My Quality Investment Philosophy

Hi Friend 👋

I’m Pieter and welcome to a 🔒 free edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Dear reader,

Via this way, I warmly want to welcome you to this blog. This blog of Quality Compounding focuses – as you might suspect - on quality investing.

The beautiful thing about quality investing is that quality companies (or compounders) manage to grow their free cash flow exponentially thanks to a combination of favorable characteristics. Once you have done your homework and your view about the company was correct, you can let the company work and compound for you. In other words, quality investing is one of the only investment methods where you can use a buy-and-hold strategy. When you invest in a value stock, you buy a company that is undervalued. As a result, you should sell it when the company’s stock price evolves to their intrinsic value (calculated by you). Once that is done, the process restarts, and you should find another undervalued company. This is in stark contrast with quality investing because when you can buy a great company at a fair price, you should never sell the stock. Some examples of long-term great compounders since their IPO: IDEXX Laboratories (CAGR of 21.2% since 1991), Microsoft (CAGR of 25.9% since 1986) and Pool Corporation (CAGR of 26.3% since 1995).

For Terry Smith, Quality Investing is based on 3 metrics:

Buy good companies

Don’t overpay

Do nothing

Chuck Akre’s Three-Legged Stool is also a great framework for quality investors:

Obviously the million-dollar question is how you can find these quality companies. Quality companies often possess over the following characteristics. We will go through them all in this article:

A wide moat (competitive advantage)

High management integrity

Low capital intensity

Good capital allocation

High profitability

Attractive historical growth

A secular trend / optimistic outlook

Some great examples of quality companies can be found in the portfolio of Terry Smith (Fundsmith):

Wide moat (competitive advantage)

“A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable.“ – Warren Buffett

As a quality investor, you are not looking for The Next Big Thing. You want to invest in companies that have already won. In other words, you want to invest in companies that are clear market leaders with strong pricing power that managed to outperform the stock market for years and preferably even decades in the past.

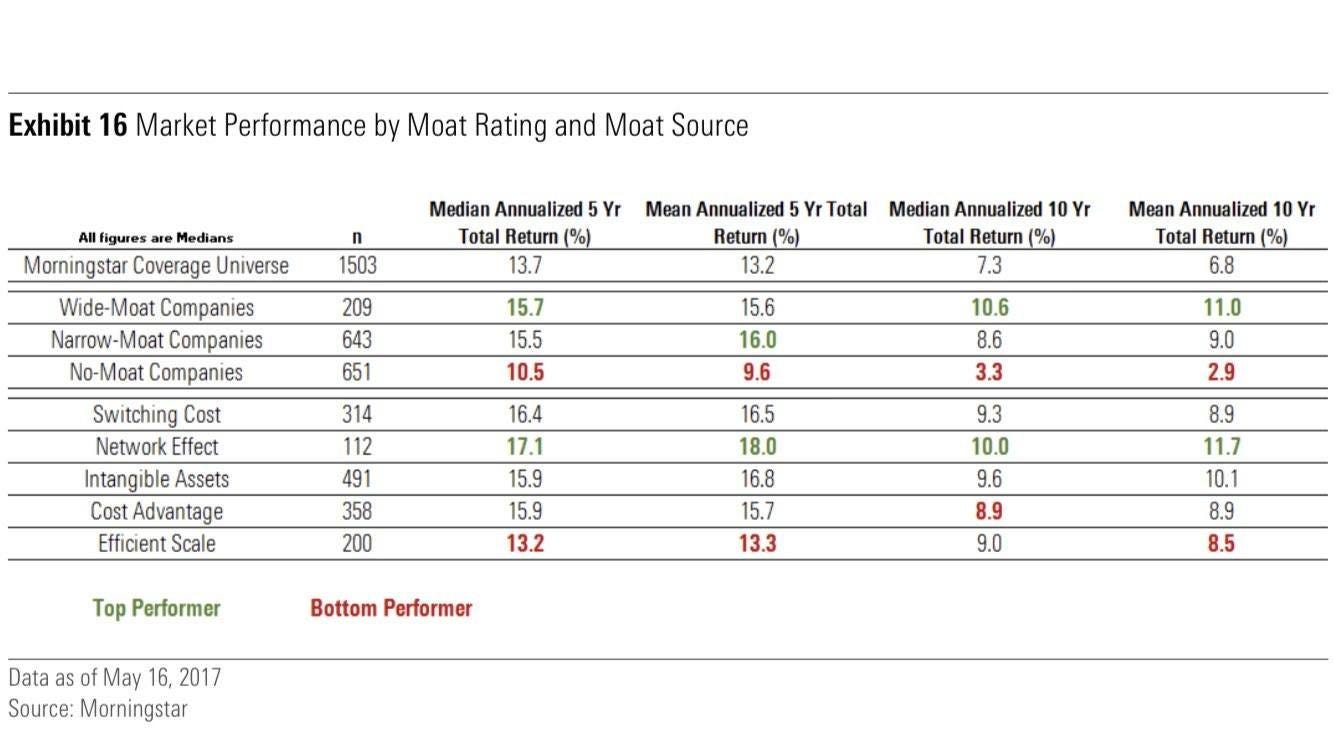

Wide moat stocks outperform the market in general:

Think for example about companies like S&P Global and Moody’s. Both companies are active in the credit rating business and are truly essential for the global debt market. Every US listed company that wants to issue debt, needs a credit rating from at least 2 of the 3 big rating agencies: S&P Global, Moody’s or Fitch. Debt issuers practically have no choice than asking for a credit from these companies and this gives S&P Global and Moody’s a lot of pricing power. S&P Global and Moody’s were industry leaders in the 1970s, are industry leaders today and probably will still be industry leaders in 40 years from now.

Some other great examples of wide moat stocks: Nike and Adidas, Visa and Mastercard, Assa Abloy, MSCI, and Equifax.

Wide moat stocks perform better than the market:

High management integrity (skin in the game)

“If management and the board have no meaningful stake in the company – at least 10 to 20% of the stock – throw away the proxy and look elsewhere.” – Martin Sosnoff

You want to invest in companies with high management integrity. Management’s interest should be aligned with the one of you as an investor. Having skin in the game is very powerful.

That’s also the reason why, in general, family-owned business often perform better than non-family business. Credit Suisse has written a great paper about this wherein they conclude that since 2006, family companies outperformed non-family companies with 3,6% per year. The paper can be found here: https://www.credit-suisse.com/media/assets/corporate/docs/about-us/research/publications/cs-family-1000-post-the-pandemic.pdf

Some examples of great quality family-run business: LVMH, L’Oréal, Kone, Copart, and Stryker.

Low capital intensity

“Asset-light industries are attractive since they require less capital to be deployed to generate sales growth. The finest examples are franchise operations, such as Domino’s Pizza, where growth is funded by franchisees rather than by the company.” - Lawrence Cunningham

As a quality investor, you want to invest in low capital-intensive business. These companies require very little capital to maintain their current business and to achieve future growth. When you find companies with a low capital intensity that have high profitability margins and can reinvest a lot in future growth opportunities (high ROIIC), you are investing in compounding machines. These are the companies you seek as a quality investor. In general, you aim for companies with CAPEX/Sales < 5% and CAPEX/Operational Cash Flow < 15%.

Some low capex quality business: Automatic Data Processing (CAPEX/Sales: 1.2%), Domino’s Pizza (CAPEX/Sales: 2.2%) and Blackrock (CAPEX/Sales: 1.8%).

Great capital allocation

“Capital allocation is the most important task of the CEO. Organic revenue growth (reinvesting in the business) is the most preferable source of growth.” – Quality Compounding

When a company earns cash, they can do three things with the FCF that is generated: reinvesting in the business, acquisitions / buybacks, and dividends.

Reinvesting in the business: This is the most preferred capital allocation choice. You want to invest in companies that can reinvest a lot of their FCF in future growth opportunities at high profitability rates and great capital allocation metrics. The higher the Return on Incremental Invested Capital (ROIIC), the better. You want to invest in companies that can report organic revenue growth figures of more than 7%.

Acquisitions and buybacks: Companies can also use their FCF to buy back their own shares (which increases the FCF per share when these shares are destroyed) or to acquire other companies. On the global stock market, there are great serial acquirers like Constellation Software, Roper Technologies and Lifco.

Dividends: Finally, companies can also pay dividends with its FCF. Dividends are usually not the most efficient way to allocate capital as it does not generate future growth and you as an investor pay taxes on the dividend you receive.

In general, the greater the capital allocation of a company, the better. Looking at ROIC and ROCE is a good start. We prefer companies with a ROIC greater than 20%.

Some examples of companies in my investable universe with great capital allocation metrics: Sherwin-Williams, Domino’s Pizza, Pool Corporation, and Adobe.

High profitability

“When a company can report high FCF margins for decades, this is a great indication of a wide economic moat.” – Quality Compounding

The free cash flow margin shows how much percent of sales are translated into cash. When a company has a FCF margin of 30%, for every $100 the company sells, $30 of cash is generated. In general, companies can use their FCF to reinvest in itself, buyback shares, acquire other companies, and dividends.

To become a part of my investable universe, the FCF margin of a company should be at least 15% (and preferably more than 20%). Furthermore, a high percentage (> 90%) of the companies’ earnings should be converted into free cash flow. Free cash flow is a way more important metric than earnings as it truly shows how much cash is entering the business.

Some beautiful examples of companies with high profitability margins: IDEXX, Ansys, Johnson & Johnson, and Fortinet.

A secular trend (bright outlook)

“When you invest in companies active in a strongly growing end market, you have the wind in the sails as an investor.” – Quality Compounding

The trend is your friend. You want to invest in companies with a strong secular trend. Think about themes like urbanization, cybersecurity, datacenters, semiconductors, hearing aids, and obesity. You want to invest in a company which is active in a market that is growing strongly and where preferably the company you invest in also can gain market share within this exponentially growing market. I am aiming for companies which can grow their organic revenue with at least 7% per year in the foreseeable future.

Some examples of companies active in an end market with strong secular trend: Novo Nordisk (obesity), Kone (urbanization), Fortinet (cybersecurity), Blackrock (passive investing), and Sonova (hearing aids).

Valuation

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

For quality investors, the quality of the business is more important than the valuation. Obviously, you don’t want to overpay for quality as beautiful companies can become terrible investments when you pay way too much. You want to buy a beautiful company at a fair price, as stated by Buffett.

In the long run, your return as an investor is equal to the FCF growth per share plus the shareholder yield (buyback yield + dividend yield) +/- multiple expansion/contraction. The longer you invest in a company, the more important the FCF per share growth becomes.

Conclusion

“A stock that returns about 20% per year for 25 years multiplies your money by a factor of 100x. An investment of $10.000 in that case becomes $1.000.000.” - Christopher Mayer

To wrap it up: as a quality investor you want to invest in the best companies in the world. You don’t want to invest in The Next Big Thing but invest in companies that have already won. Looking at the evolution of the stock price over the past years and preferably decades is already a good indication for this. Personally, I am not investing in companies that did not manage to generate a 15% CAGR for shareholders since their IPO. Quality companies possess over the following characteristics: a wide economic moat, high management integrity, low capital intensity, good capital allocation, high profitability, attractive historical growth, and a strong secular trend. When you can pick up these companies at a fair valuation, you will end up with one hell of a result over time. That’s the beautiful thing about investing in compounding machines.

That’s about it. Hopefully you liked this first official article written by me, Quality Compounding. Feel free to reach out if you have any questions or feedback. Subscribing, sharing and liking this article is greatly appreciated as it is very hard to start a new blog. Just like investing in companies with a wide moat driven by network effects (e.g. Visa/Mastercard), the more people are reading your articles, the greater the compounding effect.

Thank you for reading!

Email any questions to compoundingquality@gmail.com. I hope to see you soon to ride our investment journeys together!

Disclaimer

Compounding Quality is not a licensed investment professional. Nothing produced by the Compounding Quality should be construed as investment advice. Do your own research.

Good article. Amazing that you grew a twitter account from 0 to 10k in a month. Respect. You ever want to give up fund management, you can train people in social media. I will be your first pupil. Well done and good luck with the substack

So much wisdom ... As Ken Honda says ... teach everyone the art of giving and the one who gives keeps on receiving.. Thank you !!