📈 Buying Our Third Stock (with a special twist)

The learning curve has been steep since the beginning of our Partnership.

We already bought 2 stocks and the ETF Portfolio launched.

Today, we’re adding another Compounding Machine to the list.

Historical transactions

Buying a Quality Cannibal Stock on Monday 9 October. You can read the full investment case here.

Buying an Owner-Operator Quality Stock on Monday 16 October. You can read the full investment case here.

Compounding Machine

Here are some of the essentials of the next stock we’ll buy for 5% of the portfolio:

The CEO and Founder still owns 25% of the company

The end market as a whole should be able to grow at 11.5% per year until 2030

The company has a healthy balance sheet and focuses on organic growth

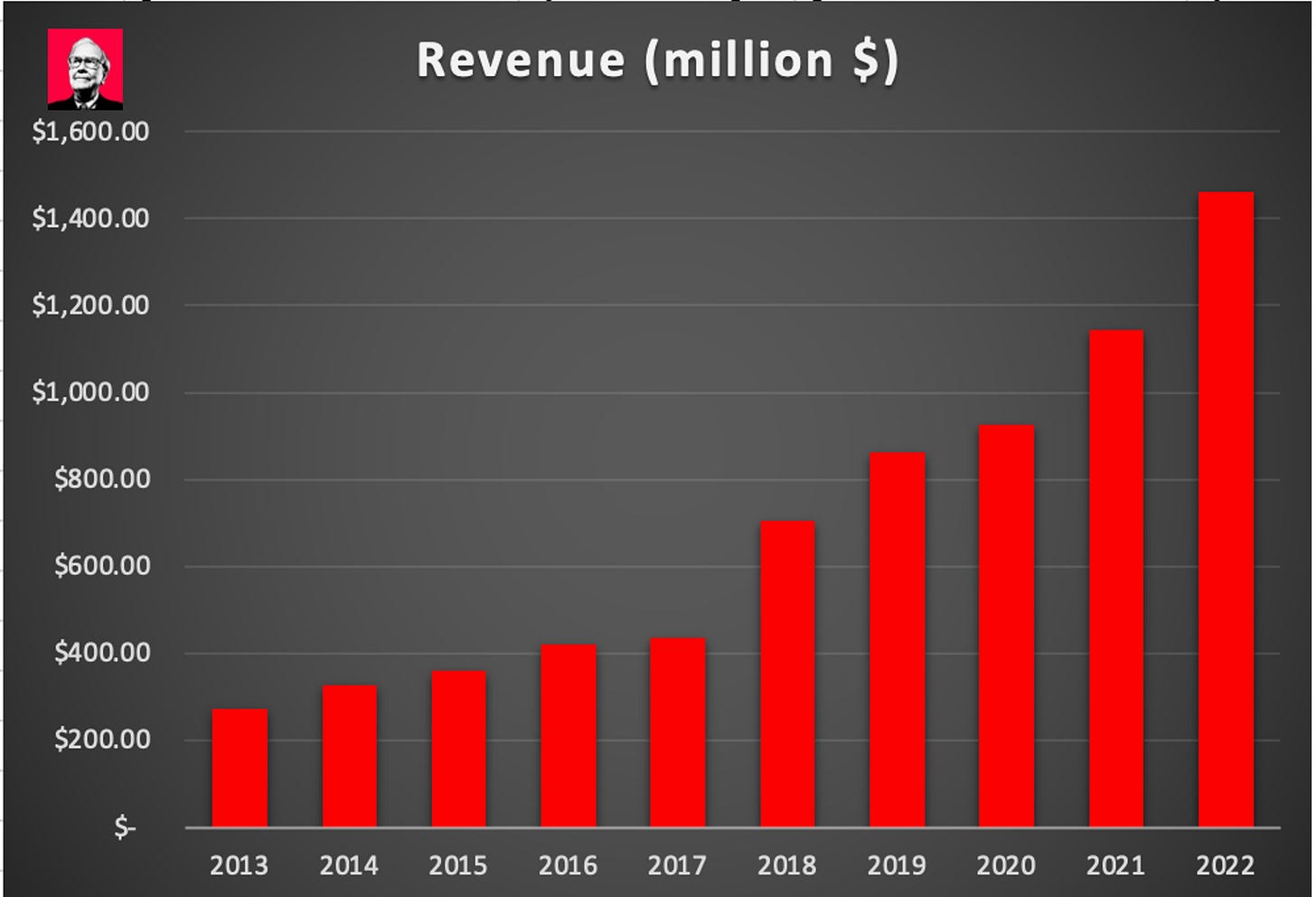

The company has grown its revenue with almost 30% per year over the past 5 years

High profitability with excellent capital allocation skills

The company compounded at more than 40% per year since its IPO

Let’s dive into the Investment Case and prepare our transaction.