📈 Deep Dive Constellation Software

CSI week part I

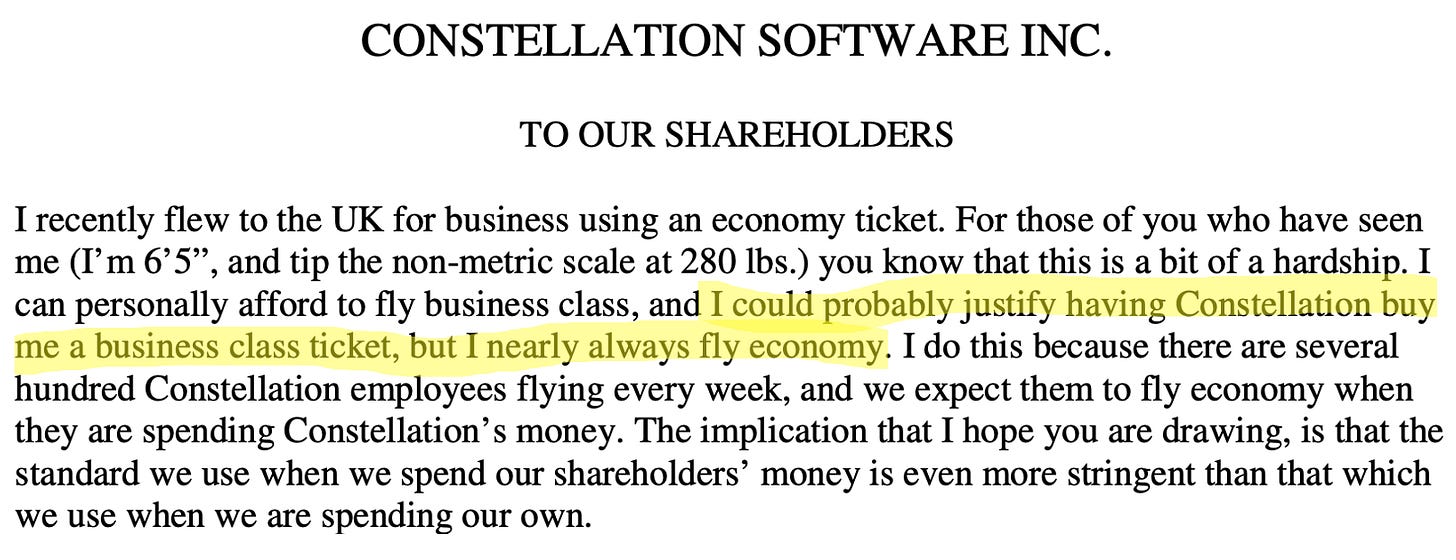

What if I told you there’s a company that has delivered a +30% return every year since 2006?

Don’t believe me? Go look at a chart of Constellation Software.

We’re going to spend all week diving deep into this true compounder.

Constellation Software Week

It’s Constellation Software Week this week!

In four articles, you’ll get a full deep dive into the company (over 60 pages).

Here’s what’s coming up in this 4-part series:

Part 1 (today): The business model and management team

Part 2: Understanding the business and the industry

Part 3: Look into the profitability, growth prospects, and valuation

Part 4: Put everything together and decide if we’re buying Constellation

Constellation Software

👔 Company name: Constellation Software

✍️ ISIN: CA21037X1006

🔎 Ticker: $CSU

📚 Type: Owner-Operator/Serial Acquirer

📈 Stock Price: CAD 3,650

💵 Market cap: CAD 78.0 billion

📊 Average daily volume: CAD 183 million

📅 Last update: November 3rd, 2025

1. Do I understand the business model?

Constellation Software History

Mark Leonard worked in venture capital for almost 11 years.

During that time, he learned something important.

There are many small companies that make a lot of money.

They are necessary

Grow without needing extra cash

Have strong pricing power

With strong moats.

But almost nobody wants them.

Why? Because their Total Addressable Market (TAM) is too small. As a result, Venture Capitalist companies ignore them.

Mark Leonard saw this as an opportunity:

Buy amazing small companies for a cheap price that nobody else is looking at.Vertical Market Software

These companies are called Vertical Market Software (VMS) companies.

They make very specific software for one very specific type of customer.

Their software is mission-critical, meaning customers really need it, but it usually costs less than 1% of the customer’s budget.

So customers keep paying every single year.

Examples include:

Software to manage libraries

Software to track car dealership inventory

Management software for golf courses

Software for luxury yachts

Even chicken-farm software that counts eggs

They are small… but very valuable.

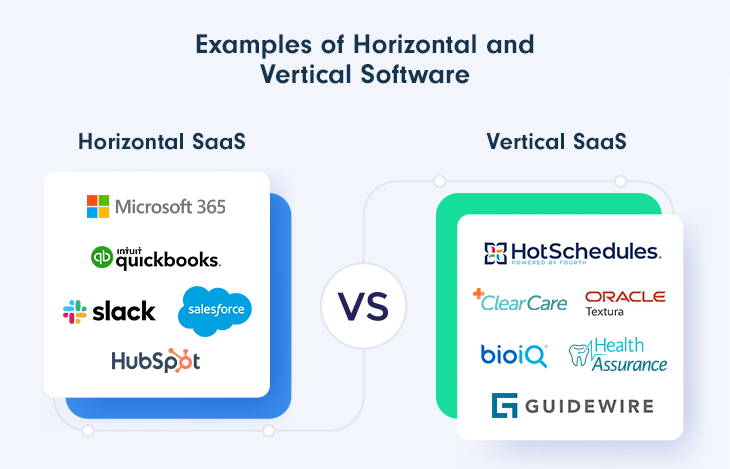

Vertical Market Software (VMS) is the opposite of Horizontal Software, like Microsoft Office (Excel, PowerPoint), which can be used by almost any business.

Eventually, Mark Leonard asked himself a simple question:

If these small, amazing businesses are so good… why not own many of them in one holding company?

While venture capital investors were chasing the next big thing and quick profits, Constellation Software took a different path.

They focused on buying high-quality, stable, and cheap companies, and holding them forever.

That’s a big lesson for all of us as investors: Never sell great businesses.

When you buy Constellation Software, you own a huge group of all these small, high-quality companies.

Here are three key lessons

VMS companies are high-quality businesses you can buy for a fair or cheap price.

It’s smart to own many of these small companies inside one holding company.

Never sell your winners.

That’s the secret behind Constellation Software.

It’s a company that keeps buying great VMS businesses, and holds them forever.

But Constellation isn’t just another company that buys others.

It’s the best serial acquirer in the world!

Just look at its history.

Constellation Stock History

Constellation Software began in 1995 with $25 million.

A few years later, in 1999, it raised another $60 million.

So the company started with about $75 million in total.

Today, it’s worth around $70 billion.

That’s an incredible return! A 100-bagger in just 15 years (the average 100-bagger takes 25).

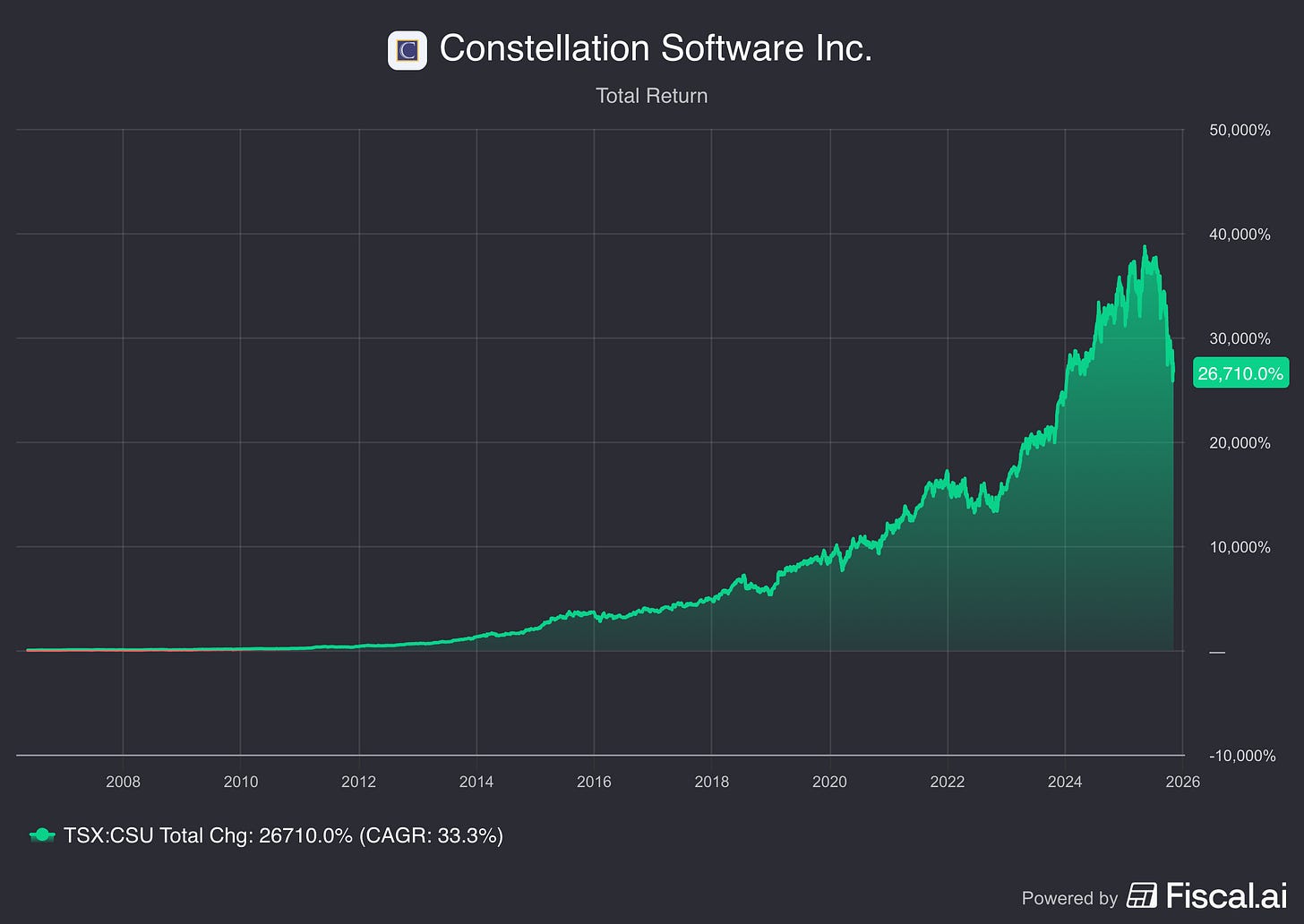

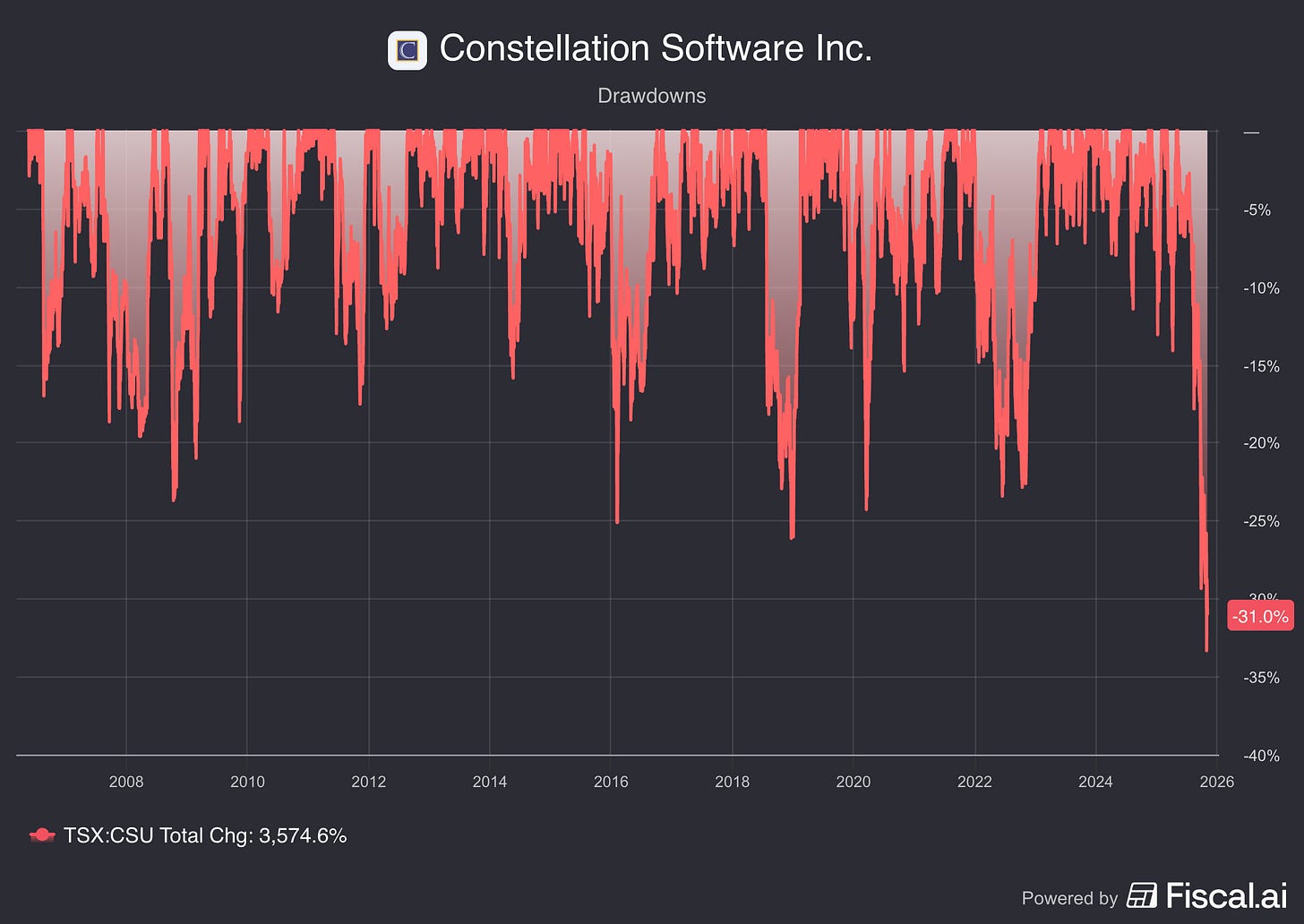

Strong and Steady

In those 15 years, Constellation’s stock never fell more than 40%.

However, today we’re very close (this could provide opportunities):

Most 100-baggers drop by 50% or more at some point.

Even the best companies had big crashes:

Berkshire Hathaway dropped 50% three times.

Amazon has gone down more than 90%!

But Constellation is different.

It never even had a single year with a return lower than -10%.

That shows how stable and high-quality the company is.

Today’s Opportunity

But times have changed.

Right now, Constellation is facing its biggest drop ever.

And for long-term investors like us, that might be a great buying opportunity.

Constellation achieved this amazing success using a simple, yet extremely powerful flywheel:

Acquire a Vertical Market Software (VMS) company

Take the cash flows

Acquire more VMS companies

Repeat, Repeat, Repeat

Today, Constellation owns over 1,400 VMS companies.

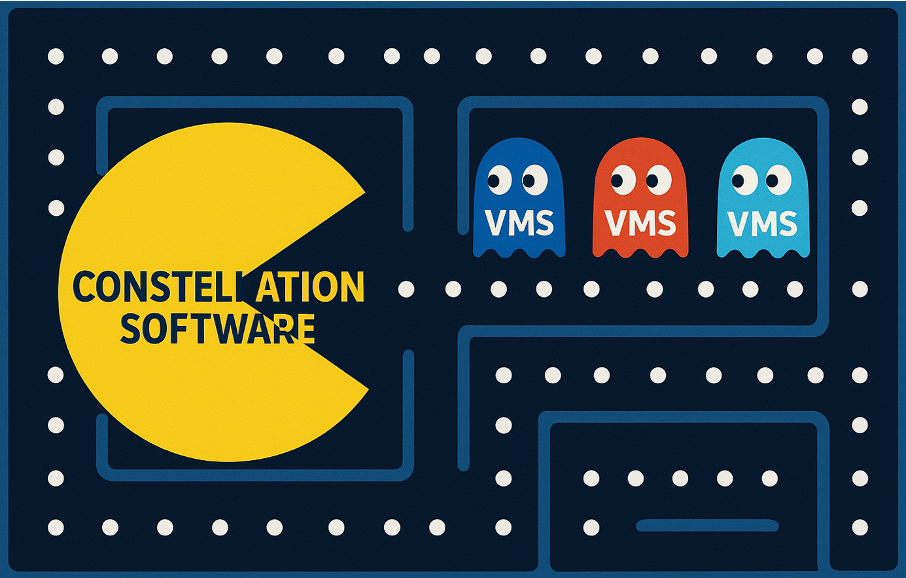

A funny visual that summarizes the company well?

The one below. Constellation is the Pac-Man of VMS.

Revenue Split

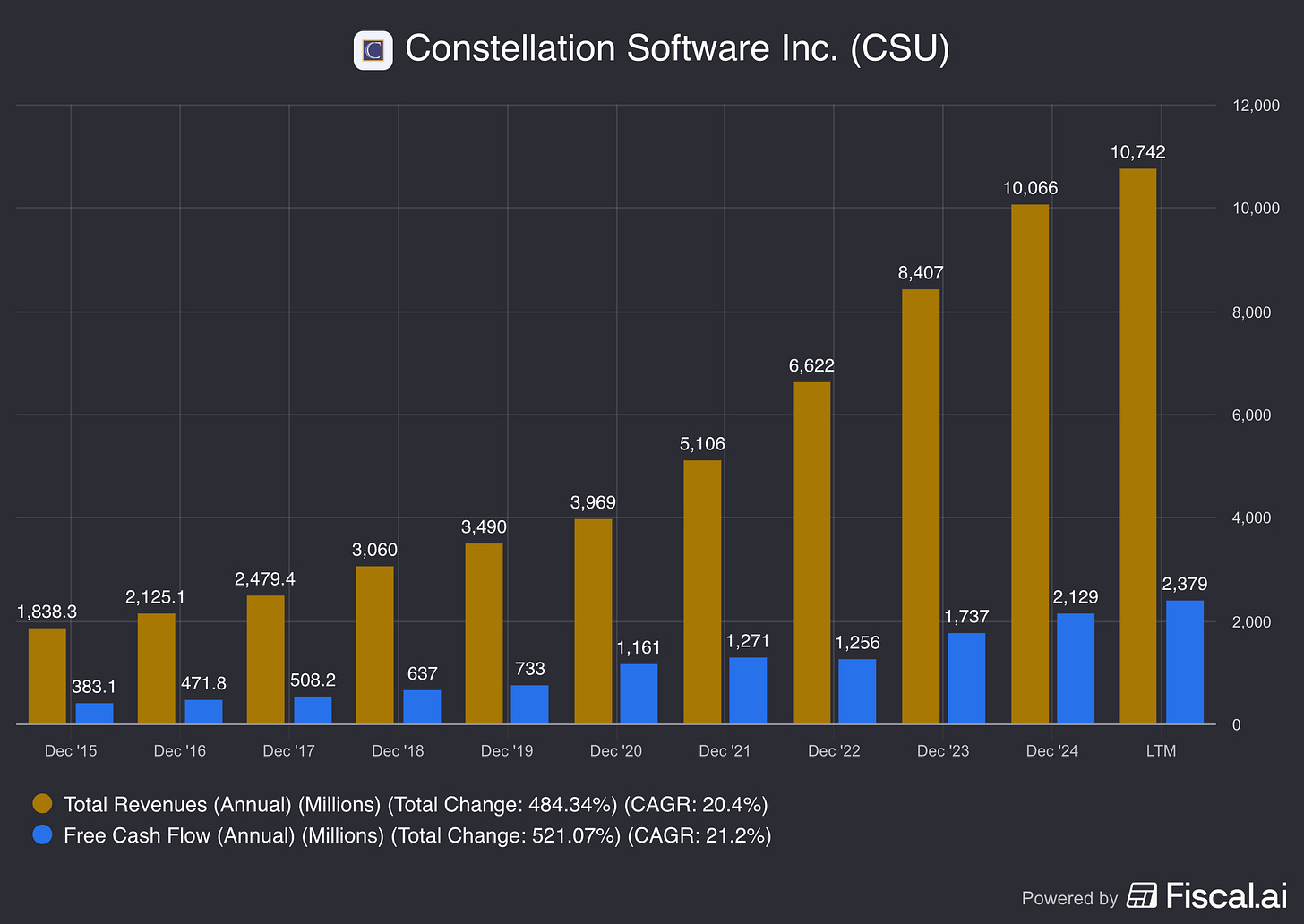

Before we dive deeper into the Revenue Split, take a look at how beautiful the chart of Constellation’s revenue and cash flow is.

It’s compounding in its purest form.

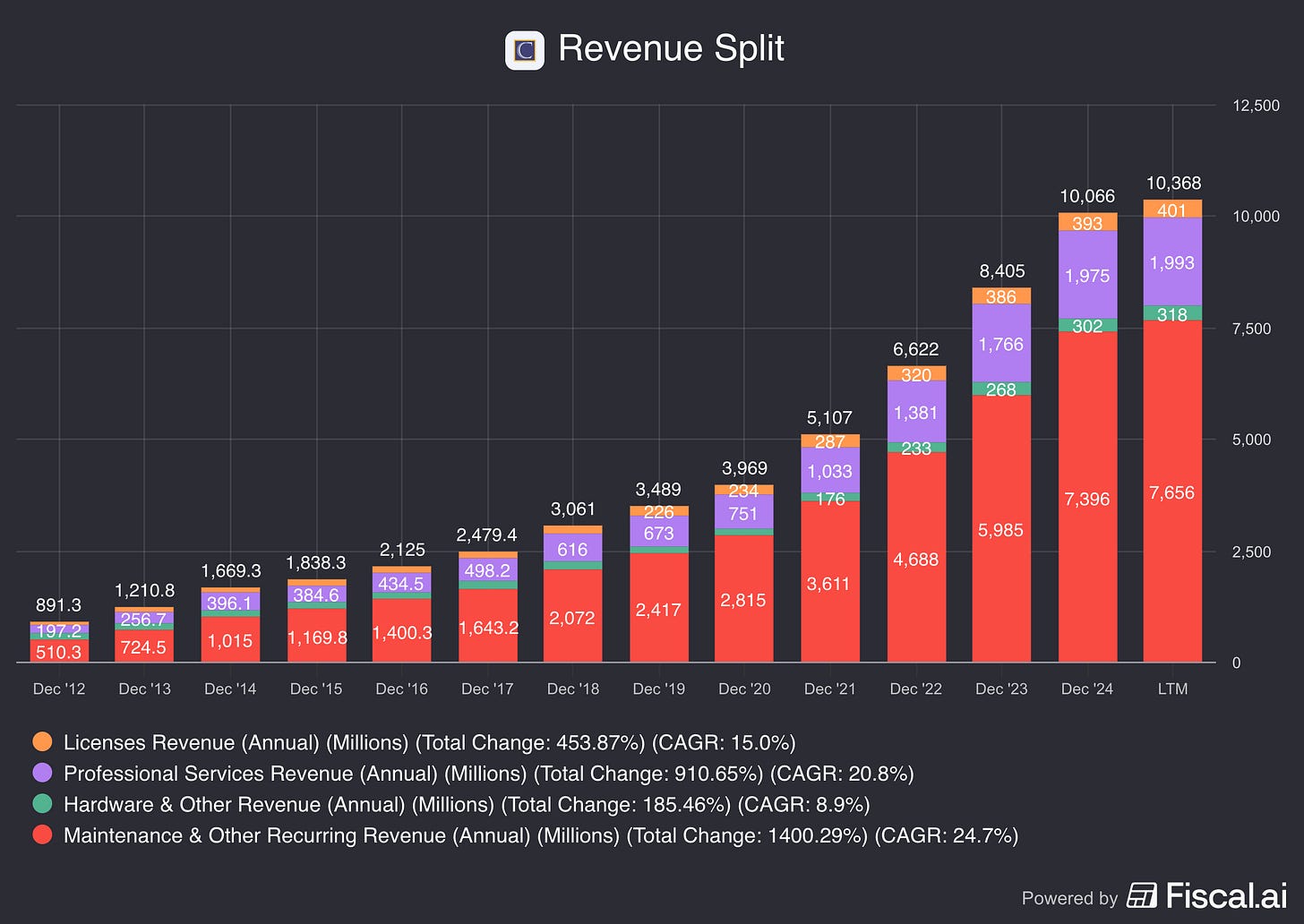

Constellation Software earns money in four main ways:

Recurring and maintenance revenue (74.3%) This is the biggest part of the business. It includes:

Subscriptions: customers pay every month or year to use the software

Maintenance contracts: customers pay to keep the software updated and running smoothly

Professional services (18.9%) This money comes from helping customers use the software, including:

Installing the software

Customizing it for their needs

Training people how to use it

Giving advice to help the business run better with the software

License revenue (3.7%) This is money customers pay to get the right to use the software, either for a limited time or forever.

Hardware & other revenue (3.1%) This comes from selling physical devices that work with the software, and other small products or services the company offers.

Constellation earns most of its money from stable, long-term software subscriptions, and a smaller amount from services, licenses, and hardware.

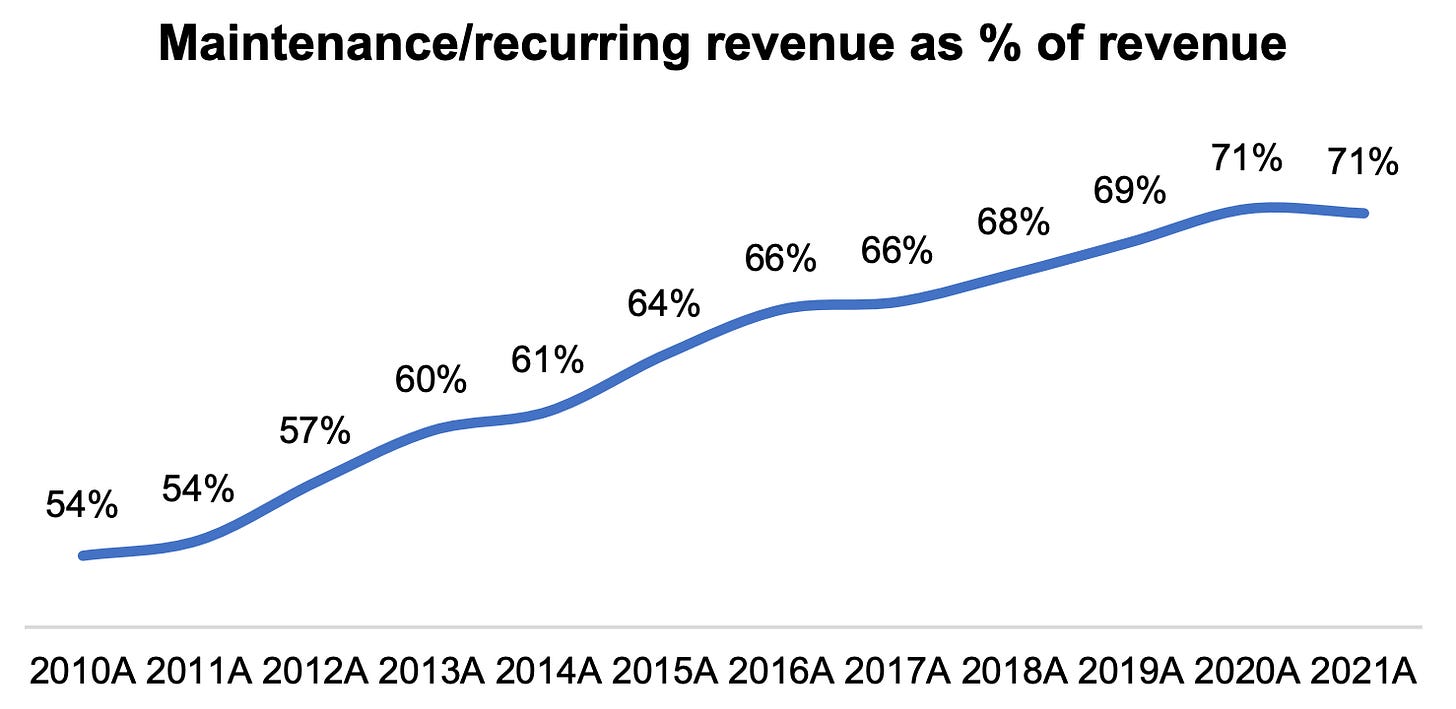

We love seeing that recurring revenue (subscriptions + maintenance) is becoming a bigger part of the business.

This type of revenue is the best kind, because it is very stable and predictable.

The main reason is the rise of Software-as-a-Service (SaaS).

In the past, companies bought software once with a one-time payment.

Now, they pay a monthly or yearly subscription instead.

It’s just like Netflix, you pay as long as you want to keep using it.

Because of this shift, recurring revenue keeps going up.

Geographical Split

Constellation’s revenue is very diversified across the globe.

40% of its revenues come from the U.S.

40% from Europe and the U.K.

10% from Canada

The remaining 10% comes from the rest of the world

Overall Score – Business Model: 9/10

Constellation Software has an amazing business model. It’s the best serial acquirer in the world. Just 15 years after going public in 2006, it became a 100-bagger.

Constellation earns money from over 1,400 different companies in many industries, operating all around the world. This gives Constellation very steady and safe income. And most of that income is recurring, which means customers keep paying every month or year.2. Is management capable?

The Warren Buffett of software

Even though he stays very private, most serious investors know who Mark Leonard is.

He is the founder and CEO of Constellation Software, and many people consider him one of the best investors and capital allocators ever.

His nickname? “The Warren Buffett of software.”

And he didn’t ask for that nickname, he earned it.

A Very Private Leader

Mark Leonard avoids the spotlight.

He looks more like a quiet monk than a CEO.

In a world where everyone shares everything online, he has stayed almost completely hidden.

For many years, only three photos of him existed.

Recently, a fourth photo appeared when an investor saw him by chance and snapped a picture:

If you’re reading this, you’ve now seen half of the public photos of him.

Because of his long beard, some people call him “Software Santa.”

He doesn’t do interviews, podcasts, or media.

He doesn’t have to. His company’s results speak for him.

We did manage to find one interview with him. You can listen to it here.

His Background

Mark Leonard did not grow up rich.

He had little financial help during school, so he worked many jobs to support himself in university, including being a grave digger.

He also worked as a bouncer, warehouse worker, and furniture mover. He learned hard work early in life.

A Different Kind of CEO

Mark Leonard is not your typical CEO.

He is private, humble, and very unconventional… and that’s part of what makes him so special.

“You cannot be normal and expect abnormal results.”

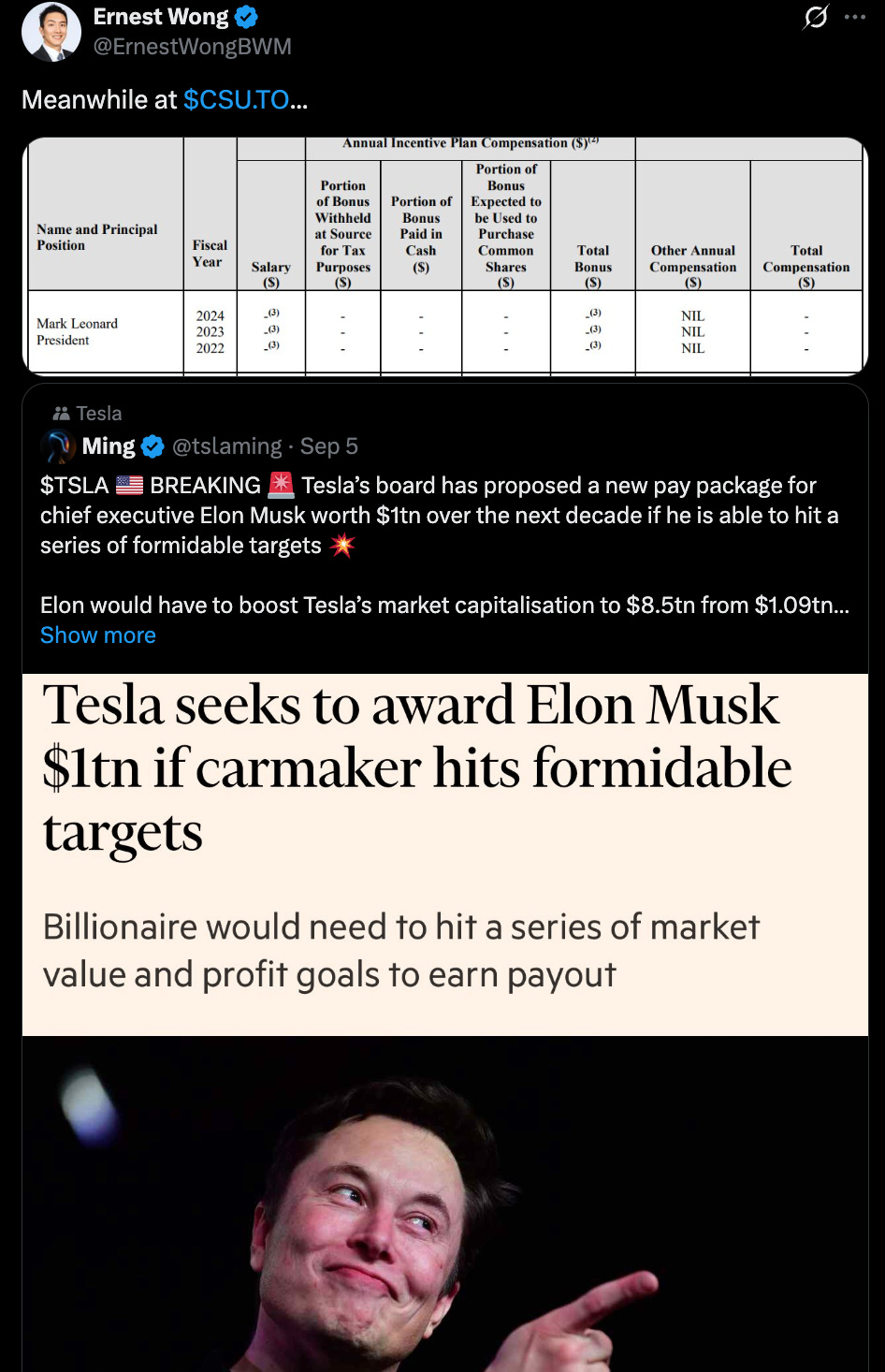

Mark Leonard’s compensation

Mark Leonard’s pay shows what kind of person he is.

Since 2015, he has taken no salary and no bonuses.

Why? He believes that owning Constellation stock is enough reward.

Compare Leonard’s attitude with that of some other CEOs and we can again see how different he behaves:

In His Own Words

In 2014, Mark Leonard explained why he stopped taking compensation.

He said he worked extremely hard for 20 years and wanted more balance in life.

He also didn’t want to live off shareholders’ money.

He used to fly economy and stay in cheap hotels, because he wanted to set a good example for his employees.

Now that he is older and richer, he pays for his own travel so he can fly more comfortably, but using his own money, not the company’s.

“I’ve been the President of CSI for its first 20 years. I have waived all compensation because I don’t want to work as hard in the future as I did during the last 20 years. Cutting my compensation will allow me to lead a more balanced life, with a less oppressive sense of personal obligation. I’m paying my own expenses for a different reason. I’ve traditionally travelled on economy tickets and stayed at modest hotels because I wasn’t happy freeloading on the CSI shareholders, and I wanted to set a good example for the thousands of CSI employees who travel every month. I’m getting older and wealthier and find that I’m willing to trade more of my own cash for comfort, convenience, and speed ... so I’m afraid you’ll mostly see me in the front of the plane from here on out.“ – Mark Leonard in his 2014 shareholder letter”

What This Means

Mark Leonard is not acting like an employee, he behaves like a true owner.

If we buy Constellation Software, we get one of the best capital allocators in the world…for free.

That tells you a lot about his character: humble, ethical, and focused on long-term success.

Skin in the Game

Mark Leonard owns about 1.9% of Constellation Software, so he wins only when shareholders win.

And he’s not the only one.

Years ago, he said that over 100 employees owned more than $1 million in company stock.

Given how much the stock has grown, that number is likely much higher today.

Constellation Software has become a millionaire factory.

Important Update

While we were working on this investment case, sad news came out:

Mark Leonard stepped down as CEO because of health issues.

He once said in a shareholder letter:

“I love what I’m doing and don’t want to stop unless my health deteriorates.”

Sadly, that moment has now arrived.

We hope he recovers well and enjoys rest and peace.

Even though Mr. Leonard isn’t leading Constellation anymore, everything we wrote earlier still matters.

It reflects Constellation’s culture and the legacy he built.

But is the investment case still intact now Mark Leonard left? Let’s find out.