic value of a company better than an insider.

There are multiple studies about this topic and the consensus states that companies in which insiders are heavily buying their own stock outperform the market over the next 12 months with 3-6% per year on average.

Via Dataroma you can see which insiders recently bought back their own shares:

Take a look at this article if you want to learn more:

Conclusion

That’s it for the 100th article of Compounding Quality. I am really looking forward to the next 100 and hope you are too.

If you like this newsletter, please let us know by emailing us, reacting to this post or by giving a like. Sharing Compounding Quality with friends and family is the greatest gift I can ask you for.

To summarize this article:

All intelligent investing is value investing. You try to buy things for less than what they’re worth.

In general there are 5 reasons to buy a stock:

The stock is undervalued

Fundamentals are improving

The moat is strengthening

The future looks bright

Insiders are heavily buying

Next week we’ll discuss reasons to sell a stock. Stay tuned!

The end

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

Another Thursday and another treasure of very useful and beautifully presented content. Thank you, CQ for all 100 pearls of knowledge! As always, I saved your excellent article for last.

All five reasons to buy shares of a business are very logical and easy to understand. And yet, so many people fail to stick with them. Speaking from my own past mistakes, it’s not the complexity of the buying principles that is hard, but rather the discipline to wait and buy only when all the check marks are present. Most people want to get rich quickly, but it almost never works out for them. Therefore, it’s important to come to this realization as soon and as early in life as possible. Then, very good things start to happen.

One more day to get to the weekend, my friend! Summer has officially begun, and I hope you have a great and sunny weekend. You won’t believe it but, here, it was only 3 degrees outside when I woke up this morning. Lol!

Thank you for another knowledge compounding gem! I always learn something from CQ! What stood out to me in this article, which is also contained in other CQ articles, is the expected return formula. Brilliant, short, simple, and clear! Please keep it up!