Hi Friend 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into the update and show you my favorite stocks right now.

March 2024

In March, the S&P 500 increased by 3.1%.

The Fear & Greed Index indicates that we’re currently in ‘Greed’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

The cheaper we can buy great companies, the more we like it.

Worst performers

Best Performers

The best of the best

Here’s a list of companies we would love to buy at the right price.

We think the companies in this list are (a bit) too expensive right now:

Best Buys April 2024

Now let’s dive into our favorite stocks for April 2024.

Let’s make it a bit more interesting and only write about stocks that can’t be found within our Portfolio.

We love the companies within our Portfolio and we think most are still (significantly) undervalued.

You can read the latest Portfolio Update here:

5. Hamilton Lane

Private Equity is a very attractive niche.

Do you know why? In the long term, private equity (PE) performs even better than equities (stocks).

Since 1996, equities compounded on average at 8% per year compared to 12% per year for private equity.

Hamilton Lane is an American company providing Private Equity solutions. It’s a global solution provider of private market investment with $112 billion in Assets Under Management (AUM) and $745 billion in Assets Under Advisement (AUA).

The company works with its clients to structure, build, and monitor portfolios of private market funds and direct investments.

Clients are usually large global investors who rely on Hamilton’s private market expertise.

Here are the key strengths of Hamilton Lane’s investment case:

Owner-Operator company (27% insider ownership)

Private Equity is a very attractive niche

High profitability (Gross Margin: 67.8% - Profit Margin: 29.8%)

Great capital allocation skills

The future still looks bright for the company

4. Zoetis

Do you have a pet? Because in that case, you’ll know that pets are often treated as full family members nowadays.

Zoetis is a company that benefits from this.

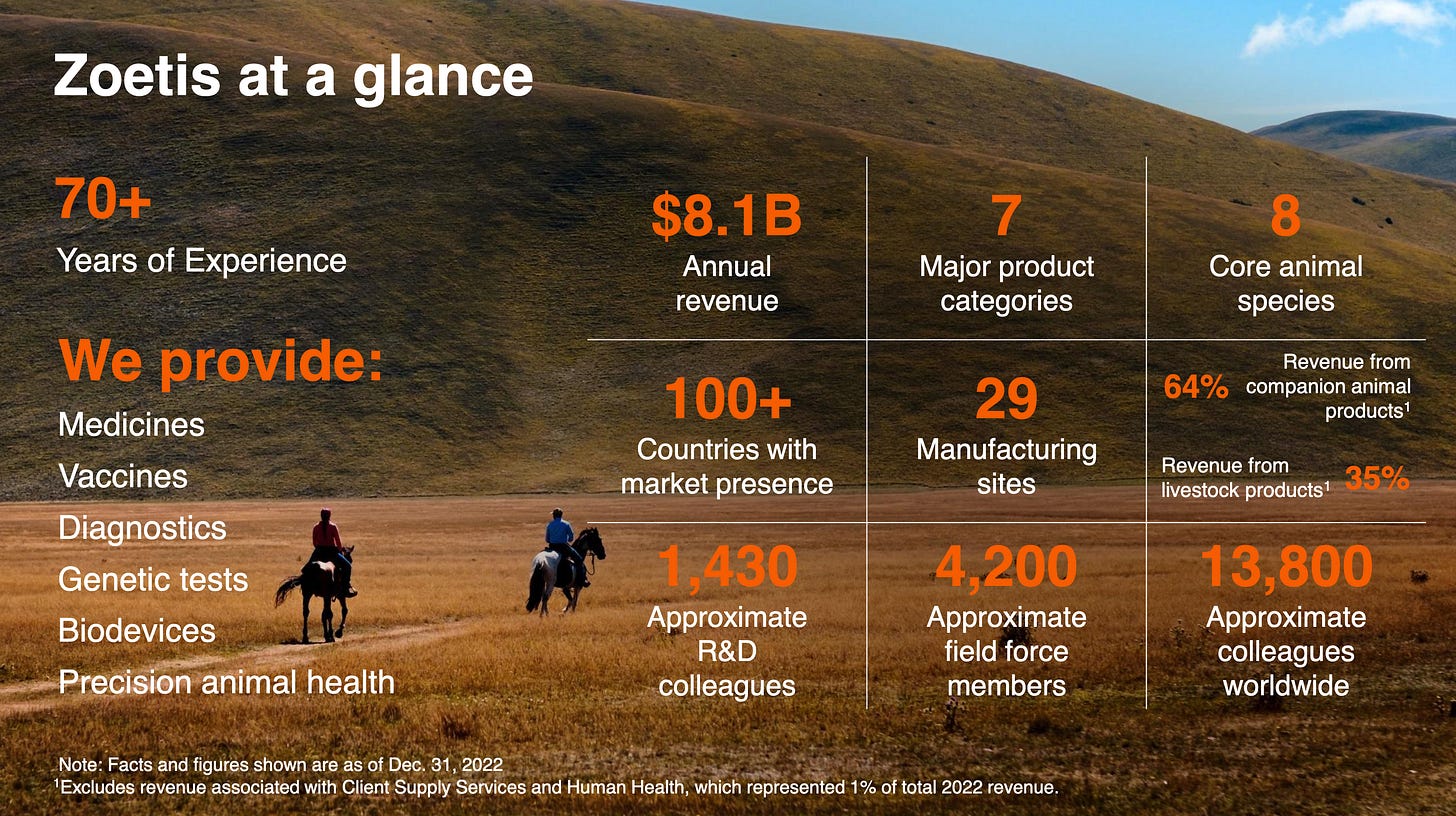

The American company produces vaccines, medicines, diagnostics, and other technologies for pets and livestock.

Here’s what I like about the company:

High profitability: FCF Margin of 19.0%

Great capital allocation skills: ROIC of 23.5%

The global pet food market is expected to grow at a CAGR of 4.4% until 2030

Expected long-term EPS Growth for Zoetis: 10.8%

Clear winner: Zoetis compounded by 17.3% per year since 2014

Now let’s dive into our 3 favorite stocks.