Hi Friend 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you my favorite stocks.

June 2024

In May, the S&P 500 increased by 5.2%.

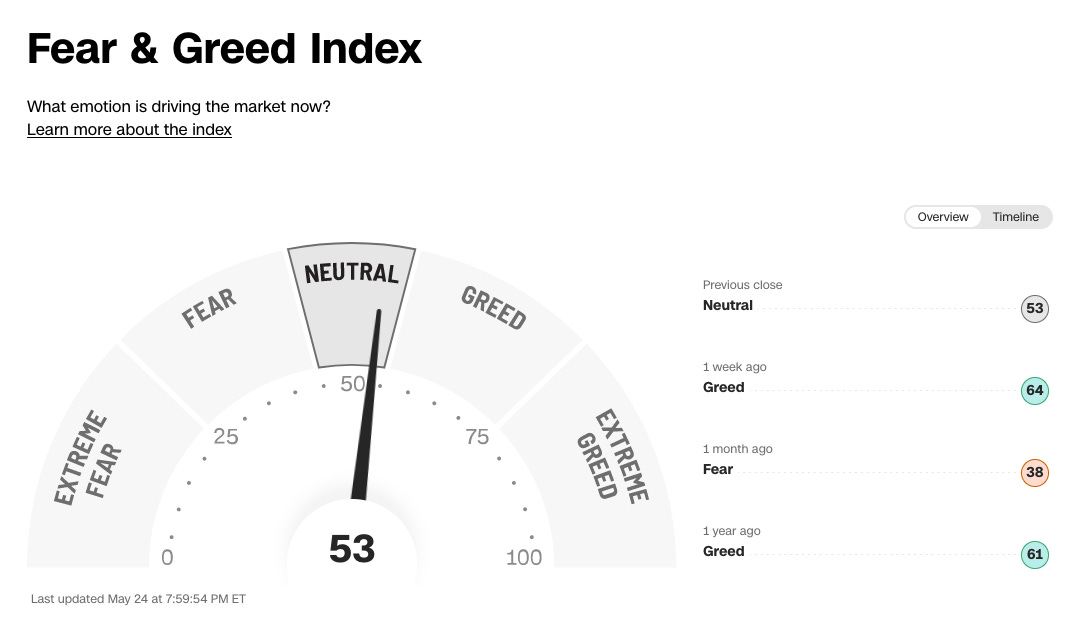

The Fear & Greed Index indicates that we are currently in ‘Neutral’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

The cheaper we can buy great companies, the more we like it.

Worst performers

Best Performers

Chuck Akre

Chuck Akre is an amazing quality investor.

He owns great companies such as Mastercard, Moody’s, and KKR.

One of his best investments? He bought American Tower for $0.80. The current stock price is $186.

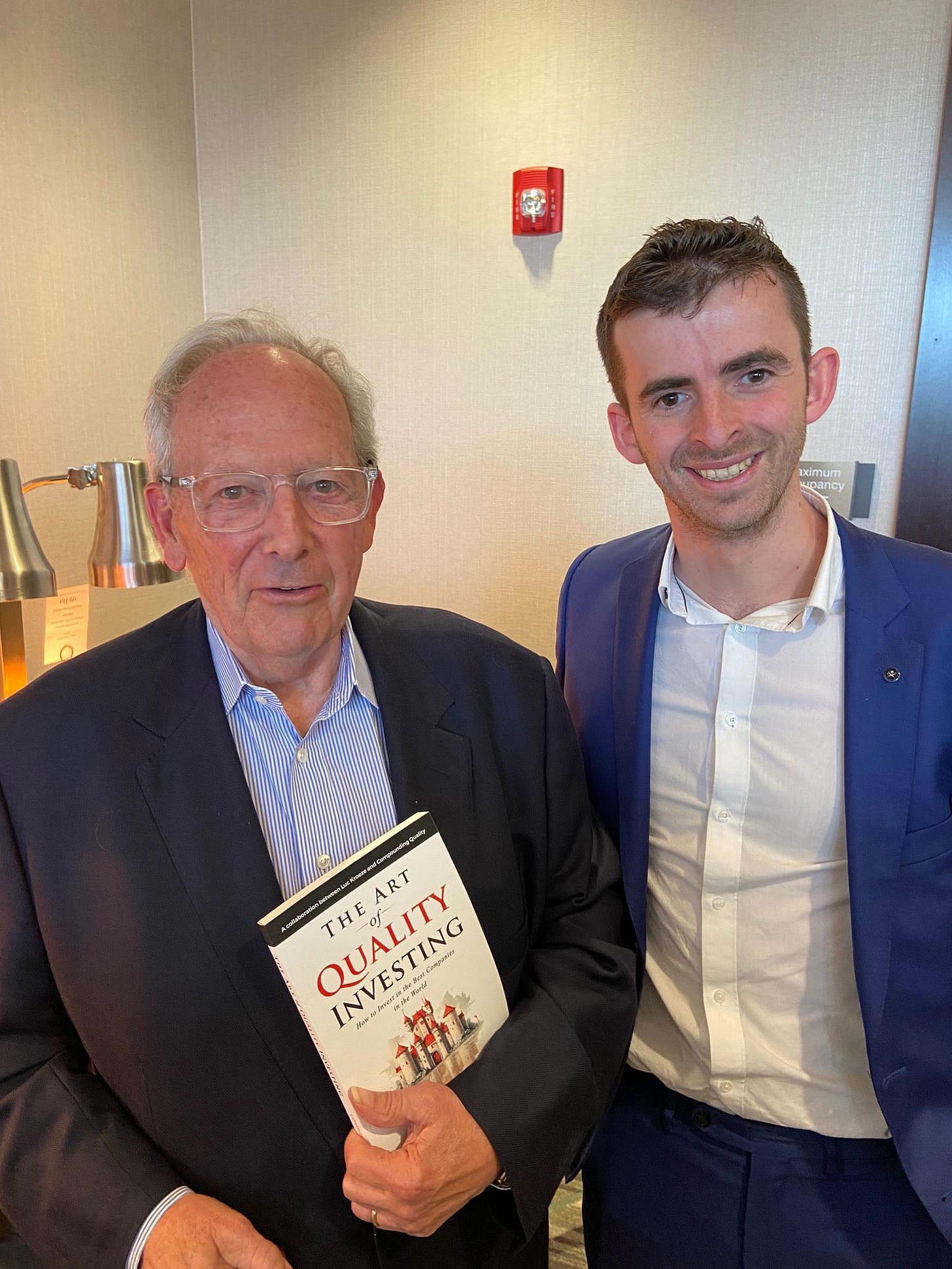

I had the opportunity to talk with Chuck at the Berkshire Hathaway Meeting in Omaha.

The key takeaway? When you invest in quality stocks with plenty of reinvestment opportunities, great things will happen to you.

The best place to find them? In the small- and mid-cap space.

Order The Art of Quality Investing here.

Best Buys June 2024

Now let’s dive into our favorite stocks for June 2024.

I only mention companies that can’t be found within the Portfolio today.

I love the companies within our Portfolio and I think most are still (significantly) undervalued.

5. Lululemon Athletica ($LULU)

Lululemon Athletica Inc. is a designer, distributor, and retailer of technical athletic apparel, footwear, and accessories.

The American company sells pants, shorts, tops, and jackets designed for a healthy lifestyle including athletic activities such as yoga, running, training, and many other activities.

They also have a wide offering of fitness-inspired accessories.

Lululemon generates the majority of its sales via women's clothing. 84% of their revenue is generated in the United States.

A lot has been said and written about Lululemon Athletica in our Community.

The stock is down 33% since the beginning of the year.

Why are we not buying the company right now in that case?

The market for women's clothing is changing rapidly. Today, yoga pants are very popular.

Will this still be the case in 10 or 20 years from now? I genuinely don’t know.

And that’s why I am staying away from the company.

Lululemon Athletica might be an interesting opportunity for investors with a higher risk appetite.

The company trades at one of the cheapest valuation levels they have ever traded at:

Source: Finchat

Earlier, we wrote a Not So Deep Dive about the company:

4. MSCI ($MSCI)

MSCI is a lovely company I would love to own at the right price.

Last month, the stock declined 13% after the publication of its slightly disappointing results.

But what does the company do? MSCI creates indexes for international stock markets and gets paid every time an ETF provider uses an MSCI index as a benchmark or underlying product.

This way, MSCI also benefits massively from the trend towards passive investing.

In total, the company manages over $98 trillion ($98,000,000,000,000) in assets.

Over 100,000 public equities and millions of fixed-income instruments use MSCI’s services.

What’s interesting is that MSCI’’s business model is built on a foundation of recurring subscription fees and asset-based fees.

97% (!) of its revenue is recurring in nature.

Since 2009, MSCI has compounded at 19.9% per year. This means an investment of $10,000 turned into $120,000.

Here are the essentials of MSCI’s valuation:

MSCI trades at a forward PE of 32.7x (5-year average: 41.1x)

Earnings Growth Model: an expected return of 12.4% per year for shareholders

Reverse DCF: MSCI should grow its FCF by 15% per year to return 10% per year to shareholders

We would become interested in MSCI at a stock price of $440 (current stock price: $495).

Source: Finchat

Let’s now dive into our 3 favorite stocks right now.

Two of them are serious candidates for the Portfolio.