📈 Constellation Software Deep Dive Part 2

CSI Week part II

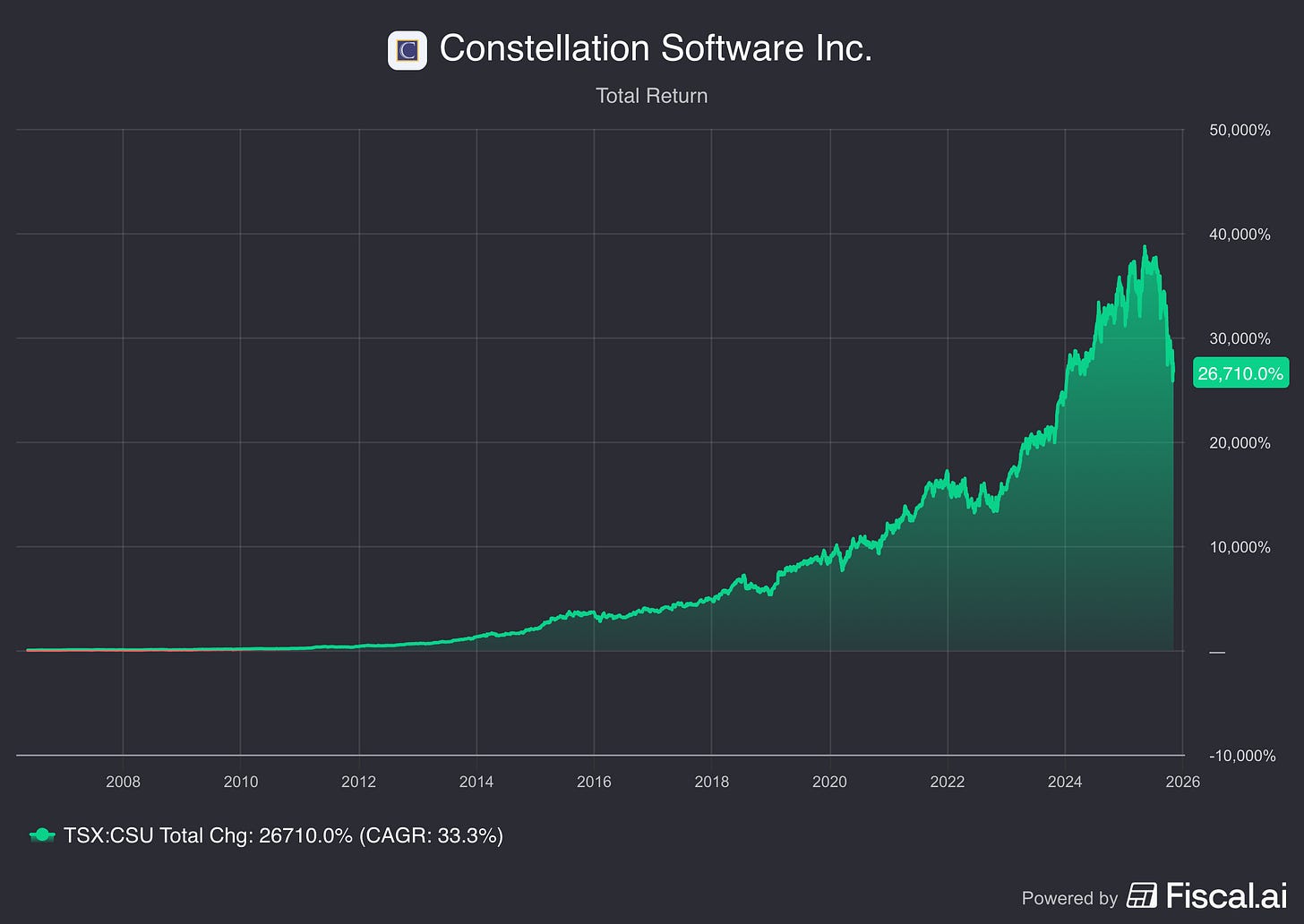

Constellation Software is one of the best companies in the world.

That’s why we’re very happy to do a Deep Dive on this amazing compounder.

Today’s it’s time to dive into Constellation Software’s moat and reinvestment opportunities.

Constellation Software Week

Welcome to part I of a series of articles on Constellation Software!

In this series, you’ll get a deep dive into the company.

You missed part I? You can read it here:

Constellation Software

👔 Company name: Constellation Software

✍️ ISIN: CA21037X1006

🔎 Ticker: $CSU

📚 Type: Owner-Operator/Serial Acquirer

📈 Stock Price: CAD 3,507

💵 Market cap: CAD 74.5 billion

📊 Average daily volume: CAD 183 million

📅 Last update: November 3rd, 2025

Does the company have a sustainable competitive advantage?

Competitive Advantage of Constellation

Mark Leonard himself has mentioned several times that CSI doesn’t have a competitive advantage.

He writes that the barrier to entry for a company like Constellation is basically a cheque book and a telephone.

It looks like Mark Leonard is underselling here. I do believe Constellation has a wide moat. It’s a moat based on culture and a reputation of being the preferred buyer.

When assessing the quality of a company’s culture, I always ask myself this question: Would I like to work there?

While I acknowledge that this question is highly subjective, I still believe that many people with an investing background would die to work for Constellation. I certainly would.

We can also look at Constellation Software’s Glassdoor rating. CSI gets a 4.1/5 on Glassdoor.

This is significantly above the average of 3.5/5.

It proves the excellent culture.

Harris, an Operating Group (OG) of Constellation, was named a Best Place to Work in 2020 by Glassdoor.

Interestingly, 93% of total employees appreciate Mark Leonard as a CEO.

CSI’s culture is based on decentralization and an entrepreneurial spirit. While reading this, keep in mind: “Culture eats strategy for breakfast.”

1. Decentralization

Mark Leonard’s worst nightmare?

Bureaucracy at Constellation Software. This is why he runs an extremely decentralized organization.

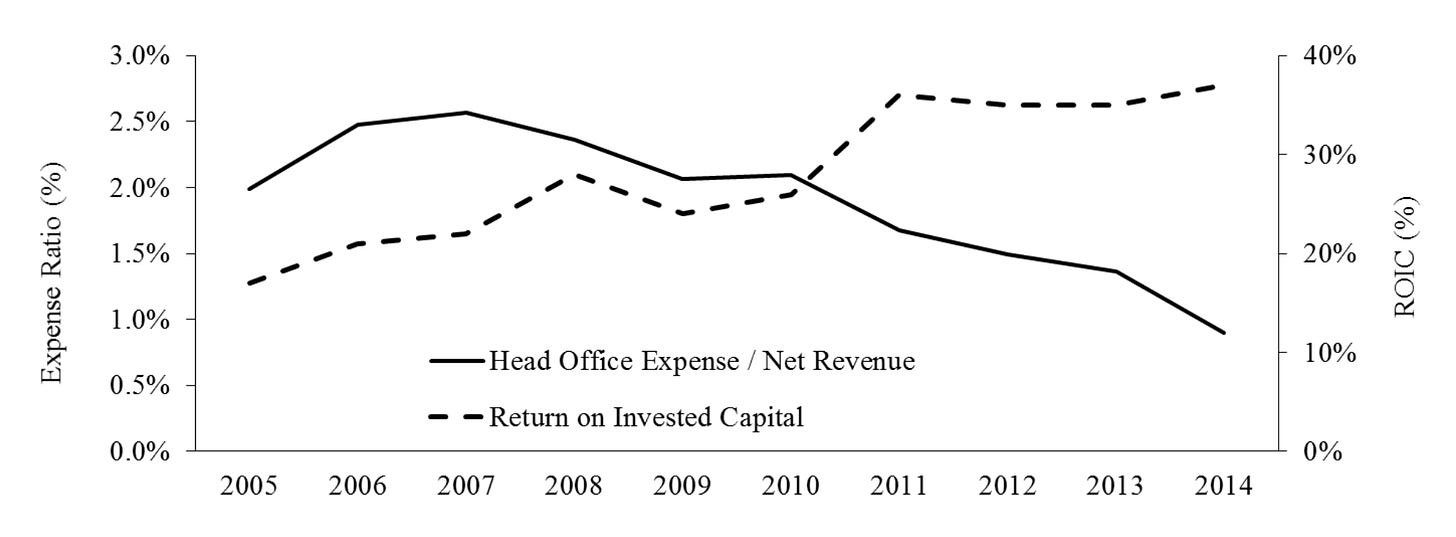

In his earlier shareholder letters, Mark Leonard used to share this chart:

As you can see, Head Office Expense/Net Revenue is extremely low.

In his more recent writings, Mark Leonard mentioned it’s at 0.5% of Total Revenue. It keeps going down. Mark Leonard aims to grant as much autonomy as possible to employees who work closely with customers.

A fundamental belief of Constellation is that autonomy motivates people and that bureaucracy pushes talent away.

Today, there are still only 20 people working at Constellation’s HQ. This compares to a total headcount of +10,000.

It means that 99% of Constellation’s employees work outside of its headquarters!

Unlike many other big conglomerates, Constellation has also decentralized capital allocation. This is something unique. We’ll come back to this point.

The following Buffett quote is very applicable to Constellation:

“The key is always to hire the right people first, train them well, push decisions down the organization, and then resist the temptation to be involved with details. Putting this trust and power in the hands of workers is critical to success.” – Warren Buffett

2. Entrepreneurial ethos

CSI has a very interesting methodology to keep an entrepreneurial ethos in its company.

Every time a platform becomes too large, it’s split into two smaller, new entities.

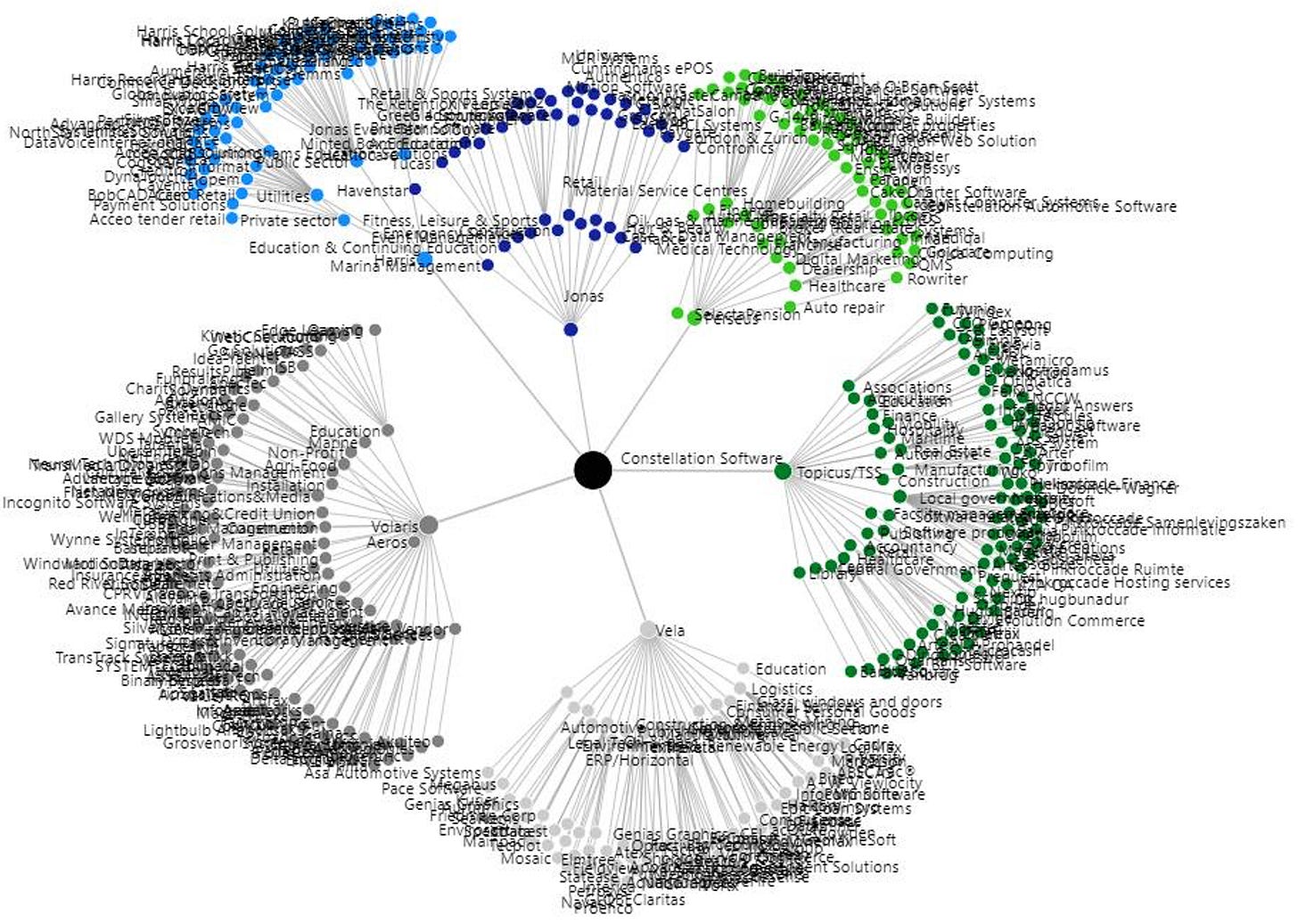

CSI itself is already split up into 6 different platforms.

Topicus.com is the most well-known platform here. It acquires VMS companies in Europe. However, the biggest platform is Volaris Group.

Volaris Group is split up into three smaller entities. One of these is the publicly traded Lumine Group, which focuses on acquiring VMS companies in the media and telecom industry.

Lumine Group itself is separated into four smaller entities.

They are sub-platforms of a sub-platform of a sub-platform of Constellation Software.

All of this, simply to maintain lean teams and an entrepreneurial culture.

“We are the anti-economies of scale company. We believe in small teams outperforming large teams, and so given the choice of taking a 200-person business and buffing it up into two smaller ones, we would much prefer to do that and believe that the benefits are there as opposed to ramming businesses together, firing a bunch of people, and moving a bunch of work offshore.” – Mark Leonard

To summarize, just look at this tree. It shows all companies Constellation Software owns:

Constellation Software lives up to its name. It’s really becoming a constellation of VMS companies.

Looking at this culture of decentralization and entrepreneurial ethos, it feels like Mark Leonard has been preparing Constellation for a long time to run without him.

3. Being the preferred buyer

A second competitive advantage (next to culture) is that Constellation has also built a reputation as the preferred buyer for these VMS companies.

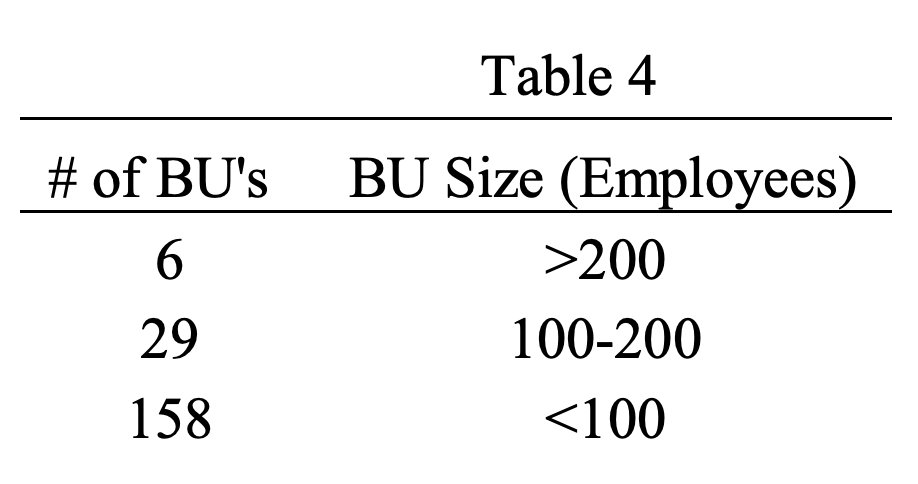

The typical acquisition size is in the $2-$5 million range. In other words, these are small companies with a small number of employees. As you can see below, most of CSI’s Business Units (BU) have fewer than 100 employees.

(BU stands for Business Unit. A BU consists of one or several VMS companies.)

Imagine being the founder of a small VMS company with 25 employees that you want to sell. You’ve worked together with these people for your entire life. They all live in the same neighborhood. You see them when you’re shopping for groceries and picking up your kids from school...

In short, you care about these people. This is why you want a good home for them. In addition, your company is your life’s work. It’s your baby. This is why you’re not looking to sell your company to the company offering the highest price; you’re looking for a good home for your people and your baby. This is where Constellation has a major competitive advantage.

In fact, if you want the highest price, CSI is not the best place. CSI is the highest bidder in auctions in less than 10% of the cases.

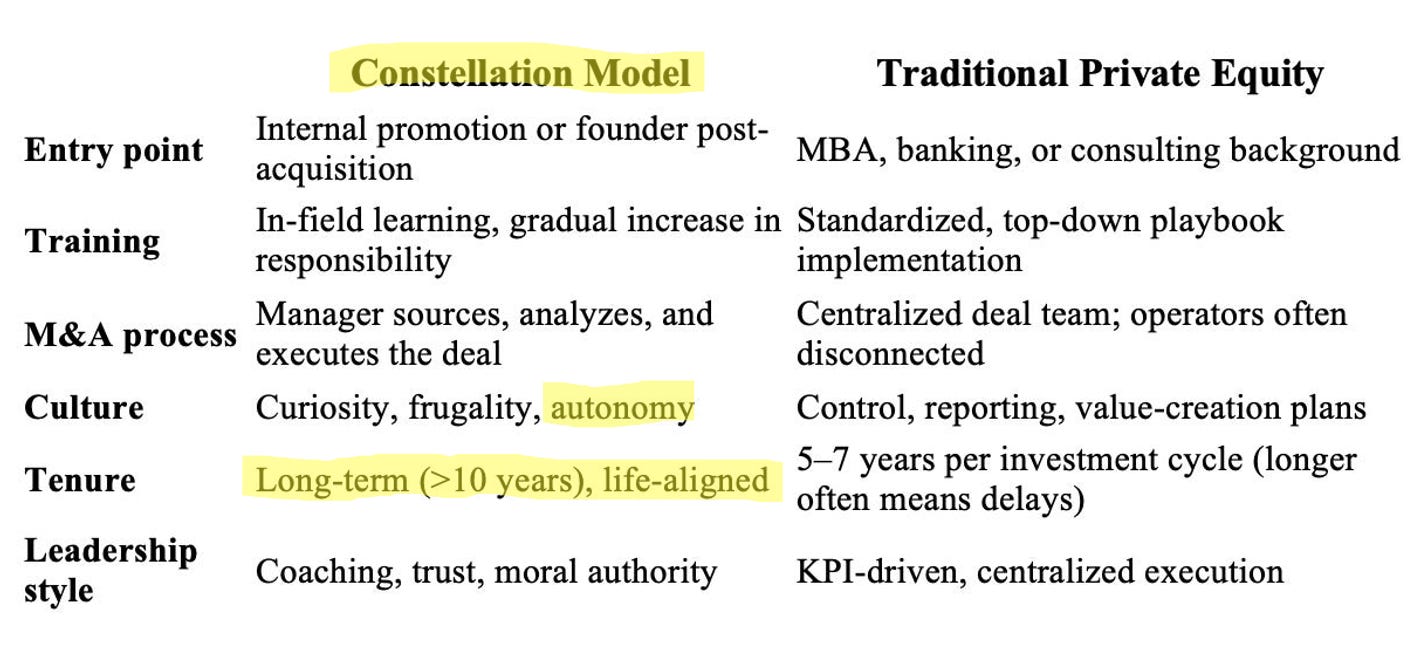

Constellation often competes with other private equity players to buy these VMS companies. Private equity promises “synergies” but actually delivers layoffs to improve profitability. In addition, they load the companies with debt and try to exit after 5-7 years.

Constellation Software takes a different approach compared to private equity. Acquired companies maintain autonomy. The only way Constellation influences the acquired companies is by setting up a new incentive plan based on ROIC and sharing best practices.

In addition, Constellation is a permanent home for these companies. This can offer the stability that a seller is looking for. To this day, Constellation Software has only sold one company because they were offered a high price. Mark Leonard regrets this decision to this day. It’s even rumored that Constellation is checking this company several times a year to re-acquire it and correct “the mistake”.

In short, when you’re being acquired by Constellation, you don’t have to worry about losing your job or losing autonomy. And you will likely benefit from the best practices CSI shares. It’s a win-win for both parties.

Competitive advantage of VMS companies

Constellation Software does have a moat.

But how attractive is the VMS industry in general?

And should you consider buying Constellation Software after it already increased by +19.000%?