🧑🏫 Build your watchlist

Do you want to improve your investment results?

In that case, this course ‘How to analyze stocks’ is perfect you.

In this course you’ll learn:

How to find attractive stocks

Where to find information about these companies

How to determine whether a company is an attractive investment

Let’s say that you manage to improve your investment results by 1% per year by following this course and that you invest $500 per month.

In that case your investment will be worth the following amount in 30 years from now:

Return of 7% per year: $609,000

Return of 8% per year: $745,000

A difference of $136,000!

When you put it like that, a subscription to Compounding Quality Premium for $42 per month sounds like a steal.

Now you know this, let’s hop right into the course.

Build your Watchlist

Everyone wants to build a successful stock portfolio.

But how can you do this? And how do you know which stocks might be interesting?

In the first article of this series, you’ll learn how to find potentially interesting stocks.

What kind of investor are you?

Do you have a pet, children, or grandchildren?

You will probably love them because of these little unique things that make them special.

You should realize that the same goes for investors: every investor is unique.

Multiple roads that lead to Rome.

You should choose an investment strategy that suits you.

Quality Investing: investing in the best companies in the world

Value Investing: investing in companies that look cheap based on fundamental ratios such as the P/E Ratio

Growth Investing: investing in companies where the future looks bright

Dividend Investing: investing in companies that consistently pay out an attractive dividend

…

Based on the kind of investor you are, you should use different selection criteria to build your watchlist.

As Compounding Quality (what’s in a name) is a quality investor, we use Quality Criteria to define our Investable Universe.

How to build your watchlist

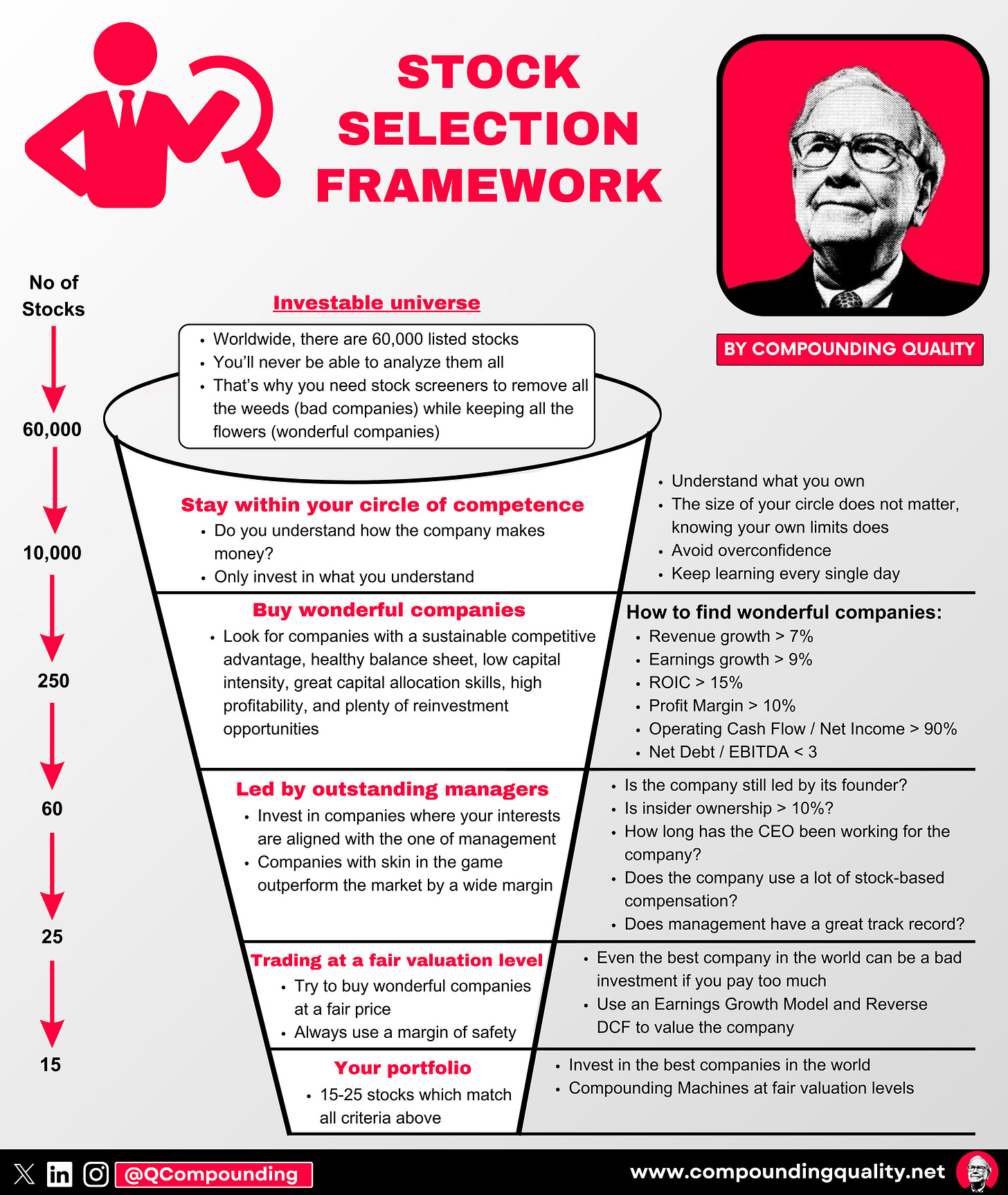

Do you know how many listed stocks there are worldwide?

The correct answer is almost 60,000.

It goes without saying that you won’t be able to look into them all.

That’s why you should use a stock screener to remove all the weeds (bad companies) while keeping all the flowers (wonderful companies).

Let’s show you how to build a watchlist with more than 200 quality stocks using a stock screener.

Screen for quality

We’ll use Stratosphere as they allow you to screen for great stocks yourself.

Let’s use these criteria to find great stocks: