By monthly tradition, you’ll get an update on our Best Buys of the month.

Where are the markets today? And what are our favorite stocks?

Let’s explore everything today.

February 2025

In January, the S&P 500 decreased by 0.7%.

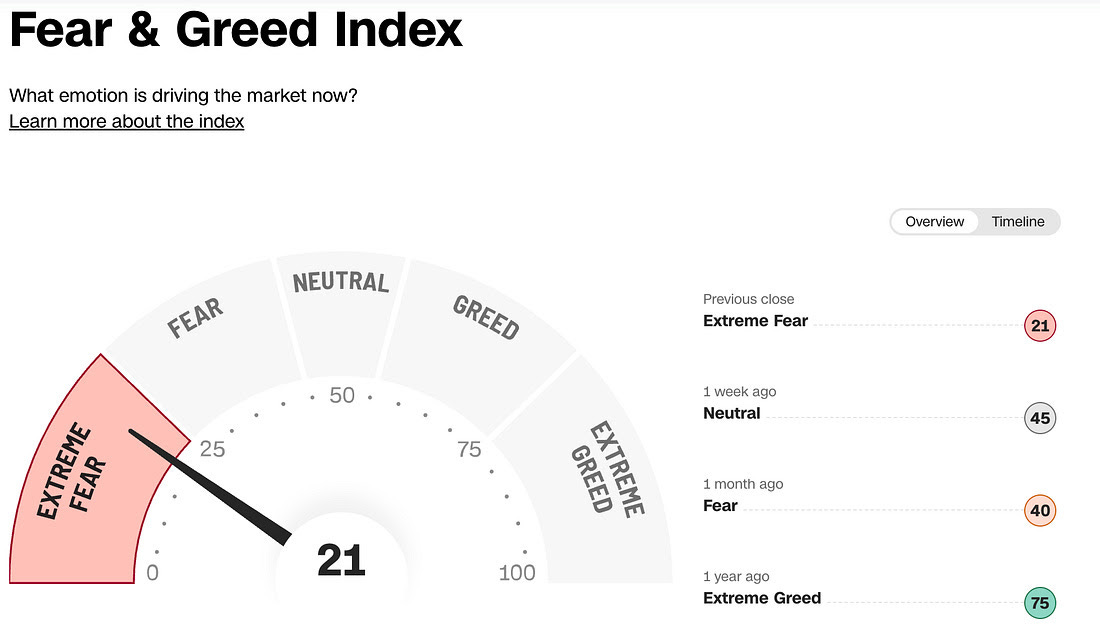

The Fear & Greed Index indicates that we are currently in ‘Extreme Fear’ Mode.

We love an ‘Extreme Fear’ Mode as this allows us to buy great companies at cheaper prices.

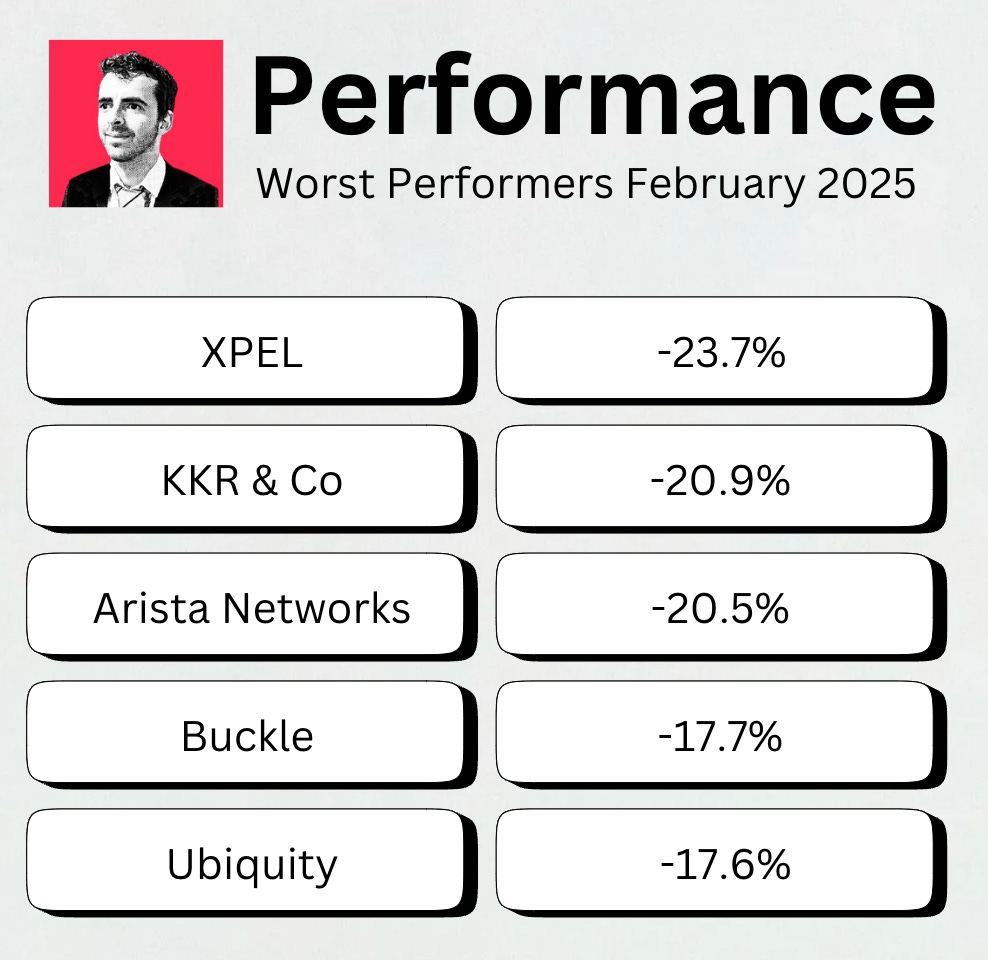

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

Best performers

Spotlight: Medpace ($MEDP)

Medpace makes money by helping biotechnology companies test new products, ensuring they are safe and effective before they are sold.

For example, if a pharmaceutical company wants to test a new pill, Medpace runs clinical trials to confirm it's safe and works as expected.

Medpace has the expertise to do this faster, more accurately, and at a lower cost, saving companies both time and money.

I have Medpace in my Portfolio since 2023.

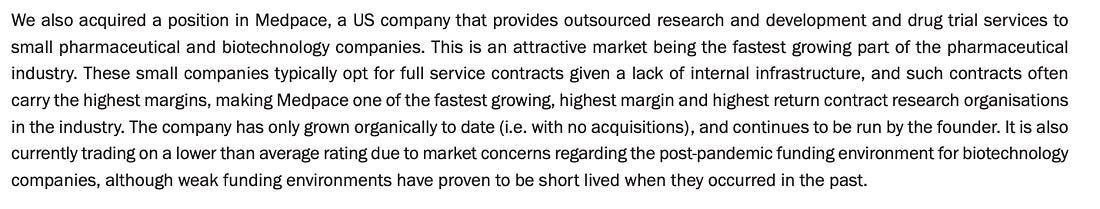

A great confirmation? Terry Smith (Fundsmith) bought Medpace last quarter too.

This is what Terry Smith wrote in his Letter to Shareholders:

The fundamentals of MEDP look like this:

Debt/Equity: 0.2x

Net Profit Margin: 19.2%

ROIC: 21.7%

Forward PE: 27.7x

Expected Long-Term EPS Growth: 9.0%

CAGR since IPO in 2016: 34.1%

You want to learn more about the company? Read this article.

Best Buys March 2025

Now let’s dive into our favorite stocks for March 2025.

I only mention companies that can’t be found within the Portfolio today.

I love the companies within our Portfolio and I think most are still (significantly) undervalued.

5. MSCI ($MSCI)

How does the company make money?

MSCI provides financial data and creates indexes for international markets. The company sells data subscriptions to investment firms and earns money when ETF providers use its indexes.MSCI had a great 2024.

Revenue grew almost 13% and Free Cash Flow increased by 12%, leading to an FCF-margin of over 50%.

As you can see, MSCI is extremely profitable.

The success of the company is further demonstrated by the growth of its AUM (Assets Under Management).

MSCI manages $16,5 trillion in assets.

They clearly benefit from the trend of passive investing.

Remember, every time you buy an ETF with MSCI in its name, like iShares Core MSCI World (IWDA), MSCI makes money.

There are more than 1.400 MSCI ETF’s.

As the leading provider of global indexes, big companies like Vanguard and Blackrock rely on MSCI.

Moreover, MSCI is trusted by these investment firms due to their reliable data and years of experience, which makes them a strong and important player in the financial world.

You can read our Not So Deep Dive about MSCI here.

4. Zoetis ($ZTS)

How does the company make money?

Zoetis is the American world leader in animal health. They make money by selling medicines, vaccines and animal health services to veterinarians, farmers, and pet owners. More and more people are getting pets and treating them like family, which makes them spend more money on their pet's health.

Better healthcare helps pets live longer, which in turn constantly drives demand for medical care.

Zoetis, the leader in animal health, is ready to benefit from this trend.

YTD, the stock has barely moved, although 2024 was a good year. Free Cash Flow even increased by 41.8%!

Zoetis has a strong moat due to switching costs. Customers find it difficult to switch to other brands because of the reliability of Zoetis’ products and excellent customer service.

What’s more, many patents protect Zoetis from competitors.

In other words, the company is well-positioned to remain the dominant player in the animal health industry.

Trading at a Forward P/E of 27.1x, Zoetis has one of the lowest P/E valuations in the past 10 years.

My friend Luc Kroeze made an amazing Deep Dive on Zoetis:

Now let’s dive in the Top 3.