Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Do you know the company MSCI?

They create indexes for international stock markets.

MSCI gets paid for every dollar that is invested in an ETF with the name ‘MSCI’ in it.

Since 2009, MSCI returned 19.9% per year (!) to shareholders.This means an investment of $10,000 turned into $120,000.

MSCI - General Information

👔 Company name: MSCI

✍️ ISIN: US55354G1004

🔎 Ticker: MSCI

📚 Type: Oligopoly

📈 Stock Price: $504

💵 Market cap: $39.9 billion

📊 Average daily volume: $234 million

Onepager

Here’s a onepager with the essentials of MSCI

You can click on the picture to expand:

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give MSCI a score on each of these 15 metrics, resulting in a Total Quality Score.

1. Do I understand the business model?

$98 trillion ($98,000,000,000,000).

That’s how many assets MSCI manages over more than 100,000 public equities and millions of fixed-income instruments.

The American company is a leading provider of critical decision support tools and services for the global investment community.

What’s interesting is that MSCI’’s business model is built on a foundation of recurring subscription fees and asset-based fees. 97%. (!) of its revenue is recurring in nature.

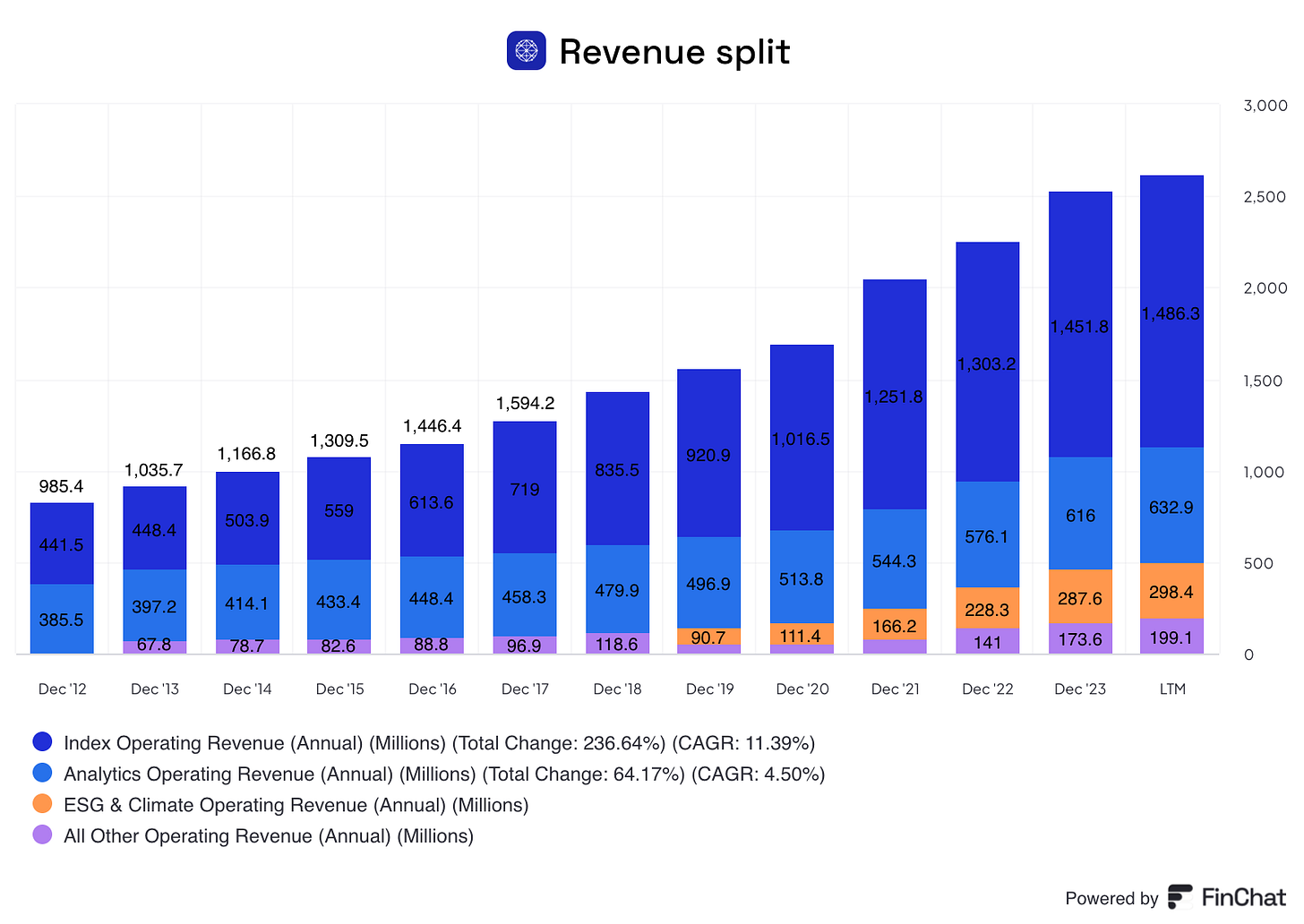

MSCI is active in 4 main segments:

Index (57% of sales): Investment companies use MSCI's indexes to create exchange-traded funds (ETFs), mutual funds, and other financial products. MSCI earns fees based on the assets under management (AUM) in the products that track their indexes.

This way, MSCI benefits from the rising popularity of passive investing

Analytics (24% of sales): Risk management, performance attribution, and portfolio management tools providing clients with risk and return tools

ESG and Climate (11% of sales): Providing ESG and climate data to institutional investors helping them understand the impact of sustainability on their investments

All other - private assets (8%): Data and analytics for private assets

Source: Finchat

2. Is management capable?

Henry Fernandez is the CEO and Chairman of MSCI since 1998. This means he has been leading the company for over 2 decades. Fernandez has a stake of almost $1 billion in MSCI (2.7% of the business).

Andrew Wiechmann is the CFO. He has been working for the company since 2012.

In total, insiders own 3.2% of MSCI.

3. Does the company have a sustainable competitive advantage?

Does MSCI have a sustainable competitive advantage? Absolutely.

The company has a market-leading position within the index segment and enjoys a lot of pricing power.

Revenue retention is equal to 97%. This shows that customers are very loyal to the company.

Furthermore, MSCI also benefits from network effects. MSCI is very well-known within the investment field and when an ETF provider builds an ETF based on an MSCI Index, it increases the trust of clients.

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin and ROIC:

Gross Margin: 82.2% (Gross Margin > 40%? ✅)

ROIC: 25.9% (ROIC > 15%? ✅)

4. Is the company active in an attractive end market?

MSCI benefits from the rising trend towards passive investing.

The company earns fees based on the assets under management in products that track their indexes. Think about indexes like the MSCI World and MSCI World Quality Index.

Source: Morningstar - Citywire

The main rivals for MSCI are S&P Global, Bloomberg, London Stock Exchange, Morningstar, and Nasdaq.

5. What are the main risks for the company?

Here are some of the main risks for MSCI:

Dependence on third parties to supply data, applications, and services

Reputational and credibility concerns

Possibility for clients to negotiate lower asset-based fees

Data leaks and cybersecurity risks

Dependence on overall global markets

Inability to protect intellectual property rights

Client concentration risk

6. Does the company have a healthy balance sheet?

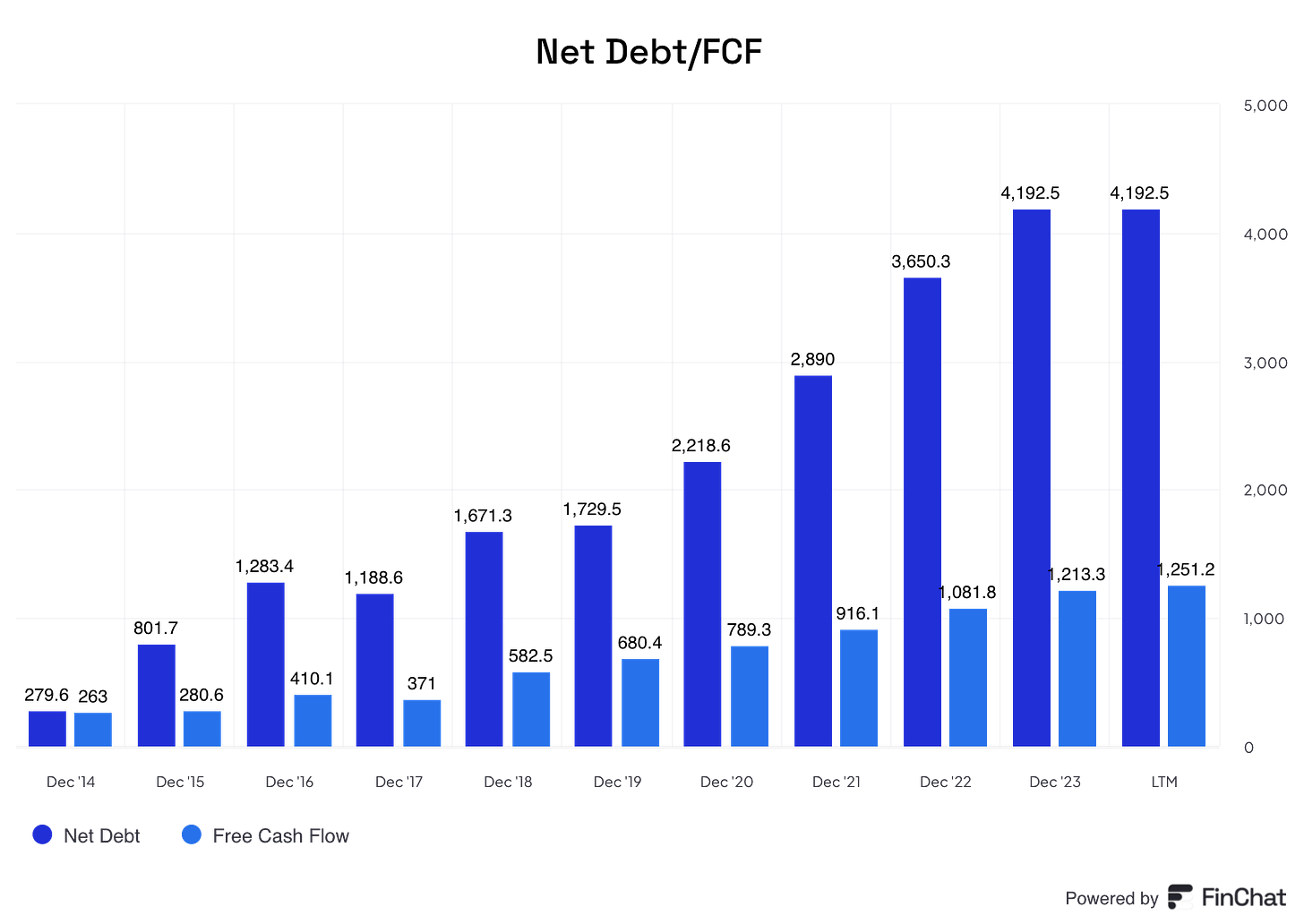

We look at 3 ratios to determine the healthiness of MSCI’s balance sheet:

Interest Coverage: 7.5x (Interest Coverage > 15x? ❌)

Net Debt/FCF: 3.4x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 52.3% (Goodwill/assets not too large? < 20% ❌)

It’s important to highlight that MSCI has quite some debt and goodwill on its balance sheet.

Source: Finchat

7. Does the company need a lot of capital to operate?

We prefer to invest in companies with CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

MSCI:

CAPEX/Sales: 0.8% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 1.6% (CAPEX/Operating CF? < 25% ✅)

As you can see, MSCI has a very low capital intensity.

Source: Finchat

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

Look for companies that put the money of shareholders to work at attractive rates of return.

MSCI:

Return On Equity (ROE): -80% (ROE > 20%? ❌)

Return On Invested Capital: 25.9% (ROIC > 15%? ✅)

Wait… MSCI has a negative ROE of -80%.

Say what?!

Please note that the formula for ROE goes as follows:

Return On Equity = Net Income / Shareholders Equity

MSCI is very profitable. The reason that MSCI’s ROE is negative can be explained by the fact that its equity is negative.

Is this a bad thing? Not if you ask me.

Do you know why?

MSCI is such a good and capital-light business that it generates so much cash that they just don’t know what to do with it.

As a result, they are heavily buying back their own shares. Over the past 10 years, they bought back 30% of their outstanding shares.

It can be concluded here that MSCI’s capital allocation metrics DO look attractive.

Source: Finchat

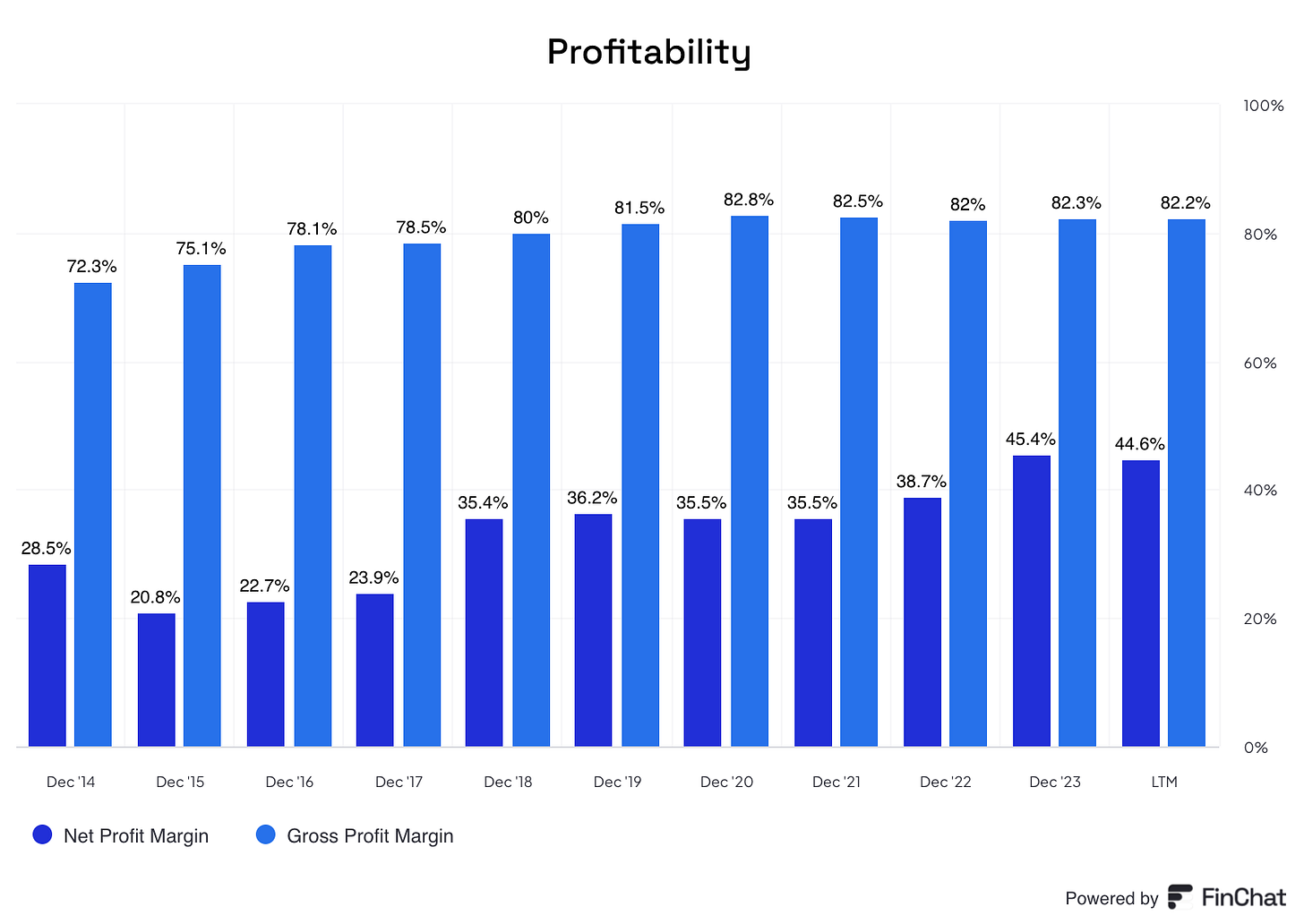

9. How profitable is the company?

The higher the profitability of the company, the better.

Here’s what things look like for MSCI:

Gross Margin: 82.2% (Gross Margin > 40%? ✅)

Net Profit Margin: 44.6% (Net Profit Margin > 10%? ✅)

FCF/Net Income: 106.8% (FCF/Net Income > 80%? ✅)

MSCI’s profitability looks phenomenal.

Source: Finchat

10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably we want SBCs as a % of Net Income to be lower than 4% and certainly below 10%.

MSCI:

SBCs as a % of Net Income: 7.3% (SBCs/Net Income < 10%? ✅)

Avg. SBC as a % of Net Income past 5 years: 7.1% (SBCs/Net Income < 10%? ✅)

Now let’s do the following:

Look a the growth of the company

Determine whether MSCI is valued attractively

Figure out whether MSCI is an interesting buy for investors