Each month, we’ll give an overview of our favorite stocks of the month.

This list will be based on our Investable Universe and Portfolio.

Let’s dive right into an update and show you our 5 favorite stocks for November 2023.

November 2023

During the month of November, the S&P 500 declined by 2.2%.

The S&P 500 currently trades at a forward PE of 18.9x compared to a 25-year average of 16.8x.

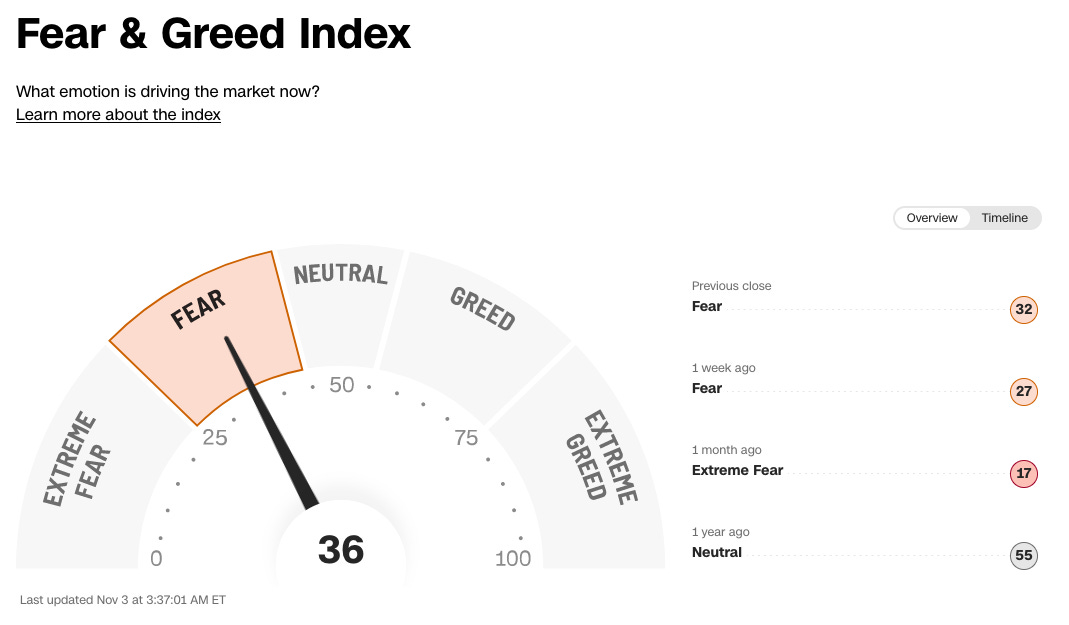

The Fear & Greed Index indicates that we’re currently in ‘Fear’ Mode.

The more fear there is in the market, the lower stock prices and the better for long term investors.

Insider buys, superinvestors & 52-week lows

Berkshire Hathaway keeps buying Occidental Petroleum:

Stocks trading near or at their 52-week low:

Quality stocks within this list are among others Tractor Supply, Generac Holdings, RH and Walt Disney.

Best & Worst Performers

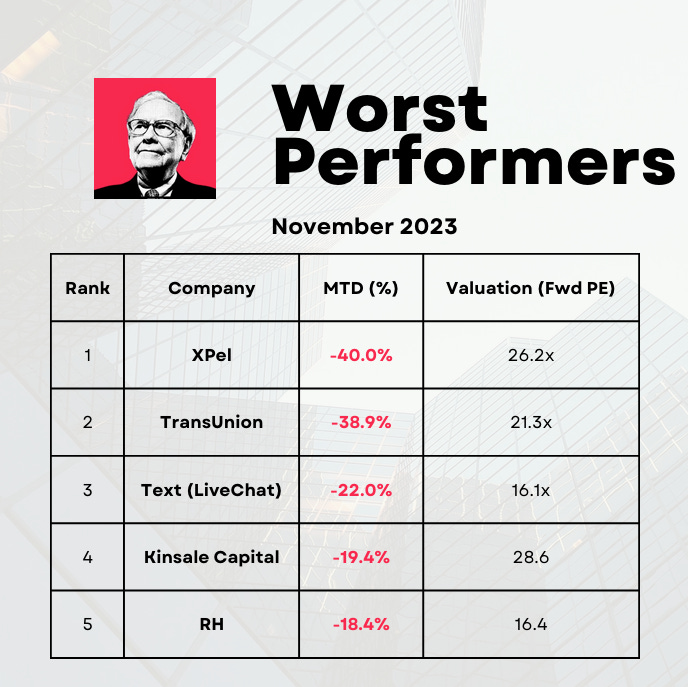

Here’s an overview of the top 5 best and worst performers within our investable universe last month.

Worst performers

Best Performers

Selection Compounding Quality

Now let’s dive into our 5 favorite stocks for November 2023.

5. Medpace ($MEDP)

The best time to buy a wonderful company with plenty of reinvestment opportunities is always today.

Before a new drug can be commercialized, it often must undergo extensive (pre-)clinical testing and regulatory review to verify safety and efficacy. These tests are often very expensive and can take a lot of time. That’s why a lot of small to mid-sized biotech companies rely upon Contract Research Organizations or CROs like Medpace to execute these clinical tests. It’s important to highlight that Medpace itself is not a biotechnology company. They help biotechnology companies in executing their clinical tests providing them with reliable cash flows. In general, Medpace completes clinical tests up to 30% faster compared to those managed in-house.

The company initiated its FY24 guidance and forecasts 2024 revenue in the range of $2.150 billion to $2.200 billion. Full-year 2024 EBITDA is expected in the range of $390.0 million to $415.0 million.

When we assume that margins stay constant from today’s level, this would mean that the company would generate $311.5 million in Net Income in FY24, meaning that Medpace trades at P/E 24E of 27.0x.

You can read the full investment case here.

4. Games Workshop ($GAW)

Games Workshop has a simple and easy-to-understand business model: they make the best fantasy miniatures in the world. Furthermore, the company offers games like Warhammer and Warhammer 40,000. Games Workshop can be seen as a market leader in a niche. The company has skin in the game and the CEO and CFO have been active in the company since 1986 and 1996 respectively. The company thinks and acts like a shareholder, which we like to see.

“We are cost-conscious. We don’t spend money on things we don’t need, like expensive offices or prime rent shopping locations.”

“We measure our long-term success by seeking a high return on investment.”

Fundamentally, the company looks very attractive. Games Workshop has a net cash position, operates at a profit margin of 31%, doesn’t need a lot of capital to operate (CAPEX/Sales: 4.1%), and allocates capital efficiently (ROIC: 44.8%). Over the past 5 years, the company grew its Earnings Per Share with 23.8% per year and the company returned 21.9% (!) per year to shareholders since its IPO in 1994.

Games Workshop can be seen as a beautiful company trading at fair valuation levels. The forward P/E is now equal to 22.7x and the company should be able to grow its revenue and EPS with double digits over the next 3 years.

Evolution forward PE Games Workshop:

Now let’s dive into our 3 favorite stocks.