Hi Friend 👋

Currently, I am in Omaha to attend the Berkshire AGM.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you my favorite stocks right now.

April 2024

In April, the S&P 500 declined by 2.4%.

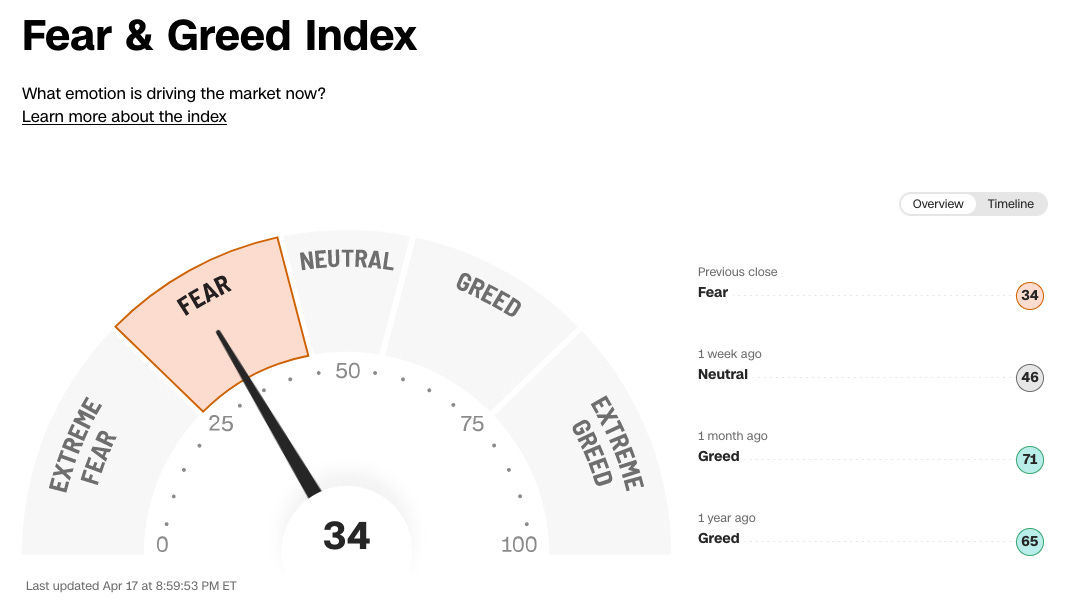

The Fear & Greed Index indicates that we are currently in ‘Fear’ Mode.

Fear is a good thing as we LOVE to buy great companies at lower prices.

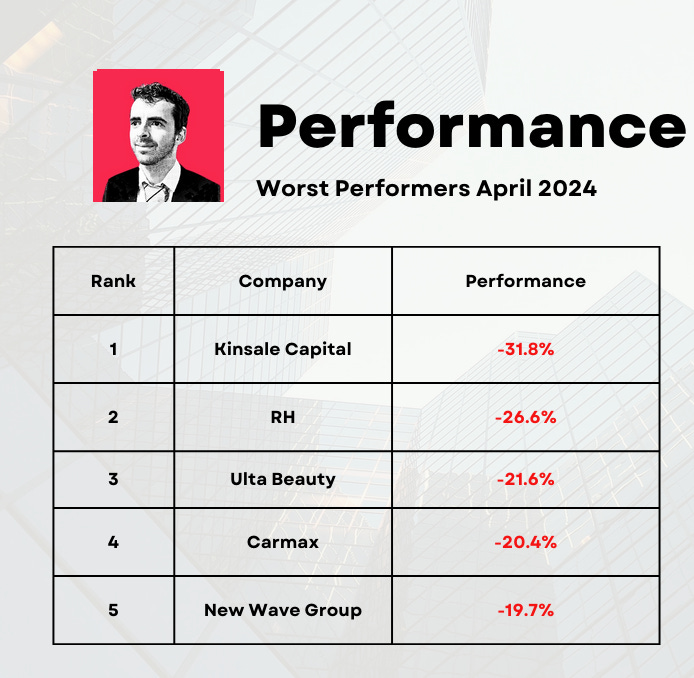

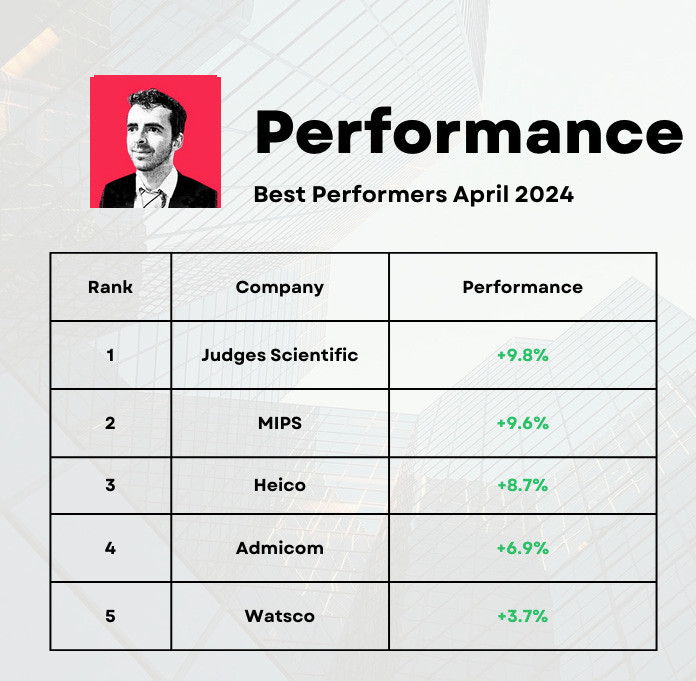

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

The cheaper we can buy great companies, the more we like it.

Worst performers

Best Performers

100 Owner-Operator companies

As you already might know, we love companies with skin in the game.

As Warren Buffett once said, you want to be associated with managers who tap dance to work every day.

When a company has skin in the game, you also know that the interests of management are aligned with the ones of you as a shareholder.

This improves your chances of success as an investor:

Founder-led businesses outperform the market by 3.9% per year on average

Family companies outperform by 3.7% per year on average

I made a list of 100 quality companies with skin in the game.

Partners can find a weekly update of this list in the Community.

The average company within this list compounded at 16% per year over the past 5 years.

This is an annual outperformance of 3% compared to the S&P 500.

And this while Big Tech drove almost all performance of the S&P 500 over this period.

Here are a few examples of companies in the list that match the following criteria:

Net Cash Position

ROIC > 20%

Profit Margin > 10%

Expected earnings growth next 5 years > 10%

As you can see, Copart and Fortinet are on this list.

You can read their investment cases here:

Best Buys April 2024

Now let’s dive into our favorite stocks for April 2024.

I only mention companies that can’t be found within the Portfolio today.

I love the companies within our Portfolio and I think most are still (significantly) undervalued.

You can read the latest Portfolio Update here:

5. Yougov

Yougov is an online research data and analytics technology company. They help media owners, government agencies, and brands to explore, plan, activate, and track their marketing activities better.

The company is a strong compounder. Yougov returned 20% per year since its IPO in 2005.

The company consistently outperforms its peers and is a preferred online market research pioneer.

Here’s what I like about the company:

Skin in the game: the co-founders still own a significant stake

Healthy balance sheet

High free cash flow margin of 15-20%

Attractive growth: over the past 10 years Yougov grew its revenue at a CAGR of 15% per year. The company should continue to grow at these attractive rates

Valuation: Yougov trades at a forward PE of 18.0x. It’s one of the cheapest valuation levels they have traded at over the past 10 years

Source: Finchat

4. Lululemon Athletica

Lululemon Athletica Inc. is a designer, distributor, and retailer of technical athletic apparel, footwear, and accessories.

The American company sells pants, shorts, tops, and jackets designed for a healthy lifestyle including athletic activities such as yoga, running, training, and most other activities.

They also have a wide offering of fitness-inspired accessories.

Lululemon generates the majority of its sales via women's clothing. 84% of their revenue is generated in the United States.

Lululemon Athletica is down more than 25% YTD.

The cheaper we can buy great companies, the better.

Key investment thesis:

Chip Wilson, the founder of Lululemon Athletica, still owns 8.4% of the company

Strong brand name and one of the highest margins in the industry

Very healthy balance sheet (Net Debt/FCF: 0.1x)

Great capital allocation skills (ROIC: 40.9%)

Valuation is not too expensive (forward PE: 25.7x)

You can find more information about Lululemon Athletica here:

Source: Finchat

Now let’s dive into the top 3.