🔍 Are markets efficient?

Are markets efficient?

Because if they are, you should just buy an index fund.

In today’s article, I’ll explain to you why it still makes sense to invest in individual stocks.

What is the Efficient Market Theory (EMH)?

Imagine that you are a 7-year old and that you and your friends like to trade toys.

You like to buy toys for cheap and sell them for a higher price.

However, in a perfect efficient market all your friends as well as yourself already know how much each toy is worth.

As a result, it’s impossible to buy a toy for a very low price and sell it for a higher price because everyone knows how valuable each toy is.

The above is exactly what believers in the efficient market theory (EMH) state.

They say that investing in individual stocks doesn’t make sense as every stock is priced efficiently.

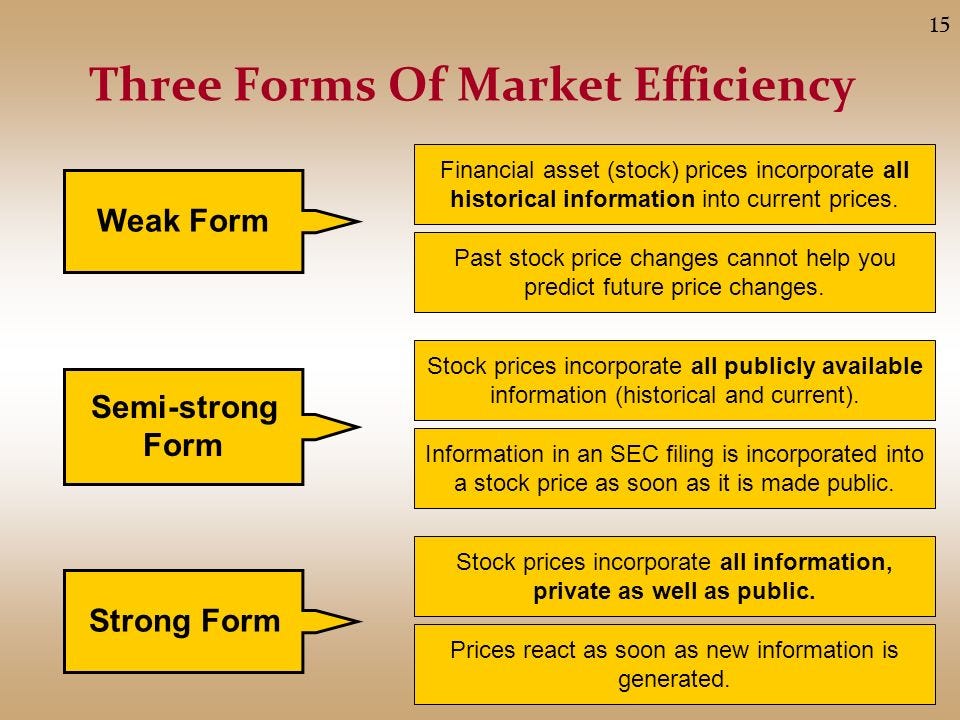

In general, there are 3 types of the Efficient Market Theory:

Weak form: Prices of assets already include all information from past trading data like past prices and trading volumes

Result: Technical analysis doesn’t add value for investors

Semi-strong form: Prices of assets not only include all information from past trading data but also all public available information

Result: Technical analysis nor fundamental analysis adds value for investors

Strong form: All information, whether it's publicly available or private, is already incorporated into the asset's price

Result: It’s impossible to outperform the market. Even if you have access to insider information

Should I invest in individual stocks?

Let’s be honest with each other. Most investors don’t outperform the market.

A study of JP Morgan found that while the S&P500 returned 9.5% per year over the past 20 years, the return of the average investor was equal to only 3.6% per year.

If the above is correct, shouldn’t you just buy an index fund?

While it might make a lot of sense for some people to invest solely in index funds, I am 100% convinced that you can outperform the market with 3-5% per year if you use a sound investment strategy.

Just look at the performance of this investable universe full of quality:

After reading the above I hope we can all agree that the Efficient Market Hypothesis in the strong form (outperforming the market is impossible) and the semi-strong form (no value is added via fundamental analysis) doesn’t make sense.

You don’t believe me? Don’t take my word for it:

“It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. “Efficient” markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.” - Warren Buffett

"I really think that a lot of modern finance theory can only be described as disgusting." - Charlie Munger

The market can be irrational

While markets are quite rational most of the time, there are times when the market loses its sense of reality.

Here are some examples of euphoria:

At the height of the Tulip Mania, tulips sold for approximately 10,000 guilders, equal to the value of a mansion on the Amsterdam Grand Canal.

In the 1980s, Japanese stock and urban land values tripled. The Nikkei Index traded at 60x earnings. The index had a negative return for the next 30 (!) years.

During the Dotcom Bubble, there were 457 (!) tech IPOs. By 2002, all investors together lost more than $5 trillion.

Here are some examples of extreme fear:

After the Great Depression (1929), most stocks were trading under their book value. A lot of stocks even traded under their liquidation value

Nobody wanted to own stocks these days and this was one of the best times to buy them. Over the next decade, American stocks returned 250%

During the Financial Crisis, the S&P500 fell 56.8% from its peak

It seemed like the world would end during the financial crisis. Warren Buffett stated that this was the opportunity of a generation and the S&P500 has returned 563% since then

In general, the best time to buy stocks is when there’s blood running trough the streets.

The main reason why markets aren’t fully rational

The main reasons why the stock market isn’t fully efficient?

Humans are not rational at all.

80% of drivers think they drive better than average

65% of Americans believe they are above average in intelligence

Human irrationality creates periods of extreme fear and greed.

Rational investors can benefit from this.

Do the following to take advantage of Mr. Market:

Define your financial goals and create a plan to achieve these goals

Pick an investment strategy which matches your personal beliefs and stick to it rigorously

Make sure the strategy makes sense and has proven it’s success in the past

Here’s the Quality Investment Philosophy summarized: My Quality Investment Philosophy

Keep learning and keep fine-tuning your strategy

“Despite the comfortable academic consensus of market efficiency, financial markets will never be efficient because markets are, and will always be, driven by human emotions: greed and fear.” - Seth Klarman

“The efficient-market-believing professor takes a walk with a student. “Isn’t that a $10 bill lying on the ground” asks the student. “No, it can’t be a $10 bill,” answers the professor. “if it were, someone would have picked it up by now”. The professor walks away, and the student picks it up and has a beer.” - Howard Marks

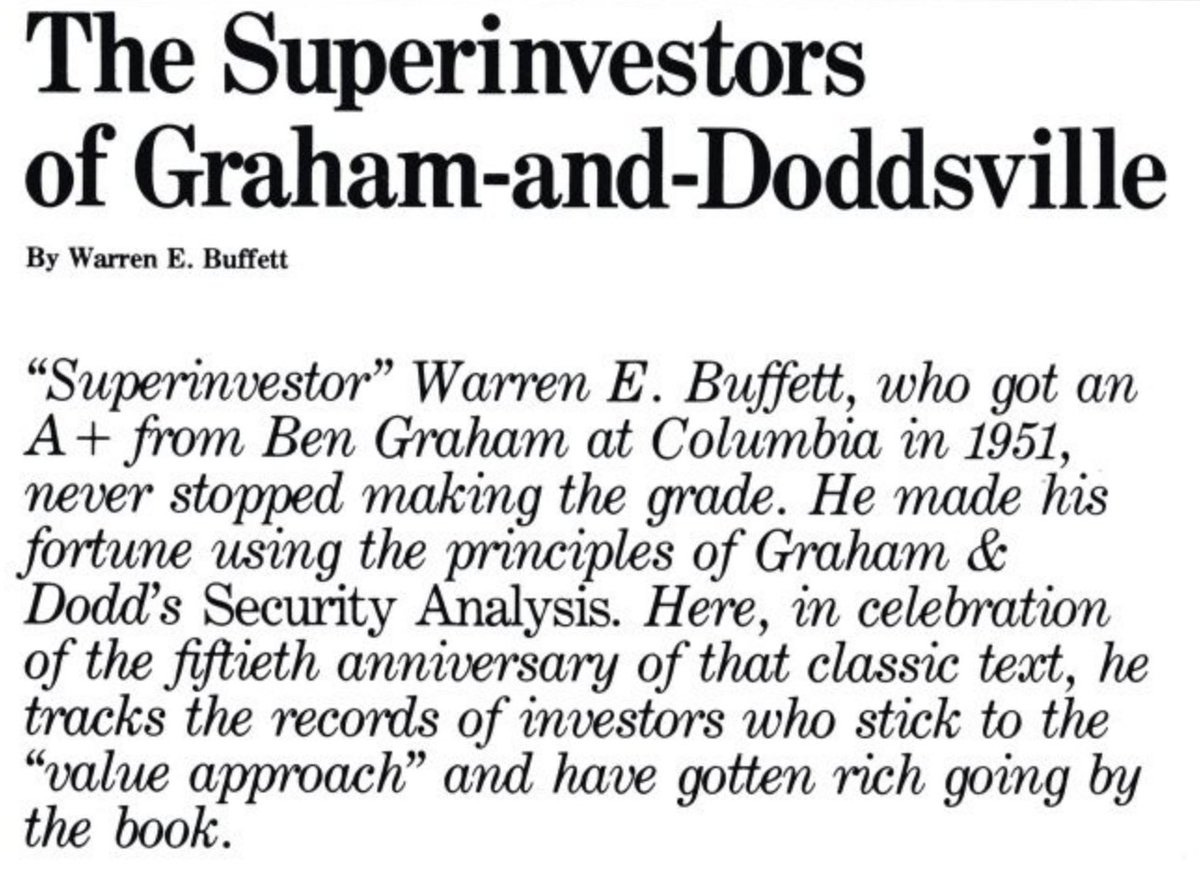

The Superinvestors of Graham-and-Doddsville

Do you want to learn more about the Efficient Market Theory?

In 1984, Warren Buffett wrote an article which challenged the idea that equity markets are efficient. He did this via a study of nine successful investment funds generating long-term returns which significantly outperformed the market.

You can read it here:

The end

That’s it for today.

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

![Buy! BUY! Sell! SELL! [pic] : r/investing Buy! BUY! Sell! SELL! [pic] : r/investing](https://substackcdn.com/image/fetch/$s_!kiXe!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1d2f32b0-dd56-4120-a1e2-026ea619c28d_1024x945.jpeg)

This was a great post. Thankfully the markets aren't efficient. Otherwise, we're wasting our lives.

Another great article CQ, Thank you, and I have to agree with you.

As a new investor i started a new small PF (22 Stks) using DCA for my daughter in July 2022 and was told many times about the bad timing, and to wait etc, but believing long term i should be ok with good companies, we just finished our first year, last month July 2023 and ended up with ~$40k & +27% after costs and fees so I am more than happy with that for Yr 1, especially when leaving it in cash would of cost me money through Inflation and loss of purchasing power.

Yes there were multiple +30% draw-downs and the road gets bumpy at times, but preferred to continue buying and to average down and for this year it paid off, time will tell long term, but with Bull mkts on average 65-75% of the time, I still feel the numbers are with us.

I don't think any theory can account 100% for our energetic human emotions in both directions when it comes to stocks, and history shows they are still the best investments long term.

Thanks again CQ, much appreciated, it's yr solid/factual info that helps to steady the boat.

Cheers Kev